Posted on 03/09/2008 1:03:23 AM PST by TigerLikesRooster

Ping!

Can someone give me a quick tutoring in this. I read the article and basically understand it but I am looking for more insight. Thanks.

Yes, bond buyers are getting nice returns.

Can someone give me a quick tutoring in this. I read the article and basically understand it but I am looking for more insight. Thanks.

********************************************************

With the bond insurers failing buyers are demanding a higher interest rate be paid as the income generated from the project (rather than the rating of the insuring agency) is now the primary concern when it comes to repayment..

What Denver is seeing is nothing ,, these are small increases compared to what Orlando got hit with for the three vanity projects of our mayor ,, an arts center , a new stadium for the Orlando Magic and refurbing (again) the underutilized Orange bowl stadium ,, estimated at $1B ,, we are already over by $150M just in interest expenses as buyers see this as a boondoggle (they’re right) with none of the three ever able to repay their initial cost ,, instead we are relying on tourist taxes to pay for them just as we enter a long drawn our recession to pay the bills..

bmp

Are we seeing a domino effect started by the toppling of the sub-prime mortgage lending market? Where will this one end?

States scrambling to convert action-rate bonds to fixed securities but funding sorces are in the tank on the sub-prime lending losses.

Again, where will this one end?

” Again, where will this one end? “

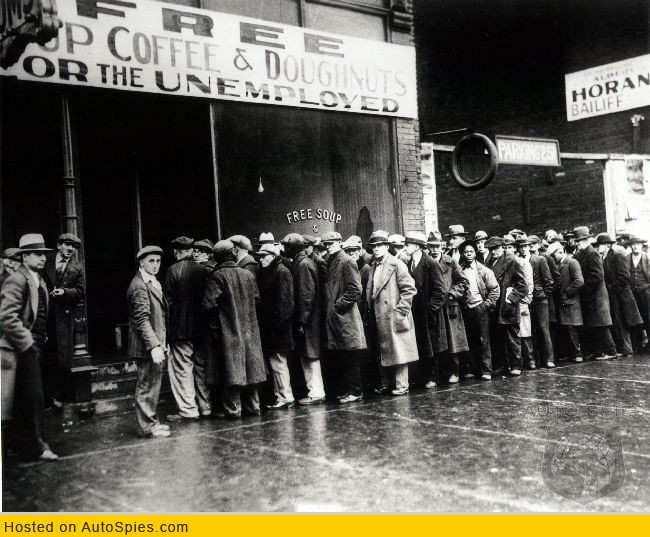

Hint: Start a crash study program on subsistence farming, and lay in a supply of trade goods....

This is just one line in a series of converging trends — it’s not gonna be pretty.....

Two years ago we set out to pay off our house. It will be paid off in a couple more months and we can then start buying canned goods I suppose.

where will this one end?

Look up stagflation.

Now the problem lies in the fact that your Government has taken to starting long term projects and funding them on cheap short term money (only to find out short term money is no longer cheap).

“Again, where will this one end?”

Nobody really knows. Billions of dollars that were invested in equity investments are disappearing. That sounds like deflation to me but I’m no expert.

The same Bloomberg reported a few days ago that some 70% of the auctions had failed and issuers wanted to bid at their own auctions, a thing not now allowed.

The people with ARM home mortgages have an empty bar stool waiting for financial officers.

Interest rates reflect:

* Demand for debt (the market has little appetite for debt, these days) low interest = no interest from the market

* The risk that the debt won’t be repaid.

* The waning credibility of the rating agencies and bond insurers as means of assessing and mitigating risk.

All right, who’s been talking down the Auction Rate Bond Market, people are gonna start blaming us for that too.

“Several brokerage houses tumbled; blue-sky investment companies formed during the happy bull market days went to smash, disclosing miserable tales of rascality; over a thousand banks caved in during 1930, as a result of marking down both of real estate and of securities; and in December occurred the largest bank failure in American financial history, the fall of the ill-named Bank of the United States in New York.” ~~"Only Yesterday: An Informal History of the 1920’s" by Fredrick Lewis Allen

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."~~Ludwig von Mises

"Credit expansion can bring about a temporary boom. But such a fictitious prosperity must end in a general depression of trade, a slump."~~Ludwig von Mises

"True, governments can reduce the rate of interest in the short run. They can issue additional paper money. They can open the way to credit expansion by the banks. They can thus create an artificial boom and the appearance of prosperity. But such a boom is bound to collapse soon or late and to bring about a depression."~~Ludwig von Mises

"Credit expansion is not a nostrum to make people happy. The boom it engenders must inevitably lead to a debacle and unhappiness."~~Ludwig von Mises

"What is needed for a sound expansion of production is additional capital goods, not money or fiduciary media. The credit boom is built on the sands of banknotes and deposits. It must collapse."~~Ludwig von Mises

"If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders."~~Ludwig von Mises

Yep, the same permabull tout Pollyanas are going to, after the fact, say, “Everything was just peachy, until the doomers started ‘talking down’ the economy.”

Try to point out a coming train wreck, and they laugh and mock you. After the train wreck, they’ll blame you for it. You brought it on by “bad karma” or something.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.