Skip to comments.

QE3: Helicopter Ben Bernanke Unleashes An All-Out Attack On The U.S. Dollar

The Economic Collapse Blog ^

| 09/14/2012

| Michael Snyder

Posted on 09/14/2012 9:25:53 AM PDT by SeekAndFind

You can't accuse Federal Reserve Chairman Ben Bernanke of not living up to his nickname. Back in 2002, Bernanke delivered a speech entitled "Deflation: Making Sure 'It' Doesn’t Happen Here" in which he referenced a statement by economist Milton Friedman about fighting deflation by dropping money from a helicopter. Well, it might be time for a new nickname for Bernanke because what he did today was a lot more than drop money from a helicopter. Today the Federal Reserve announced that QE3 will begin on Friday, but it is going to be much different from QE1 and QE2. Both of those rounds of quantitative easing were of limited duration. This time, the quantitative easing is going to be open-ended. The Fed is going to buy 40 billion dollars worth of mortgage-backed securities per month until they have decided that the economy is in good enough shape to stop. For those that get confused by terms like "quantitative easing" and "mortgage-backed securities", what the Federal Reserve is essentially saying is this: "We're going to print a bunch of money and buy stuff for as long as we feel it is necessary." In addition, the Federal Reserve has promised to keep interest rates at ultra-low levels all the way through mid-2015. The course that the Federal Reserve has set us on is utter insanity. Ben Bernanke can rain money down on us all he wants, but it is not going to do much at all to help the real economy. However, it will definitely hasten the destruction of the U.S. dollar.

You can't accuse Federal Reserve Chairman Ben Bernanke of not living up to his nickname. Back in 2002, Bernanke delivered a speech entitled "Deflation: Making Sure 'It' Doesn’t Happen Here" in which he referenced a statement by economist Milton Friedman about fighting deflation by dropping money from a helicopter. Well, it might be time for a new nickname for Bernanke because what he did today was a lot more than drop money from a helicopter. Today the Federal Reserve announced that QE3 will begin on Friday, but it is going to be much different from QE1 and QE2. Both of those rounds of quantitative easing were of limited duration. This time, the quantitative easing is going to be open-ended. The Fed is going to buy 40 billion dollars worth of mortgage-backed securities per month until they have decided that the economy is in good enough shape to stop. For those that get confused by terms like "quantitative easing" and "mortgage-backed securities", what the Federal Reserve is essentially saying is this: "We're going to print a bunch of money and buy stuff for as long as we feel it is necessary." In addition, the Federal Reserve has promised to keep interest rates at ultra-low levels all the way through mid-2015. The course that the Federal Reserve has set us on is utter insanity. Ben Bernanke can rain money down on us all he wants, but it is not going to do much at all to help the real economy. However, it will definitely hasten the destruction of the U.S. dollar.

And the Federal Reserve is apparently very eager to get QE3 going. Purchases of mortgage-backed securities are going to start on Friday.

In the coming months, hundreds of billions of dollars that the Federal Reserve has zapped into existence out of nothing will be injected into our financial system.

So what will happen to all of this new money?

If banks and financial institutions use that money to make loans then it could have somewhat of a positive impact on the economy in the short-term.

However, the truth is that it isn't as if banks are hurting for cash to loan out. In fact, right now banks are already sitting on $1.6 trillion in excess reserves. Just like with the first two rounds of quantitative easing, a lot of the money from QE3 will likely end up being put on the shelf.

But the stock market loved the news because they know that the previous two rounds of quantitative easing have been great for the financial markets. On Thursday, the stock market soared to levels not seen since December 2007.

There is much rejoicing on Wall Street right now.

And this stock market bounce is great for Bernanke's good buddy Barack Obama.

Obama nominated Bernanke to a second term as Fed Chairman, and this might be Bernanke's way of paying him back.

But of course the Fed is supposed to be "above politics" so that would never happen, right?

The Federal Reserve essentially "crossed the Rubicon" today. No longer will quantitative easing be considered an "emergency measure". Rather, it will now be considered just another "tool" that the Fed uses in the normal course of business.

