Maybe he thought this was diesel fuel:

Posted on 05/08/2006 3:07:18 PM PDT by fight_truth_decay

How the Credit Bubble Boat will sink: by hitting the iceberg of inflation. Grab your life jackets...

Yesterday, driving back from a horse show in Bath, we stopped for gas. Britain has gone metric in order to stay in harmony with her European trading partners, but she still lists distances in miles. Gasoline is measured out in liters, just as it is in France, but it is priced in pounds.

The price for a liter of diesel fuel was 99.9 pounds. If we did the math right, this is equivalent to about $6.50 per gallon.

By comparison, we read today that the average price per gallon in America is $2.92. Gasoline is so cheap in the U.S. that Canadians are flocking across the border to fill up their tanks.

If the British are confused about how their gas is priced, the Yanks are certain they know where it should be - at rock bottom. The U.S. economy is set up for much cheaper gasoline. People have organized their lives and habits around the expectation of cheap fuel and cheap credit. They're understandably disappointed to see prices rise. But now, prices are rising; the dollar is falling; inflation is increasing. And we begin to see how the great Credit Bubble Boat ends, don't we? It runs into the iceberg of inflation.

It seems obvious.

College tuition, health care, commodities - all seem to be going up quickly. Last week brought news that even salaries are going up. Pay levels are said to be 3.8% above those of a year ago, despite very sluggish job growth. Why would salaries go up when there is no apparent pressure to recruit new employees or hold onto old ones? The answer is simple: salaries are responding to inflation, not to job market. And on Friday, even stocks went up. The Dow rose 138 points. Are business conditions suddenly much better? No? Maybe it is just inflation.

Way up high, in the staterooms and luxury suites of this Titanic, the price increases are even more dramatic. One painting by Picasso sold for $95 million. Another sold for $34 million and still another sold for $18 million. That's a lot of money to pay for crude paintings of people with their noses in the wrong place.

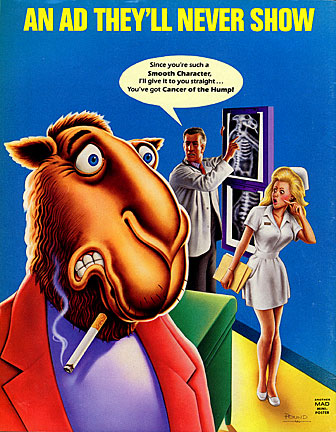

But now, some fellow in China has figured out how to create his own gimmick. He's picked up the advertising cartoon, Joe Camel, and turned him into an art-world icon. Look, he explains, this modern art is simple; anyone can do it. In fact, you don't even have to do it yourself. He pays others to do the actual work. He just comes up with the idea.

You'd think the art world would be annoyed at the chutzpah; the Chinese hustler is clearly pulling someone's leg. But it doesn't seem to matter. Aficionados are either too dumb to notice or too rich to care. They're buying up the paintings of Joe Camel and hoping to score as big a coup as people who bought Picassos.

While prices rise, the dollar falls. Against yen, it dropped to a seven-month low on Friday. Against the euro, it fell again, last week - to $1.27 per euro. And against gold, the dollar plummeted. June contracts for gold sold over $684 on Friday. Overall, the dollar has lost 4.5% of its value in the last three weeks.

There is no question that prices are increasing. Nor is there doubt as to why. Central banks are desperate to keep up with the expanding supply of dollars. Remember, they can control either the quantity of their currencies, or the quality of it, not both at the same time. As the United States emits billions and billions more dollars, the foreign central banks have to produce more of their own currencies. Otherwise, the falling quality of the U.S. dollar will make the foreign currencies go up in price. This will put their export industries at a disadvantage.

All over the world, central banks are favoring quantity over quality. They are inflating their currencies. Consumer price inflation is sure to follow.

There might be more to the story. Yes, all central banks favor inflation. And yes, Americans would vote for inflation, if they could; they are deep in debt and would welcome inflation as a way out.

But for every debtor, there's a creditor. And for every fool who borrowed money to buy something he couldn't afford and didn't need, there's a lender who lent to someone who might not be able to pay him back. The big question is: who will turn out to be dumber - the lenders or the borrowers? We don't know the answer, but we suspect there is enough dumbness to go around. When the ship goes down, there will be plenty of losses for everyone.

Bonner remarks: "The money leaves home a servant; it comes back a master. We buy flat-screen TVs and Chinese tea. The money does our bidding. But then, the overseas suppliers end up with a net trade surplus over $800 billion a year. What do they do with the money? It comes back to us. They buy our factories, our T-bonds...and now, our roadways. Now, we are their servants - their clients, their customers, their employees, their debtors, their lackeys, their proles, and their lumpen."

"At the federal level," writes Daniel Gross in Slate, "the foolish plan" to sell public infrastructure- "We rely on China's central bank to buy our bonds and fund basic operations. As a result, our tax revenues wind up in Beijing—as interest payments. At the state level, Indiana is relying on foreign companies to lease public infrastructure like toll roads. And under these arrangements, tolls—taxes people pay for driving—are being paid to foreign shareholders of foreign companies."

I guess when we own their stuff, in their country, it matters "not" in this calculus...right?

Ahhh...more tripe.

"Pay levels are said to be 3.8% above those of a year ago, despite very sluggish job growth. Why would salaries go up when there is no apparent pressure to recruit new employees or hold onto old ones?"

That is simply dishonest.

If that's your math the price would be over 350 pounds per gallon so something's off.

I know, right? How on earth do we have sluggish job growth? And even if it isn't blazing, we're at 4.7% unemployment. You don't go much lower than that.

Sluggish job growth... please. Sluggish job growth is Germany with over 10% unemployment and zero new gains.

That makes sense then.

Don't buy the hype on unemployment at 4.7%. Unfortunately, its probably a good deal higher than that. Anyone who has been out of work for more than six months is no longer counted. So during the Great Depression, the "official" unemployment statistics would have been all rosy even with million in the breadlines.

The "true" unemployment rate can be approximated by:100% minus( (Total persons employed+housewives+prisoners+those incapable of working+those unwilling to work)/ (Total population between ages of 20-65 plus illegal Mexicans et al. between 20-65)).

I've fiddled around with the various numbers I've been able to find, and the lowest rate I've been able to come up with has been a little over 11%. Certainly not the govt's. smiley face numbers, but it won't sink the republic either. The problem is that nobody is 4.7% or 11% unemployed. Its either 0% or 100%, and, if you are on the wrong side of that number life truly s*cks.

Agreed. Although there are plenty of NOW HIRING signs and jobs ads around here. Speaking to friends who are graduating from B-School and Law School, sounds like things are pretty good on those fronts, as well.

USAToday reported that the average hourly earnings rose 3.8% in the 12 months through April — the stiffest year-over-year rise since a matching 3.8% pickup in August 2001. The April "new-jobs number" was the lowest for any month since October. But then how many new jobs can we expect if we are told we are at "almost full employment"?

Stocks gained last Friday after the Labor Department reported U.S. nonfarm payrolls expanded by 138,000 in April, which is less than the 199,000 expected by economists surveyed by MarketWatch. But it is great news that the unemployment rate remained at 4.7%, as expected.

"The report as a whole is softer than expected," -- Philip Shaw, an analyst at Investec Securities. "It's not suggesting that the U.S. labor market is roaring away. Accordingly we've seen the dollar drop noticeably after the report, and bonds have made some gains (that can be a good thing, bonds need loving too)."

The dollar, which fell on the data, is another positive for stock investors, said Shaw. "A weak dollar makes exports of U.S. goods cheaper and increases the value of repatriated corporate earnings."

Staying out of debt personally is the only safe way to weather any storm. Keeping more money in your pocket is key, whether you invest, spend, or just hide it under your Sealey. Sure, the economy is booming, but are more Americans becoming deeper in debt? Dave Ramsey always leads into this show.."Cash is King" and a lot of people are listening. It just comes down to our addiction to spending more than we make, so follows the bad habits of our elected pork bellied politicians in their State and Federal spending. Give them a dollar and they run around like fire ants trying to latch onto our piece of 'bread' and drag it down their hole never to be seen again!

It all becomes confusing; and we rush as "positive thinkers" toward the bright side of ongoing reports on positive data-- unemployment, job creations, household income (not often mentioned), more home "ownership" (bank) than ever before (some with no money down and a $$ perk at closing for furniture!) Credit seems so easy to attain nowadays and that scares me! Therefore, I have the same concerns in Bonner's piece when he says: "The big question is: who will turn out to be dumber - the lenders or the borrowers?"

I know I just hate to wake up from the great American dream!

It's happening here in Texas too. Governor Goodhair (Perry - R(Barely)) wants to build a huge highway from mexico to OK to make sure that drug/illegal alien smugglers have an easier time of it in the future, with the tolls going to a spanish company.

It's o.k. though, because he's a republican. After all, he deserves a retirement funded by a spanish company.(Cintas)

I agree that inflation is significantly greater than being reported. I've been building a house (actual construction) for the last two years. Prices have increased dramatically during that time. It has been painful...

But at the same time I would not characterize the current job market as being sluggish. 4.7% unemployment is very low. There's a certain unknown percentage that is basically unemployable. We can't be far from "full employment" where employers compete against other employers for workers.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.