Skip to comments.

California Tax Revenues Plunge; Businesses Exit "Taxifornia" in Droves

Mish's Global Economic Trend Analysis ^

| 03/24/2012

| Mike Shedlock

Posted on 03/25/2012 6:44:58 AM PDT by SeekAndFind

California Tax Revenue Plunges

Inquiring minds have noticed a huge plunge in California Tax Revenue for the month of February compared to February 2011.

That is a 22.55% plunge in spite of the fact that this February was a leap year adding a day to the calendar.

Madeline Schnapp, at TrimTabs Investment Research sent me a quick note regarding that plunge a few days ago.

Madeline writes...

Hello Mish

I came across this little tidbit from the February report from the Comptroller's office of the State of CA.

In Feb 2012 income tax receipts are down $328 million y-o-y, or 16.5%. Ouch!

What about retail sales taxes? CA had a "temporary" sales tax hike of one cent that expired last July. Adjust the data to reflect that change, it looks like sales taxes in February are $400 million y-o-y +/-, a decline of about 12.4%. Double ouch!

That doesn't sound like robust growth to me.

Something About the Economy Doesn't Add Up

In Piecing Together the Jobs-Picture Puzzle, Jon Hilsenrath at The Wall Street Journal wonders "How can an economy that is growing so slowly produce such big declines in unemployment?"

Something about the U.S. economy isn't adding up.

At 8.3%, the unemployment rate has fallen 0.7 percentage point from a year earlier and is down 1.7 percentage points from a peak of 10% in October 2009. Many other measures of the job market are improving. Companies have expanded payrolls by more than 200,000 a month for the past three months, according to Labor Department data. And the number of people filing claims for government unemployment benefits has fallen.

Yet the economy is barely growing. Many economists in the past few weeks have again reduced their estimates of growth. The economy by many estimates is on track to grow at an annual rate of less than 2% in the first three months of 2012. The economy expanded just 1.7% last year. And since the final months of 2009, when unemployment peaked, the economy has expanded at a pretty paltry 2.5% annual rate.

How can an economy that is growing so slowly produce such big declines in unemployment?

Trimtabs thinks the problem lies in the heavily massaged BLS employment data and the highly suspect BEA personal income data.

That said, withholding tax data is also messy and not a perfect measure either, but no matter what I do with the data, I can't get to 200,000+ jobs unless a huge percentage of the workforce is suddenly working for McDonalds

Best,

Madeline Schnapp

Director, Macroeconomic Research

TrimTabs Investment Research

Many Explanations for the Unemployment Puzzle

There are many explanations for the "miracle drop" in unemployment.

- Disability Fraud: Disability Fraud Holds Down Unemployment Rate; Jobless Disability Claims Hit Record $200B in January

- Exploding growth in student loans and middle-aged job hopefuls returning to school: Consumer Credit "Demolishes Expectations" Really? No Not Really! The "Non-Bounce" in Non-Revolving Credit

- Involuntary Retirement: Boomers of retirement age that still want and need a job have involuntarily retired to collect social security because unemployment benefts rans out and they have no other source of income.

Divergence with Gallup

Those three things piece together the "unemployment puzzle" nicely except for one thing. Gallup polls do not agree as noted in Gallup Reports Large Jump in Unemployment to 9.1%, Underemployment to 19.1%.

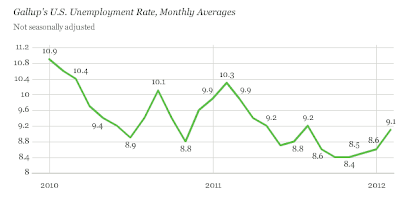

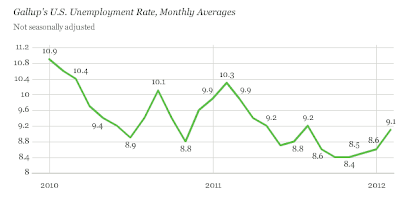

U.S. unemployment, as measured by Gallup without seasonal adjustment, increased to 9.1% in February from 8.6% in January and 8.5% in December.

The 0.5-percentage-point increase in February compared with January is the largest such month-to-month change Gallup has recorded in its not-seasonally adjusted measure since December 2010, when the rate rose 0.8 points to 9.6% from 8.8% in November.

So, is the BLS carefully massaging the data, or are their seasonal adjustments simply that far out of line with reality, tax collections, and common sense?

Businesses Exit California in Droves

Madeline and I are not the only ones who noticed the plunge in California. Chriss W. Street on Beitbart discusses the California Exodus behind the drop. Street has the reason: Businesses fed up with high taxes have fled the state.

California politicians seem delusional in their continued delusion that high taxes have not savaged the State’s economy. Each month’s disappointment is written off as due to some one-time event.

The more likely reason tax collections continue falling is that businesses and successful people are leaving California for the better tax rates available in more pro-business states.

Derisively referred to as “Taxifornia” by the independent Pacific Research Institute, California wins the booby prize for the highest personal income taxes in the nation and higher sales tax rates than all but four other states. Though Californians benefit from Proposition 13 restrictions on how much their property tax can increase in one year, the state still has the worst state tax burden in the U.S.

Spectrum Locations Consultants recorded 254 California companies moved some or all of their work and jobs out of state in 2011, 26% more than in 2010 and five times as many as in 2009. According SLC President, Joe Vranich: the “top ten reasons companies are leaving California: 1) Poor rankings in surveys 2) More adversarial toward business 3) Uncontrollable public spending 4) Unfriendly business climate 5) Provable savings elsewhere 6) Most expensive business locations 7) Unfriendly legal environment for business 8) Worst regulatory burden 9) Severe tax treatment 10) Unprecedented energy costs.

Vranich considers California the worst state in the nation to locate a business and Los Angeles is considered the worst city to start a business. Leaving Los Angeles for another surrounding county can save businesses 20% of costs. Leaving the state for Texas can save up to 40% of costs. This probably explains why California lost 120,000 jobs last year and Texas gained 130,000 jobs.

California Governor Jerry Brown’s answer to the State’s failing economy and crumbling tax revenue is to place a $6 billion tax increase initiative on the ballot to support K-12 public schools. He promises to only “temporarily” raise personal income rates by 25% on any of the rich folk who haven’t already left.

Taxed to Death

If Brown continues to suck up to the public unions responsible for the mess California is in, expect still more businesses to leave, expect the unemployment rate to rise, and expect a continued plunge in revenue.

TOPICS: Business/Economy; Society

KEYWORDS: california; tax; taxes

Navigation: use the links below to view more comments.

first previous 1-20, 21-34 last

To: BfloGuy

When the state of California goes bankrupt, will it revert to territorial status and lose its Representatives, Senators, and electoral votes?

21

posted on

03/25/2012 8:22:08 AM PDT

by

reg45

(Barack 0bama: Implementing class warfare by having no class!)

To: US_MilitaryRules

NY tooo...

22

posted on

03/25/2012 8:35:50 AM PDT

by

Chode

(American Hedonist - *DTOM* -ww- NO Pity for the LAZY)

To: peteyd

The smart ones (conservatives) will be the first to leave as they’ll see the writing on the wall. The moochers already have a gravy train and won’t leave until the state collapses and the spigot runs dry.

It would be interesting to see what the 2020 census turns up and how many electoral votes leave the state.

Hey, look on the bright side. The illegals might “self-deport” now that Mexico’s economy is on the upswing. Heck, maybe some Californians might join them.

23

posted on

03/25/2012 8:36:40 AM PDT

by

ak267

To: SeekAndFind

And the definition of insanity is............ well, you know!

The insane asylum at Sacto is run by the Dems controlled by the puppet strings of their Union overloads. Its no wonder why productive businesses, citizens and sane people are going 'Galt' on Kookifornicate.

