Posted on 12/25/2007 7:33:47 PM PST by bruinbirdman

Japan has launched its biggest financial shake-up in a decade to regain lost business from London and meet the fast-rising challenge of Shanghai.

A sweeping package of 60 measures will give special tax exemptions to hedge funds, and allow companies to make simplified disclosures in English rather than Japanese.

It will tear down the archaic barrier between banking and broking, which is widely blamed for relegating Japan to backwater status, without the system of universal banking now prevalent in the US and Europe.

Japan's Financial Services Authority said the "entire government" would be harnessed to push through the master plan, aimed at turning Tokyo into the financial hub of Asia and broadening the country's economic base away from manufacturing. Officials have openly stated that the model is London. They plan their own "Canary Wharf" of shimmering towers in an enclave of Tokyo.

Japan remains the world's biggest creditor nation with some $2.5 trillion (£1.3 trillion) in net foreign assets and a massive $19 trillion pool of domestic savings and household assets, the world's biggest stash of private wealth. Yet it has almost completely lost its footing as a major money centre.

At the end of the 1980s, the Tokyo Stock Exchange (TSE) briefly encompassed a third of global stock market assets. It has been in relative decline ever since, losing out to all the rising hubs in Asia and the Gulf, as well as London.

Just one Chinese company has listed on the TSE, compared to more than 100 on the London Stock Exchange. Total foreign listings in Tokyo have dwindled from 125 in 1990 to 25 today.

The new package will go to the Japanese parliament early next year. The plan aims to break down the hidden barriers in Japan's cosy boardroom structure and open the system to a blast of fresh air.

Exchanges will be able to trade a much broader range of stocks, bonds, derivatives and commodity futures. Banks and insurance companies will be allowed to deal in almost any global instrument, from Sharia-compliant bonds and carbon emissions derivatives.

The government has already made it easier for foreign companies to use their stock when taking over Japanese groups, a move designed to set off a burst of consolidation and to force management to treat shareholders with greater respect. The old system of cross-shareholding has already broken down, falling from 50pc of all holdings in 1990 to near 15pc now.

The latest changes come amid growing angst that Japan is being left behind by globalisation, despite the country's formidable success as an exporter of cars and high-tech goods.

will this bail out the U.S. credit crunch ?

It might cover the interest.

At present, every housewife in Japan instead keeps a few million yen in physical notes stashed in every hollow object in the house...

with that much money lying around and no one there to inherit it, they might as well ship it out , isn’t that right?

I read financial things only casually, thanks for the primer. But why don’t you hear a lot about that $19 trillion with as much doom and gloom speculation about credit woes?

” At present, every housewife in Japan instead keeps a few million yen in physical notes stashed in every hollow object in the house...”

Hehe...A bit of hyperbole , surely ...You would be surprised at just how many folks , especially in rural areas , are existing thanks to loans from banks and elsewhere . No cash under the mattresses . My wife’s uncle - a local businessman - committed suicide on Christmas eve because he was so in debt to banks and family members ...Wifey tells me that a lot of people are deep in debt these days . The gap between the rich and the poor inexorably grows ...

“If private Japanese investors, e.g. through mutual funds, decided to buy $1 trillion in US stock at the present low level of the dollar, they could have most of the US financial sector.”

Golly, they surely must be idiots not to do so if this is accurate.

14 points? The Good Lord needed only 10. — Georges Clemenceau.

That's the reason for the 60 points. They can't. Jap brokers service Jap companies. Foreign financial institutions have been kept out. Just like in Communist China. ChiComs can only invest in Red China.

Interest rates are at 0.5%. Not every individual is in hock and committing suicide. There are plenty who must save for old age. Most of them save in the Postal Saving at about .5%. They have no family to help out.

yitbos

Thanks. I’m gonna just watch this thread for a little while before I pipe up.

“Japan fights back with 60-point master plan”

As long as one of ‘em isn’t going after the US Pacific Fleet at Pearl Harbor...

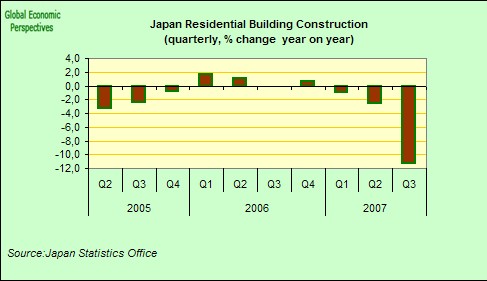

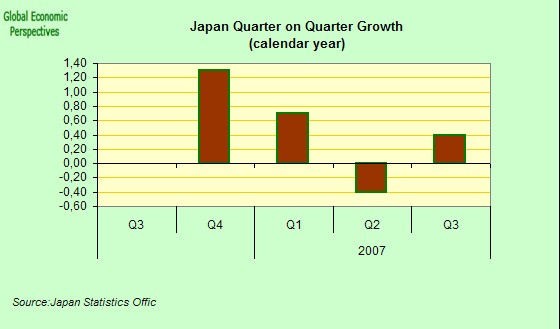

I apologize for the double image post.

IMO, that Era is gonna fade soon.

It's about to change? It will change when they start importing more than 50% of their rice consumption.

yitbos

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.