Posted on 11/07/2007 4:26:23 AM PST by DeaconBenjamin

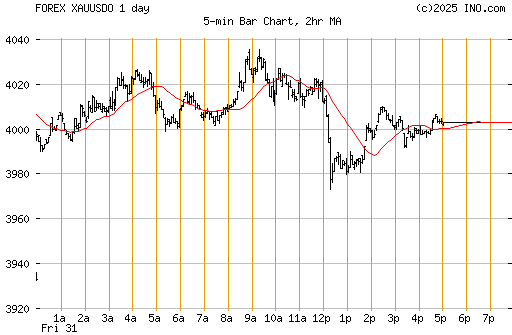

TOKYO - The dollar skid to a record low against the euro Wednesday in Asia on speculation that China may shift more of its foreign currency stockpiles -- the world's largest -- into the European unit and away from the greenback.

The euro jumped to a record US$1.4666, compared with US$1.4554 late Tuesday in New York. The 13-nation currency reached the previous record high of US$1.4571 in late European trading on Tuesday.

The U.S. dollar fell to 113.90 yen by midafternoon, down from 114.57 yen late Tuesday in New York.

Reuters reported a senior Chinese political figure as saying Wednesday that China should diversify its $1.43-trillion foreign exchange reserves into the euro and other strong currencies. The comments ignited a broad sell-off of the dollar, traders said.

The U.S. currency pared some losses against the euro later in the session. But traders said the dollar, which has been weakening due to concerns over the U.S. economy and expectations of more cuts in U.S. interest rates, could fall further and broadly.

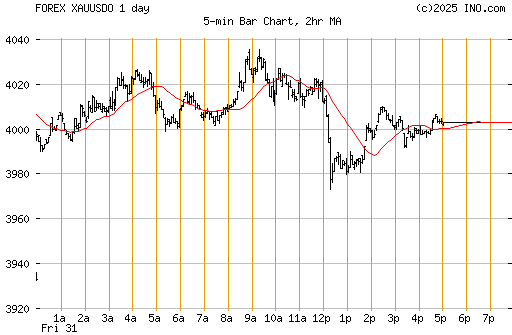

"Charts indicate that the euro still has plenty of room to go up" versus the dollar, said Mamoru Arai, a senior vice president of the foreign exchange division at Mizuho Corporate Bank.

Even if there are signs of improvement in the U.S. economy, they may do little to cool the euro's appreciation because "Russia, China and Middle-Eastern nations are steadily diversifying their foreign exchange reserves" by selling dollars for the European unit, Arai said.

Rising oil prices also supported the European currency because of speculation that oil-exporting nations were selling dollars earned from petroleum sales to buy more euros, traders said.

However, the dollar is likely remain directionless against the yen in days ahead, Arai said. "Who wants to buy the yen?" with Japan's low interest rates, sluggish stocks and stalled economic reforms amid political confusion, he said.

The dollar was mixed against other regional currencies, rising to 7.7680 Hong Kong dollars from 7.7654 the previous day, and to 39.260 Indian rupees from 39.24. It fell to 1.4428 Singapore dollars from 1.4462, and to 904.4 South Korean won from 907.8.

Bush’s Treasury Secretary has done nothing about this. He should have been acting a lot sooner than this.

Isn’t globalism grand? Our enemies can now set the price of our money and control the fuel supply for our economy.

The elite class has certainly managed to screw everything up again for the rest of us. Wonder when we will get tired of it?

This is exactly what the anti-China crowd has been asking for, though. They wanted China to stop accumulating dollars. Now it appears that’s what they are doing. Instead, according to this article, they are converting their dollars to euros, and hence accumulating more euros than dollars. You would think anti-China crowd would be celebrating, but they don’t seem to understand what’s going on. For some reason, they think this reinforces what they’ve been saying all along.

I understand your point, but I disagree. I think the anti-China crowd were arguing — if you give Red China a weapon to use against us, they will do so (because of who they are, and who we are). Now they are doing so.

That is hardly a matter that would elicit joy or pleasure. Perhaps an “I told you so.”

The value of our money compared to foreign currency only matters for buying imported goods.

The lower value of our dollar actually makes our goods more affordable to foreigners.

So if you are really an opponent of globalism, why are you unhappy about this?

I’ve been trying to explain that a lower dollar essentially functions as a higher tariff on imported goods, but almost no one listens.

“Wonder when we will get tired of it?”

We’ve been tired of it for many years. The problem is that nobody is willing to take the government to task on this issue.

*Please note following disclaimer!!!...I am not advocating a violent takeover, but there must be some sort of revolution soon. Either it be at the polls or by marching in mass demonstrations in D.C. to show them we are serious and have had enough of their pandering to other countries, i.e. China. I fear that by the time we realize that something drastic has to be done, it will be way too late.

And that would be, well, uhhhh, everybody.

Except for commodities whose price is set globally, such as oil, natural gas, wheat, corn, even orange juice. Unless you are suggesting price controls and export restrictions, as some countries have already instituted.

