Posted on 05/30/2014 6:16:34 PM PDT by Lorianne

The housing "recovery" since 2010 can be summarized in four phrases: diminishing returns, unprecedented central state/bank intervention, unintended consequences, end-game. Three charts from our friends at Market Daily Briefing and one of the Case-Shiller Home Price Index tell the story.

The index of major housing markets rose from 80 to 227--a staggering 280% rise in a few years.

The housing bubble was a classic Ponzi Scheme. A recent article in Scientific American explains that Ponzi schemes do not require a fraud--all they require is the belief that another buyer will pay significantly more for an asset than we did: The Whole Economy Is Rife with Ponzi Schemes (subscription required; look for the June issue at your local library).

This bubble dynamic needs nothing more than a supply of greater fools willing to pay substantially more for assets that haven't changed qualitatively or quantitatively, and our expectation that the supply of greater fools is endless.

Alas, the number of people willing and able to borrow immense sums to buy more houses eventually falls below the number needed to sustain the bubble, and the bubble promptly implodes.

(Excerpt) Read more at charleshughsmith.blogspot.com ...

You could be the next John Paulson!

Ponzi schemes do not require a fraud

*******************************

The housing bubble did indeed have IMMENSE FRAUD at it’s core ,, sure the buyers bought into the “bigger fool” theory ,, but the bankers blacklisted any appraiser that didn’t come in with the (higher and higher) numbers they demanded. The banksters also threw out ALL underwriting standards to the point where anyone could buy a $500k mansion knowing that there was no income to support the loan ,,, they also defrauded the insurers and ratings agencies ...

Why aren’t a few thousand of them ,, including ceo and board level execs , in prison...

Now we discern the end-game: the pool of greater fools is evaporating as prices reach nosebleed territory and newbie rental-housing investors discover houses and renters have all sorts of real-world issues that paper wealth doesn’t have. In other words, that promised 6% net yield is not guaranteed, but is fraught with risks— especially in a recession, where renters stop paying and the pool of renters able to pay sky-high rents dries up.

I have been wondering about this for a long time now. How the hell long can these “investors” snap up properties when the pool of potential renters is static or shrinking?

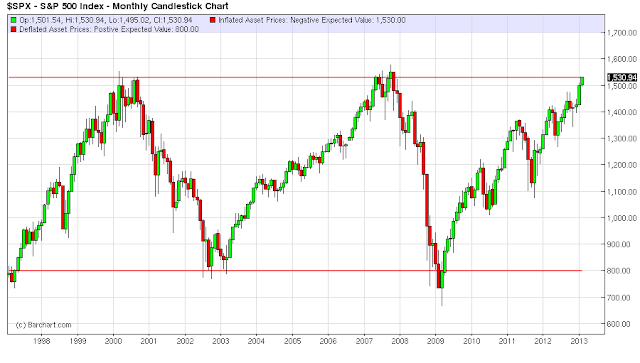

The Stock Market is a Giant Ponzi Scheme

So a Ponzi scheme pays out old investors with the proceeds of the new investors. Well, current retirees right now are benefitting from these ‘artificial injections’ into the stock market at the expense of future retirees who will be left holding the bag on depreciating assets once the fed stops the artificial injections, and asset prices go down. Moreover, when they take the additional step of removing the liquidity from the system, i.e., tightening mode, asset prices will go down even further. Consequently, anybody who takes money out of the stock market while the fed is artificially raising asset prices is benefitting at the expense of all 401k money that is buying assets now at artificially raised prices. In short new investors are buying assets at prices higher than they would otherwise without the Fed`s involvement in the markets.

Just wait until the Stock Market crashes big (and it will). It will make the Housing Market Bubble look like a game of checkers.

And we know much of that was because of immense, incredible pressure by the Federal Government to give the "liar loans" on the basis of affirmative action loan practices.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.