Considering how vulnerable the U.S. dollar already is, announcing an "open-ended" round of quantitative easing is utter foolishness. According to the Fed, when you add the 40 billion dollars of new mortgage-backed security purchases per month to all of the other "easing" measures the Fed is continuing to do, the grand total is going to come to about 85 billion dollars a month. The following is from the statement that the Fed released earlier today....

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

So what does all of this mean?

I really like how one analyst put it when he described this announcement as a "I'm gonna ease till your eyes bleed kinda statement".

The Fed also promised to keep interest rates at "exceptionally low levels" until mid-2015....

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens. In particular, the Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015.

It seems that whenever the U.S. economy gets into trouble, Bernanke and his friends at the Fed only have one prescription and it goes something like this....

"Print more money and promise to keep interest rates near zero even longer."

Of course a lot of Republicans are quite disturbed that QE3 was announced with just a couple of months remaining in a very heated election battle.

Even big news organizations such as CNBC are commenting on this....

Though the Fed is ostensibly politically independent, the decision comes at a ticklish time with the presidential election less than two months away.

And without a doubt the mainstream media will be proclaiming this to be "good news" for the economy in the short-term.

But is QE3 really going to help the average person on the street?

Well, first let's take a look at employment. We are told that one of the primary reasons for QE3 is jobs.

But did QE1 and QE2 create jobs?

The answer is clearly no.

As you can see from the chart below, the percentage of working age Americans with a job fell dramatically during the last recession and has not bounced back since that time despite all of the quantitative easing that has been done already....

So why try the same thing again when it did not work the first two times?

But what more quantitative easing is likely to do is to pump up stock market values because a lot of the money from QE3 is going to end up being put into stocks and other investments.

This is going to help the wealthy get even wealthier, and it is going to make the "wealth gap" between the rich and the poor even larger in America.

QE3 is also probably going to cause commodity prices to rise just like QE1 and QE2 did.

That means that you will be paying more for gasoline, food and other basic necessities.

So there may not be more jobs, but at least you will get the privilege of paying more for things.

The inflation that QE3 will cause will be particularly cruel for those on fixed incomes such as retirees.

None of the extra money from QE3 is going to go into their pockets, but they will have to pay more to heat their homes and fill up their shopping carts.

And the "exceptionally low interest rate" policy of the Federal Reserve is absolutely devastating for those that have saved for retirement and that are relying on interest income for their living expenses.

In short, quantitative easing is very good for the wealthy and it is very bad for the average man and woman on the street.

But what else would you expect from the Federal Reserve?

It is imperative that we educate the American people about the Federal Reserve and about how they are destroying our economy. For much more on this, please see my previous article entitled "10 Things That Every American Should Know About The Federal Reserve".

Perhaps the biggest danger from QE3 is that it could greatly hasten the day when the U.S. dollar ceases to be the reserve currency of the world.

The rest of the world is not stupid. They see that the Federal Reserve is now firing up the printing presses whenever they feel like it. They can see the games that we are playing with our currency.

Why should the rest of the world continue to use the U.S. dollar to trade with one another when the United States is constantly debasing it and playing games with its value?

As I wrote about the other day, China and Russia have been calling for a new reserve currency for the world for several years. They have been leading the charge to conduct international trade in currencies other than the U.S. dollar, and I have documented many of the major international agreements to move away from the U.S. dollar that have been made in the last couple of years.

The status of the U.S. dollar in the world has already been steadily slipping, and now Helicopter Ben Bernanke pulls this kind of nonsense.

We are handing the rest of the world an excuse to abandon the U.S. dollar on a silver platter.

And when the rest of the globe rejects the U.S. dollar as a reserve currency, the dollar will crash, the cost of living will increase dramatically, our standard of living will go way down and we will never fully recover from it.

So if you think that things are "bad" now, just wait until that happens.

The U.S. dollar is one of the best things that the U.S. economy still has going for it, and Helicopter Ben Bernanke is doing his best to absolutely destroy that.

TOPICS: Business/Economy; Government; Society

KEYWORDS: bernanke; dollar; qe3

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

To: blam; Kartographer

2

posted on

09/14/2012 9:28:09 AM PDT

by

FrogMom

(There is no such thing as an honest democrat!)