24

posted on

03/25/2012 8:59:10 AM PDT

by

tflabo

(Truth or tyranny)

To: mo

Maryland gov. 0’Malley passes a tax on millionaires and they in turn leave Maryland taking their money and business with them ,, leading to a loss of the states revenue source . Now he has come up with another great plan to make up for that lost revenue ,, increasing the tax burden on two groups making over 100k and 500k a year . When the pack up and make their exodus to a more friendly environment he will be FORCED to make up the losses in the middle class and the poor . These are the same people who claim to be so intelligent as they tax the state to it's doom . Today Md. operates on a 38.5 billion $ deficit all created by the present Gov. 0’Malley a (D) . When 0’Malley took office there was a scant 2 billion surplus left by out going Bob Ehrlich a (R) . Try to run your house like the dems run our govt. and hold your breath waiting for the bail out .

25

posted on

03/25/2012 9:01:25 AM PDT

by

Lionheartusa1

(-: Socialism is the equal distribution of misery :-)

To: Lionheartusa1

You know Lion its simply incredible the evidence and history of govt increases of excessive taxation on the productive citizens indirectly results in fewer total tax revenues generated.

Yet these mad dog lieberals like O’Malley continue to do it ad nauseum while ignoring the factual history of its results. Yes Michael Savage....”Liberalism IS a Mental Disorder”.... and let me add....{by willfull and stubborn ideological choice}.

26

posted on

03/25/2012 9:14:22 AM PDT

by

tflabo

(Truth or tyranny)

To: Starboard

“Maryland is beginning to feel the effects of this phenomenon as many people are sick and tired on the rapidly increasing tax burden Democrats. Needless to say, Democrats have a stranglehold on the state legislature.”

And a result is, that as more and more of the productive people leave, those who are left behind will turn the state “bluer and bluer” until there is isn’t a chance that the state’s political leanings, along with its problems, will ever be “righted” again....

The country is “dividing”.

For the second time in history...

To: SeekAndFind

“Immigrants” from south of the border are moving in as fast as residents leave. More people come in from other states that aren’t as welfare friendly as California is. They come in to feed at the trough.

I didn’t “Californicate” the other states I lived in. Not all of us do that. That’s a stereotype that I see in FR frequently. We have cities and even entire counties, some bigger than eastern states, that are conservative. The problem is the huge metro-urban centers of LA and SF. Especially LA.

The southern counties wanted to split off and form a 51st state called “South California”. It would have included all the southern counties EXCEPT LA county.

To: Road Glide

The Dems have had almost complete control of MD since the 70’s. If it wasn’t next to DC and supported by all the Fed money (gov worker salaries, contracts, etc), MD would be a wasteland.

To: Road Glide

The country is “dividing” for the second time in history...

Roger that. The growing differences between liberals and conservatives is simply irreconcilable and reaching a tipping point. A financial calamity (owing to excessive government spending at all levels) may be the only thing that will avoid another serious division of the country. You can already see signs of it in the mass exodus of productive and responsible people from broken liberal cities and states. It’s a kind of virtual secession movement.

To: E. Pluribus Unum

I see a bumper sticker . . .

The Problem With Wealth Distribution Is

You Only Get To Do It Once

31

posted on

03/25/2012 10:05:51 AM PDT

by

RightField

(one of the obstreperous citizens insisting on incorrect thinking - C. Krauthamer)

To: Lionheartusa1

“0’Malley...has come up with another great plan to make up for that lost revenue”

I wouldn’t put it past him to levy an exit tax on people and businesses leaving the state. Those who choose to remain in the state can drown their sorrows in alcohol — if they can afford the recent 50% increase in the liquor tax. Yet another assault on the Maryland taxpayer by O’Malley.

To: SeekAndFind

Well it looks like CA got some of its revenue back as people are drinking and smoking more now this February. Gee wonder why that might be?

33

posted on

03/25/2012 12:06:22 PM PDT

by

Secret Agent Man

(I'd like to tell you, but then I'd have to kill you.)

To: SeekAndFind

Navigation: use the links below to view more comments.

first previous 1-20, 21-34 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

NY tooo...

NY tooo...