Posted on 12/13/2012 12:16:27 PM PST by ExxonPatrolUs

Economist Jed Kolko at Trulia writes: Housing in 2013: What’s In, What’s Out. Kolko discusses five predictions for 2013, the first is on inventory:

1. OUT: Will Home Prices Bottom? IN: Will Inventories Bottom? The big question this year was whether home prices had finally hit bottom. We now know the answer is a resounding “Yes”: every major index shows asking and sales prices rising in 2012. The key question in 2013, though, is whether prices will rise enough so that for-sale inventory–which has fallen 43% nationally since the summer of 2010–will hit bottom and start expanding again. The sharp decline in inventory was a necessary correction to the oversupply of homes after the bubble, but now inventory is below normal levels and holding back sales, particularly in California and the rest of the West. Rising prices should lead to more inventory, for two reasons: (1) rising prices encourage new construction, and (2) rising prices encourage some homeowners to sell. The big question for 2013 is whether today’s price gains will continue strongly enough to encourage builders to build and homeowners to sell. Why it matters: more inventory will lead to more sales and give buyers more homes to choose from.

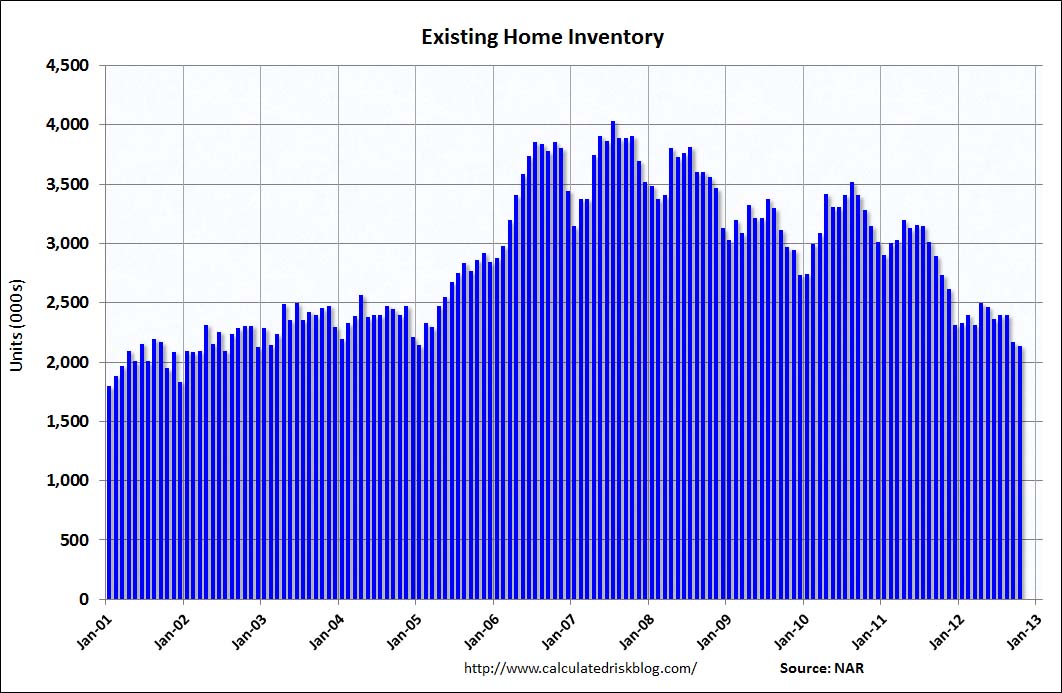

This is a very important question for 2013. This graph shows nationwide inventory for existing homes through October.

According to the NAR, inventory declined to 2.14 million in October down from 2.17 million in September. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

If we see the usually seasonal decline in December and January, then NAR reported inventory will probably fall to the 1.80 to 1.85 million range. That would be the lowest level since January 2001.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. When we compare inventory to earlier periods, we need to remember there were essentially no "short sale contingent" listings prior to 2006.

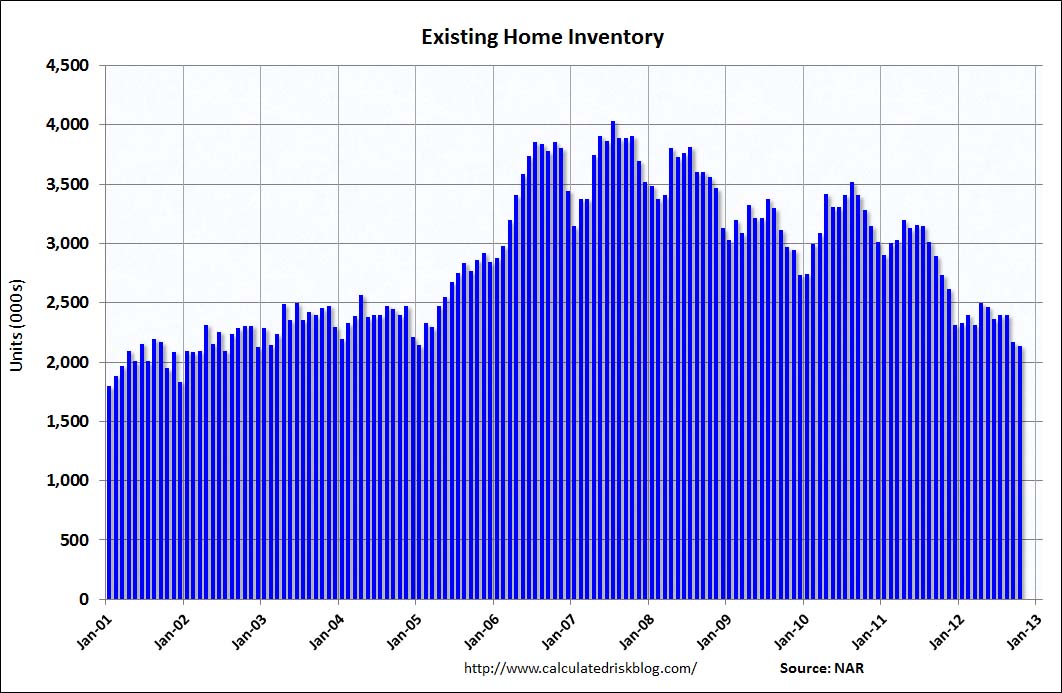

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This was the 20th consecutive month with a YoY decrease in inventory. It appears that inventory will be down sharply YoY in November too.

Months of supply declined to 5.4 months in October and is now in the normal range. I expect months-of-supply will be under 5 in December and January for the first time since early 2005.

Whenever I talk with real estate agents, I ask why they think inventory is so low. A common answer is that people don't want to sell at the bottom. In a market with falling prices, sellers rush to list their homes, and inventory increases. But if sellers think prices have bottomed, then they believe they can be patient, and inventory declines. Another reason is that many homeowners are "underwater" on their mortgage and can't sell.

If prices increase enough (probably around 5% in 2012) then some of the potential sellers will come off the fence, and some of these underwater homeowners will be able to sell. It might be enough for inventory to bottom in 2013.

Another issue is if the Mortgage Debt Relief Act of 2007 is allowed to expire at the end of 2012. If the act isn't extended, many of the contingent short sales will be pulled off the market. Although this doesn't impact active inventory directly, it might have an indirect impact.

Right now my guess is active inventory will bottom in 2013.

Not as long as the Fed keep buying Mortgages.

These NAR listed inventory numbers are just the tip of the iceberg. They do not include the shadow inventory of another four to six million homes. The shadow inventory includes homes in various stages of foreclosure and mortgages over several months delinquent. Government action of one sort or another is holding these properties off the “market”, such as it is, or encouraging conversion to rental. Nationally, listed inventory is declining due to restrictions on supply, not increased demand.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.