To: RandallFlagg

My mom started saying Romney paid too low of a rate compared to the 25% my family pays and I shut her down with 1 sentence: “I doubt you ever pay over $1,000,000 in taxes. Ever.”

To: abercrombie_guy_38

If your family pays 25% effective rate, their income would have to be at least $500,000 and probably more like $1 million or above. The tax rate for 25% doesn’t even start until you hit $300,000 or so AFTER deductions, charity, mortgage, personal deductions, business deductions, etc. That’s only on earnings from salary or business profit for self-employed. Any stocks, investments, dividends, etc is 15%, which almost anyone one at that level of income is certainly going to be factored in.

I challenged someone I know on this a few months ago, after she said she pays 25%. I called BS on it. In reality, she had no idea.

22 posted on

09/22/2012 7:36:04 PM PDT by

ilgipper

To: abercrombie_guy_38

My mom started saying Romney paid too low of a rate compared to the 25% my family pays Does her family really pay 25%? Or is that just the marginal rate?

Romney's tax rate was calculated by dividing taxes paid by gross income. It was low for his income bracket, but considering the source of his income and the huge charitable deduction, it's not usual.

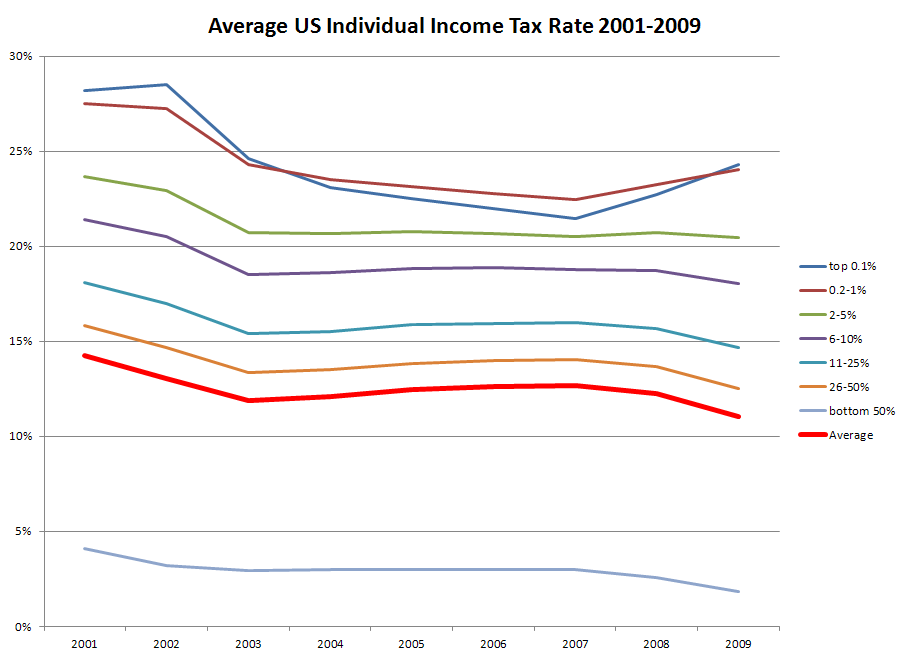

As a group, you don't pay an average rate of 25% unless you are in the top 1%. The average for EVERYONE (in 2009) was about 11%:

That is just for individual income taxes. If you are a wage earner, you pay another 7.65% for Social Security and Medicare. Actually, you pay double that, but most people don't know it.

But, you can't compare your combined Social Security + Medicare + individual income taxes to someone else's income taxes (only). There are three different taxes, and each has a different purpose.

If Romney doesn't pay Social Security taxes, he doesn't get any Social Security benefits. He will be covered by Medicare, but I suspect he won't be using it.

23 posted on

09/22/2012 7:39:08 PM PDT by

justlurking

(The only remedy for a bad guy with a gun is a good WOMAN (Sgt. Kimberly Munley) with a gun)

To: abercrombie_guy_38; dixiechick2000; Black Agnes; Pelham

Man...you yankees have some difficult families

God bless you for sticking it out for conservatism

down here at least amongst whites it’s rare to find lefty family members

out of my extended family of say..200 folks all the way to 3rd cousins and whatnot..of which none are blue collar anymore..all educated class

two libs...maybe 3 actually...one in San Francisco (not out of the closet gay) and another in academia (female..not totally lib) and another hybridizing the world without the benefit of marriage and also in academia (female obviously)

I actually have a lesbian very old aunt who is very conservative and very quiet about her and her old partner of 50 years...they are near 80..they detest Obama and entitlement culture..and think gay marriage is loony

but most Yankees I know come from lib families and they have struck out on their own

now folks will say “now wardaddy, all southerners used to be Democrats”

true ..as were most yankees too..but those southerners were still EXTREMELY socially conservative but drank New Deal elixir ..like most of the country

36 posted on

09/22/2012 11:17:25 PM PDT by

wardaddy

(this is a perfect window for Netanyahu to bomb Iran..I hereby give my go ahead..thanks Muzzie idiots)

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson