Posted on 06/08/2010 3:37:44 PM PDT by danielmryan

Where have all the gold bugs gone?

They would entirely be in their rights to be jumping up and down for joy, since gold bullion earlier today traded at a new all-time high. Read full story on gold's new high.

Yet they're not. Far from it.

According to the Hulbert Financial Digest, in fact, the average short-term gold market timer is currently allocating just 30.5% of his gold-oriented portfolio to gold -- keeping 69.5% in cash.

(Excerpt) Read more at marketwatch.com ...

The only way gold is going to stop climbing and start going down is when the global economy picks up and the torrent of bad news about the Euro, deficits, impending inflation etc slows down to a trickle and people start talking more about good times returning.

I don’t see that happening for a while yet. It will happen at some point in the future, but not in the short term.

Touche’.

...if only...

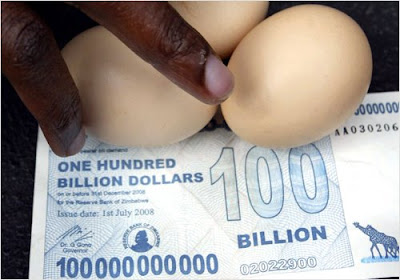

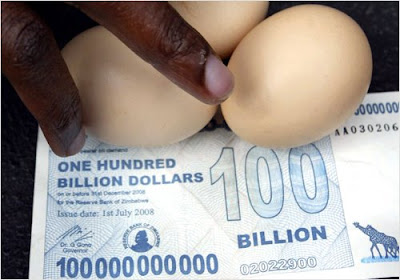

If gold goes to the sky, it means the dollar has become worthless, we’re in hyperinflation, and bloody revolution etc usually follows.

Perhaps, perhaps not.

I do think MBR’s will suddenly become quite valuable, ditto even scatterguns in your scenario.

(I hope the books are doing well Bro)

We both hope not. But I think we can agree that the dollar is in BIG trouble.

the average short-term gold market timer is currently allocating just 30.5% of his gold-oriented portfolio to gold — keeping 69.5% in cash.

IDK, the Dollar, like America, is merely the healthy patient in the cancer ward, but I think we both agree on the fact that Politicians are stripping the dollar of real world value in terms of purchasing power.

That puts the US on the road to poverty as the norm with quickness.

Goldbug ping

FWIW, I’ve held through this latest mini-collapse and continue to hold. I’ll wait for prices much closer to $1300 before I look for some obvious bell-ringing from the usual disinformation sources (Cramer, Forbes Magazine, Citibank, mail me for the list) to contemplate unloading and possibly going short.

Mail me to get on or off the Free Republic Goldbug Ping List.

If you don’t have cash, you can’t buy at the top

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.