Skip to comments.

What Happens When City Hall Goes Bankrupt? (unions)

NPR ^

| February 28, 2008

| Eric Weiner

Posted on 03/03/2008 8:27:54 AM PST by 2banana

What Happens When City Hall Goes Bankrupt? by Eric Weiner

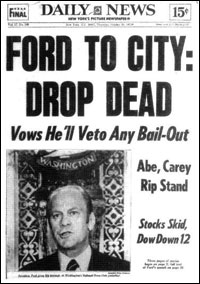

New York City didn't actually declare bankruptcy in the 1970s, but it came close. When the city appealed to Washington in 1975 for a bailout, President Ford balked, prompting this famous New York Daily News headline. New York Daily News

Moments in Municipal Bankruptcy

1975, New York City: The Big Apple teeters on the verge of bankruptcy but is rescued at the last minute, thanks to a loan from the federal government and other measures. 1991, Bridgeport, Conn.: The city, population 140,000, declares bankruptcy after a dispute with the state. 1994, Orange County, Calif.: The county declares bankruptcy after officials make a series of bad investments. It was — and still is — the biggest municipal bankruptcy in U.S. history. 1995, Pittsburgh: The city escapes bankruptcy — barely — by selling its water plant. 1995, Washington, D.C.: The nation's capital is in danger of bankruptcy but is rescued when the White House and Congress establish a financial control board for the city. 2000, Camden, N.J..: The state of New Jersey takes over the faltering city. It's the biggest city takeover in the country since the Great Depression. 2008, Vallejo, Calif.: Faced with a budget crisis, city officials contemplate filing for bankruptcy protection.

NPR.org, February 28, 2008 · We know that individuals and corporations can declare bankruptcy, but entire cities?

That is exactly what officials in Vallejo, Calif., are contemplating. And they are not alone. There's a long and sad history of municipalities declaring bankruptcy. Here's a look at how these places got into hot water — and what life is like for residents of a bankrupt town.

Why do cities and towns declare bankruptcy?

For the same reason that individuals and corporations do. They're broke and can't pay their debts. This might be because of an unexpected expense — say, a costly lawsuit — or a sudden shortfall in revenue, due to falling property values, for instance. Either way, declaring bankruptcy protects cities and towns from their creditors, just as it does for individuals and corporations. (In Vallejo's case, bankruptcy offers another benefit: It would allow the city to renegotiate costly labor contracts with public-safety employees, which reportedly account for about 80 percent of the city's general fund budget.)

The one main difference: Municipalities can't liquidate assets to pay off their creditors — the mayor can't sell the town fire engine to pay the bank.

Have municipalities always been able to declare bankruptcy?

No. For most of U.S. history, cities and towns were not eligible for bankruptcy protection. But during the Great Depression, more than 2,000 municipalities defaulted on their debt, and they pleaded with President Roosevelt for a federal bailout. "All they got was sympathy," reported Time magazine in 1933. Instead, Roosevelt pushed through changes to the bankruptcy laws that allow towns and cities to file for bankruptcy. They even got their own section of the bankruptcy code: Chapter Nine.

How many municipalities have sought bankruptcy protection?

Since 1980, 32 cities and towns have declared bankruptcy, according to James Spiotta, a leading municipal bankruptcy lawyer. Most notable of these were Bridgeport, Conn., population 140,000, which declared bankruptcy in 1991. And, in the nation's biggest municipal bankruptcy, Orange County, Calif., sought protection from its creditors in 1994 after city officials made a series of bad investments.

What is life like in a "bankrupt" city or town?

In one sense, life goes on as usual. Police and fire departments still respond to 911 calls; the garbage is still collected. But don't expect that new bridge or school to be built. For a bankrupt city, all new projects must be approved by a majority of creditors. The biggest hit, though, is to the city's image. Bankruptcy carries a much greater stigma for a city than for a corporation, which is why officials go to great lengths to avoid Chapter Nine.

If a city or town declares bankruptcy, does it affect others nearby?

Yes. Surrounding cities and towns can find it harder to borrow money for new projects because investors — who buy and sell bonds — will question their financial viability. That's why states often intervene to prop up a faltering municipality and avoid the sting of bankruptcy. Sometimes all it takes for a town or city to get help from the state capital is the mere threat of bankruptcy. "It's an instrument of getting attention and getting others to help you," Spiotta says.

What about New York City? Didn't it declare bankruptcy in the 1970s?

No, but it came close. The city was teetering on the edge of bankruptcy in 1975 when it appealed to Washington for a bailout. President Ford balked, prompting the famous Daily News headline "Ford to City: Drop Dead." (Ford never actually uttered those exact words.) In the end, Congress did pony up some money for New York, and the city formed the Municipal Assistance Corp. — a quasi-government body that, in effect, allowed New York to lend money to itself. Other big cities — Philadelphia, Pittsburg, Miami — have flirted with bankruptcy in recent decades but not actually declared it.

Are we likely to see more towns and cities declare bankruptcy in the future?

That's difficult to say, but some experts believe the warning signs are clear: unfunded pension liabilities, an anemic economy, costly infrastructure repairs and falling property values. "All of the ingredients are there," Spiotta says. "I wouldn't be surprised if we start to see more bankruptcies."

TOPICS: Crime/Corruption; Culture/Society; Government; News/Current Events

KEYWORDS: bankrupt; city; unions; unionthugs

Navigation: use the links below to view more comments.

first 1-20, 21-22 next last

In Vallejo's case, bankruptcy offers another benefit: It would allow the city to renegotiate costly labor contracts with public-safety employees, which reportedly account for about 80 percent of the city's general fund budget

It ALL comes down to paying the OUTRAGEOUS salary, benefits and pensions of city and state UNION employees. It is driving all these cities in bankruptcies.

1

posted on

03/03/2008 8:27:58 AM PST

by

2banana

To: 2banana

What Happens When City Hall Goes Bankrupt?Blame the taxpayers?

To: 2banana

This article is from NPR. I note that they don’t mention excessive spending as a cause. How odd. /sarc

3

posted on

03/03/2008 8:42:55 AM PST

by

Hardastarboard

(DemocraticUnderground.com is an internet hate site.)

To: Boston Blackie

Hasn’t East St. Louis, IL been in Chapter 9 a couple of times? Now, there’s a bright spot on the face of the earth!

4

posted on

03/03/2008 8:45:57 AM PST

by

Wally_Kalbacken

(Seldom right but never in doubt)

To: 2banana

What Happens When City Hall Goes Bankrupt? (unions) The taxpayers get screwed over ... again.

5

posted on

03/03/2008 8:50:09 AM PST

by

Centurion2000

(su - | chown -740 us ./base | kill -9 | cd / | rm -r)

To: 2banana

Outrageous compensation is not the only issue but it certainly is a major factor. The deferred compensation hidden in defined benefit pensions and retiree health care is a major factor. This compensation is effectively hidden to taxpayers and legislators in compensation surveys. For details about deferred compensation in Colorado pensions, you should read my recent study:

Speakout editorial for RMN (http://blogs.rockymountainnews.com/denver/speakout/2007/09/): scroll down the page

Full version: http://ssrn.com/abstract=985621

Public employees in many states claim constitutional protection for pension benefits. Colorado public employees make this claim for both retirees and current employees. Because judges are public employees covered by the same pension plans, it looks like judges becoming law makers in raising taxes.

The recent stock market decline will bring plenty of pain to public employee pension funds and taxpayers. This decline and the potential for future declines validates my idea that defined benefit pensions such as Colorado PERA are huge repositories or undisclosed deferred compensation.

To: 2banana

Hopefully when this hits Massachusetts and the local governments therein they will be able to freeze bloated pensions and reduce overstaffing?

7

posted on

03/03/2008 8:54:01 AM PST

by

MSF BU

(++)

To: 2banana

if they file bankrupcy today all the papers becoem public accessable via the federal Pacer system.

A JUDGE approves all the deals in open court and no more back room deals with unionistas.

8

posted on

03/03/2008 8:54:54 AM PST

by

longtermmemmory

(VOTE! http://www.senate.gov and http://www.house.gov)

To: businessprofessor

Are they allowed to freeze COLA’s? Ten years of inflation should whittle the value of those pensions down.

9

posted on

03/03/2008 8:55:13 AM PST

by

MSF BU

(++)

To: 2banana

"It ALL comes down to paying the OUTRAGEOUS salary, benefits and pensions of city and state UNION employees. It is driving all these cities in bankruptcies." Oh no. Jefferson County, Alabama has $5.7 Billion in speculative Credit Default Swap (CDS) "investments" that it is upside down on by more than $150 Million.

So you see, bureaucrats can gamble with tax Dollars as well as overspend them.

10

posted on

03/03/2008 8:59:40 AM PST

by

Southack

(Media Bias means that Castro won't be punished for Cuban war crimes against Black Angolans in Africa)

To: Southack

that it is upside down on by more than $150 Million $150 million is about the lifetime cost of pension and medical of only about 200 public union retirees...

11

posted on

03/03/2008 9:07:35 AM PST

by

2banana

(My common ground with terrorists - they want to die for islam and we want to kill them)

To: All

FYI for everyone:

http://caselaw.lp.findlaw.com/casecode/uscodes/11/chapters/9/subchapters/ii/toc.html

United States Code

TITLE 11 - BANKRUPTCY

CHAPTER 9 - ADJUSTMENT OF DEBTS OF A MUNICIPALITY

SUBCHAPTER II - ADMINISTRATION

Section 921. Petition And Proceedings Relating To Petition

Section 922. Automatic Stay Of Enforcement Of Claims Against The Debtor

Section 923. Notice

Section 924. List Of Creditors

Section 925. Effect Of List Of Claims

Section 926. Avoiding Powers

Section 927. Limitation On Recourse

Section 928. Post Petition Effect Of Security Interest

Section 929. Municipal Leases

Section 930. Dismissal

12

posted on

03/03/2008 10:04:29 AM PST

by

longtermmemmory

(VOTE! http://www.senate.gov and http://www.house.gov)

To: Wally_Kalbacken

Hasn’t East St. Louis, IL been in Chapter 9 a couple of times? Now, there’s a bright spot on the face of the earth!Lets hope its not coming to a community near you or me.

To: Boston Blackie

the bloated civil servant wages and bennies is precluding maintaining parks, zoos, trails, roads, etc.....

as long as the public employees....all of them....keep getting their Kings ransom then we will not progress, improve, beutify, maintain, or excell as a society....

maybe we'll go back to the day of everyone belonging to a country club because everything else has gone belly up....

thankyou civil servants.

14

posted on

03/03/2008 12:53:03 PM PST

by

cherry

To: cherry

thank you civil servants.They're referred to as Payroll Patriots in Boston.

To: MSF BU

COLA adjustsments are not allowed in Colorado. The state legislature made some modest reductions in the pension formulas. However these adjustments only apply to new hires, not existing employees.

To: businessprofessor

...at what point do COLA’s get nixed? Bankruptcy?

17

posted on

03/03/2008 7:39:23 PM PST

by

MSF BU

(++)

To: MSF BU

It depends on state laws and constitutions. In Colorado, public employees think that the constitution protects their pensions. Judges can try to raise taxes. I do not see bankruptcy as an option.

To: businessprofessor

Interesting; if we have fourteen percent inflation the judges are going to raise taxes are they?

19

posted on

03/03/2008 10:16:47 PM PST

by

MSF BU

(++)

To: MSF BU

In Colorado, COLAs are limited to 3.5%. Hyper inflation will lower the value of public employee pensions also. Social security benefits are linked to the average wage index which is usually higher than the CPI. 14% inflation will have a substantial impact on federal spending due to social security alone.

Navigation: use the links below to view more comments.

first 1-20, 21-22 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson