,/A>

,/A>Posted on 05/27/2022 2:19:47 PM PDT by blam

Last weekend we showed something remarkable (or delightful, if one is a stock bull): with the US economy on the verge of recession, with inflation topping, with the housing market about to crack, the last pillar holding up the US economy (and preventing the Fed from continuing its tightening plans beyond the summer), the job market, had just hit a brick wall as revealed by real-time indicators – such as Revello’s measure of total job postings – which plunged by 22.5%, the biggest change on record (we also listed several other labor market metrics confirming that the job market was about to crater).

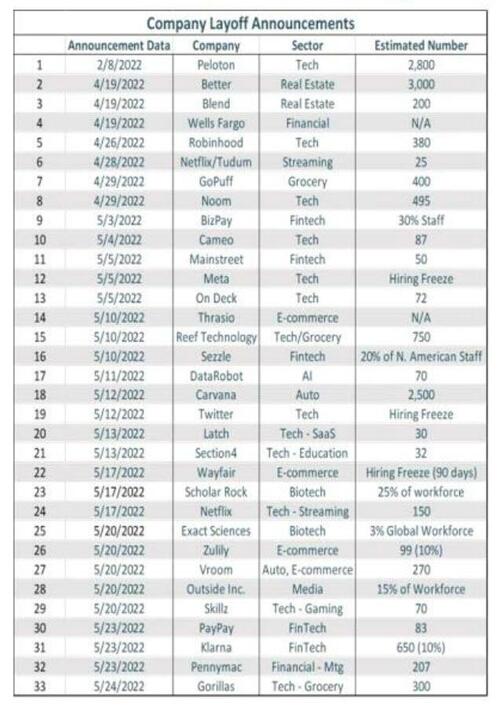

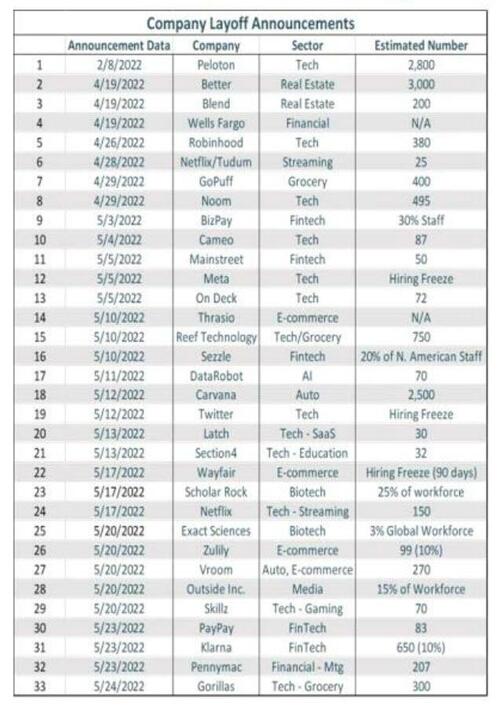

Fast forward to today when one day after we found that initial jobless claims continue to rise after hitting a generational low in March, and as company after company is warning that it will freeze hiring amid a historic profit margin crunch – if not announce outright layoff plans – Piper Sandler has compiled all the recent company mass layoff announcements. They are, in a word, startling.

,/A>

,/A>

Commenting on the surge in layoffs, Piper Sandler’s chief economist Nancy Lazar says that “post-covid rightsizing means that lots more layoffs are coming” and adds that “many companies overhired and overpaid during the Covid crisis.” Lazar also points out the obvious, that “the stay-at-home bubble was a bubble, and not a “new paradigm” of goods consumption” which means that “a right-sizing cycle is coming, with weaker growth in jobs and wages.”

Here are the stunning implications according to Piper Sandler:

◾We could see a million layoffs or more, as many goods sectors that benefited from the pandemic now realize they added too much capacity (as involuntary admissions make clear).

◾Low-income workers – who enjoyed the hottest wage gains during the crisis – are now most at risk of layoffs, with remaining job holders to see much slower wage growth.

◾Payrolls gains are poised to downshift to just 100k/month on average in the second half of the year, from about 515k/month through April.

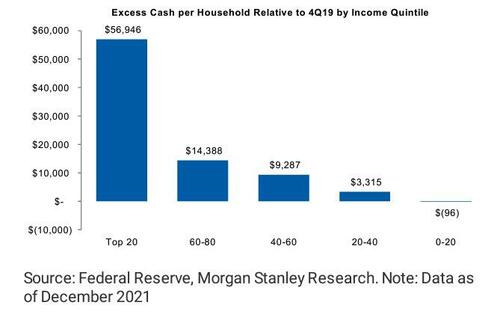

While the above implications are startling for the US economy as a whole, they are especially bad for America’s poorest quintile which, according to Morgan Stanley calculations, now have less “excess cash” than they did pre-covid. In other words, the poorest 20% income quintile is now poorer than it was before Biden’s massive stimmy bonanza. And with every passing month, more quintile will get dragged underneath.

Of course, the US labor market doesn’t need to go into all-out cardiac arrest – a sharp drop in wage growth should do it. And sure enough, according to a Bloomberg report today, after handing out hefty salary increases over the past year, companies are now becoming more cautious with their cash over concern further big payouts will eat into profits, according to staffing companies, business owners and recent surveys.

“We’ve reached a level of wage inflation where employers are going to say, ‘I’ve done as much as I can,’” said Jonas Prising, chief executive officer of ManpowerGroup Inc., the Milwaukee-based staffing company that serves more than 100,000 clients worldwide. “‘My consumers and customers aren’t going to accept me passing these costs on any further, so we need to start to mitigate them.’”

Burning Glass Institute Chief Economist Gad Levanon said the US is transitioning from a pandemic-driven job market — where many Americans weren’t actively seeking work due to fears of the virus and related issues — to one that is more traditionally tight because unemployment is low. “Every company still needs people but they don’t need hundreds of people,” said Tom Gimbel, chief executive officer of Chicago-based employment agency LaSalle Network. “They’re being choosier about who they’re hiring than they were six months ago.”

Beveridge Well Drilling Inc. is among those feeling the pinch. The Nebraska-based company is offering an hourly wage of $16.50 for manual labor, up from $12 about a year ago. But even with “100%” health care benefits and other generous perks, it can’t fill all the open slots, vice president of construction Brandon Jones said.

And while the firm could bump up its offers to about $18 an hour, that’s “about as high as we feel we can do” against the backdrop of rising fuel and supply costs, Jones said.

All of which begs the question: yes, Biden may be terrified about soaring inflation….

Biden about to find out what polls worse: recession and bear market or runaway inflation.

— zerohedge (@zerohedge) May 20, 2022

… but how long will he tolerate an economy (and how long will an economic tolerate him) where millions are not only about to see their wages “revert back to normal” if they are lucky, while many other millions are about to lose their jobs.

As for the Fed, well with the Citi US Eco surprise index already crashing…

… one can only imagine where it will go not if but when we get a negative payrolls print in one of the coming months, and what that will do to the Fed’s hiking plans.

I have heard over and over again that raising the unemployment rate is exactly what the Feds are trying to do. They need to crash the stock market and the economy to get inflation under control, which I believe is running at a double-digit rate despite what official reports say. Even Elon Musk has said it may not be a bad idea to as a means to control inflation. And yet, there is still talk of Biden injecting billions more into the economy.

Read the list of companies; not exactly the Fortune 500 except Meta.

Inflation is driving up the cost of all necessities and is therefore taking a bite out of disposable income. Less money to spend on such items will mean lower revenues for lots of companies, which could translate into reduced employment.

We’re a long way from getting out from under extraordinary inflationary pressures.

One report I’ve seen said that strip clubs are empty

With price of gas skyrocketing nobody has the cash for ass ......

Brandon: "Hold muh beer while I try both..."

Yep.

As more money is spent on necessities food, gas etc, discretionary spending is toast. Luxury good businesses, travel, entertainment, restaurants area all going to be downsizing.

Looks like all those “help wanted” signs we’ve been seeing in small businesses and eateries will soon disappear.

The health system where my wife works laid off a couple hundred staff the other day.

Most of those spots were “open positions”, but it’s 200 fewer jobs in our area.

So much of “Hospital Heroes.”

The Fed’s balance sheet is ‘only’ $9 trillion. What could go wrong?

The health system where my wife works laid off a couple hundred staff the other day.

***************

I don’t know anything about the economics of health care but it would seem that the flood of immigrants into this country has to be driving up costs. I don’t see how hospitals cope with the costs of treating people with no insurance.

Biden has no idea what is going on. He is in a fog 24/7

Actually, I listened into some of the planning calls: it had more to do with a change in “patient behavior.” Stuff that people would go to the offices is simply not getting people. They are consolidating stuff that has gone telehealth.

Very few “clinical” people were whacked.

It was one of the weirdest layoff processes I’ve seen. And I did M&A in banks for years.

Has anyone tracked this source to know their reliability?

Has anyone tracked this source to know their reliability?

#13 My cousins husband is a hospital supplies buyer and he lost his job because of illegals costing the hospital alot and they had to close.

He was lucky as his contract paid him and he was able to find another same job at another hospital so 2 salaries for several months.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.