To: SeekAndFind

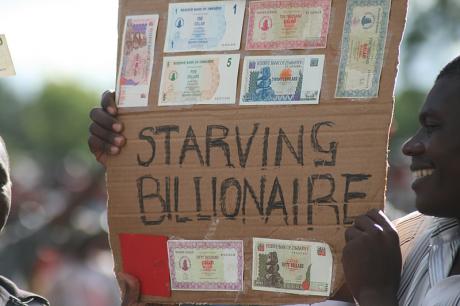

The Weimar Solution by TheBenBernank.

He may wind up doing more damage than Obama.

3

posted on

09/14/2012 9:31:42 AM PDT

by

Paine in the Neck

(Socialism consumes everything)

To: SeekAndFind

If more of the public realized that what Bernanke is doing, is tantamount to a destruction of generations of American achievement, there would probably be a demand to throw him in a cell with Bernie Madoff. Price "Infaltion" will eventually result; but in the meanwhile the confiscation of the fruits of American labor, wherever stored in Dollars, is going on at a terrible pace.

To understand the economic reality, see Gold & Money In America. Or to see how all of this will combine with Obama's Tax ideas to destroy the Middle Class: Inflation & Capital "Gains" Taxation.

William Flax

4

posted on

09/14/2012 9:36:42 AM PDT

by

Ohioan

To: Paine in the Neck

5

posted on

09/14/2012 9:39:57 AM PDT

by

SeekAndFind

(bOTRT)

To: SeekAndFind

Bernanke is worse than a common thief. Families can recover from the acts of thieves, but they won’t recover from this evil. While Wall Street celebrates, the rest of us are making less and paying more. Filth like Bernanke don’t care.

6

posted on

09/14/2012 9:46:36 AM PDT

by

pallis

To: SeekAndFind

Bernanke is trying to keep the patient alive. Bernanke is required by U.S. law to institute policies to try to keep unemployment down.

It's going to take congress though to cure us. We need to raise the import tariffs back up to historical norms (or higher until unemployment goes down). We need to insulate ourselves from future energy price increases. And we need a loose monetary policy to help rebuild our industries that have been devastated by 0 tariffs.

A loose monetary policy without fixing the structural issues above is like a bandaid on a major wound. It's better than nothing but we are still bleeding to death.

Raise the import tariffs, put our people back to work. And when unemployment drops Bernanke will happily go back to fighting inflation instead of unemployment. He can sell the debt he is buying as quick as he bought it if the market is strong.

7

posted on

09/14/2012 9:46:57 AM PDT

by

DannyTN

To: Ohioan

8

posted on

09/14/2012 9:50:25 AM PDT

by

Paine in the Neck

(Socialism consumes everything)

To: pallis

what about the bump up in retirement funds for those still working and or reinvesting dividends and interest?

9

posted on

09/14/2012 9:51:01 AM PDT

by

CGASMIA68

To: pallis

Bernanke is doing exactly what he is supposed to be doing according to U.S. Law. And the law is correct, that's what he needs to be doing. The problem isn't Bernanke. The problem is Congress, U.S. Trade Policy, and U.S. Energy Policy.

Fix those and Bernanke will go back to worrying about inflation.

12 USC Sec.225a -CITE-

01/03/2012 (112-90)

TITLE 12 - BANKS AND BANKING

CHAPTER 3 - FEDERAL RESERVE SYSTEM

SUBCHAPTER I - DEFINITIONS, ORGANIZATION, AND GENERAL PROVISIONS AFFECTING SYSTEM

Sec. 225a. Maintenance of long run growth of monetary and credit aggregates

-STATUTE-

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.

10

posted on

09/14/2012 10:00:07 AM PDT

by

DannyTN

To: SeekAndFind

Printing paper money always has been a problem for leaders who prized individual liberty and opportunity for citizens over outright lust for power for themselves.

Readers of this thread may be interested in the following quotations on the subject from "Our Ageless Constitution." Dr. Edwin Vieira, who contributed to that volume, has written extensively on the Founders' protections for liberty through their provisions for a sound money system. A search of his books and writings provide a great resource for understanding the dangers of paper money, and the wonderful protections of the Founders' system.

Thomas Jefferson:

"Paper is liable to be abused, has been, is, and forever will be abused, in every country in which it is permitted."

". . . although the other nations of Europe have tried and trodden every path of force or folly in fruitless quest of the same object, yet we still expect to find in juggling tricks and banking dreams, that money can be made out of nothing. . . The misfortune is. . . we shall plunge ourselves in unextinguishable debt, and entail on our posterity an inheritance of external taxes, which will bring our government and people into the condition of those of England, an nation of pikes and gudgeons, the latter bred merely as food for the former."

"Stock dealers and banking companies, by the aid of a paper system [paper money] are enriching themselves to the ruin of our country, and swaying the government by their possession of the printing presses, which their wealth commands, and by other means, not always honorable to the character of our countrymen."

Then there is John Maynard Keynes observation in "The Economic Consequences of the Peace - 1920":

"Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method, they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. . . . Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. . . . (It) does it in a manner which not one man in a million is able to diagnose. . . ."

To: DannyTN

“...promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.”

Seriously, you think this is what QE3 is doing? Get real. It will do little or nothing for employment. If it creates jobs, they will be minimum wage and part time. Commodities are going to soar while salaries remain stagnant or depressed. Interest rates are going to remain artificially low for as “long-term” as they can suppressed, and still have a dollar worth more than the paper they are printed on. Meanwhile, the large banks that are still holding billions in bad mortgage debt get another reprieve for their part in all this corruption. Excuse it anyway you want. Bernanke is a thief, and creating more debt to feed the habit of debt isn’t a cure. It will be the thing that kills us.

12

posted on

09/14/2012 10:14:25 AM PDT

by

pallis

To: DannyTN

His policies are destroying savers, retirement plans and people who have been responsible. How do you feel about that.

To: pallis

I think it is much more than just bad mortgage debt. I think the securitization process itself, with the systemically associated loss of original titles, notes and failures to file county property transfers is at the center of all the mortgage mess. The focus on fraud in foreclosure proceedings with “settlements” achieved, simply serves to COVER UP the original fraud, the destruction of the paper trail that is necessary for maintenance of the legal legitimacy of all property, inherent in the securitization process of creating the mortgage “backed” securities that the Executive Branch of govt. holds in the trillions (Fed, Fannie, Freddie, FHLB, FHA, etc). These MBS’ are not only associated with debt, they have no legal standing ina court of law because of the absence of producable title transfers, note transfers. The fraud inherent in the securitization process has been hidden all along.

All “transactions” after the securitization process with destruction of original titles and notes are fraudulent. The rating agencies (S and P, Moody’s, Fitch, et al) all assumed that legal processes were followed systemically in the securitization processes...they were not followed..systemically.

The mortgage processors could not fill waiting orders for tranches of Mortgage Backed Securities if they did title transfers, note assignments for each mortgage, and county registrations can take months. It was practical to destroy the legal standing of the mortgages for all time by simply committing fraud by omission rather than follow due process. What has been created with each mortgage in the securitization processes is, in legal terms, a new entity...”NON-PROPERTY”. It is a crime.

THe first right protected by the Constitution is the right of property. There is no legitimate reason for the Constitution if there is NO PROPERTY. The de facto creation of “NON-PROPERTY” destroys the Constitution and its relevance to our very reason for being as a Constitutional Republic, and mortgage backed securitization is the model used today. The mortgage industry has been nationalized and formerly private property, property with legal standing, is piling up on the balance sheets of the Fed Reserve and in the Agencies of the Executive Branch.

THe taxpayer is paying for it, and as the securities have no legal standing in a court of law, the public is paying, guaranteeing...”property” of no value. The Fed is buying MBSs from Fannie Mae at $40B a month..the MBS’s are worthless, and we are held ultimately accountable for the “debt”.

14

posted on

09/14/2012 10:38:53 AM PDT

by

givemELL

(Does Taiwan eet the Criteria to Qualify as an "Overseas Territory of the United States"? by Richar)

To: pallis

If you look at what QE3 is doing, he's buying mortgage debt.

He's increasing the money supply, but doing it in a way that is likely to make more money available to the public as mortgage loans. He's hoping to cause new housing starts and put construction workers back to work.

So despite your impugning his personal integrity, his plan is logical in light of his congressional mandate. Construction is one of the largest industries that he can target, and one that has been hit the hardest with job losses. Manufacturing has had more job losses, but he can't effectively target manufacturing as well as he can home building. But Congress can, easily with an import tariff.

Employment by major industry sector

Now you can probably argue, and I'd probably agree to an extent, that there is a glut of housing and building more just to put people back to work doesn't make sense. But it's what Bernanke can do, and we'll grow into the additional housing soon enough. And it's at least producing real assets and not wasting the money on producing some alternative energy that was never even viable in the first place.

It makes a lot more sense to look at where we are spending our money, that is not producing American jobs and try to get that to produce American jobs. Thus my call for import tariffs. But Bernanke can't do that. That takes Congress or the Executive.

15

posted on

09/14/2012 11:05:02 AM PDT

by

DannyTN

To: desertfreedom765

"His policies are destroying savers, retirement plans and people who have been responsible. How do you feel about that."People losing their jobs, major industries and businesses going under destroys savings and retirement plans much more effectively than does Bernanke pursuing a loose monetary policy. So I "feel about" that as the lesser of two evils. And the choice between two evils has been made necessary by the unwise trade polices that we have had for the last 30 years.

So far we haven't seen the hyper-inflation that the doomsayers have said is inevitable, because despite all the money pumping, he's simply offset the drop in money supply from the credit freezes.

When the credit market starts pumping money back in, Bernanke will have to start selling the debt he bought up or there will be inflation. But we won't get to that until unemployment is down.

16

posted on

09/14/2012 11:20:02 AM PDT

by

DannyTN

To: DannyTN

“He’s hoping to cause new housing starts and put construction workers back to work.”

It’s hard for me to impugn something that is so lacking as Bernanke’s character. What he hopes for, and what will transpire, are two different things. What is already occurring is inflation in commodities. We can call that collateral damage to all the little people who don’t figure into the QE scheme. While we are waiting for the construction industry to fire back up, and for another housing boom to rally the economy with real money, there will be more people going under, contributing to the glut of unemployment and housing. At best, depending on your perspective of best, Bernanke’s latest QE will cause the stock market to rally, and maybe create enough growth on paper to give Obama bragging rights come November. You go on believing this is a good thing, spawned from good intentions and legal mandate. The debt crisis will still be here, worse than ever, when it is all over.

17

posted on

09/14/2012 11:32:52 AM PDT

by

pallis

To: pallis

"The debt crisis will still be here, worse than ever, when it is all over."The Federal Reserve didn't cause the debt crisis. That's 100% Congress. The Federal Reserve didn't even own many gov't securities before 2008. And the crisis is 2008 was caused by the oil price spike which resulted in unemployment. The Unemployment caused mortgages to go bad and the two caused the banking crisis and credit freeze.

A lot of the commodity price increase you are seeing is due to oil, not Bernanke.

The debt crisis will indeed still be here when this is over. And this won't be over until Congress and/or the Executive wise up about trade and energy policies. But none of that is Bernanke's fault.

To the extent that we have inflation the debt crisis may be easier to deal with. But I don't think Bernanke would inflate for that reason. It's not his mandate, and he didn't before the 2008 crisis. And I'm not advocating that. I think he is responding soley to the unemployment as he should. But Bernanke is just first aid. Congress is cause and the cure.

18

posted on

09/14/2012 11:46:47 AM PDT

by

DannyTN

To: DannyTN

DannyTN said:

"We need to raise the import tariffs back up to historical norms (or higher until unemployment goes down). " We aren't living in the 1950s.

There are many, many industries today that are dependent upon sales abroad. If you enact barriers to free trade, you will reward some people here in the U.S. and punish others.

What is it about free trade that threatens you? The sooner Americans adapt to the competitive pressures from the rest of the world, the sooner we will have an economy worth investing in.

