Posted on 02/21/2022 9:57:34 AM PST by SeekAndFind

The eurozone’s annual price inflation rate hit 5 percent in December 2021 and (as of this writing) the consensus is for 5.1 percent in January 2022. Eurozone industrial producer prices were up 26.2 percent in 2021.

This has been pressuring the European Central Bank (ECB) to adopt a tight monetary policy (or at least a less loose one). On February 3, the ECB announced its monetary policy decisions regarding the Pandemic Emergency Purchase Program (PEPP) and the Asset Purchase Program (APP), its asset purchase programs, and interest rates, with no major changes compared to the previous announcement in December.

In the Q1 2022, the ECB intends to carry out net asset purchases through the PEPP at a slower pace than in Q4 2021 and should discontinue net asset purchases at the end of March 2022.

The Governing Council (the equivalent of the Fed’s Federal Open Market Committee) stated that under conditions of economic stress, flexibility will remain an element of monetary policy whenever there are threats to the ECB's monetary policy objective—the “symmetric” price inflation target of 2 percent. For example, in the event of a pandemic-related market complication, PEPP reinvestments can be flexibly adjusted over time. This adjustment could include purchases of Greek government bonds over and above redemption rollovers in order to avoid an interruption of purchases, which could be detrimental to the Greek economy. Net purchases under the PEPP can also be resumed to counteract negative shocks related to the pandemic if necessary.

In line with a gradual reduction of asset purchases and to ensure that the monetary policy stance remains consistent with the “symmetric” price inflation target, the Governing Council decided to set a net purchase pace of €40 billion per month in Q2 2022 and €30 billion per month in Q3 2022 under the APP. As of October 2022, the Governing Council intends to maintain net asset purchases under the APP at €20 billion per month for “as long as necessary” to maintain the ECB’s accommodative policy. The Governing Council expects net purchases to end shortly before it starts to raise key ECB interest rates.

The key ECB interest rates (the main refinancing operations rate, the marginal lending facility rate, and the deposit facility rate) will remain unchanged, at 0.00 percent, 0.25 percent, and −0.50 percent, respectively.

With the goal of maintaining the 2 percent “symmetrical” price inflation target and in line with its monetary policy strategy, the Governing Council expects the key ECB interest rates to remain at or below current levels until it sees inflation reaching 2 percent “over the medium term.” This may imply a transitional period during which price inflation is moderately above the 2 percent target.

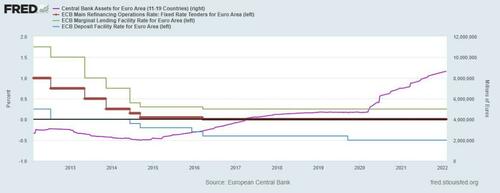

On February 4, the ECB's balance sheet exceeded €8.63 trillion. Since 2015, the ECB has not shrunk its balance sheet. And, since 2014, it has kept interest rates very close to 0 percent (and below 0 percent in the case of the deposit facility rate).

Chart 1: ECB interest rates and balance sheet, 2012–22

Source: FRED; author’s own elaboration. Note: The main refinancing operations rate is the red line read against the left axis; the marginal lending facility rate is the green line read against the left axis; the deposit facility rate is the blue line read against the left axis; and the ECB’s balance sheet is the purple line read against the right axis.

Like the Fed, the ECB does not have much room to raise interest rates without causing major complications in the financial market and the economy. In addition, its asset purchases, mainly of eurozone government bonds, are what keeps its interest rates artificially low and by extension the costs of financing these governments’ budget deficits artificially low.

ECB president Christine Lagarde, when answering a question about the yield spreads on eurozone government bonds, stated that there were no large spreads. Curiously, however, the mere signaling of a possible interest rate hike to guarantee the 2 percent price inflation rate “in the medium term” (as Lagarde stated) raised investor and trader expectations that the ECB will raise interest rates this year and led to an increase in spreads (see chart 2).

Chart 2: Italy-Germany (blue) and Greece-Germany (orange) spreads on ten-year bonds, September 2021–February 2022

Source: Tradingview.com. Retrieved from Fernando Ulrich, "Inflação recorde no euro pressiona BCE a subir juros arriscando o futuro da moeda única," Feb. 7, 2022, YouTube video, 13:19.

The government debts of Italy and Greece are, respectively, 155.3 percent of GDP and 200.7 percent of GDP (provisional data for Q3 2021), way above Germany’s 69.4 percent of GDP. This huge difference reflects the higher risk of Italian and Greek bonds (compared to German bonds). The mere signaling of an increase in interest rates and a decrease in asset purchases makes investors account for this risk, and the interest rates on Greek and Italian bonds increase more than those of German ones (since a good part of the demand for Greek and Italian bonds will disappear if the ECB actually stops buying them or even reduces purchases).

The following chart shows the ten-year government bond yields of some eurozone countries. Note that before 2008, in the first years of the euro, there was practically no difference between the yields. However, after 2008, there was a general perception of the greater risk of bonds issued by countries with larger debts, such as Greece, Italy, Portugal, Spain, and Ireland (which lowered its debt-to-GDP ratio most in the following years). Thus, as these governments kept increasing spending, the yields of their bonds started to increase (ultimately leading to a sovereign debt crisis and a recession in the eurozone).

It was only after 2015, when the ECB started its asset purchase program, that the spreads became smaller again.

Chart 3: Ten-year eurozone government bond yields,1998–2022

Source: Tradingview.com. Note: Greece (orange), Italy (blue), Portugal (yellow), Germany (white), France (purple), Netherlands (green), Ireland (pink), and Spain (red).

Therefore, it is the ECB that has kept the interest rates on these bonds artificially low. Thus, the ECB does not have much room to raise interest rates and decrease (or cease) its monthly asset purchases. Countries like Portugal, Spain, Italy, and Greece, which have higher debt and more profligate governments, are very dependent on this monetary policy. And there are no incentives for these governments to reduce their spending and their borrowing enough for the interest on their bonds to fall without ECB intervention.

Best-case scenario, the governments reduce their debt very gradually (as Portugal did from 2016 to 2019 and in 2021, after a significant increase in 2020).

I firmly believe this is being done intentionally to collapse our economies so they can enact “The Great Reset” in North American and Europe.

This is our world monetary system. Hogtie the FED/Central Banks with govt overspending for decades and then blame them for the problems that come as a result.

Jubilee

Cancel all the debts.

Kill the central banks.

Let justice be done, though the heavens fall.

And it would be Justice, because the damn “Great Reset” which would make slaves of us all is being birthed by the Central Banks. They need to be destroyed.

We need to radically reduce the size/outflows of government, then.

That works.

Yes!

It is TIME to DownSize DC!

If cut in 1/2, in the right places, nobody outside of DC would ever know.

It is that bad.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.