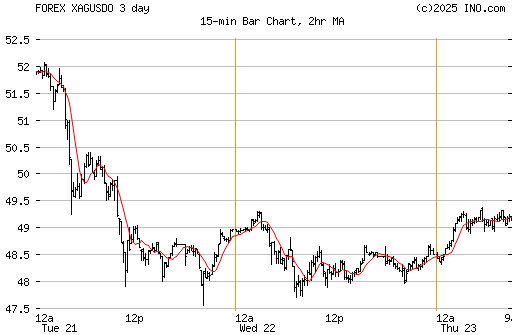

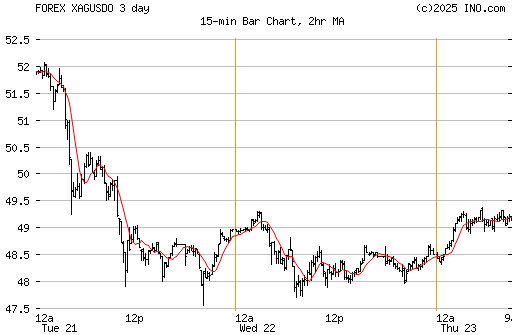

I’ve been buying Gold and Silver at bargain rates lately.

“Bush’s Treasury Secretary has done nothing about this.”

Right you are, as always. Bush’s Treasury Secretary has done exactly what he was told to do by the NWO powers that be. Those being Daddy Bush, Clinton and now Baby Bush.....next stop Her Thighness. Welcome to the New World Order and the soon to be our new currency, the “Amero”. Canadian money worth more than ours? Peso soon to be revalued so we can all be equal in the North American Union.

Bush-bots please line up to the left (if there are any of you left out there.) Your silence has been deafening!

What’s the going rate for Canadian silver dollars 1963-66? Uncirculated or Almost Uncirculated.

Trade is a two way street though. Both sides benefit. To say that one side has a weapon, and the other side is a victim of the use of that weapon, merely misstates the nature of trade. For example, we could have banned the Chinese from selling their computers or cameras in the US. But how would we be better off? We wouldn’t. We would be paying more for cameras and computers made in Japan and Taiwan.

We got the cheaper cameras and computers for a number of years. Now it is clear that the low prices are not sustainable in the long run, but how would we be better off if we had not gotten the low prices while we had the chance to do so?

It sort of reminds me of something my boss once said in a business meeting. We were debating whether to take on a very big client. The problem with taking on this client was that it would probably some day get taken over by someone, and we would then lose the client, and find ourselves with a lot of excess capacity, and not enough business to meet expenses. He summed everything up at the end of the debate by making the statement, “You take a slice when the cake is passed,” meaning that you don’t get rich by passing up opportunities.

Ironically, the client did get taken over and is now gone, and we are dealing with the very problem that we saw when we made the decision years ago to take on this client. On the other hand, I made a lot of money off that client over the last 10 years. How would I have been better off if I’d passed up the opportunity to do so?

As the dollar falls, funny thing, inflation is now on a steam roller for the US and the ability of the US consumer to consume more is gonna come to a screeching halt. Actually, we will see deflation here with a serious pullback on consumer spending for the upcoming Holiday Season. China is just shifting its focus to Europe and Asia to keep its exports flowing, however, the Chicoms are gonna feel it seriously.

Oh brother...

The anti-China crowd demanded we stop trading with that pariah state and those on the globalist bong would have none of it.

Well here we are. Remember when the globalist bong gobblers said there was nothing to fear by China holding all those dollars.

Well, you’ll at least have that to comfort you. Nobody could convince you that China in that position was a bad idea.

Now cope with it and don’t you dare blame anyone but the globalist bong-gobblers for this stinking mess.

Just damn. The free trade at any cost crowd damned us for objecting, and now they’ll blame us because China has done what we tried to warn them about.

“Nobody could convince you that China in that position was a bad idea.”

Well, that is true... because I believe in free markets. If it was a bad idea to buy goods from China, we wouldn’t do it.

To say that one side has a weapon, and the other side is a victim of the use of that weapon, merely misstates the nature of trade. America's benefit was the importation of deflation/much lower inflation for 10-12 years. This had a very negative effect on workers and communities whose jobs went overseas or out of business (where foreign suppliers were substituted), but as a whole, it was beneficial to the economy's growth. It also allowed politicians to avoid the inflationary consequences of their excessive spending for an extended period. But now we are paying the piper.

I do not see a perfect parallel between taking on a client, knowing that the contract will not likely be long term (although 10 years is fairly long), and purchasing consumer items at a lower price for a decade with the knowledge that your currency will be subject to severe correction at the whim of a (at least semi-)hostile nation.

The thing that will happen is that the ag-corp-slut-giants will sell corn, beans, rice, and wheat to the highest bidder which will be heading overseas. Look for $3.60 / lb 70/30% hamburger by March and gasoline $3.80 /gal national average. The people who have been living on credit will not be buying anything but the necessities for a long time if they don't go bankrupt.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.