That the standard of living of Americans must be reduced for some is a reality that must be accepted. There is simply no way for the less-productive among us to live much better than more highly productive people in other countries.

If you feel personally generous, then you should give whatever amount of your income you wish to such people. To enforce your standard of who should prosper and who should not isn't fair to those of us who want to encourage greater productivity and the prosperity which it can enable.

The livelihoods of millions of people who once would have worked our farms with manual labor, has been replaced with the livelihoods of thousands making harvesting machines. If you make it impossible to sell harvesting machines world-wide, you force those millions back onto the farms. Who will be available to make luxury items if so many must toil to make food?

Don't buy into the "zero-sum" fallacies of liberalism. There isn't a fixed amount of food which requires that we decide who gets it and who doesn't. We want to encourage the production of food as a general benefit to all.

Similarly, there is no fixed amount of jobs. If you want as many jobs as possible, then you must encourage people to create jobs. It is the profit motive that encourages that creation. Economic barriers simply reward some people at the expense of others. Jobs that only exist because of government barriers are WORTHLESS. Jobs that only exist because of "quantitative easing" are WORTHLESS.

To: DannyTN

Your answer is reasonable given the circumstances. (Pick your poison). Especially about the trade policies.

Whether by design or stupidity we are De-Industrializing the USA.

The FR is understating the inflation rate for political reasons.

Because hyperinflation hasn’t arrived yet doesn’t mean that it won’t get us. Kinda of like jumping out of an Airplane, your doing great until the end.

Even a 50% devaluation of the dollar over 5 years is going to really hurt a lot of people.

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

You can't accuse Federal Reserve Chairman Ben Bernanke of not living up to his nickname. Back in 2002, Bernanke delivered a speech entitled "Deflation: Making Sure 'It' Doesn’t Happen Here" in which he referenced a statement by economist Milton Friedman about fighting deflation by dropping money from a helicopter. Well, it might be time for a new nickname for Bernanke because what he did today was a lot more than drop money from a helicopter. Today the Federal Reserve announced that QE3 will begin on Friday, but it is going to be much different from QE1 and QE2. Both of those rounds of quantitative easing were of limited duration. This time, the quantitative easing is going to be open-ended. The Fed is going to buy 40 billion dollars worth of mortgage-backed securities per month until they have decided that the economy is in good enough shape to stop. For those that get confused by terms like "quantitative easing" and "mortgage-backed securities", what the Federal Reserve is essentially saying is this: "We're going to print a bunch of money and buy stuff for as long as we feel it is necessary." In addition, the Federal Reserve has promised to keep interest rates at ultra-low levels all the way through mid-2015. The course that the Federal Reserve has set us on is utter insanity. Ben Bernanke can rain money down on us all he wants, but it is not going to do much at all to help the real economy. However, it will definitely hasten the destruction of the U.S. dollar.

You can't accuse Federal Reserve Chairman Ben Bernanke of not living up to his nickname. Back in 2002, Bernanke delivered a speech entitled "Deflation: Making Sure 'It' Doesn’t Happen Here" in which he referenced a statement by economist Milton Friedman about fighting deflation by dropping money from a helicopter. Well, it might be time for a new nickname for Bernanke because what he did today was a lot more than drop money from a helicopter. Today the Federal Reserve announced that QE3 will begin on Friday, but it is going to be much different from QE1 and QE2. Both of those rounds of quantitative easing were of limited duration. This time, the quantitative easing is going to be open-ended. The Fed is going to buy 40 billion dollars worth of mortgage-backed securities per month until they have decided that the economy is in good enough shape to stop. For those that get confused by terms like "quantitative easing" and "mortgage-backed securities", what the Federal Reserve is essentially saying is this: "We're going to print a bunch of money and buy stuff for as long as we feel it is necessary." In addition, the Federal Reserve has promised to keep interest rates at ultra-low levels all the way through mid-2015. The course that the Federal Reserve has set us on is utter insanity. Ben Bernanke can rain money down on us all he wants, but it is not going to do much at all to help the real economy. However, it will definitely hasten the destruction of the U.S. dollar.