Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

To: SeekAndFind

What we are seeing is KENYAN economics...

2 posted on

11/23/2009 6:29:52 AM PST by

Crim

To: SeekAndFind

Like the Global Warming scam, Keynesian economics(political theory) will never die.

3 posted on

11/23/2009 6:30:42 AM PST by

deadrock

(Liberty is a bitch that needs to be bedded on a mattress of cadavers.)

To: SeekAndFind

Reagan-like faith in efficient markets set the stage for the financial meltdown. So blaming Bush isn't working, blaming Palin isn't working, so now they are blaming Reagan.

4 posted on

11/23/2009 6:30:58 AM PST by

pnh102

(Regarding liberalism, always attribute to malice what you think can be explained by stupidity. - Me)

To: SeekAndFind

Los Angeles Times : The world still can learn from Keynesian economicsOf course it can -- it can learn what not to do.

5 posted on

11/23/2009 6:31:39 AM PST by

Cincinatus

(Omnia relinquit servare Rempublicam)

To: SeekAndFind

Is this guy frigging KIDDING me? The entire reason for the meltdown as risk wasn’t borne by the ones making the transactions - that risk was held by the federal GOVERNMENT! If companies couldn’t shift risk to the feds (e.g. Fannie Mae), they would have to weigh their risks more appropriately and conservatively. Isn’t the failure of the stimulus the ultimate proof that Keynesian economics is bullcrap?

6 posted on

11/23/2009 6:32:06 AM PST by

domenad

(In all things, in all ways, at all times, let honor guide me.)

To: SeekAndFind

"Reagan-like faith in efficient markets set the stage for the financial meltdown." Are these people that stupid? Democrats meddling in the lending standards for mortgages created the meltdown.

7 posted on

11/23/2009 6:32:18 AM PST by

avacado

To: SeekAndFind

“Reagan-like faith in efficient markets set the stage for the financial meltdown.”

This is a basic lie at so many levels there is no reason to read further or, read any part of the Left Angeles Times.

8 posted on

11/23/2009 6:32:22 AM PST by

edcoil

(If I had 1 cent for every dollar the government saved, Bill Gates and I would be friends.)

To: SeekAndFind

"KENYAN economics..." How Brilliant. 750 people in Washington spending every last cent of disposable income of over 300 million people. How could it be so wrong? /sarcasmoff.

To: SeekAndFind

The world can still learn from Keynesian economics Sure, in the same sense we can learn from Adm. Villeneuve's tactics at Trafalgar in 1805.

11 posted on

11/23/2009 6:35:00 AM PST by

1rudeboy

To: SeekAndFind

There’s no such thing as free markets in the US. In recent decades, government has extended its tentacles into every crevice of the American economy.

So, basically, the author is arguing that the answer to a disaster that was caused by government interventionism is more government interventionism.

To: SeekAndFind

(From the unbrokenwindow.com)

1. Enlightened consumer groups and citizens point to a problem that needs correcting.

2. These folks often point to free trade or market capitalism as the reason for the problem.

3. Regulation is passed in order to make “capitalism work for everybody”.

4. The regulation produces impacts that the regulators never saw coming – screwing consumers and small businesses that was never the intention of the regulation.

5. The regulations themselves are often inspired by, written, and welcomed by, the major companies being regulated!

6. The regulations turn out to make the companies being regulated MORE profitable and increase their market power. See the tobacco settlement, see the myriad auto safety regulations, see the health insurance industry, see the toy industry, see the Clean Air Act, etc.

7. Critics call this capitalism again.

8. Enlightened regulators try to improve regulations, carve out exemptions, and undo the poor consequences from the first round of regulation.

9. Return to step 2.

18 posted on

11/23/2009 6:46:52 AM PST by

In veno, veritas

(Please identify my Ad Hominem attacks. I should be debating ideas.)

To: SeekAndFind

(From the unbrokenwindow.com)

1. Enlightened consumer groups and citizens point to a problem that needs correcting.

2. These folks often point to free trade or market capitalism as the reason for the problem.

3. Regulation is passed in order to make “capitalism work for everybody”.

4. The regulation produces impacts that the regulators never saw coming – screwing consumers and small businesses that was never the intention of the regulation.

5. The regulations themselves are often inspired by, written, and welcomed by, the major companies being regulated!

6. The regulations turn out to make the companies being regulated MORE profitable and increase their market power. See the tobacco settlement, see the myriad auto safety regulations, see the health insurance industry, see the toy industry, see the Clean Air Act, etc.

7. Critics call this capitalism again.

8. Enlightened regulators try to improve regulations, carve out exemptions, and undo the poor consequences from the first round of regulation.

9. Return to step 2.

19 posted on

11/23/2009 6:46:56 AM PST by

In veno, veritas

(Please identify my Ad Hominem attacks. I should be debating ideas.)

To: SeekAndFind

Los Angeles Times : The world still can learn from Keynesian economicsYes, we can !

Keynesian economics can turn the recession of GW Bush

into the Great Depression of Barak Hussein Obama. Much the same as Keynesian economics turned the Hoover

recession into the Great Depression of FDR.

mmmmm mmmmmmm mmmmmmm

21 posted on

11/23/2009 6:48:38 AM PST by

Uri’el-2012

(Psalm 119:174 I long for Your salvation, YHvH, Your law is my delight.)

To: SeekAndFind

>Reagan-like faith in efficient markets set the stage for the financial meltdown.

Question: Do we even _HAVE_ a free-market? Did the government let the airlines fail after 11 Sep? Did the Government let Fannie Mae / Freddie Mac fail? How about GM / Chrysler?

Question: With this much meddling, how can the efficiency of markets be observed?

The claim is like claiming that “survival of the fittest” is efficient, then refusing to allow the unfit’ to die, and then looking at the result and ‘finding’ that the observations contradict the claim of the efficiency of “survival of the fittest.”

23 posted on

11/23/2009 6:51:52 AM PST by

OneWingedShark

(Q: Why am I here? A: To do Justly, to love mercy, and to walk humbly with my God.)

To: SeekAndFind

Read my tag line, this is a perfect example. Markets are efficient and responsive, govt is neither. Govt interference is the CAUSE not the solution to this crisis. University libtards have been teaching Keynesian ecomonics as dogma for decades. Its the only economic theory the leftists in the media are familiar with.

25 posted on

11/23/2009 6:58:10 AM PST by

Hacklehead

(Liberalism is the art of taking what works, breaking it, and then blaming conservatives.)

To: SeekAndFind

“Reagan-like faith in efficient markets set the stage for the financial meltdown.”

No. Actually it was housing subsidies that did that.

To: SeekAndFind

To: SeekAndFind; Falcon4.0

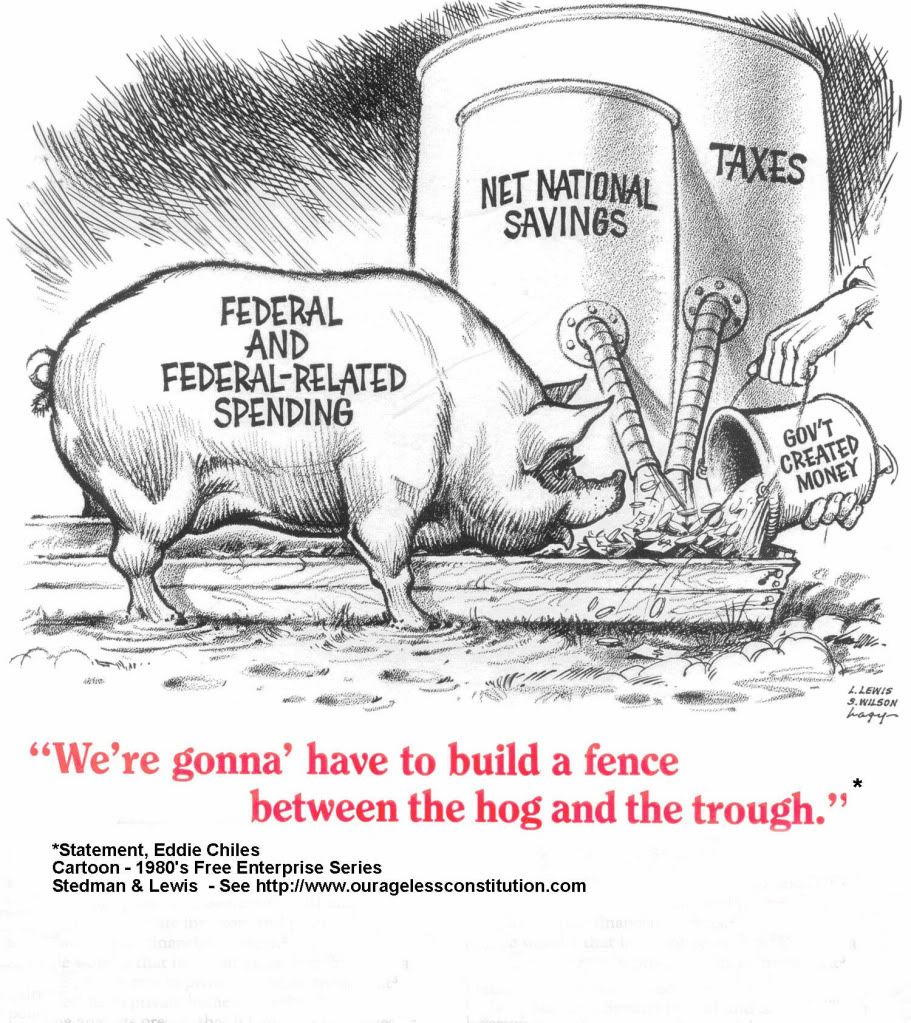

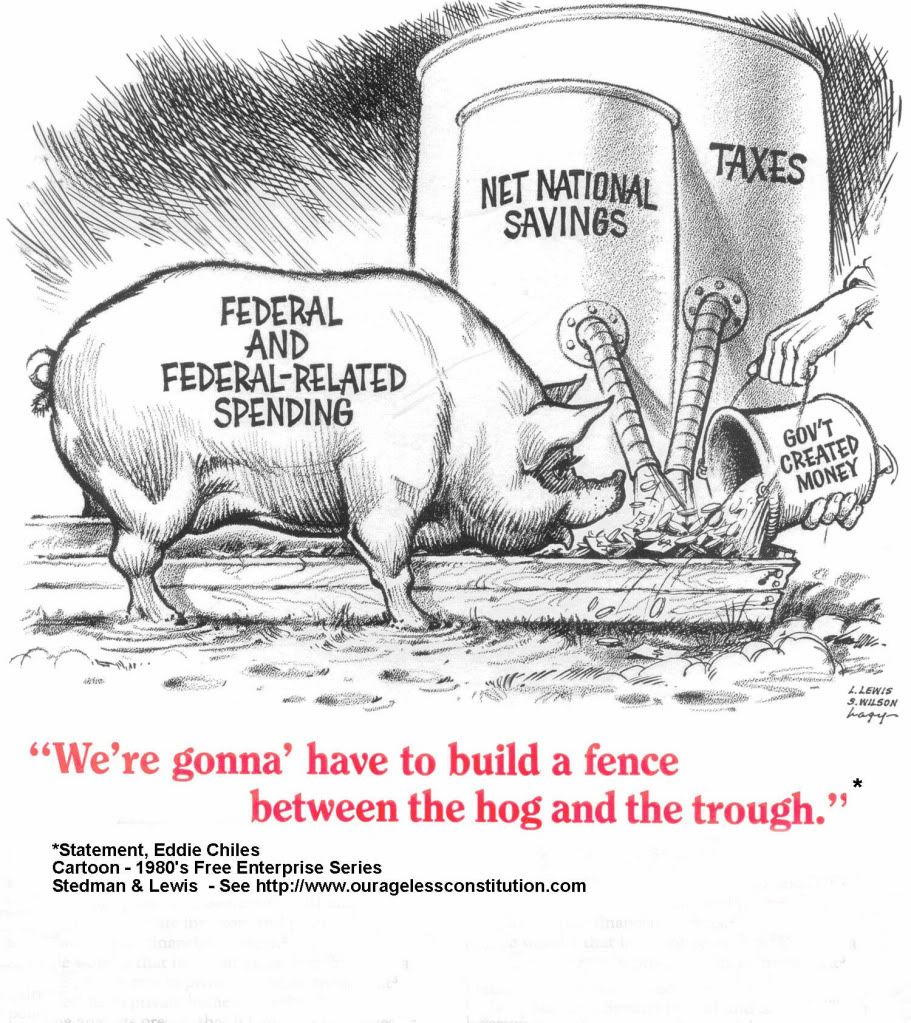

"750 people in Washington spending every last cent of disposable income of over 300 million people."They now have spent the fruits of the labors of future generations, as well as printing dollars to cover their arrogant habits.

America's Constitution set limits and boundaries, checks and balances, on the powers of those "people in Washington." "Bind them down from mischief by the chains of the Constitution," declared Jefferson.

It is time for the Constitutioin's "only keepers" (We, the People), to do what the Founders intended. Bring them home, and set term limits for those who replace them, thereby building a fence between them and the nation's wealth creators.

To: SeekAndFind

Reagan-like faith in efficient markets set the stage for the financial meltdown. This is such a BS statements on many levels. What do you suppose the author means by "Reagan-like". It is clear that by linking the term to financial meltdown, the author means that "Reagan-like" faith in free markets is simple-minded and stems from ignorance and lack of understanding of the complex truths of Keynesian economics.

Nothing could be further from the truth. Reagan and his team understood that there were certain fundamentals that had to be in place to foster prosperity. One of the cornerstones is sound money. Sound money was abandoned to pump cash into the housing market to make home ownership cheaper for those who were not credit-worthy. This not surprisingly caused a housing bubble. With the Fed steadily expanding the money supply, lending to risky home-buyers made sense, as the values of the homes they were buying were bound to go up (supplies of commodities like real estate expand slowly so prices respond to increases of money supply). It is therefore expected that loan-to-equity ratios would improve as inflation raised the values of the collateral.

Fannie and Freddie were also distorting markets by taking on bad mortgages to the tune of trillions. Banks, seeing how much money was to be made in this environment looked for ways to get in on it. These marginal loans are very profitable short-term with lots of fees that go straight to the bottom line. By insuring themselves against losses, and by selling off risk as bonds they thought that they were in no danger. Bond rating agencies rated these bonds too highly, both in order to get the fees from the bond issues and because they seemed safe unless there was a total collapse in the market.

What could cause that.... Well, the huge amount of money in housing pumped up the supply of available housing as developers went into overdrive building upscale homes and homeowners traded up while selling there old homes to people who probably couldn't afford them. How could they get loans? No money down loans, encouraged by Congress.

When the Fed tightened due to fears of inflation and dollar collapse (foreign investors eventually tire of buying bonds that will be paid back with debased currency), the bubble burst. No one at the Fed or Treasury knew how dependent the whole housing market was on inflating the dollar.

To counter this collapse that was caused by interference in free markets the Treasury and Fed are further distorting real values by pumping tons of "dollars" into the system. Nothing particularly free market about any of this.

I could go on, but this sickens me. One sentence and my blood is boiling. Someone else will have to deconstruct the rest of the article.

To: SeekAndFind

The first sentence in this article was enough for me.

31 posted on

11/23/2009 7:43:32 AM PST by

Oldpuppymax

(AGENDA OF THE LEFT EXPOSED)

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson