Skip to comments.

A CONSUMPTION TAX A low-rate, broad-based consumption tax would raise the same amount of revenue...

ncpa.org ^

| Tuesday, September 06, 2005

Posted on 09/06/2005 7:21:12 AM PDT by InvisibleChurch

A CONSUMPTION TAX

Daily Policy Digest

TAXES

Tuesday, September 06, 2005

--------------------------------------------------------------------------------

As the President's Advisory Panel on Federal Tax Reform works on its report (due by the end of September), one of the measures under consideration is switching to a low-rate, broad-based consumption tax.

According to Alan J. Auerbach (University of California, Berkeley), a consumption tax could raise the same amount of revenue as the current tax system:

A shift to a consumption tax could increase Gross Domestic Product (GDP) in the long run by as much as 9 percent. Lower marginal tax rates would increase employment and therefore expand production somewhat in the short run. Over a longer period of time, production would increase even more as the result of stronger capital accumulation induced by the more favorable tax treatment of savings. Critics argue that adopting a consumption tax would raise asset values, but Auerbach says a consumption tax would actually reduce asset values somewhat in the short run:

A consumption tax eliminates the burden on saving and investment, a key reason why capital accumulation would rise; however, a consumption tax would actually increase the tax burden on existing assets because those who have accumulated assets in the past would face consumption taxes when selling their assets in order to consume goods and services. The purchasing power of accumulated assets would suffer, meaning the real (price-level adjusted) values would be lower than before; this feature of the consumption tax is sometimes referred to as a levy on “old” capital. Auerbach says not all consumption taxes are equal. Significant gains are possible even if the tax system retains its current degree of progressivity, though not if the tax reform also fully shields existing assets.

Source: Alan J. Auerbach, “A Consumption Tax,” Wall Street Journal, August 25, 2005.

For text (subscription required):

http://online.wsj.com/article/0,,SB112492381500022421,00.html

For more on National Sales Tax:

http://www.ncpa.org/iss/tax/

TOPICS: News/Current Events

KEYWORDS:

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 161-176 next last

To: kellynla; livius

Is the proposed consumption tax rate 14.91%?

Don't be fooled. The proposed tax rate in sales tax terms is 30%, not 23%.

21

posted on

09/06/2005 8:35:15 AM PDT

by

lewislynn

(Status quo today is the result of eliminating the previous status quo. Be careful what you wish for)

To: southernindymom

This would replace the now income tax, correct, or would this be in addition to?

It replaces all federal income, payroll(e.g. SS/Medicare taxes) and gift/estate taxes.

The current tax laws are repealed and a national retail sales tax substituted in their place.

You can find the actual legislation as it has been introduced on the Thomas website:

H.R.25

Fair Tax Act of 2005 (Introduced in House)

http://thomas.loc.gov/cgi-bin/query/z?c109:H.R.25:

TITLE I--REPEAL OF THE INCOME TAX, PAYROLL TAXES, AND ESTATE AND GIFT TAXES

- Sec. 101. Income taxes repealed.

- Sec. 102. Payroll taxes repealed.

- Sec. 103. Estate and gift taxes repealed.

- Sec. 104. Conforming amendments; effective date.

TITLE II--SALES TAX ENACTED

- Sec. 202. Conforming and technical amendments.

TITLE III--OTHER MATTERS

- Sec. 301. Phase-out of administration of repealed Federal taxes.

- Sec. 302. Administration of other Federal taxes.

- Sec. 303. Sales tax inclusive Social Security benefits indexation.

|

22

posted on

09/06/2005 8:36:47 AM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: southernindymom

...but I don't see this ever flying, as then those currently not paying any taxes will have to start paying and they'll pitch a hissy.You need to acquaint yourself with this a little more. Those people you describe will be more influenced by the check they get every month than the tax they are paying.

23

posted on

09/06/2005 8:43:47 AM PDT

by

Mind-numbed Robot

(Not all that needs to be done needs to be done by the government.)

To: lewislynn

The proposed tax rate in sales tax terms is 30%, not 23%.Even if it were 50% it would be better than this Communist abortion we presently have.

24

posted on

09/06/2005 8:46:24 AM PDT

by

Mind-numbed Robot

(Not all that needs to be done needs to be done by the government.)

To: lewislynn; kellynla; livius

The proposed tax rate in sales tax terms is 30%, not 23%.

Actually, a bill enacted to meet the Bush's criteria for a revenue neutral plan, such as one providing the same revenues as the current tax system with Bush adminstration tax cuts in place, the rate would be 19.3% tax inclusive as income taxes are calculated, or 23.8% in sales tax terms.

Table two: national FairTax rate calculation: 2003

http://www.fairtaxvolunteer.org/smart/tax_system.html

| Revenue-neutral rate calculation |

|

|

| 28 |

Tax exclusive rate (no rebate) |

19.1% |

|

| 29 |

Tax inclusive rate (no rebate) |

15.9% |

|

| 30 |

Base reduction equivalent for rebate |

$ 1,746.1 |

Total consumption allowance for 109 million rebate units |

| 31 |

Net tax base |

$ 6,993.8 |

|

| 32 |

Tax exclusive rate (with rebate) |

23.8% |

|

| 33 |

Tax inclusive rate (with rebate) |

19.3% |

|

25

posted on

09/06/2005 8:48:31 AM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Kitanis

Do I have the answer.. No.. but I believe that the state and federal governments need to start thinking of reducing their programs because they have grown to the point to where we can not longer substain the bill for them.You don't seem to know enough about the NRST to be against it. Your complaint is with politicians, not the NRST. Aren't you paying those local and state taxes now? How does that affect your thought about the national tax system? Those state and local taxes are going to be there no matter what. Why not improve the big bite from the fed?

26

posted on

09/06/2005 8:51:42 AM PDT

by

Mind-numbed Robot

(Not all that needs to be done needs to be done by the government.)

To: ancient_geezer

This proposal certainly sounds good, which by itself is suspicious.

My belief is that in practice such a "consumption" tax, say 23% as you cite, would simply be in addition to the present system. The IRS is not going away no matter what politicians promise, and no matter how much any politician believes he is being honest.

Sure, the income tax rate would be, say, 7% on incomes over a million dollars, to begin with. Promises, promises. Remember the 1913 beginnings and how long the promises not to tax the middle class lasted.

Even with Republican control of Congress and the Presidency the only tax relief has been a slowed rate of increase in taxes you, and I, pay.

To get votes, to be elected to office, requires paying off supporters and taxing opponents for the required funds. Ain't going to change. No upside limit to the process, either.

27

posted on

09/06/2005 8:55:43 AM PDT

by

Iris7

("A pig's gotta fly." - Porco Rosso)

To: InvisibleChurch

The purchasing power of accumulated assets would suffer, meaning the real (price-level adjusted) values would be lower than before; this feature of the consumption tax is sometimes referred to as a levy on “old” capital. I am sure retirees will love this feature of losing purchasing power. It is unusal for a sales taxer even acknowledges a negative. This is not suitable for fair tax propaganda.

To: kellynla

I'm all for a consumption tax but only after the IRS and ALL federal income taxes are eliminated. I don't want the clowns in DC adding a consumption tax and then saying "oops...we forgot to repeal the federal income tax." The sales tax rates can go up without a vote. There are automatic tax rate adjustments in the fair tax bill for social security and medicare. Taxes can go up every 6 months because of government statistics.

To: Mind-numbed Robot

A 23%, or 19%, sales or VAT will be called "taking from the poor to give to the rich." Not a "progressive tax", don't you know. Ability to pay and all of that.

Besides, doling out exemptions from income taxes is very important politically. You figure the political class will vote themselves less power?

The last I heard the IRS regulations amount to two hundred linear feet of book shelves. We are talking bound manuals here. 99.9% of this, or more, are "special interest" rules.

If income tax were reduced to zero it would only last until the Democrats were in office. Believe it.

"Meet the new boss, same as the old boss." "Those who refuse to learn from history are condemned to repeat it." "If anything can be learned from history, it is that people do not learn from history."

Don't get me wrong, I am not wild about the situation either.

30

posted on

09/06/2005 9:10:10 AM PDT

by

Iris7

("A pig's gotta fly." - Porco Rosso)

To: Iris7

This proposal certainly sounds good, which by itself is suspicious.

That might be because it was not politicians who authored the legislation.

refer: FairTax History

My belief is that in practice such a "consumption" tax, say 23% as you cite, would simply be in addition to the present system. The IRS is not going away no matter what politicians promise, and no matter how much any politician believes he is being honest.

Specualtion does not mean much, as the langage of the legislation controls. Just where would the support to "simply" double the current come from?? If they could get away with it as you suggest, then federal taxes today, with respect to income available for expenditure, would be 50% right now, not the 20% they are.

refer Tax Freedom Day 2005 report PDF: Special Report No.134, April 2005

|

Total Effective Tax Rates by Level of Government

Percent Net National Product(NNP) |

| Year |

Federal |

State |

Total |

| 1996 |

21.3% |

10.4% |

31.6% |

| 1997 |

21.8% |

10.3% |

32.1% |

| 1998 |

22.4% |

10.4% |

32.8% |

| 19990 |

22.5% |

10.4% |

32.9% |

| 2000 |

23.1% |

10.4% |

33.5% |

| 2001 |

22.2% |

10.5% |

32.7% |

| 2002 1 |

19.6% |

10.2% |

29.8% |

| 2003 2 |

18.8% |

10.1% |

28.9% |

| 2004 3 |

18.4% |

10.2% |

28.6% |

| 2005 |

19.0% |

10.1% |

29.1% |

| Notes: Leap day is omitted to make dates comparable over time. Since depreciation is not available to pay taxes, GDP is an overstatement of spendable income for the purpose of measuring tax burdens. Depreciation is netted out of NNP. "Overall, NNP provides the best statistical representation of the common notion of “spendable” resources. In 2004 NNP was $10,371.6 billion. Like GDP and PI, NNP is a component of the National Income Product Accounts (NIPA). These accounts are computed and compiled annually by the Commerce Depart-ment’s Bureau of Economic Analysis (BEA)."

Tax Foundation Special Report No.134, April 2005 0 First year introduction of HR2525(Fair Tax legislation). 1 Economic Growth and Tax Reform Reconciliation Act of 2001

2 The Job Creation and Worker Assistance Act of 2002

3 Job Growth and Tax Relief Reconciliation Act of 2003 Sources: Office of Management and Budget; Internal Revenue Service; Congressional Research Service; National Bureau of Economic Research; Treasury Department; and Tax Foundation calculations. |

To get votes, to be elected to office, requires paying off supporters and taxing opponents for the required funds. Ain't going to change.

The problem with the current income tax is that nearly half the electorate have no income tax liability and do not give a d' what the other half pay.

"It's like me in the restaurant: What do I care about extravagance if you're footing the bill?"

Walter Williams

and the numbers are growing:

Bush touts relief as tax day looms

Another 3.9 million Americans will have their income tax liability completely eliminated, officials said.

That's 3.9 million Americans more added to the spending constituency of 70% of the public clamoring for more from government, figuring someone else foots the bill.

No upside limit to the process, either.

Under the current system you are certainly correct.

The Honorable James DeMint (R-SC)

United States House of Representatives

APRIL 5, 2001

- "There has been a shift in the relationship between individuals and government, he argues, such that fewer and fewer are paying taxes at the same time that more and more are receiving increasingly generous benefits. If it becomes the case that most voters do not bear a financial burden for this largess, then there will be little to restrain--and significant political incentives to encourage--the continued growth of government.

Under a consumption tax that everyone visibly participates in and has a stake in, the paradigm changes significantly:

Federalist #21:

"Imposts, excises, and, in general, all duties upon articles of consumption, may be compared to a fluid, which will, in time, find its level with the means of paying them. The amount to be contributed by each citizen will in a degree be at his own option, and can be regulated by an attention to his resources. The rich may be extravagant, the poor can be frugal; and private oppression may always be avoided by a judicious selection of objects proper for such impositions. "

"It is a signal advantage of taxes on articles of consumption that they contain in their own nature a security against excess.

They prescribe their own limit, which cannot be exceeded without defeating the end proposed - that is, an extension of the revenue."

Patrick Henry, Virginia Ratifying Convention June 12, 1788:

- "the oppression arising from taxation, is not from the amount but, from the mode -- a thorough acquaintance with the condition of the people, is necessary to a just distribution of taxes. The whole wisdom of the science of Government, with respect to taxation, consists in selecting the mode of collection which will best accommodate to the convenience of the people."

31

posted on

09/06/2005 9:14:05 AM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Iris7

Your complaint is with politicians and you are justified in feeling that way. If we had better politicians we would not be discussing this because there never would have been an income tax. However, this NRST is the best chance we have had in a long time to rid ourselves of one of the biggest yokes we have been tied to, the income tax.

The important thing is not the rate but the method. Taxing consumption is a whole new ballgame from taxing income. No gestopo IRS is a tremendous relief. It is freedom.

To start adding exemptions to buy support is to kill it. That is the reason the present system is 60,000 pages long and incomprehensible.

32

posted on

09/06/2005 9:23:29 AM PDT

by

Mind-numbed Robot

(Not all that needs to be done needs to be done by the government.)

To: Always Right

The arguments on this thread, so earnest, so convinced that rationality governs human affairs, and that "rationality" really means something, as in "men of good will reasoning together", and in the replacement of, hopefully, all taxation by a sales tax, etc. reminds me of me in my youth. Shucks, I used to make earnest arguments, I used to explain "how things work", too. Maybe 30 years ago.

