Posted on 06/17/2012 6:22:21 AM PDT by blam

U.S. Government Debt Goes From Frying Pan To Fire

Interest-Rates / US Debt

Jun 17, 2012 - 01:44 AM

By: Andy Sutton

This morning, the Treasury Department almost gleefully and proudly announced that foreign holdings of US Debt had hit a record high during the month of April and that bond heavyweight China had upped its holdings after trimming for two straight months. This dovetails nicely with a story that was published earlier this week about the federal reserve and its own holdings of US Debt, which have increased over 450% in the past three years. And no, that is not a typo. The federal reserve now holds over $1.6 Trillion in USGovt debt.

Obviously the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramifications that few are paying attention to and are getting almost zero coverage from traditional media outlets. From the AP this morning:

“China boosted its holdings 0.1 percent to $1.15 trillion in April. That followed a 1 percent drop in March and a 0.9 percent decline in February. March's figures were revised down from the government's initial estimate a month ago that China had boosted its holdings in March.

Japan, the second-largest buyer of Treasury debt, trimmed its holdings 0.9 percent to $1.07 trillion. Brazil, the third-largest buyer of Treasury debt, boosted its holdings 5.3 percent to $246.7 billion.”

The US Government and its catastrophic fiscal morass are now viewed by the world as a ‘safe haven’? This would easily qualify for a comedy shtick if it weren’t so serious.

Where is the ‘Eurozone Effect’ in USGovt Debt?

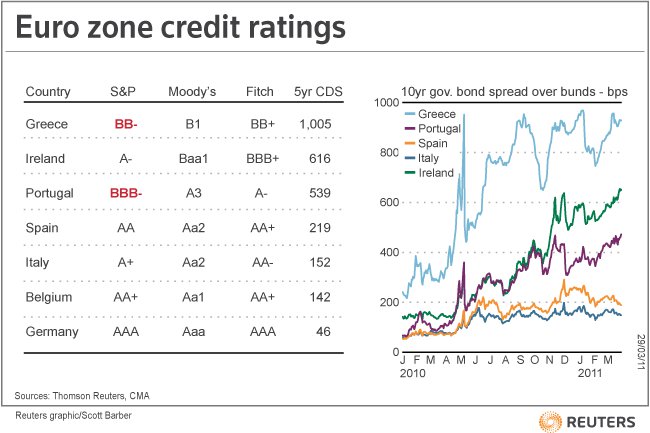

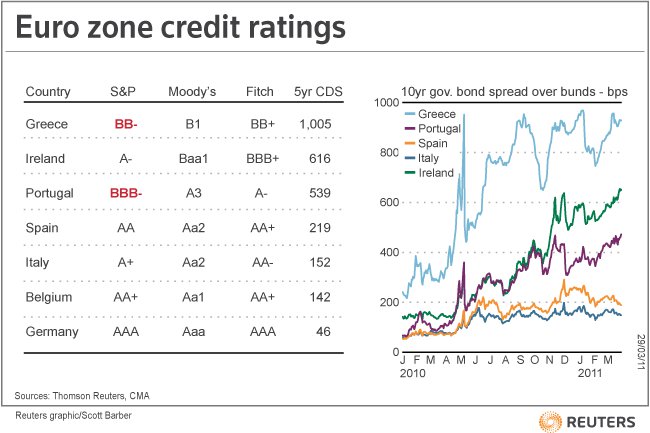

The headlines have been filled with story after story about how the major rating agencies (S&P, Moody’s and Fitch in particular) have been literally wrecking EU nations for their inability to get a handle on their fiscal affairs. This has created a self-reinforcing cycle. Agencies cut the ratings, which prompts bond investors to demand higher yields, which makes it even less likely that the nations will be able to meet payment obligations, which leads to further downgrades and so forth. Wash, rinse, repeat. Not only have the nations themselves been hit, but their banks have been hit as well – and deservedly so. In truth, the entire Eurozone, save for Germany, should be rated below investment-grade; and quite a few of them should be rated as junk.

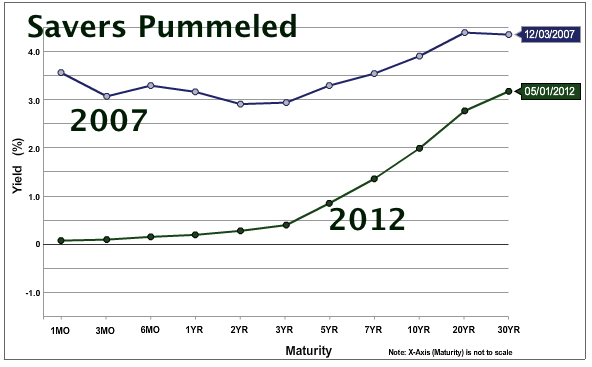

Which brings us to America. The inability of our government to do much of anything without further borrowing is now well documented. Uncle Sam borrows nearly 50 cents of every dollar spent, and despite massive stimulus via heavy deficit spending, the US Economy is dead in the water. There is a huge paradigm shift going on in the labor market right now. Jobs are available, but for the most part they’re of the variety of which two (or more) are needed to create a manageable situation for a family. Families are back on the credit card and this writer must wonder how much of that debt accumulation is out of necessity rather than a need for largesse. There is a bubble in student loan debt and both Social Security and Medicare are in serious trouble. Last August S&P, citing these and other factors, dropped the government’s rating a single notch. Generally when ratings go down, yields go up. Quite the opposite has happened in our case. Yields are now at all-time lows.

The False Paradigm Continues

First, this continues and even reinforces the notion that America is somehow immune from the laws of economics (and common sense for that matter). Somehow we can borrow and spend as much money as we want without fear of negative repercussions. In fact, not only won’t we be punished, we’ll be rewarded by having to pay lower interest rates. Does it make any sense though that the average credit card rate for individuals is somewhere in the mid 13% range and the average American’s finances – as bad as they are – are still several orders of magnitude better than that of the US Govt, which is treated to the lowest rates in history?

Make no mistake about it; the bubble blowing up in US Treasuries is the mother of all bubbles to date, eclipsed only by the even larger bubble being blown up in OTC derivatives, which almost NOBODY is talking about. In plain English, this will not end well – enjoy it while it lasts.

Why Save?

Secondly, the near-zero interest rates being paid by banks and other savings vehicles are so low that it actually discourages people from saving when they need to be doing it most. I had the severe displeasure of scanning rates on money market funds for a client the other day and found that the average of the handful of money market funds I looked at was .06%. That is six cents a year for every hundred dollars invested. Incredible. And when you figure that veritable fortune is taxed? Well, what’s the point of even saving? Unfortunately, many people are taking that attitude. If we’re not going to be compensated, why bother? A quick look at the savings averages for people nearing retirement is downright scary. Granted, this has been going on an awful long time. People appear to be under the false notion that the government is going to take care of them and that their Social Security (which is anything but) will carry them through. Many are now finding out the hard way that this simply isn’t the case.

We are Europe

Thirdly, the persistently poor economy, which by several authentic non-GDP based metrics has now been in recession for nearly 6 years, has created and entire class of people who are dependent on the government for either all or nearly all of their sustenance. Social Security Disability claims are at an all-time high. Food stamp subscriptions are at an all-time high, as are energy assistance, and Medicaid use. We are Europe, plain and simple. While our politicians and Mr. Geithner sit here and lecture the Europeans on fiscal responsibility, we’ve got our very own Titanic that is listing from a huge gash in its side caused by the overriding welfare mentality and a complete lack of leadership over the past half century. Much like many of the Eurozone nation-states, we have lost our own sense of personal responsibility. Somebody else will take care of it. Someone else will pay for it. Someone else will clean up our mess.

As the money flies out of Greek banks and the Eurozone in general so fast that it can barely be counted, there aren’t a lot of viable places to stash it. One must wonder where it is all going. Global stock markets have been in a correction over the past month or so. Commodities are stagnant as financial agents attack prices at every turn in a vain attempt to contain the effects of all the monetary inflation going on around the globe. USTreasuries have been one parking place, but really, given the fundamentals of America’s finances, stashing your capital in USTreasuries is the equivalent of jumping from the frying pan directly into the fire.

This is where the final component of the false paradigm comes into play: the complete lack of moral hazard. The bailout mentality, like the welfare mentality, is firmly in place. We taught banks and hedge funds back in 2008 (and even before) that the USTaxpayer is always willing, able, and ready to back up any losses experienced as a result of poor risk management, gambling, and outright irresponsible behavior. We’ve taught people that they can behave irresponsibly and buy homes they have no hope of ever affording and while millions have lost those homes, millions more have been bailed out.

The real question becomes who is going to do the bailing out when the USTreasury and OTC Derivative bubbles burst? There isn’t enough capital in America to cover the Treasury mess and there isn’t enough capital in the universe to cover the OTC casino gambling of financial agents around the globe.

Got gold?

The WHO is easy. The name Hussein gives you all the hints you need.

When you try to figure out WHY and WHO is this guy, ask yourself WHAT WOULD A MUSLIM TERRORIST DO IF HE WERE MADE POTUS? The answer is EXACLTY WHAT BARRY HUSSEIN OBAMA IS DOING.

Got gold?

Can’t eat gold!

My how I would like to see an

immediate rise of the present

false interest rate, to about

six percent, and see the dominoes

do their thing.

The US government is on a collision

course with reality, and when the

govt goes over the falls, the rest

of us will be in the barrel with

them. You just can’t make this stuff

up. The question remains when, rather

than if.

...and the final reality, who ya gonna

hang. The complicit masses, or the willing

accomplices in the congress?

My understanding is that if/when the interest rates go to 6.0%, the government cannot afford to make the payments on the debt and default is the next step. Correct?

Why? Because fiscal austerity is unpopular. Any politician who tries to sell it will be looking for another line of work.

People like statism - as long as someone else pays for it.

The general attitude with debt in this country is as long as its not mine, its not my problem. Let someone else pay for it.

And with all our debt overhang we’ll never pay back, the feeling is nothing much will change because it won’t. Not in our lifetime.

“Secondly, the near-zero interest rates being paid by banks and other savings vehicles are so low that it actually discourages people from saving when they need to be doing it most. I had the severe displeasure of scanning rates on money market funds for a client the other day and found that the average of the handful of money market funds I looked at was .06%. That is six cents a year for every hundred dollars invested. Incredible. And when you figure that veritable fortune is taxed? Well, what’s the point of even saving? “

Just some thoughts of mine:

1. Money is capital

2. Zero interest rates= no increase in capital

3. No increase in capital+inflation= erosion of what capital remains

4. Soon, no capital remains- it will be worthless paper if it exists at all.

Forget Social Security as a retirement option, or even as assistance.

My retirement “plan” is to own and operate a small farm. That way, at least we can eat while the rest of the planet spins apart over worthless fiat money and sovereign debt defaults.

Got Gold?

Nope. Guns, ammunition, tools. I figure they will be more useful when the collapse comes.

I'm expecting that you will be accepting gold coins for any food surpluses from your farm?

If not, what will you be accepting?

We are deep in trouble it is clear. We know what is wrong, we know what will happen. Wringing our hands isn’t going to stop it. Most of us are well and truly screwed.

Like so many other times when we have been in deep trouble we have to first stop digging. That means getting rid of the Marxists that occupy or capital and many of our state houses. From there, if we do survive, we begin the long climb out of this hole we are in.

My Grandmother had a saying, “When you have a big job to do, you put your head down and hoe to the end of the row.” She did that row after row after row in her bonnet and long sleeves under a glaring sun.

We have left good principals and right behind for too long. We know what is right, it is the straight and narrow path, the hard route. We have stood for everything until we stand for nothing at all. Cliche, but I think it is true. We have raised at least three generations of people who think that being taken care of is a way of life and don’t even know or care where the taking care of comes from. We have given up our sovereignty by not even having the common sense to enforce our borders and laws. We have let others raise our children in our schools and fill their heads with crap. We deserve all the misery we are receiving. You sow the wind and you reap the whirlwind.

Sounds like my mother during the depression.

My dad met my mother while working for her dad 'chopping cotton.'

I think their courtship was in that cotton patch hoeing cotton.

What seems crazy about this is that the world is still willing to loan us money at THE LOWEST RATES IN HISTORY. The ten year bond now yields a measly 1.6%. What do you think the dollar is going to be worth in ten years?

Now we can moan and sigh and long for the good old days, but it seems like a clever person would do something to take advantage of the ability to borrow money against a soon to be worthless US dollar at 1.6% for ten years.

It seems to me that we should borrow money to fix the parts of our infrastructure that are crumbling around us—the highways, the bridges, the electrical system, the schools, airports, rail systems....An immediate upside would be that it would put lots of Americans back to work. The other would be that we’d get to pay the money back with dollars worth a great deal less than they are worth today.

The U.S. government will never find its supplies of paper and ink so low that it cannot print money. An actual default never has to happen.

What will happen is that the value of the dollar will plummet.

Paper money was invented as a convenience to replace precious metals. Gold and silver will continue to be money because the attraction to them hasn't changed in thousands of years.

There will be pockets of shortages where gold and silver are worth less in terms of how much food they will purchase. This imbalance will act to encourage people with food to move it to where it is worth more. That is how economics is supposed to work.

Government will attempt to interfere with this movement because government will want to take the gold. People will resist this. You can't eat gold. But you can eat food next year purchased with gold.

The only thing that would make food too costly to buy with gold will be government interference. The Soviets, before the collapse of the Soviet Union, created a situation where millions of people had to stand in bread lines and where virtually nobody had the means or the incentive to make bread.

With the proper incentives, there is enough labor and productivity in the world to make more than enough bread to feed the productive and have labor left over to create other kinds of wealth. Only government interference can keep this from happening.

That is not an "upside". Inflation is a form of taxation. Everyone holding dollars is taxed to pay for the loss in value of the dollars. Hyper-inflation is the result of people recognizing this tax and refusing to accept the dollars.

How can you hire someone to fix roads and bridges if you pay them in pieces of paper with a rapidly declining value?

There is no free lunch. Just because the government wants to do something, that does not provide the resources to do that thing. The resources have to come from somewhere.

Our grandchildren are going to wonder just what were we thinking to have allowed the situation that they will inherit. They are going to be very angry at what they are forced to face. Fortunately for them, some of the price is going to be paid sooner rather than later.

If not for the irresponsible behavior of the rest of the world, the U.S. would have had to change its ways a long time ago. Europe lives in a socialist paradise that is crashing around them. Africa continues to be of no account. China allows themselves to be ruled by central-planning and denies the productive among them the standard of living they deserve.

Those nations will, of necessity, be changing their ways soon. This will result in a new reality for the U.S. We are already seeing the effect of China not buying as much U.S. debt. The U.S. is printing money to make up for this.

What goods and services will the U.S. be supplying to Greece in the coming months? Little or nothing. The same will soon apply to Spain, Portugal, Italy, and others. These nations have been living on borrowed money too long and cannot continue to do so.

The company from which I retired makes half of its sales outside the U.S. What will happen to that company and its employees? "Austerity" will mean a significant drop in its business level. Some employees will be laid off and others will have their incomes reduced.

This scenario would normally cause a recession and deflation, but that is impossible with the U.S. government continuing to send out more and more entitlement checks backed by freshly printed money. We will have "stag-flation" for half a lifetime or more. I don't see a way out of this.

Obama wasted it on solar power companies and unions.

“How can you hire someone to fix roads and bridges if you pay them in pieces of paper with a rapidly declining value?”

How does your boss pay you today?

Actually, the dollar is not declining all that rapidly, and the best evidence of that is that other nations are willing to buy ten year treasury bonds at 1.4% interest. Yes, in the future it may well decline, and may do so quite rapidly. But say it declines to 50% of its present value. Then the money we use to pay off our debts would be worth only half what we borrowed, so we would come out ahead, wouldn’t we?

Just for the sake of discussion, let's say that you are 30, have no retirement savings, and owe a mortgage which is more than your house is worth. Let's say that I am retired, living off a fixed amount of conservatively invested savings and owe no mortgage.

In the scenario I described, my answer would be "it depends". Your comment, however, explains why I am so certain that inflation lies ahead. People who are in debt will be somewhat rewarded. Others may be severely penalized.

That’s how I understand it, and so anyone allowing the government to get even deeper in debt is an absolute moron, much less being worthy of criminal charges, and forget what happens to the American people, which is to say the least a treasonous thought.

Have you seen this?

President Obama: The Biggest Government Spender In World History

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.