Posted on 12/26/2018 10:16:18 AM PST by Red Badger

Stocks rose sharply in volatile trading on Wednesday as surges in retail and energy shares helped Wall Street regain most of the steep losses suffered in the previous session.

The Dow Jones Industrial Average traded 550 points higher as of 12:58 p.m. ET, while the S&P 500 gained 2.6 percent. The Nasdaq Composite outperformed, rising 3.5 percent. The Dow and S&P 500 briefly turned negative earlier in the day.

Retailers were among the best performers on Wednesday, with the SPDR S&P Retail ETF (XRT) jumping 3.5 percent. Shares of Wayfair, Kohl's and Dollar General all rose at more than 5.5 percent. Data released by Mastercard SpendingPulse showed retailers were having their best holiday season in six years. Amazon's stock also jumped 5.5 percent after the company said it sold a record number of items this holiday season.

Energy stocks also jumped as U.S. crude oil prices jumped more than 7 percent. Shares of Marathon Oil and Hess were the best performers within the energy sector, jumping 7.6 percent and 6.9 percent, respectively.

"With the end of the quarter, we could get a bounce in the next few days," said Peter Cardillo, chief market economist at Spartan Capital Securities. But "the problem is [President Donald] Trump continues to create a lot of uncertainty. We can't focus on the fact there are a lot of good bargains out there."

Wednesday's moves come after the worst Christmas Eve sell-off ever on Monday, which sent the S&P 500 into a bear market. The S&P 500 was down 20.06 percent from an intraday record high set on Sept. 21. The broad index is also down 19.78 percent from its record close reached the day before. U.S. exchanges were closed Tuesday for the Christmas holiday.

The plunge in stocks on Monday came after Treasury Secretary Steven Mnuchin held calls with CEOs of major U.S. banks last weekend and issued a statement saying, "The banks all confirmed ample liquidity is available for lending to consumer and business markets."

On Monday, a senior Treasury official, who declined to be named, told CNBC that the purpose of the call and putting out the statement, was a "prudent, preemptive measure" following last week's market volatility, which saw the Dow experiencing its worst one-week plunge in a decade. Yet while the moves were intended to be reassuring, they triggered confusion among market watchers.

"This call was absolutely unnecessary and in terms of their ability to communicate to the markets, they're losing it," Frank Troise, managing director at SoHo Capital, told CNBC's "Squawk Box" on Wednesday.

Troise said the Treasury call begs the question of whether Mnuchin has "no idea what he's doing" or if "there actually is a liquidity crisis." If the latter option is the case, he questioned why it didn't come up in the Federal Reserve's recent minutes. "The concern now in the market is actually that Treasury's out of touch with what's going on," he said.

Monday's move lower also came after President Donald Trump commented on the Federal Reserve once more, calling it "the only problem our economy has" in a tweet. Trump also said Tuesday the Fed was "raising interest rates too fast because they think the economy is so good." Trump has been critical of the Fed's decisions regarding monetary policy this year. The central bank has hiked overnight rates four times this year.

This is all taking place amid an ongoing government shutdown that started last week. The Trump administration and congressional leaders are at a stalemate over funding for a wall along the U.S.-Mexico border. The administration says the wall is important for national security while opponents of the barrier note it will not solve the U.S.' immigration issues.

"Government shutdown starts with no end game strategy by either side," L. Thomas Block, Washington policy strategist at Fundstrat Global Advisors, said in a note to clients. "The President ... remains convinced that fighting for HIS wall is worth a government shutdown and his base loves the confrontation."

—CNBC's John Melloy and Michael Sheetz contributed to this report.

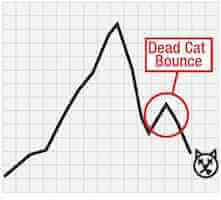

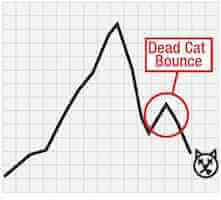

Dead. Cat. Bounce.

Democrats didn’t succeed in lying the nation into an economic depression?

Soros still sleeping off the Christmas party. Forgot to trigger the sell programs.

Lots of sad faces out there in cable land today, I’ll bet.

That’s right, no economic depression. Only the puppet masters messing with the market.

Best Christmas sales in years, with everyone I know fully employed... No reason for the market drop that low....

Buy Low sale high, invest long term, not for next month/year.

Naturally. Because everything that caused a 15% decline in the last 3 months has gone away. Everything is awesome again. I’d like to meet the idiot that bought today because Trump said all is well. I’d say todays gain evaporates in a few days...maybe there’s a 10% rally in the next few weeks or months. But it’ll be down below 20K by June.

I just read U.S. Holiday Retail Sales Are Strongest in Years, Early Data Show.

There are a lot of forces trying to undermine the US economy, most for political reasons, but at some point, the money makers will not sit on the sidelines and let others profit in the market.

Bottom feeders nibbling today. I am seeing Dow well below 20,000 in 2019. Tax cuts no longer possible with democrats in charge of House. And not many regulations left to remove. And we must keep tariff wars active for the sake of future American jobs in manufacturing.

Europe still has very low interest rates and their economy is worse shape than ours. And they have no room left to stimulate with lower rates.

Right now I like energy and precious metals as defensive stocks.

Thanks for jinxing it!

Noticed that the media wasn’t reporting the excellent total spent for Christmas. I believe it was way higher than predicted.

Because seniors and savers and CD holders are receiving the most interest in years. Thanks to Chairman Powell at FED.

I have no idea why some FReepers, like you, are cheering for losses.

“Worst Christmas Ever”

Snort, hardly the worse ever. Long, long way from being the worse ever. But, hey, everything under the sun (and including the sun) is the worst ever because of Trump.

Oh BS. Main Street is doing well because of Trump and Feds are trying to run it.

Not so sure of that.

I’m not cheering for losses. I am accepting reality.

Exactly, tell me the drop was not the Fed Reserve, the media and the Democrats driving down the market. Because explained what changed over Christmas to turn around the market?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.