Posted on 01/18/2023 6:14:34 PM PST by SeekAndFind

Should the wealth effect reverse as assets fall, capital gains evaporate and investment income declines, the top 10% will no longer have the means or appetite to spend so freely.

Soaring wealth-income inequality has all sorts of consequences. As many (including me) have noted, the concentration of wealth and income in the top 0.1% has enabled the few to buy political influence to protect their interests at the expense of the many and the common good.

In other words, extreme wealth-income inequality dismantles democracy. There is no way to sugarcoat this reality.

But the concentration of wealth and income isn't limited to the top 0.1% or top 1%. The top 5% and top 10% have increased their share of household wealth and income, too, and this has far-reaching consequences for the economy, as the top 10% accounts for the bulk not just of income but of spending.

According to the Federal Reserve, ( Distribution of Household Wealth in the U.S. since 1989), the top 1% owned 22.7% of all household wealth in 1989. Their share increased to 30.6% in 2022. The share of the 9% below the top 1% (90% to 99%) remained virtually unchanged at 37.4%. The top 10% own 68% of all household wealth.

But this doesn't reflect the real concentration of income-producing assets, i.e. investments. Total household wealth includes the family home, the F-150 truck, the snowmobile, etc. What separates the economic classes isn't their household possessions, it's their ownership of assets that generate income and capital gains.

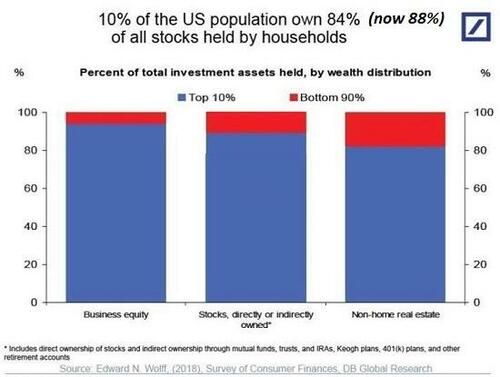

As the chart below shows, the top 10% own the vast majority of business equity, stocks/bonds and income-producing real estate, between 80% and 90% of each category.

This means the tremendous increases in asset valuations of the past two decades have flowed almost exclusively to the top 10%, with the important caveat that the vast majority of the gains in income and wealth have flowed to the top 0.1%, top 1% and top 5%.

According to the US Census Bureau, ( Income in the United States: 2021), the top 20% of households have 52% of all household income, and the top 5% have about 1/4th, (23.5%). The top 20% have roughly 50% of all income, but the top 10% have 40% of all income.

The other charts below reveal that the bulk of income gains sine 1980 have been concentrated in the top 1%. The top 5% registered triple the gains (71%) of the bottom 90% (24%). The income of the top 0.1% soared by 340%.

For context, let's look at some annual-income numbers. According to the Bureau of Labor Statistics, the mean income of the top 10% ($290,000) is almost six times the mean income of households at the 50% level ($51,000).

Even more telling, the top 10% households ($290,000) earn twice as much as the 80% to 90% households ($145,000).

What's all this mean? It boils down to the wealth effect and spending. The top 10% account for roughly half of all consumption, which makes sense given they own 2/3 of the wealth and 85% of income producing assets, and they get 40% of the total income.

If their wealth were to diminish in an extended Bear Market, their spending will also diminish. Not only will they no longer feel so rich (the wealth effect), the income and capital gains produced by their assets will also decline.

The dependence of major sectors of the economy on the spending of the top 10% is often overlooked. For example, one study of US airline flights found that 12% of the American populace take two-thirds (66 per cent) of all flights.

You see the pattern here: the top 10% account for half, two-thirds or over three-quarters of everything: wealth, income, income-producing assets, capital gains and spending.

Should the wealth effect reverse as assets fall, capital gains evaporate and investment income declines, the top 10% will no longer have the means or appetite to spend so freely. By concentrating wealth and income in the top 10%, and making their spending so heavily dependent on capital gains and income generated by the bubble du jour, we've set our economy up for an asymmetric decline as credit-asset bubbles popping will lead to steep declines in top 10% spending--spending that supports myriad sectors that are heavily dependent on the free-spending top 10%.

Put another way: the chickens of income-wealth inequality will inevitably come home to roost, generating far-reaching consequences in consumption, employment, tax revenues and virtually every other economic metric.

If you want to know the direction of the economy, watch the top 10%. In some sense, everything else is signal noise.

* * *

The latest available data from the EPI show that in 2020 annual wages for the top 1% reached $823,763, up 7.3% compared to 2019. How much do you need to earn to be in the top 0.1%? A hefty $3,212,486, which is almost 10% more than that group earned a year before. Wages for the bottom 90% rose at a much more modest rest of just 1.7% over the same period, with an average income of $40,085.

| 2020 Average Annual Wages | |

|---|---|

| Group | Avg. Wages |

| Top 0.1% of Earners | $3,212,486 |

| Top 1% of Earners | $823,763 |

| Top 5% of Earners | $342,987 |

| Top 10% of Earners | $173,176 |

“Saint Peter, don’t you call me ‘cause I can’t go

I owe my soul to the company store”

Top 10% of Earners $173,176

^^This^^

Nothing actionable in this.

Interesting piece and thanks for posting.

The next few years are going to be interesting.........

Mentioned a couple months ago when some were making light of tech layoffs—those layoffs have a hugely disparate impact on their surrounding community

Granted they can often pull through a year without much of a hitch but domestic help loses, new stuff isn’t purchased, new ventures aren’t started

By the time it sorts out that 250k/yr person losing their disposable income probably has more impact than 10 median earners from purely a numbers perspective

I agree. I am skeptical one can use this theory for investing or whatever to predict market trends. Not doubting the data necessarily but not sure how it can be used reliably.

One of my favorite songs. Tennessee Ernie Ford.

“Looks like it was a obvious conclusion that wealth creates wealth.”

I suspect there’s a large element of government corruption and largess creating wealth also.

Age creates wealth.

Being in a very big generation of people creates wealth.

Quantitative easing to infinity creates asset inflation, so relative wealth for people who already hold assets.

Extremely deceitful to conflate being in the top 0.1%, and thus being able to buy congressmen / influence legislation - and being in the top 10%, and hence being able to afford granite kitchen countertops or annual ocean liner cruises.

Regards,

I suspect there’s a large element of government corruption and largess creating wealth also.

The author of this piece has explicitly conflated belonging to the top 0.1% - at which level one's personal wealth allows one to purchase political power and thus undermine democracy - and being in the top 10% - at which level one can merely afford annual vacations in Europe or enjoy a weekend house?

QUESTION: Why does the author of this piece wish to impute guilt through association and imply that the top 10% wage-earners are somehow working against Democracy?

Regards,

The author is a Marxist! He wants only to engender resentment, vague fear, and social envy!

He assiduously avoids providing a concrete road plan on how the supposed "problem" might be solved (because that would reveal his true ideological orientation / allegiance).

Tripe!

Regards,

sorry, but the averages are pretty meaningless in this context - median would be a much better metric - a small number of people earning a few billion dollars a year skews the averages so much that it becomes meaningless.

solar...electric cars....wind turbines..etc etc....

the wealthy really do dictate what the laws and regulations are going to be.....

we've had too many DEFEND THE WEALTHY people on FR imo......

I don't dispute that.

HOWEVER, it is maliciously wrong to conflate the 0.1-percenters with those in the top 10% (for the reasons I already touched upon in my previous posting in this thread).

He segues seamlessly from "the top 0.1% - with their millions hidden away in the Cayman Islands - buy the votes of congressmen, etc." to "the top 10% of all earners..."

That is deceitful.

Folks like us are "comfortable," but in no wise do we have a disproportionately powerful influence on the outcome of elections, the appointment of judges, etc.

we've had too many DEFEND THE WEALTHY people on FR imo......

Any American who has come by their wealth honestly - usually by dint of their superior intellect, diligence, willingness to defer pleasure, etc. - is deserving of our praise (they are the ones "holding together" the moral fabric of our nation) and our defense.

Regards,

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.