Time to post my economic philosophy again:

Posted on 08/02/2009 6:17:25 AM PDT by Notary Sojac

Let's call this what it is: A new bull market in stocks has emerged from the ashes of the financial meltdown and the deep recession that followed. And it's signaling the onset of economic recovery. Free-market capitalism is more durable, resilient, and self-correcting than its detractors would have us believe.

This is not just a summer rally -- although a 12 percent market rise since July 10 is absolutely splendid. There's a lot more going on here. Over the last five months, since March 9, the broad-based S&P 500 is up 46 percent. If I'm not mistaken, a 20 percent rally that is not quickly reversed constitutes a bull market. We are more than double that, and there will be no total reversal.

Consequently, I want to change the agenda. This is much grander than what most commentators are describing. This is a new bull.

With positive, beat-the-street earnings coming from all corners of the economy, the current rally is based on solid fundamentals. Roughly two-thirds of S&P companies have reported so far, and 75 percent have beaten profits expectations by about 10 percent on average. Just look at the recent results posted by companies as diverse as Dow Chemical, MasterCard, Visa, Tyco, Colgate-Palmolive, Kellogg's, Cummins, and International Paper, all of which follow better-than-expected announcements from Caterpillar, IBM, and Intel a few weeks ago.

Incidentally, research from JPMorgan shows that sequential revenues -- second quarter over first quarter -- are rising. And investment guru Vince Farrell says there's $11 trillion sitting on the sidelines in money-market and other short-term balances. So this rally is no empty air pocket. When markets in China plunged 7 percent earlier this week, U.S. stocks could have followed suit. But they held their own. It was a big show of bull-market strength.

And let's not forget the banks. The KBW Bank Index has doubled since early March. With a zero short rate and a steeply upward-sloping Treasury yield curve, even a banker can make money. Financial earnings are soaring. The credit crisis is over. And the banks will earn their way out of their toxic-asset problems provided that the nerds at the Financial Accounting Standards Board (FASB) don't resurrect mark-to-market accounting and force immediate distressed-market write-downs.

Does this bull have long legs? Historically, bull markets last an average of 17 months, and this bull should run well into next spring. And judging from the breathtaking decline in LIBOR rates, the TED spread (between LIBOR and Treasury bills), and corporate-bond spreads relative to Treasuries, I believe there's another 20 percent upside to the bull. That would return us to the pre-Lehman levels of August 2008, with the S&P above 1,100 and the Dow at 11,000.

And here's the economic deal: Businesses have made the necessary cost-cutting adjustments to jobs, salaries, and inventories to restore profitability. (My hunch is that businesses fired too many people when the credit roof fell in and the economic bottom fell out.) It's a classic, Austrian, Ludwig von Mises corrective to prices and production. As the economy rises, lean-and-mean companies will reap a profitable harvest. Profits are the mother's milk of stocks, business, and the economy. As profits heal, consumer incomes and spending will rebound.

My guess is the economy will grow by 3 percent annually or slightly more in the second half of 2009 and the first part of 2010. This growth is back-stopped by a very-easy-money Federal Reserve, which in the short-run is overcoming some of the anti-growth, war-on-capital policies hailing from Washington. It's because of these prosperity killers that a return to the stock market peak of mid-2007 -- when the Dow climbed over 14,000 -- is not likely.

The ineffectual Keynesian spending-and-borrowing from Team Obama will actually reduce our long-run potential to grow, but at least in the shorter-term Milton Friedman's monetary power from the Fed has re-liquefied commerce. This includes a $1 trillion rise in the Fed's balance sheet and steady 10 percent annualized growth in the inflation-adjusted money supply this year.

Longer-term, yes -- there are inflation risks and potentially big obstacles to prosperity. A full economic recovery from a deep recession should produce 7 to 8 percent growth, as was the case with the 1983-84 Reagan rebound. But tax rates are going back up in 2011, not down. That's the wrong side of the Laffer curve. And if we're going to get nationalized health care, with surtaxes on the rich and higher payroll taxes for businesses and workers, then I would say: Enjoy the fat goose at Christmas this year, because there may be fewer Easter eggs next spring.

But this is much more than a summer rally. It's a new bull market heralding a new economic recovery. Free-market capitalism is trying hard to push back against Obama's central-planning.

The bears will lose this round.

First, your Yahoo stock is not going back to 120 in your lifetime. So quit the pump and dump stuff, okay? You're going to have to finance that next shipment of nose candy some other way. How about a pick-a-payment ARM refinance? That is if you're not already underwater.

Second, and more seriously.... if the economy can recover into the teeth of what Obama is trying to do, then everything conservatives believe about public policy and human nature is simply wrong, and we might as well join up at DU and Kos.

If not, well, lead and gold and canned beans.

“...despite its severity, we believe that the slump in stock prices will prove an intermediate movement and not the precursor of a business depression such as would entail prolonged further liquidation...”

- Harvard Economic Society (HES), November 2, 1929

“... a serious depression seems improbable; [we expect] recovery of business next spring, with further improvement in the fall.”

- HES, November 10, 1929

“The end of the decline of the Stock Market will probably not be long, only a few more days at most.”

- Irving Fisher, Professor of Economics at Yale University, November 14, 1929

“In most of the cities and towns of this country, this Wall Street panic will have no effect.”

- Paul Block (President of the Block newspaper chain), editorial, November 15, 1929

“Financial storm definitely passed.”

- Bernard Baruch, cablegram to Winston Churchill, November 15, 1929

“I see nothing in the present situation that is either menacing or warrants pessimism... I have every confidence that there will be a revival of activity in the spring, and that during this coming year the country will make steady progress.”

- Andrew W. Mellon, U.S. Secretary of the Treasury December 31, 1929

“I am convinced that through these measures we have reestablished confidence.”

- Herbert Hoover, December 1929

“[1930 will be] a splendid employment year.”

- U.S. Dept. of Labor, New Year’s Forecast, December 1929

“For the immediate future, at least, the outlook (stocks) is bright.”

- Irving Fisher, Ph.D. in Economics, in early 1930

“...there are indications that the severest phase of the recession is over...”

- Harvard Economic Society (HES) Jan 18, 1930

“There is nothing in the situation to be disturbed about.”

- Secretary of the Treasury Andrew Mellon, Feb 1930

“The spring of 1930 marks the end of a period of grave concern...American business is steadily coming back to a normal level of prosperity.”

- Julius Barnes, head of Hoover’s National Business Survey Conference, Mar 16, 1930

“... the outlook continues favorable...”

- HES Mar 29, 1930

“... the outlook is favorable...”

- HES Apr 19, 1930

“While the crash only took place six months ago, I am convinced we have now passed through the worst — and with continued unity of effort we shall rapidly recover. There has been no significant bank or industrial failure. That danger, too, is safely behind us.”

- Herbert Hoover, President of the United States, May 1, 1930

“...by May or June the spring recovery forecast in our letters of last December and November should clearly be apparent...”

- HES May 17, 1930

“Gentleman, you have come sixty days too late. The depression is over.”

- Herbert Hoover, responding to a delegation requesting a public works program to help speed the recovery, June 1930

“... irregular and conflicting movements of business should soon give way to a sustained recovery...”

- HES June 28, 1930

“... the present depression has about spent its force...”

- HES, Aug 30, 1930

“We are now near the end of the declining phase of the depression.”

- HES Nov 15, 1930

“Stabilization at [present] levels is clearly possible.”

- HES Oct 31, 1931

“All safe deposit boxes in banks or financial institutions have been sealed... and may only be opened in the presence of an agent of the I.R.S.”

- President F.D. Roosevelt, 1933

Compiled by Colin J. Seymour, June 2001

http://www.users.dircon.co.uk/~netking

“This is a new bull.”

Yeah it’s Bull alright.

I hate to hurt your feelings, but I believe this guy is right. This market is NOT going to turn down sharply. Somehow, the powers that be are keeping it up and will continue to run things up (probably imaginary numbers) no matter what.

It’s a BULL Market alright!! A Bull-Sh*t market!

“We are more than double that, and there will be no total reversal.”

There is a leap of faith. Look at the stock market during Great Depression I, and you’ll see a nice bull run or two early on.

There are plenty of reasons the markets could fully retrace their movement during that time. Stocks lost about 90% of their initial value, meaning today the Dow would dip to around $1400.

Captain America /sarcasm has jumped ship. He’s now a deckhand rearranging the deck chairs on the Titanic.

saving this one for the records- check back in 6 months on Larrys’ predictions.

Time to post my economic philosophy again:

when you have fewer employees to pay, you make more profit ....

Larry Kudlow has been clean and sober for many year’s. Inferring that he is a user of cocaine is wrong and diminishes your post.

Kudlow has been so wrong, so often, for so long, that I take anything he has to say as a ‘contrarian’ indicator....

Remember that he was one of the last holdouts in the ‘there’s no banking crisis’ crowd....

I don't know about the new bull market hype from Kudlow, but he does have a point that the Fed action to increase the money supply since last Fall will have some stimulative effect on the economy, no matter that the so-called stimulus spending will have little effect.

Just as in discussions of the Great Depression (where they money supply was decreased 30% by the Fed in four years), many forget about the impact of monetary policy and focus mostly on government spending.

I’ll give him credit for pointing out that cost cutting, IOW job cuts, have a lot to do with the bottom line. I think he’s too optimistic otherwise, which is easy for him since he still has his job.

I had a real good July and picked up 10% on my portfolio, so Larry’s outlook is positive news for our household....but he DIDN’T talk about the Dems dangerous tax proposals....that’s the real wild card in all of this IMHO... when Reagan signed the tax cut bill of 1981 it laid the ground work for the Great Bull Market of 82-99...you didn’t have to be a financial genius....all you had to do was buy some good blue chips and watch your money grow.

Free-market capitalism is more durable, resilient, and self-correcting than its detractors would have us believe.

Earth to Kudlow: Get a clue, dude.

Cost cutting, IOW job cuts, IOW shrinking/contraction of businesses, will show (illusory) profits in the short run - it’s not an open-ended process...

A true sustainable ‘Bull Market’ requires growth and expansion.....

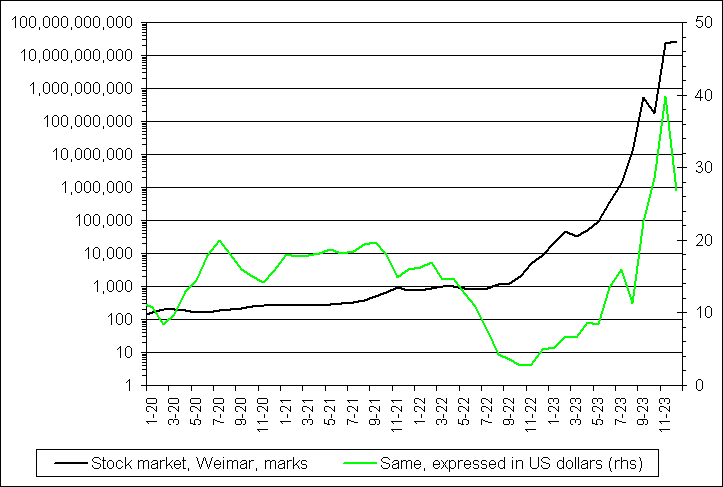

Over the longer term, stocks did OK in the Weimar hyperinflation. Or at least better than government bonds.

He could be right. Maybe Yahoo $120 at the same time as $200 Happy Meals?

All “experts” are alternatively right and wrong on the market. I predict that their predictions are (on average) accurate 50% of the time.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.