Skip to comments.

Economic Woes Maim Stocks; Dow Down 300

yahoo/ap ^

| Thursday January 17, 3:51 pm ET

| Tim Paradis, AP Business Writer

Posted on 01/17/2008 1:04:46 PM PST by central_va

Stocks Extend Slide As Manufacturing Index Falls; Bond Insurers Fall Amid Fears of Losses

NEW YORK (AP) -- Stocks skidded lower Thursday after a regional Federal Reserve report showed a sharp decline in manufacturing activity and as investors grew concerned that downgrades of key bond insurers could trigger further trouble with souring debt. ADVERTISEMENT

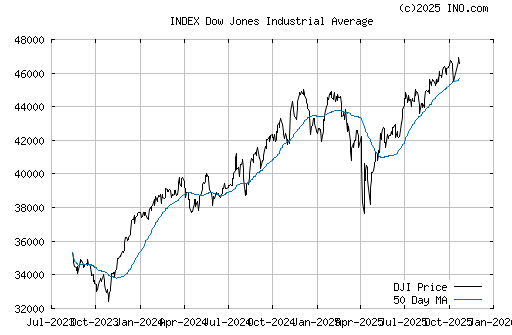

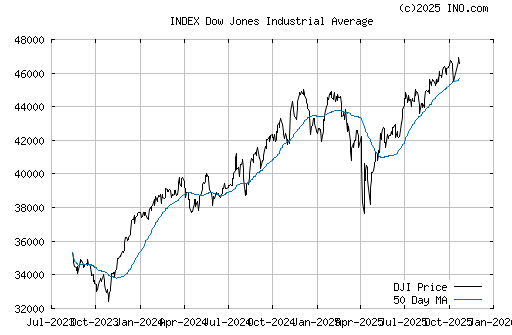

Some of the major indexes were off more than 2 percent, including the Dow Jones industrial average, which at times fell more than 300 points.

Stocks opened higher but quickly gave up their gains after the Philadelphia Federal Reserve said its survey of regional manufacturing activity registered a negative 20.9 from a revised reading of negative 1.6 in December. The reading came in well short of what Wall Street had been expecting and underscored the seriousness of the economic concerns that have gripped both Wall Street and Washington in recent weeks.

Credit concerns also dogged Wall Street after rating agency Moody's Investors Service placed bond insurer Ambac Assurance Corp. on review for a possible downgrade. That possibility alarmed Wall Street because it would place all bonds insured by Ambac on review as well. Ratings agencies are concerned that bond insurers would be unable to absorb a spike in claims.

The latest economic woes emerged as Fed Chairman Ben Bernanke, testifying before the House Budget Committee, warned the risks of an economic downturn have grown more pronounced. While his comments largely echoed his previous remarks, he lent support to a notion also backed by the White House on Thursday that an economic stimulus package could help the economy sidestep recession.

Thursday's session, with the latest in a series of triple-digit declines in the Dow, showed much of the rockiness that has taken stocks sharply lower in the short time since the year began. Investors fears of a slowing economy again dominated trading.

"The Philadelphia Fed just announced dreadful numbers," said John O'Donoghue, co-head of equities at Cowen & Co. He said if you look back at Philadelphia Fed data for similar numbers, it takes you back to the 2001 to 2002 recession.

"It's not rocket science -- the economy is slowing dramatically, and it's being reflected in economic reports."

In the final half hour of trading, the Dow, which had been up more than 50 points early in the session, fell 286.46, or 2.30 percent, to 12,179.70.

Broader stock indicators also lost ground. The Standard & Poor's 500 index fell 37.00, or 2.69 percent, to 1,336.20, and the Nasdaq composite index declined 41.76, or 1.74 percent, to 2,352.83.

Declining issues outnumbered advancers by about 5 to 1 on the New York Stock Exchange, where volume came to 1.81 billion shares.

Bond prices rose as stocks fell. The yield on the benchmark 10-year Treasury note, which moves opposite its price, fell to 3.62 percent from 3.68 percent late Wednesday. The dollar was mixed against other major currencies.

Light, sweet crude fell 71 cents to settle at $90.13 a barrel on the New York Mercantile Exchange after Bernanke's prediction of slower economic growth this year. Slowing growth could dampen demand for oil.

The Philadelphia manufacturing reading caught Wall Street by surprise -- igniting fears that the economy is slowing precipitously and that policymakers might be too late in aiding it.

Economists had expected the Philadelphia index would come in at a negative 1.5, according to Dow Jones Newswires. Instead, the negative 20.9 figure was the weakest since October 2001 when the economy was reeling from the shock of the Sept. 11 terror attacks.

Jim Herrick, manager of equity trading at Baird & Co., contends that the Philadelphia Fed reading and other recent negative economic reports indicate the economy is likely in a downturn.

Other economic reports added to investors' glum mood. The Commerce Department said housing starts plunged 14 percent to 1.01 million in December, marking the weakest pace of home building in more than 16 years. In addition, permits to build new homes dropped 8 percent last month to 1.07 million, the lowest level since 1993.

Thomson/IFR had forecast smaller declines for both housing starts and building permits. Still, some economists pointed out that the weakness may prove helpful in the long run, as smaller inventories of homes will take some pressure off the housing sector.

In one bright spot, the Labor Department reported jobless claims dropped by 21,000 to 301,000 in the latest week. Claims had been expected to rise by 8,000 to 330,000, according to Thomson/IFR. However, the weekly readings can be volatile.

The week's steady flow of news, much of which has dented investor sentiment, has led to a growing chorus of calls for the Fed to cut rates. The Fed's monetary policy committee will meet Jan. 29-30 and is widely expected to lower its Fed funds target from the current 4.25 percent level. Bernanke on Thursday reiterated recent signals that the central bank will reduce rates for a fourth straight time.

Some on Wall Street have called for the Fed to intervene sooner with steep rate cuts.

The economic concerns come in a week in which some of Wall Street's biggest names have posted huge losses following bad bets on mortgage investments. Financial shares fell sharply Thursday after the reports have made clear that there is also increasing weakness in home equity and other consumer banking operations. The problems with subprime and home equity, along with a badly stalled housing market, are among the chief reasons investors are pinning their hopes on stimulus efforts and cheaper lending rates.

Merrill Lynch & Co. on Thursday posted a massive loss that underscored the depth of the economy's credit problems. The world's largest brokerage said it lost $9.91 billion in the fourth quarter, hurt by massive write-downs from investment and trades battered by the ongoing credit crisis.

John Thain, the new chief executive at Merrill, said he believes this will be the bulk of the company's write-downs from its subprime mortgage exposure. But he would not speculate about what 2008 might hold in store in other areas. Earlier this week, Merrill secured a new round of capital infusions from foreign funds.

Merrill fell $5.46, or 10 percent, to $49.63.

Moody's announcement that it will review Ambac came after the insurer booked a $5.4 billion write-down on its credit derivative portfolio during the fourth quarter.

Ambac plunged $6.88, or 53 percent, to $6.09, while Ambac rival MBIA Inc. fell $4.44, or 33 percent, to $8.99. First Horizon National Corp. fell $3.24, or 17.2 percent, to $15.65 after Standard & Poor's Ratings Services lowered its rating on the bank's long-term credit.

The Russell 2000 index of smaller companies fell 17.31, or 2.47 percent, to 682.60.

Overseas, Japan's Nikkei stock average closed up 2.07 percent. Britain's FTSE 100 finished down 0.68 percent, Germany's DAX index fell 0.78 percent, and France's CAC-40 fell 1.31 percent.

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: djia; dowdown; stocks; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 101-116 next last

Regardless of politics, this is starting to get real.

To: central_va

Yep. All of last year’s gains gone in two weeks.

2

posted on

01/17/2008 1:08:28 PM PST

by

microgood

To: central_va

Whatever reasons are assigned, even if only headlines happening at the same time, 12160 is not much above the 12000 it was for the Nov elections last year.

3

posted on

01/17/2008 1:08:45 PM PST

by

RightWhale

(Dean Koonz is good, but my favorite authors are Dun and Bradstreet)

To: RightWhale

Nancy and Harry aren’t doing their jobs... Didn’t they promise the American people that it would be all better once the Dims got into office ?

4

posted on

01/17/2008 1:12:04 PM PST

by

cinives

(On some planets what I do is considered normal.)

To: central_va

Yep. Emotion is ruling the day. Maybe it’s time to start dollar cost averaging in....

5

posted on

01/17/2008 1:14:05 PM PST

by

jdsteel

(proud member of "Mothers And Children Against Criminal Aliens")

To: RightWhale

The problem is, we’ve busted through all support levels on the downside, and no one has any idea when we are going to get any news that will get people in the buying mood again.

This has been ugly for the last 4 months and we may not be done for a while. The only I can see is that a lot of institutional money will be hitting the market in the next month as large corps pay their 2007 401(k) matches and the prospect of another rate cut at the end of January. (If not before.)

6

posted on

01/17/2008 1:14:27 PM PST

by

L,TOWM

(Liberals, The Other White Meat)

To: cinives

They did that. Maybe the situation isn’t their fault now, but they shouldn’t be promising things they can’t produce.

7

posted on

01/17/2008 1:14:29 PM PST

by

RightWhale

(Dean Koonz is good, but my favorite authors are Dun and Bradstreet)

To: microgood

It's no wonder we have all this market diving goin' on with all the "end of the world, economy collapsing all around us" stories day in and day out!

I think they finally got everyone into the doom phase and my 401 is shrinking in leaps and bounds! The second I decide to jump out will be when it decides to turn, although, that's what I told myself 6 or 8% ago and now look where I am!

To: central_va

Yet another NAIL in the ‘08 Republican election coffin. Maybe none of these morons are going for re-election and don’t give a crap. Pathetic bunch of bumbling boobs...both parties.

9

posted on

01/17/2008 1:18:14 PM PST

by

GoldenPup

To: central_va

Hmmmmm.....It’s getting to be time for making our ROTH IRA contributions!

10

posted on

01/17/2008 1:18:39 PM PST

by

goodnesswins

(Being Challenged Builds Character! Being Coddled Destroys Character!)

To: central_va

Market’s oversold — excellent time to buy.

To: central_va

Where’s LEO?

The only way to deal with a systemic crisis of confidence is to REMOVE those, in whom there can be no trust, from the system.

Confidence can not be restored until justice is served.

Some subprime vampira need to be dug up in their golden sarcophagi and dragged into a court of daylight for all to see.

12

posted on

01/17/2008 1:21:34 PM PST

by

VxH

(One if by Land, Two if by Sea, and Three if by Wire Transfer)

To: Poundstone

Market’s oversold — excellent time to buyYou first

To: VxH

subprime vampira need to be dug up in their golden sarcophagi and dragged into a court of daylight for all to seeAre you a novelist? What visuals

To: central_va

With the Democrats in control of Congress coupled with the very real possibility of maintaining that control and taking the White House, I think many investors are looking to cash out. There are long term reasons for this:

1) The Bush tax cuts will expire. The effect will be a massive tax hike, particularly on investments. The Democrats would sooner bomb Iran than extend those tax cuts or make them permanent.

2) The last time the Democrats held both Congress and the White House, they made their tax hikes retroactive. Investors need to bail out in this filing year because next time may be too late.

15

posted on

01/17/2008 1:25:56 PM PST

by

bobjam

To: RogerWilko

I think they finally got everyone into the doom phase and my 401 is shrinking in leaps and bounds! The second I decide to jump out will be when it decides to turn, although, that's what I told myself 6 or 8% ago and now look where I am!

It really depends on when you are going to retire. Since you are buying shares, if you have more than 5 years until retirement, this is just a blip. That is why when you get close to retirement, you move to lower risk bonds, so you will not get caught in a trough like this.

Notice they waited until the new year to do this so everyone could get the 10% in their 401K before they went crazy wild.

To: central_va

I told everyone on FR to short futures/Spyders on December 12th. If you daytrade, it has been the easiest environment since 2000.

To: ex-Texan; stephenjohnbanker

It's getting ugly. Where's the next support level?

"I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future."

~~E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."

~~Irving Fisher PhD, leading U.S. economist , New York Times, October 17, 1929

"If recession should threaten serious consequences for business (as is not indicated at present) there is little doubt that the Federal Reserve System would take steps to ease the money market and so check the movement."

~~Harvard Economic Society, October 19, 1929

"This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan... that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years."

~~R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

“Several brokerage houses tumbled; blue-sky investment companies formed during the happy bull market days went to smash, disclosing miserable tales of rascality; over a thousand banks caved in during 1930, as a result of marking down both of real estate and of securities; and in December occurred the largest bank failure in American financial history, the fall of the ill-named Bank of the United States in New York.”

~~"Only Yesterday: An Informal History of the 1920’s" by Fredrick Lewis Allen

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."

~~Ludwig von Mises

18

posted on

01/17/2008 1:35:59 PM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Poundstone

Market’s oversold — excellent time to buy. Not yet. Wait for a panic-filled 500+ pt washout. Perhaps tomorrow.

To: central_va

20

posted on

01/17/2008 1:38:15 PM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 101-116 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson