You need C notes...

You know, the twin-ply stuff...

Posted on 12/16/2008 11:35:21 AM PST by Sub-Driver

Fed Cuts Rates to Historic Low

By BRIAN BLACKSTONE and MAYA JACKSON RANDALL

WASHINGTON -- U.S. Federal Reserve officials on Tuesday slashed official interest rates to an historic low range to combat a deepening recession and signaled they will keep rates "exceptionally low" for some time amid rapidly waning price pressures.

Officials also signaled a new phase for policy in which lending programs financed by the Fed's ballooning balance sheet, a process known as quantitative easing, replace the federal funds rate as the Fed's primary policy tool.

The Federal Open Market Committee voted unanimously to reduce the target fed funds rate for interbank lending from 1% to a range of zero to 0.25%, the lowest since the Fed started publishing the funds target in 1990. The market-determined effective fed funds rate already has already hit record lows in recent weeks. (Read the Fed's statement.)

Economists had expected a smaller cut of just 0.5 percentage point, and hadn't envisioned the Fed setting a range.

(Excerpt) Read more at online.wsj.com ...

For those complaining about the rate cut, you should have complained when the yield curve was inverted, then all of this would have been unnecessary.

Dump the wallet stock! I’m buying wheelbarrow stock!!

Ouch! That is not going to help things. With the world oil market in collapse, you may just be right about another Russian currency crisis.

Things are spiralling down the drain very fast now. It has only been a matter of months since Lehman went belly up. I can’t believe how fast all this is happening.

Time to fuel the next bubble with too-cheap credit.

I just got offered 5.25%, told him I’ll wait a while.

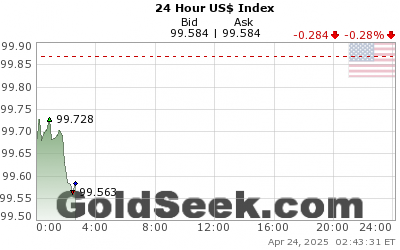

We say that every time the interest rate is cut,but the dollar seems to rebound when we find out how bad everyone else is.In 3 months,the UK will slash rates and the dollar will return.It's been an ongoing cycle through all of this.

LOL!

>”U.S. Federal Reserve officials...”

what BS!

the “federal reserve” isn’t Federal, these aren’t U.S. government officials running it, and there are no “reserves”. The “fed” central bank, is a private organization composed of private international bankers, who are no more connected to the US government then Federal Express is:

http://www.youtube.com/watch?v=LX2DgN1VYgQ&feature=channel_page

What terms?

Maybe long run - but now TLT (a proxy for the 20-yr bond) is up near its highs for the day (or ever).

I think that the plan to "fix" the economy is to lower LT rates to 4.5% for us mere subjects, so that we can buy new houses or re-fi existing ones for a bargain, so as to juice things up. That'll do the trick...and then the velocity of money will ratchet up without money being withdrawn fast enough from the economy, goosing inflation. Then the dollar tanks and rates go up - then the Treasury cannot pay the interest on the debt and THEN we have a serious problem.

All they're doing is postponing the day of reckoning, and making it worse. Greenspan refused to allow the economy to bite the bullet after the Tech Crash and 9/11, and now we're screwed. The mathematics say that we cannot possibly pay back all of the debt. Better to allow defaults now, get the pain over with and rebuild, than to prolong the agony. Its like someone with gangrene who's been given a painkiller, and who then postpones cutting off his leg because "it isn't so bad." Then it invades the rest of the body and he's pushing up daisies.

I’m seeing 5.75 to 6 right now near Chicago for 30 year fixed. Where do I go for these 4% rates?

I want you to picture Barney riding “bareback”— that should end any posts with Barney’s pic in it.

30yr fixed

SPECTACULAR! This cements my plans. I just retired. Thank you, Ben!

Life is good.

Let me translate: The economy is in full scale collapse, go ahead and rejoice over the rate, you won’t be soon ....

If you can’t figure out how to make money now, you’ll never know how. What a relief.

I wonder if now is the unthinkable situation he was considering. If even 0.25% rates can't get inflation moving like they desparately want, will they start doing crazy things soon?

“Let me translate: The economy is in full scale collapse, go ahead and rejoice over the rate, you won’t be soon ....”

The economy does what it does. Prior guesses just paid off big. Worrying about the economy is not my job, nor is it yours. Our job is always the same, to discover how to make money no matter what the economy is doing.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.