Skip to comments.

A Record of Recovery

The New York Times ^

| August 4, 2004

| George P. Shultz

Posted on 08/04/2004 2:58:42 PM PDT by Niks

These charts show the rate of change in real gross domestic product and in employment from 1990 to last June. The shaded areas show recessions. The vertical lines show when President Bill Clinton took office and when he left. Because the economy has momentum, it's useful to look carefully at the trends in evidence at the time of presidential transitions. When you look at the record, a quick summary is this: President Clinton inherited prosperity; President Clinton bequeathed recession.

The 2001 recession was short and shallow, with employment - always a lagging indicator - the last part of the economy to rebound. The employment picture has been a little puzzling since the two main surveys - one asks existing establishments how many people are on their payrolls, and the other asks people in a large sample of households whether they have jobs - show slightly different patterns. In any case, by now a third piece of the record appears clear: the recession President Clinton left behind has turned into prosperity under George W. Bush.

Thanks, Al Smith, for your good advice.

George P. Shultz, secretary of the Treasury from 1972 to 1974 and secretary of state from 1982 to 1989, is a distinguished fellow at the Hoover Institution at Stanford University.

(Excerpt) Read more at nytimes.com ...

TOPICS: Editorial; Politics/Elections

KEYWORDS: bushrecovery; georgeshultz; thebusheconomy

1

posted on

08/04/2004 2:58:42 PM PDT

by

Niks

To: Niks

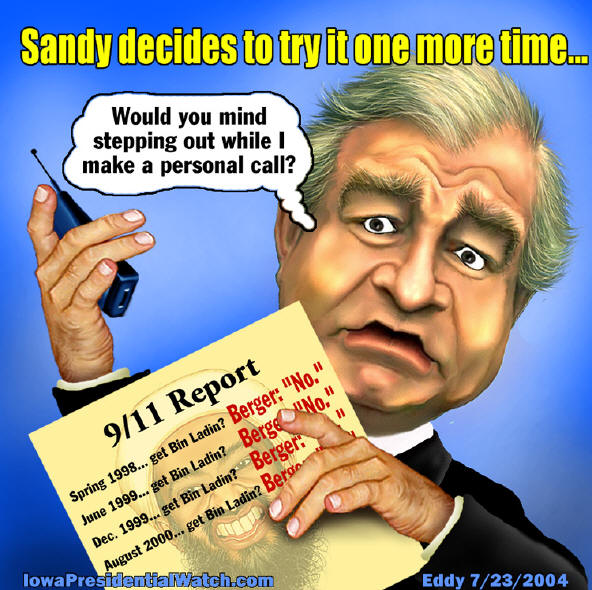

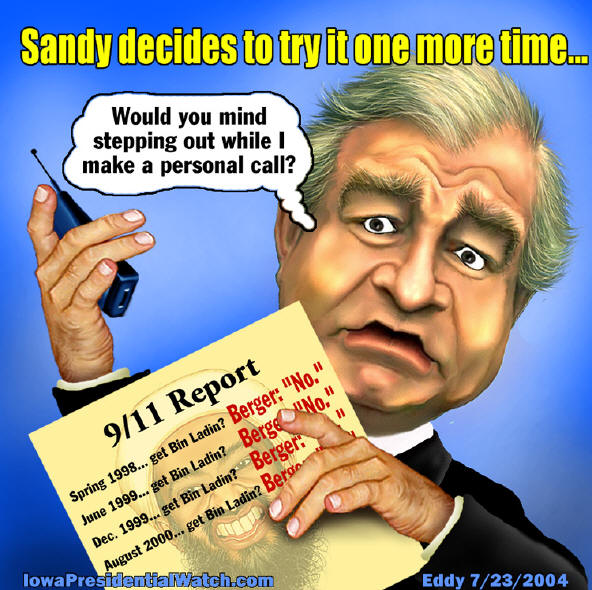

Consider: If Berger-Burglar, Gorelick, Clarke, Clinton and the ULTRACORRUPT Democrats had been completely HONEST

to the American public about the Islamic-crashed airplanes, like TWA800, etc. etc. etc. in the 90's

then Americans WOULD have been on alert on 911

and would have had the opportunity to prevent the 911 Atrocities.

2

posted on

08/04/2004 3:05:46 PM PDT

by

Diogenesis

(Re: Protection from up on high, Keyser Sose has nothing on Sandy Berger, the DNC Burglar)

To: Niks

To: Niks

"The 2001 recession was short and shallow, with employment - always a lagging indicator - the last part of the economy to rebound. "

2001 is a long three years ago. Jobs have been Shanghaied since PNTR and dividend tax cuts aren't bringing them home. In fact, it will probably encourage jobs to stay in China.

4

posted on

08/04/2004 3:55:29 PM PDT

by

ex-snook

("BUT ABOVE ALL THINGS, TRUTH BEARETH AWAY THE VICTORY")

To: ex-snook

Could you possibly describe an economic mechanism by which dividend tax cuts cause jobs to stay in China?

5

posted on

08/04/2004 8:50:32 PM PDT

by

gogipper

To: ex-snook

Larry Kudlow's recent column. It has some examples of economic mechanisms.

A Recession to Remember

Business-investment hemorrhaged in 2000-01 — don’t forget it.

It was Santayana who said, “Those who cannot remember the past are condemned to repeat it.” Let’s hope Alan Greenspan is in a remembering frame of mind.

The Commerce Department has revised data for gross domestic product, sparking a minor debate as to whether a recession actually occurred in 2001. Either way, some now argue, if there was a recession, it was one of the mildest on record.

That’s not only utter nonsense, it shows a sad lack of short-term memory.

There was a recession in 2000-01 and it was deep. But you have to look behind the headline real GDP numbers to understand it. When you do that, you find that a very unusual set of events were at work four years ago. Events worth remembering today.

Consumer spending never once declined in the recession of 2000-01. This is because middle-class income actually increased by nearly 5 percent between 2000 and 2002, according to the latest IRS statistics. This fact runs completely counter to the Kerry-Edwards argument about a “middle-class squeeze.”

Still, overall individual income declined 5 percent during this period. Why? Upper-end income suffered mightily. The top tax brackets lost about 28 percent of their income, on average, largely from the stock market crash and the fall in high-paying jobs. Twelve percent of the folks who fought their way above $200,000 a year slipped below that level in 2002.

At the rarified income level of $10 million or more, those with the highest propensity to save and invest lost a stunning 63 percent of their income during 2000-02. Total capital-gains income fell by 29 percent, and dividend income dropped 17 percent. When Bill Clinton recently told the Democrats in Boston that top tax-rate payers don’t need the extra money, he was sorely uninformed.

It was the investment-side of the economy that collapsed in 2000-02. But without investment funding, economic growth was null and void. For example, capital-goods investment (equipment and software) fell in eight of ten quarters between mid-2000 and the end of 2002, with six of those declines coming consecutively. Industrial production declined for six straight quarters. When measured against year-ago levels, after-tax corporate profits declined in seven straight quarters.

Surely, a 78 percent drop in the Nasdaq and a near 40 percent fall in the broader stock indexes deserve the lion’s share of blame for this business-investment recession. In the new economy, the stock market is essential to the investment-funding of business and the income- and wealth-creating activities of the 50 percent of the adult population called the investor class. When the market cost of capital rises sharply, as it did in 2000-02, investment activity hemorrhages.

This is why President Bush’s 2003 across-the-board tax plan — aimed especially at risk-taking investors (capital gains and dividends) — was brilliantly crafted. Since its passage, the stock market and the economy have emerged from a long slumber. Should the Kerry Democrats succeed in repealing Bush’s investment tax incentives, the economy will rapidly retreat.

Of course, the other major cause of the investment recession was unbelievably bad policy from the Federal Reserve. Key sensitive market price indicators, ignored by the central bank during 2000, warned of a world-class liquidity deflation. In particular, the normal difference between long- and short-term interest rates was turned upside down as Treasury bills yielded more than bonds. This inverted yield curve was a classic recessionary sign.

As the Fed stupidly kept taking money out of the economy, gold and commodity prices crashed by about 20 percent. The ensuing dollar scarcity caused the greenback to soar on foreign exchange markets.

Why did the Fed wreak this havoc? It was worried about fictitious inflation that never developed. Prices, profits, equity values, and production collapsed in the wake of the Fed’s unrelenting monetary deflation. It was one of the greatest Fed blunders of all time.

Today, the central bank is again worried about inflation, even though deflationary pressures only seemed to end about a year ago. Even now, manufacturing hard-good prices are still falling slightly after dropping steadily by 2 percent to 3 percent during the prior three years.

Since the Fed’s rate hike on June 30, its first in four years, growth-sensitive Nasdaq stocks have dropped nearly 10 percent. Dollar value in terms of gold, commodities (excluding energy), and foreign currencies has strengthened since early this year as a tax-cut-led business-investment recovery is gradually absorbing the excess money created by the Fed in 2003. Core inflation rates are already slipping lower after a temporary bulge this past winter.

Which brings us to the nagging question: Does the Fed really have to embark on a prolonged series of rate-hiking moves? History can be instructive. There’s no need for Greenspan to prove Santayana right yet one more time.

6

posted on

08/04/2004 8:53:35 PM PDT

by

gogipper

To: gogipper

"Could you possibly describe an economic mechanism by which dividend tax cuts cause jobs to stay in China? "Sure, the more jobs sent to China, the greater the profits. The greater the profits the higher the dividends, the longer jobs stay in China. [Hey, the dividend tax cut was to create jobs here, instead it just goosed up the stock market for a while.]

7

posted on

08/05/2004 7:43:35 AM PDT

by

ex-snook

("BUT ABOVE ALL THINGS, TRUTH BEARETH AWAY THE VICTORY")

To: ex-snook

Still not clear enough to me. The encouragement to companies to issue dividends doesn't change the degree of profit that a company experiences, it only changes how the profits are used.

8

posted on

08/05/2004 8:46:34 PM PDT

by

gogipper

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson