Posted on 07/31/2015 11:00:22 AM PDT by SeekAndFind

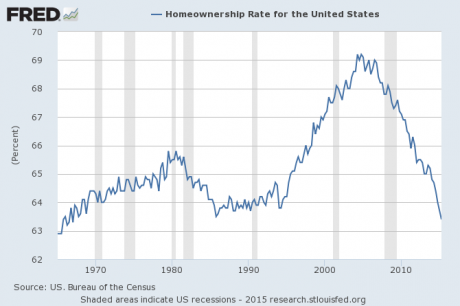

Thanks to the “Obama recovery”, the rate of homeownership in the United States has fallen to the lowest level in 48 years. The percentage of Americans that own a home is widely considered to be a key indicator of the health of the middle class, and we have just learned that during the second quarter of 2015 that number dropped from 63.7 percent to 63.4 percent. It is now the lowest that it has been since 1967. Unlike a lot of other government economic statistics, this one is fairly difficult to manipulate. Either someone owns a home or they do not. And what the homeownership rate is telling us is that the percentage of Americans that can qualify for a mortgage has been falling dramatically. Just take a look at the following chart. This is not just a decline – this is a complete and utter collapse…

Never before in U.S. history has the rate of homeownership fallen so far or so fast.

So what is the bottom line to all of this?

The bottom line is that the middle class is dying.

When I was growing up, I lived in a pretty typical middle class neighborhood and I went to a pretty typical high school. I didn’t know anybody that was “rich”, but I didn’t know anybody that was poor either. At that time, it seemed like just about anyone that was willing to work hard and be dependable could find a decent job. Most families that I knew had a nice home and a couple of vehicles in the driveway. Life was not perfect, but at least things felt “normal”.

But now things have changed. The “American Dream” is becoming out of reach for an increasingly large number of people. In fact, the percentage of Americans that do not believe that they will be able to buy a home “for the foreseeable future” just continues to soar. The following comes from Zero Hedge…

Three months ago, just as the last Census Homeownership and residential vacancy report hit, Gallup released its latest survey which confirmed just how dead the American Dream has become for tens if not hundreds of millions of Americans.

According to the poll, the number of Americans who did not currently own a home and say they do not think they will buy a home in “the foreseeable future,” had risen by one third to 41%, vs. “only” 31% two years ago. Non-homeowners’ expectations of buying a house in the next year or five years were unchanged, suggesting little change in the short-term housing market.

As Gallup wryly puts it, “what may have been a longer-term goal for many may now not be a goal at all, and this could have an effect on the longer-term housing market.”

Why are so many Americans unable to buy homes?

It is because of a lack of good jobs.

Since the year 2000, real median household income in the United States has declined by about 5000 dollars. Good paying manufacturing jobs that once fueled the rise of the middle class are being shipped overseas, and they are being replaced by low paying service jobs.

This is the new “Obama economy”, and it is absolutely shredding the middle class.

Back in 2008, 53 percent of all Americans still considered themselves to be part of the “middle class”.

By 2014, that number had fallen to just 44 percent.

Since fewer and fewer of us can now afford a mortgage, more people than ever are being forced to rent, and this has helped push rents into the stratosphere. Here is more from Zero Hedge…

Because as homeownership falls, demand for rental housing is booming. The vacancy rate for rented homes in the U.S. fell to 6.8% in the first quarter from 7.5% a year earlier. It was the lowest first-quarter rate since 1986.

And the punchline, which should come as no surprise to anyone: the median monthly asking rent just rose to a record $803 across the US.

Unfortunately, as bad as these numbers are right now, they are about to get a whole lot worse.

As I have been warning about repeatedly, we stand on the very precipice of the next great financial crisis. These are the last days of “normal life” in America, and we are about to enter a period of time which is going to be extraordinarily difficult and which is going to last for years.

So the truth is that this is not really a good time to be taking out a huge mortgage anyway. During this next crisis, it will be very important to be “lean and mean”. The less debt you have, the better off you will be.

If you do have a mortgage right now, that is okay. Just be sure to build up an emergency fund so that you can make your mortgage payments if you lose your job or your business suffers a reversal.

Don’t forget what happened back in 2008. When the stock market collapsed, millions of Americans started to lose their jobs, and because most of them were living paycheck to paycheck all of a sudden a whole lot of them could not make their mortgage payments.

We saw foreclosures surge like crazy, and millions of families that were once living comfortable middle class lifestyles very rapidly found themselves dumped out of their homes.

This is why I am constantly pounding away on the need for a sizable emergency fund. During a crisis situation, the last thing that you are going to need is for someone to be trying to kick you out of your home. Please make sure that you have a fund that can cover your rent or mortgage for at least six months.

If you are living paycheck to paycheck and you can barely afford the home that you are currently living in, there is no shame in selling your current place and moving to a more affordable location. It is very, very tough for many people to downsize, but it could end up being a huge blessing in the end.

We are moving into a time in which conditions are going to be changing rapidly.

What worked in the past may not necessarily work in the future.

Agenda 21. Move the populace into high density urban areas where they can live like rats and be dependent upon the govt. for their subsistence.

(T)he theory of the Communists may be summed up in the single sentence: Abolition of private property. …This goal of the Marxists has been widely known since 1848.

And it isn't going to get any easier if our fellow citizens keep voting for RINOs, demonRATs and socialist.

This is true.

In the 50’s and 60’s, everyone owned a home. It was relatively easy.

People who rented were thought of as a bit sketchy. There were very few, at least outside of a few big cities.

But it ain’t just Obama. It’s the destruction of wages by “free” trade - translation: untaxed Asian goods - and the insourcing of tens of millions of desperate Third Worlders into the United States, which is now something north of 80 million since 1965. Maybe more, just being conservative. In 1970 the population was about 200 million. It’s now a bit over 300 million.

All that competition for land and housing has made America a crowded country again...at least in the law abiding parts. There’s dirt in Detroit and Cleveland but...who wants it.

So if we end immigration - legal and illegal - for at least 40 years, and adopt Americans First trade policies, things will turn around.

And of course, the big one: we end Abortion entirely, the “Constitutional Right” which never existed. Then our population will recover, and we won’t think in terms of importing a replacement population.

This is only one factor, there are at least two other factors. One is people don't want to commit to buying homes unless they know they have a stable job and stable income. So you have those who can't afford to buy, and those who don't want to buy. The other is folks who were burned since 2007/2008 not wanting to buy again and get burned again.

Home ownership is NOT the American Dream. The American Dream was to be free to accomplish whatever a person’s talent, ambition, and hard work would allow, regardless of religion, ethnicity, or social status.

Under our current system of legalized perpetual property taxes actual home ownership is impossible. No one ever owns a home when taxes must be continually paid in order to maintain possession of the property.

If we are to make good on the American dream we must pass a constitutional amendment making perpetual taxes illegal.

It would be ok to have a one time tax on the purchase of property but not a perpetual tax. Anything that is perpetually taxed cannot by definition be owned.

There was never a time in the Unites States when “everyone” owned a home. As the recent stats show today’s rate is about the same as the mid sixties. While I would agree it was easier to afford a home for many people in the past, when good paying factory jobs were available to those who didn’t have to go deeply in debt to attend college, higher rates of home ownership is a more recent phenomenon.

Plank 3 is partially achieved via death taxes, and the fourth plank cannot be done without pulling down the rest of the Constitution, of course.

- Abolition of property in land and application of all rents of land to public purposes.

- A heavy progressive or graduated income tax.

- Abolition of all rights of inheritance.

- Confiscation of the property of all emigrants and rebels. …

Social ownership of property is not conducive to any of that.

And why are you using the language of the left?

With interest rates south of 4% on a 30 year mortgage for the time being, that statistic is puzzling.

And that $5,000 would cover $87,276 worth of mortgage financing at 4% for 30 years.

As I stated earlier anything that is perpetually taxed can never be owned.

Add to that, in the past (sixties) much larger down payments were the norm when taking out a mortgage to "buy" a home. In recent times many homes were sold with near zero down payment. In that case the "purchaser" doesn't really own anything at all and is more closely a renter than an owner.

Uhhh...that would be US!

The housing market is as phony as the government’s budget. The same homes that were foreclosed on five years ago are now back on the market for the same inflated prices, while real wages have gone down.

Guess who has been buying up the real estate market? Why look, it’s uncle Warren, the same man responsible for fraudulently rating mortgage securities leading to the housing crash. Oh, and he’s a big Obama supporter? Color me flabbergasted...

Yes, you’re right, the key is wage deflation, although I think there are a couple other factors contributing to it.

Home prices have risen, but wages have shrunk. That’s the reason why every newlywed couple in 1960 could save up a house downpayment in six months, but now it takes people 3 years to do the same.

This dream of owning a home is a “BIG” lie.Even though your mortgage is paid off you don’t really own it.See,Your partner,The town or municipality that you own your home in will continue to overspend and they put the load on the property owner.

Those S.O.B’s will steal your home right out from under you.

I’ve seen those statistics and I really have an issue with them.

It surprises me, because I can honestly state that in Arizona in the 50’s and 60’s, renters were college students and young singles. Everyone else owned, even if it was a crappy home.

And even in California. Everyone in my extended family owned homes in the LA basin, San Diego County etc. They were middle class and some upper middle class. One relative owned a home in Pebble Beach, but she married some banker.

So I don’t know where those statistics come from. Perhaps skewed by the Eastern Seaboard. It would be interesting to look into it deeper. But 20% down and 4% mortgages were not a problem. An uncle who worked for Northrop starting in the 30’s bought a house in Santa Monica for...drum roll please...$4500 way back when ( ‘39 I think ).

It’s now an apartment complex worth, oh, I dunno..2 mil...

He sold it over 40 years ago for 60K. Thought it was all the money on Earth!

That’s exactly how the left sees us, yes.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.