Posted on 09/20/2007 4:55:46 PM PDT by NYer

"According to some US experts, some US$ 20 trillion in worthless securities exist, putting US and European banks are at risk. Asia should avoid the worse. A new North American currency, the Amero, is making news.">

According to US financial analyst Mike Whitney[1], a mountain of unfunded, unregulated paper worth more than US$ 20 trillion might be out there [2]. Apparently, no one, neither the general public nor professionals on Wall Street, has yet to realise the extent of the hole, a hole of 20 trillion dollars with no market, nor value.

Even if the Federal Reserve were to ease bank reserve and capital requirements, the existing financial system would still be moving towards its worst crisis in 80 years because the problem is not liquidity, but solvency. The situation is such that banks are even scared to lend to one another uncertain about each other’s solvency. Even the London interbank market is not going beyond day to day lending.

Greenspan and speculative financing

The problem arose in the United States where, starting in 1987, the bank lobby—by means of US$ 300 million in contributions—got Congress to do away with the Glass-Steagall Act (officially the Banking Act of 1933) that had been adopted in the wake of the 1929 Wall Street Crisis. President Bill Clinton signed into law the Gramm-Leach-Bliley Act, which repealed the Glass-Steagall Act.

The original law had been introduced to avoid conflicts of interests between banks and companies that sell stocks and bonds.

Former Federal Reserve Chairman Alan Greenspan was the main proponent of financial liberalisation. Before his appointment to the post, he had served as a corporate director for J.P. Morgan, the first bank to take advantage of liberalisation.

Under his 18-year chairmanship he oversaw the greatest expansion of speculative financing in world history. But now the chicken are coming home to roost like a would-be train wreck that no one can stop, not even the Fed.

If Mike Whitney’s numbers are right, we are on the verge of a meltdown like that of 1929-1930, perhaps worse because of the world’s greater economic interconnectedness.

Lately, the big US financial and banking groups have tried to protect themselves by selling their junk bonds in Europe and Asia.

In Asia equity in most banking and financial institutions is in US securities and US dollar denominations. Most banks are ranked AA or even AAA by so-called independent agencies like Standard & Poors, Moody’s and Fitch. Securities with such ratings are, or perhaps we should say, were considered virtually risk-free.

Theoretically, US pension funds, insurance companies and big foundations are exposed to the uncontrolled offer of atypical securities of the past decades; so should the US financial and banking institutions which created them.

Yet we should not be surprised if those who hold the keys to the corporate are not, nor will ever be, held accountable for their wrongdoing.

Central banks, especially the Federal Reserve, are at the root of the problem because they have known about the overall situation for quite some time. But whomever is in charge of the Fed knows that a solution cannot be had from within.

Amero, North America’s new currency

With a bank crisis looming on the horizon, an odd piece of information is becoming news. As unlikely as it may seem, the United States along with Canada and Mexico, appears to be getting ready to launch a new single currency: the Amero.

With the monetary bubble on the verge of bursting, one solution would be getting rid of the dollar, replaced by a currency, the Amero, to serve a would-be North American Union.

In addition to the United States, Mexico should join such a union and in principle might be even in favour of it. Canada, too, might join, setting aside its aversion to losing its monetary sovereignty, out of concern that its equity in US dollars might simply lose its value.

When US President George W. Bush met then Mexican President Vicente Fox and then Canadian Prime Minister Paul Martin in Waco, Texas, in March 2005, they discussed a North American union.

The idea resurfaced the same year in a report released by the powerful US Council on Foreign Relations, a group that has influenced most US presidents, both Democrat and Republican, and a tri-national task force involving ministerial-level officials.

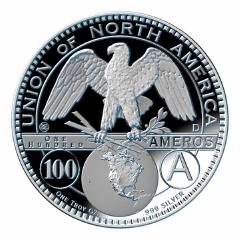

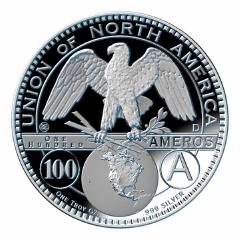

Wikipedia already sports a page dedicated to the Amero with the photos of prototypes.

A news report on the Amero broadcast on CNBC is also available on Youtube [3].

Similarly, 20 Amero coins can be seen on the Hal Turner Show webpage, with a small D visible, D as in ‘minted in Denver.’ Curiously, the Denver Mint is currently closed to the public, ostensibly for restoration work, till September 28 [4].

Whilst AsiaNews is unable to determine whether there is any basis to such claims, it does seem certain that a plan for a North American union is being developed [5].

Such an entity would have a population almost the size of the European Union, and could adequately respond to the current bank crisis that is bound to end up in a monetary crisis.

However, far from being a simple monetary union, the operation is likely to mean a de facto US annexation of the rest of North America.

For Asia the real point of interest would be economic rather than political since the Americas have been the United States’ backyard for a long time.

Firstly, the Amero would be definitely weaker than the US dollar because it would include the Mexican pesos, which was insolvent not so long ago.

A weaker North American common currency would quickly push the value of the currencies of China and the whole of Asia, which have hitherto been reluctant to do so.

Secondly, converting dollars used outside the United States would raise problems since in Asia as well as in many countries around the world payments in dollars are more common than one might think. In this case the impact of a North American union would also be very significant.

It’s a conspiracy among the Knights of Malta, the Knights Templars, and the Illuminati. They played the world conspiracy softball championship in Davos.

I know bankers of every religion. Nope, not seeing the connection.

Just keep them out of the temple, I guess.

They also kicked butt in the sack race!

Well, that was the only connection I could make at the moment. Otherwise, I have no idea why the Catholic ping.

Herbert Hoover took a needed market correction "seriously." The result of his seriousness, incidentally, WAS the crisis of 1929.

Must have something to do with Michael Corleone, the Vatican Bank and Immobiliare. Stay away from any operas.

Wow, just read the Columbia thread! The temps must have really dropped in Hell. Hope the virgins are bundled up! :-)

?

From Malkins site, last November

In an interview with CNBC, a vice president for a prominent London investment firm yesterday urged a move away from the dollar to the “amero,” a coming North American currency, he said, that “will have a big impact on everybody’s life, in Canada, the U.S. and Mexico.”

Steve Previs, a vice president at Jefferies International Ltd., explained the Amero “is the proposed new currency for the North American Community which is being developed right now between Canada, the U.S. and Mexico.”

The aim, he said, according to a transcript provided by CNBC to WND, is to make a “borderless community, much like the European Union, with the U.S. dollar, the Canadian dollar and the Mexican peso being replaced by the amero.”

Previs told the television audience many Canadians are “upset” about the amero. Most Americans outside of Texas largely are unaware of the amero or the plans to integrate North America, Previs observed, claiming many are just “putting their head in the sand” over the plans.

” Apparently, no one, neither the general public nor professionals on Wall Street, has yet to realise the extent of the hole, a hole of 20 trillion dollars with no market, nor value.”

a lot of folks on the street are very worried about this. The CMO trader I work with is convinced more bad news is down the line, but psychologically the market put in a short-term bottom a few weeks ago and I guess it takes either time or something particularly nasty to take it back down again.

True Believer Rule #33 - Never let facts get in the way of the your message.

William J. Clinton, the forty-second President of the United States (1993-2001)

Ah Haa! I have no idea of the distinction between the two.

Liquidity means not having sufficient cash. Solvency (or lack thereof) means not having sufficient cash to pay your bills. Correct?

Huh? This is BS worthy of the Weekly World News. I had no trouble rolling an $80 million 90-day LIBOR loan last week, and nothing has changed since then.

Condi wanted The Pope to bail out the hedge funds....

j/k

The difference is really between illiquidity and insolvency. It is quite possible to be solvent (i.e. all your assets minus all your liabilities equals a positive number) while being illiquid (i.e. no cash on hand to pay bills coming due right now. It’s a whole lot worse to be insolvent than to be illiquid. If you’re just illiquid but still solvent, it’s just a matter of time until you’re lquid again, and creditors will keep that in mind when negotiating with you about your currently overdue bills. If you’re insolvent, you’ll be pushed directly into bankruptcy court, so your creditors can start the process of claiming whatever reduced percentage of what they’re owed, is salvageable given your insolvent condition.

If you own a house free and clear that will easily sell for $100,000 even in this market, but only have $50 cash in the bank, and have an electric bill for $300 that’s due tomorrow, you have a liquidity problem, but you’re not insolvent. It’s reasonable to expect that the electric bill will get paid fairly soon (probably when you take out a home equity loan). But if you owe $150,000 on a house that will sell for $100,000 in this market, and $125,000 even when the housing market is back to normal, and you have that electric bill for $300 due tomorrow, you’re not just illiquid but also insolvent.

Insolvent banks are a big problem; illiquid banks are really just a little problem, that can be easily solved by emergency loans from a central bank, without any negative impact on the economy, inflation, etc.

I read an article about this early this a.m.

Not good news on the horizon at all.

Yes, it’s striking me as weird, and a bit worrisome, that everyone who has a clue is absolutely certain that a huge drop is on the way very soon. And yet it just keeps not happening. Mortgage derivative hedge funds go belly-up, CP markets freeze up, one money market fund failed to honor redemptions, a British retail bank has customers lined up at dawn to make panic withdrawals despite British Central Bank assurances that this isn’t necessary, and yet the stock market keeps toddling along as usual. This has gone on long enough that I’m starting to get seriously perplexed. I bailed out a while back, with the S&P just a hair over 1500, and I’m just sitting back waiting for the show to start. But it’s taking an inexplicably long time to start.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.