Posted on 01/26/2007 8:58:57 PM PST by MinorityRepublican

MEXICO CITY -- Daily output at Mexico's biggest oil field tumbled by half a million barrels last year, according to figures released Friday by the Mexican government. The ongoing decline at the Cantarell field could pressure prices on the global oil market, complicate U.S. efforts to diversify its oil imports away from the Middle East, and threaten Mexico's financial stability.

The virtual collapse at Cantarell -- the world's second-biggest oil field in terms of output at the start of last year -- is unfolding much faster than projections from Mexico's state-run oil giant Petroleos Mexicanos, or Pemex. Cantarell's daily output fell to 1.5 million barrels in December compared to 1.99 million barrels in January, according to figures from the Mexican Energy Ministry.

Mexico made up for some of the field's decline. Mexico's overall oil output fell to just below three million barrels a day in December, down from almost 3.4 million barrels at the start of the year. It marked Mexico's lowest rate of oil output since 2000.

Mexico's troubles at Cantarell mirror the larger problems in the global oil market. Many of the world's biggest fields are old and face decline, which can be sharp and sudden. Like other big producers, Mexico is struggling to make up the difference because new big fields are in harder-to-reach places like the deep waters of the Gulf of Mexico.

The field's decline is expected to continue, if not worsen, this year, according to most estimates. That will subtract valuable oil from the world market, which is under pressure from rising demand by growing economies like China and India. It also means less oil headed to the U.S. from Mexico, which has long relied on Mexico as one of its top-three oil suppliers.

(Excerpt) Read more at online.wsj.com ...

Geez, what happened to all the fields the abiogenic oil twits were claiming were magically refilling?

Don't overlook rate of pumping vs rate of refilling.

The next President is going to be either a Democrat or a RINO, and the oil situation will probably be worse than it is today. (Especially since prices have been going down the past couple of months, but eventually they'll go back up once again)

more illegals coming north

Oh well, not much we can do about it now. We might as well adapt.

Just heard Glenn Beck comment that the decline in oil prices came after a meeting Cheney had with the Saudi`s to increase production, therefore reducing prices which would really hurt Hugo and the Iranians. Don`t know if it`s true, but I like it. As Ollie said a while back, it`s kinda of a neat idea.

Yes, typical rate of withdraw, 60 years per field. Typical rate of filling, 60 million years.

"Typical rate of filling, 60 million years."

Prove it.

Except that Saudi Arabia has cut production since November and has pledged to cut more starting in February.

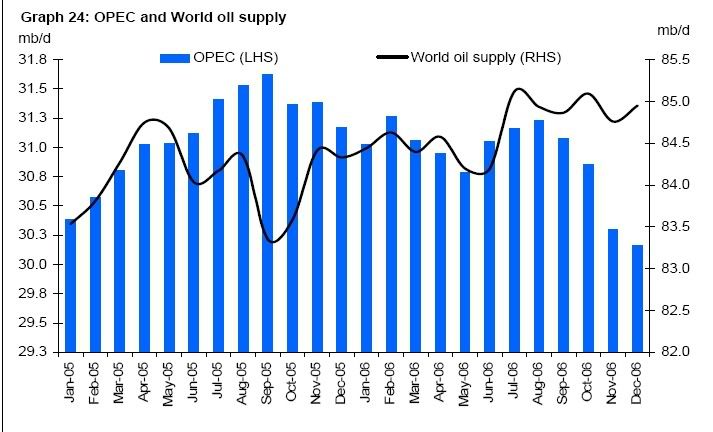

OPEC produced 28.37 MMBPD in Nov and 28.26 in Dec. The end of last year they were producing 29.63 MMBPD. Saudi Arabia produced 8.75 MMBPD in Nov and 8.71 in Dec. 4th quarter 2005 they produced 9.43 MMBPD.

I can't read the full story. Is the falloff because they are running out of oil, or is it because they aren't maintaining the field?

A century worth of oil drilling and petroleum reservoir data from the entire world proves it rather well.

But if you really have faith in the myth of abiotic oil, may I suggest reading:

No Free Lunch, Part 1:

A Critique of Thomas Gold's Claims for Abiotic Oil

by Jean Laherrere

http://72.14.253.104/search?q=cache:OHh4XIRawBsJ:www.fromthewilderness.com/free/ww3/102104_no_free_pt1.shtml+%22No+Free+Lunch,+Part+1:+A+Critique+of+Thomas+Gold%27s+Claims+for+Abiotic+Oil%22&hl=en&gl=us&ct=clnk&cd=1

No Free Lunch, Part 2:

If abiotic oil exists, where is it?

by Dale Allen Pfeiffer

http://72.14.253.104/search?q=cache:WKHDLUyZmgcJ:www.fromthewilderness.com/free/ww3/011205_no_free_pt2.shtml+%22No+Free+Lunch,+Part+2:+If+Abiotic+Oil+Exists,+Where+Is+It%3F%22&hl=en&gl=us&ct=clnk&cd=1

The mkt participants are and have been watching the worldwide excess-capacity figure, and, for 4+ years, this has been an almost perfect contrary indicator as to where the POC is headed. If ex-cap goes up, POC falls, and vice versa.

Katrina did not send WTI to $70+, not at all. A combination of circumstances reduced the ex-cap figure to 0.6 MMBbl/day in **January 2006**, and prices duly went crazy from then until April. As Mr. Stengel used to say: ''Ya could look it up.''

Now, with US Gulf production essentially fully restored, and with OPEC **cutting** some amount of production, the ex-cap figure has been rising steadily for about 9 months. Gee, what a shock that the price has been falling.

I make no brief whatever that this situation will continue, particularly with the mismanagement of Cantarell and possibly other PEMEX production areas.

However, what HAS happended with POC has happened for the reason stated above. What WILL happen? The ball's in the air; name your favourite result. If ex-cap stays at this level, POC is fairly priced. If it continues upward and there are no immediate (say, in 6 months) exogenous events, which I think likely, POC will fall; I consider $50/bbl to be a ''line in the (haha) sand'', but, if breached, we're looking at $42/bbl, basis WTI, by roughly May.

You pays your money, you takes your choice.

Slick analysis you have there. Now I need to figure out how to try to profit from these insights. Thanks for pointing out what is behind the curtain.

Oil is probably the most documented and tracked product in the world. Nobody trust anybody and verifications are done continuously. The buyers measure again what they receive that was measured first by the seller with both measurements by proven and calibrated meter inspected by third parties.

In your opinion, why are oil prices down?

Because the supply, most particular the margin capacity of supply, is up.

But it is not Saudi Arabi who is dumping oil on the market.

Who then is dumping the excessive supply?

I don't agree that there is any "dumping" and that supply is excessive. Compared to history, this still a relatively high prices, just not sky high. I see supply, and the surplus margin of supply, beginning to return to normal. In my opinion, it is returning to normal because the sky high prices infused the industry with the capital needed to invest in exploration and production to bring those values back to normal.

If you want to, go back to post #11 and read that OPEC report. It has detail and comparison of the World's oil market, supply and demand, with comparison to previous years. It is one of the most up-to-date free oil reports available. Expected world growth in demand is also down. Total demand is up, but at a much more stable growth rate than the spikes being predicted 9 months ago.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.