Central banks do not print money. They issue currency as a liability against assets of Treasury securities that they obtain from primary dealers. There is no "new" money created in this transaction.

This is partially true. Instead of printing "money", numbers are keyed into a computer that sends an encrypted data stream connected to another computer at a bank someplace, allowing that computer's accounting program to adjust the balance of available funds on hand for issue.

What are the assets these funds were issued against? Worthless government securities, themselves issued against previously issued worthless government securities never be repaid?

Just one example:

" During a 2½ year period starting at the end of 2007, the Federal Reserve provided more than $16 trillion in secret bailouts to banks and other companies around the world, according to a government audit of some of the U.S. central bank’s operations.

Fed Audit: Trillions For Foreign Banks, Conflicts of Interest

Others:

Wall Street Aristocracy Got $1.2 Trillion in Secret Loans

Government Says No to Helping States and Main Street, While Continuing to Throw Trillions at the Giant Banks

You write: "There is nothing wrong with "fiat" currency - as long as the currency represents labor that has already been completed...instead of a claim on the future labor of others."

Do the loans the Fed has made above meet that criteria? Has there ever been a fiat currency in the history of mankind that did not eventually become worthless? Look at this chart below of how much the dollar has depreciated since the Fed was formed at a secret meeting on Jekyll Island.

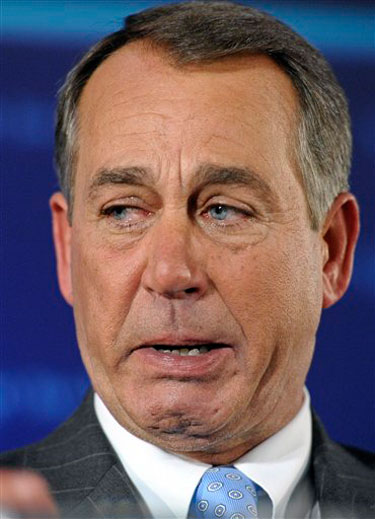

Do you really want to put ALL of your eggs in a basket guarded by these guys below? Speaking of that "basket", it's one so messed up, or messed with, it has NEVER allowed outside auditors to examine it.

Just sayin'...