I bumped into a good one today posted by hydroshock.

Posted on 11/24/2007 2:16:54 PM PST by givemELL

Yes, but it doesn't sell magazines. ;)

What, has there been a run on grape?

crap; if the Euro gets any more expensive, they’re going to have to come up with another currency to pay the last of their workers with.

“the dems have to show us all how bad EVERYTHING is.....until they get elected. “

Yep, there will continue to be talk of recession until a dem is in the oval office.

Remember, it is a stream of coupon payments, no principal is changing hands.

He can't remember that, he never knew it in the first place.

What does BDS mean?

all I can come up with is “Bull Duckin’ Sh...”

How do financial markets achieve efficiency? Consider a consultation with someone with a healthy head of jet black or blond hair.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aQk5LGM7y06M&refer=home

An excerpt from this article on credit problems and derivatives and ‘swaps’regarding US banks : Nov. 20 (Bloomberg) — The risk that banks and brokerages from Citigroup Inc. to Bear Stearns Cos. will default on their debt is accelerating as analysts increase their estimates of losses from subprime mortgages, credit-default swaps show.

Contracts on New York-based Citigroup, the largest U.S. bank by assets, rose 16 basis points to 95 basis points over the past two days, according to broker Phoenix Partners Group, setting a record today for the seventh time this month. Contracts on Bear Stearns have climbed 27 basis points the past two days to 177 basis points, the highest in at least six years. A rise signals investors are less confident in a company’s creditworthiness.

The increases are the biggest in two weeks as more analysts predict that writedowns by banks and securities firms, already $50 billion worldwide, will continue to grow. Goldman Sachs Group Inc. estimates Citigroup’s losses will expand to $15 billion in the next two quarters and CreditSights Inc. analysts said UBS AG, Europe’s largest bank by assets, may have lost as much as $9 billion on collateralized debt obligations.

``There’s still a lot more uncertainty to come,’’ said Tim Backshall, chief strategist at Credit Derivatives Research LLC in Walnut Creek, California. ``We understand the risks now, but we don’t know how to measure them yet.’’

bookmarked

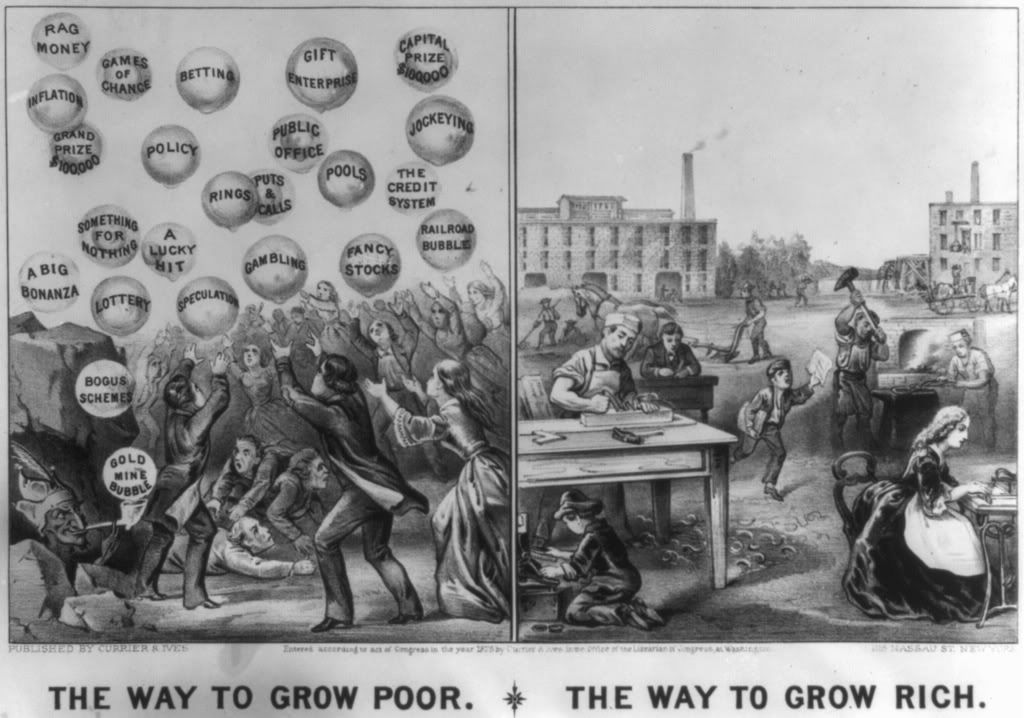

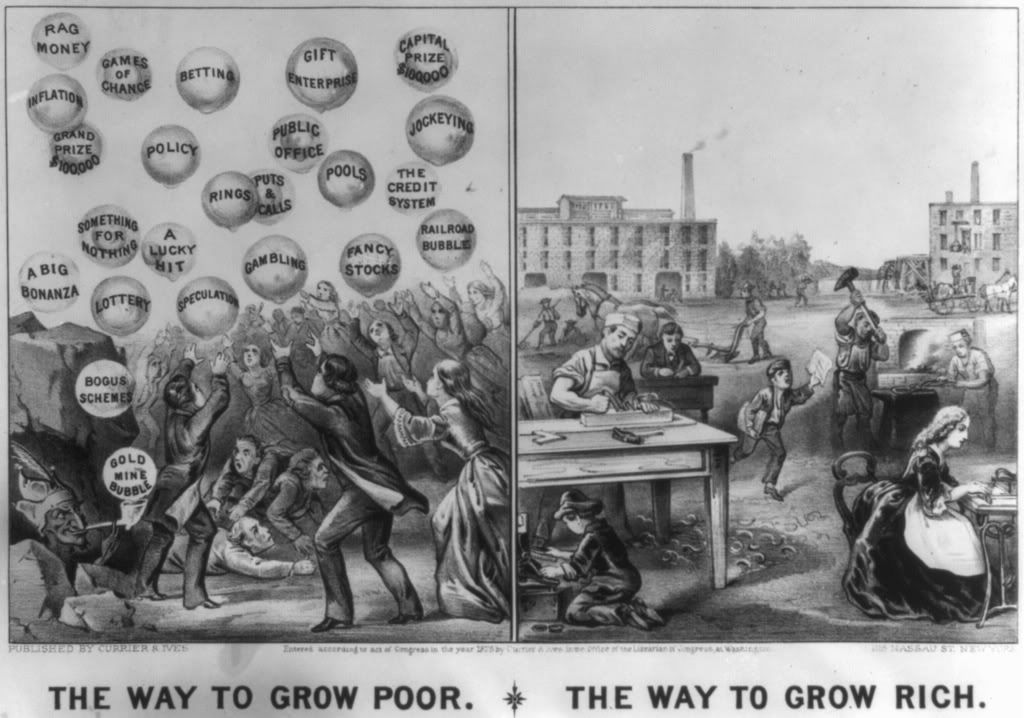

Wall Street achieves “market efficiency” by using the “it is different this time” promises of young turks to bilk the wealth out of individual investors and put it into their pockets.

Always has. Always will.

Goldman Sachs says credit is a big problem....$2 trillion worth

excerpt from article ‘The slump in global credit markets may force banks, brokerages and hedge funds to cut lending by $2 trillion and trigger a ``substantial recession’’ in the U.S., according to Goldman Sachs Group Inc.’ The credit is severe, global, and unprecedented in scale.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aem59U80V4gk

Given the situation I don't see how he had much choice. But how did he get in that situation is the important question. If the Fed doesn't get in front of the curve this time they'll end up having to lower to 1% again.

Deutsche Bank AG, Germany's biggest bank, also said in a report this week that credit losses may be $400 billion. That's equivalent to ``one bad day in the stock market,'' or 2.5 percent of the value of U.S. equities, Hatzius wrote.

Not so bad when couched in those terms, huh?

Your link is referring entirely to leveraged mortgage investments. Not derivatives.

Yep — we can see it coming. As you’ve pointed out repeatedly, one only need watch how the market is pricing the 91-day stuff.

The bigger question I’m wondering about now is “what will the EU do about the Euro?” Are they going to do nothing but complain about the dollar going downhill vs. the Euro, or are they going to start to take the Euro down to allow their exporters to keep exporting?

And if they do take the Euro down, what are all these oil producing states going to do now that they’ve started to price oil in Euro’s?

There’s no easy way out of this mess now.

The central problem, as you allude to, is that the Fed continues to use obsolete Phillips-curve notions of how/when to tighten and loosen monetary policy. A secondary problem is that the US Treasury seems utterly out to lunch, and has been since Rubin’s days. When we withdrew the 30-year T, it put us on this path in a very indirect way — it used to be that the business cycle was well contained (at least twice) within the 30 year term.

Now the benchmark is a 10-year, and that’s just about the length of a business/Fed cycle. Now the Fed has little room for delay on monetary policy WRT to how the debt market prices our deficit borrowing.

I could explain this better in terms of control system theory, but that would simply muddy the waters.

You’ve got your finger on the central issue here — the Fed has to move faster and with greater conviction than these little 25-bp moves, again and again and again. They should start thinking in terms of moving less often, but in bigger increments when they do move.

And if they do take the Euro down, what are all these oil producing states going to do now that they’ve started to price oil in Euro’s?

It does seem that everyone will be in a race to inflate their currencies down to zero now. Gold will be a key indicator of that.

“Total Major Banks and Brokers - 10 Trillion in Assets against 160 Trillion in Risk.”

______________________________________________________________

....won’t be too long now before having a skill (trade) will be a very valuable thing to barter with. I’m not sure I’d want to be a paper pusher in the future.

I bumped into a good one today posted by hydroshock.

Yesss... “Savation” will come if Hillary (the all-wise, the omni-competent, the merciful) is elected President.

Do we have here yet another attempt by Clinton’s dirty tricksters to spread panic among the economically naive?

For a review of the true situation, please see:

http://www.timesonline.co.uk/tol/comment/columnists/gerard_baker/article2925872.ece

With respect to the “derivatives crisis”, please understand that when Bank “A” sells an “interest rate swap” to Bank “B” (BTW, “interest rate swaps” are more than 50% of all derivatives), a “zero-sum” contract is created.

If Bank “A” “swaps” the 8-percent fixed interest payable on one of its $1MM loans for the “prime plus one” floating interest payable on a $1MM loan originated by Bank “B”, then a movement in interest rates will make one “party” the winner, and it’s “counter-party” the loser in the “swap”.

As an example, let’s assume that the “prime rate” was 7% when the “swap” was innitiated, so the two rates were identical. Now, interest rates float “up” and the prime rate increases to 8%. In this example, Bank “A” will earn $10,000 MORE , over one year, than it would have earned, if Bank “A” had not entered the “swap”. But Bank “B” would have lost that $10,000. In other words, a “zero-sum”.

And what is at risk, really? Is it the $1MM “notional value” of the “swap”, or the much smaller value of interest income “earned” or “lost”? The “notional value” is easier to calculate, but to use “notional value” as a proxy for “risk” is grossly misleading.

What kind of “economist” would tell people that a grossly- inflated number of “zero-sum” transactions is a certain portent of DOOM?

An “economist” whose polical agenda is stronger than his intellectual honesty.

Paul Krugman, is that youuuu...

Bottom line. Keep an eye on gold. It’s that simple.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.