The third time federal income taxes were significantly reduced came about in the 1980s under the Reagan Administration when the top tax rate was lowered from 70% to 28%. Revenues increased to the Treasury by 100% after the tax cuts were implemented.

Arguments like that caused me to analyze the Reagan tax cuts years ago. Following is the short analysis:

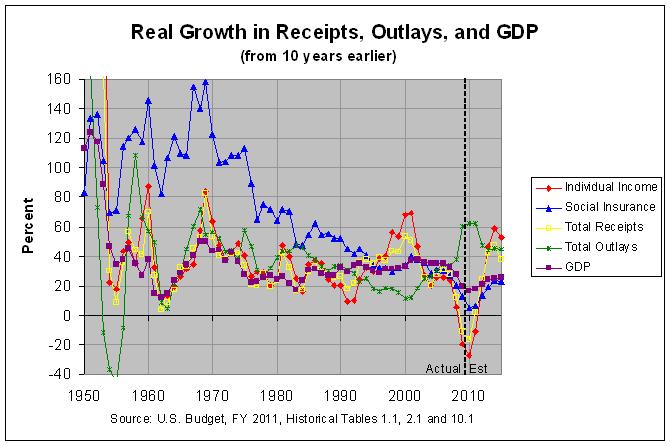

The argument that the near-doubling of revenues during Reagan's two terms proves the value of tax cuts is an old argument. It's also extremely flawed. At 99.6 percent, revenues did nearly double during the 80s. However, they had likewise doubled during EVERY SINGLE DECADE SINCE THE GREAT DEPRESSION! They went up 502.4% during the 40's, 134.5% during the 50's, 108.5% during the 60's, and 168.2% during the 70's. At 96.2 percent, they nearly doubled in the 90s as well. Hence, claiming that the Reagan tax cuts caused the doubling of revenues is like a rooster claiming credit for the dawn.

Furthermore, the receipts from individual income taxes (the only receipts directly affected by the tax cuts) went up a lower 91.3 percent during the 80's. Meanwhile, receipts from Social Insurance, which are directly affected by the FICA tax rate, went up 140.8 percent. This large increase was largely due to the fact that the FICA tax rate went up 25% from 6.13 to 7.65 percent of payroll. The reference to the doubling of revenues under Reagan commonly refers to TOTAL revenues. These include the above-mentioned Social Insurance revenues for which the tax rate went UP. It seems highly hypocritical to include these revenues (which were likely bolstered by the tax hike) as proof for the effectiveness of a tax cut.

Hence, what evidence there is suggests there to be a correlation between lower taxes and LOWER revenues, not HIGHER revenues as suggested by supply-siders. There may well be valid arguments in favor of tax cuts. But higher tax revenues does not appear to be one of them.

You can see this and a longer analysis at this link. As the first graph there shows (also shown below), GDP growth in the decade following the Reagan tax cuts was nothing special following the Reagan tax cuts and was actually subpar following the Bush tax cuts.

For years, I've asked supply-siders to tell me any specific numbers or conclusions in my analysis that they disagree with. Alternately, I've asked them to post a link to one serious economic study that purports to show evidence of any income tax cut that has ever paid for itself. None have.