People think in slogans and in visual images. Arguments using more than four words won't work. Three words is better. Then lots and lots of repetition. Watch television, you will see master propagandists at work.

Anyway, I am quite sure that something advertised as "fair tax" is a really bad idea unless you are a rabid Statist. "Fair tax" is a slogan. Two words, good emotional loading, not a bad slogan! Run away.

33

posted on

09/06/2005 9:28:38 AM PDT

by

Iris7

("A pig's gotta fly." - Porco Rosso)

To: SolidSupplySide

"Good Conservative Group"??? Good Grief!

And you quote an article by Bruce Bartlet, one of the most ardent opponents of the FairTax (or any other sort of NRST unless it is a VAT)? A little balance in outlook would be nice ...

Bartlett even quotes Mikesell as a "sales tax expert" when he is nothing like that but is also a known opponent of the FairTax. Also, Bartlett's claim of drug purchases being made only or largely with after-tax income is clearly out in left field as much of the drug purchasing going on is done with stolen funds and/or untaxed cash income. He greatly misstates the case just as he attempts to minimize the drug dealers purchases as "hamburgers from McDonalds" and "power tools from Sears". Those MAY be some of his purchases, but it would be the BMW 7 Series and xx Million Dollar new home purchases that would rack up even more tax revenue.

As for evasion by both parties that is at best questionable since the retailer is the one on the hook legally for the tax while the buyer may benefit. The retailer has little motivation to take that risk to assist a customer ... he'd be risking his business for a single customer. If he did it repeatedly for large numbers of customers, he'd clearly be in even more danger of detection.

As for requiring retailers needing to question exemptions that isn't necessary at all using the language from the bill that allows the use of the resale certification with protection to the seller (unless he has some reason to be suspicious of the exemption certificate). The retailer does not need to be any sort of gatekeeper - per the bill:

"`(d) Seller Relieved of Liability in Certain Cases- In the case of any taxable property or service which is sold untaxed pursuant to section 102(a), the seller shall be relieved of the duty to collect and remit the tax imposed under section 101 on such purchase if the seller-- `(1) received in good faith, and retains on file for the period set forth in section 509, a copy of a registration certificate from the purchaser, and

`(2) did not, at the time of sale, have reasonable cause to believe that the buyer was not registered pursuant to section 502."

34

posted on

09/06/2005 9:46:52 AM PDT

by

pigdog

To: Iris7

. "Fair tax" is a slogan. Two words, good emotional loading, not a bad slogan!

Yep, you figure any change to the status quo is going to happen without using good advertizing technique?

People think in slogans and in visual images. Arguments using more than four words won't work. Three words is better. Then lots and lots of repetition.

I see you have a handle on the principle.

Run away.

Don't bother to look into the legislation as actually proposed

http://thomas.loc.gov/cgi-bin/query/z?c109:H.R.25:

[Montesquieu wrote in Spirit of the Laws, XIII,c.14:]

- "A capitation is more natural to slavery; a duty on merchandise is more natural to liberty, by reason it has not so direct a relation to the person."

--Thomas Jefferson: copied into his Commonplace Book.

And keep the current tax system:

"A hand from Washington will be stretched out and placed upon every man's business; the eye of the federal inspector will be in every man's counting house....The law will of necessity have inquisical features, it will provide penalties, it will create complicated machinery. Under it men will be hauled into courts distant from their homes. Heavy fines imposed by distant and unfamiliar tribunals will constantly menace the tax payer. An army of federal inspectors, spies, and detectives will descend upon the state."

-- Virginian House Speaker Richard E. Byrd, 1910, predicting the consequences of an income tax.

Real smart move there.

35

posted on

09/06/2005 9:47:34 AM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Mind-numbed Robot

"To start adding exemptions to buy support is to kill it."

Then it won't get passed. Not the slightest ghost of a chance.

The first national income tax was repealed in 1872. Another income tax bill was passed in 1913, as I recollect, then the 16th Amendment in 1916. And, yeah, it was ratified funny. So was the 14th.

Since 1862 we have had 41 years without an income tax. Get those laws repealed and it won't be 41 years with no income tax but more like four. The Democrats would be in office right away on a "tax the rich not the poor" (makes a great chant, I can hear it now - "tax the rich not the poor - tax the rich not the poor - tax the rich not the poor") platform. "Ability to pay", don't you know. "The rich are sucking your blood! Eating your children! It's Slavery!"

An altogether repugnant situation.

36

posted on

09/06/2005 9:54:41 AM PDT

by

Iris7

("A pig's gotta fly." - Porco Rosso)

To: Always Right

The sales tax rates can go up without a vote. There are automatic tax rate adjustments in the fair tax bill for social security and medicare. Taxes can go up every 6 months because of government statistics. Or down. The adjustments aren't only upwards.

37

posted on

09/06/2005 9:55:20 AM PDT

by

kevkrom

("Political looters" should be shot on sight)

To: Iris7

How about two words such as:

"NO IRS" or

"NO INCOME TAX" (and, yeah, that's 3) or

"GROSS = NET"???

And there are others, too.

The FairTax is the most studeied and analyzed tax bill ever to come before Congress - and it holds up economically as indicated by the endorsement letter from 75 economists:

http://www.fairtax.org/pdfs/Open_Letter_President.pdf

38

posted on

09/06/2005 10:03:42 AM PDT

by

pigdog

To: Iris7

Then it won't get passed. Not the slightest ghost of a chance.

Then you don't need to worry about it do you.

OTH, with enough electorate support to actually enact an National Retail Sales Tax in replacement of income and payroll taxes, the probability of return to an income tax anytime soon over electorate displeasure is nil.

For enacting it removes not only the income tax, it removes the infra-structure and enforcement agency on which the income tax system is based, and removes the taxpayer database through which said tax is enforced.

The Democrats would be in office right away on a "tax the rich not the poor" (makes a great chant, I can hear it now - "tax the rich not the poor - tax the rich not the poor - tax the rich not the poor") platform.

Reality strikes:

FCA, "sales tax rebate"

Which provides:

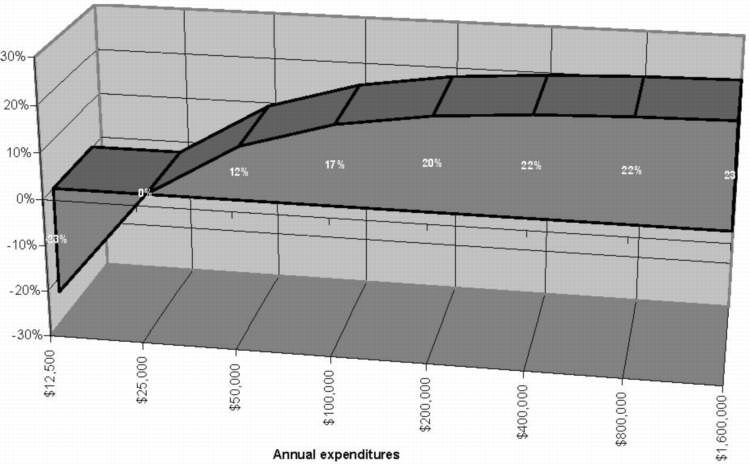

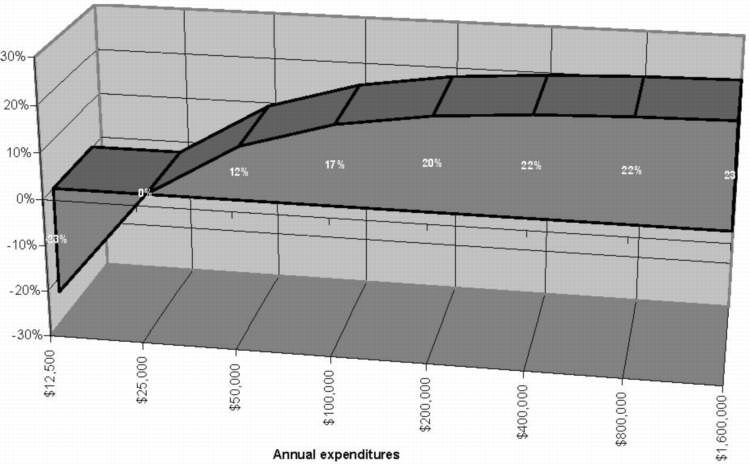

Figure 5: Annual expenditures vs. FairTax effective tax rates, for a family of four

Re-instating an income tax against electorate and business interests will be political suicide for any party that attempts it.

Poor not taxed, going to a system where middle class and business would be taxed more, not to mention return of the IRS after being free of it, not a winning move for any Dem.

39

posted on

09/06/2005 10:10:57 AM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Iris7

The FairTax bill (HR25/S25) eliminates the income tax, the IRS (and defunds it as well), requires that the income tax refords be destroyed, and calls for the repeal of the 16th amendment.

You should investigate the FairTax website.

And also:

40

posted on

09/06/2005 10:13:21 AM PDT

by

pigdog

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 161-176 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson