Posted on 01/13/2010 4:15:19 PM PST by blam

Fed Publishing Mathematical Gibberish To Hide Balance Sheet Secrets

Politics / Central Banks

Jan 13, 2010 - 11:17 AM

By: Mike Shedlock

The Fed is pulling out all stops to defend its secrets, including publishing self-serving mathematical gibberish. Please consider the St. Louis Fed article on the Social Cost of Transparency.

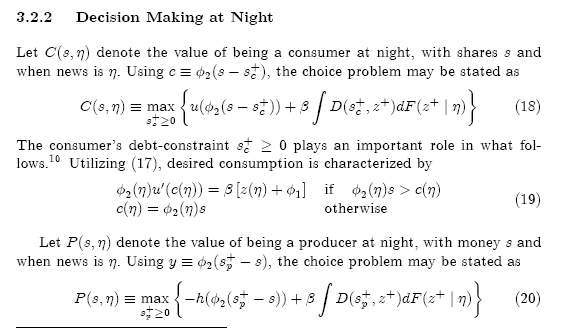

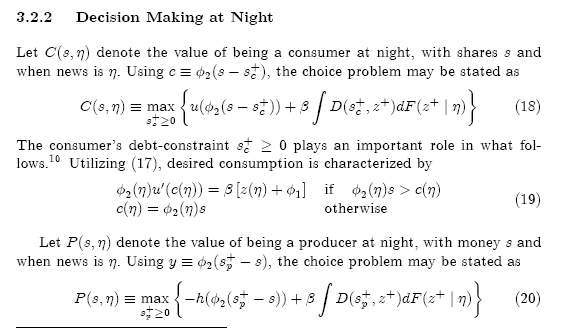

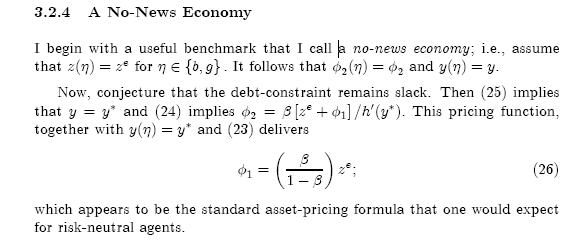

Unless you are an academic wonk, you will be stymied by pages that look like this ...

There are 24 pages of such nonsense with titles like

2.2 Private Information and Full Commitment 2.3 Private Information and Limited Commitment 3.2.1 Decision Making in the Day 3.2.2 Decision Making at Night 3.2.4 A No-News Economy Just for good measure here is the page describing 3.2.4 A No-News Economy

The article culminates with ...

For an asset economy then, the prescription of “full transparency” is not generally warranted.

Approaching the problem under the premise that fuller transparency is always desirable may not be the right place to start.

[snip]

The Fed work is just a research paper --- a big hint as to that status is at the very top of the very first page:

An even bigger hint is the disclaimer at the bottom of the same page:

The views expressed are those of the individual authors and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis, the Federal Reserve System, or the Board of Governors. Federal Reserve Bank of St. Louis Working Papers are preliminary materials circulated to stimulate discussion and critical comment. References in publications to Federal Reserve Bank of St. Louis Working Papers (other than an acknowledgment that the writer has had access to unpublished material) should be cleared with the author or authors.

Just because the author doesn’t understand it, doesn’t mean it’s gibberish.

The conclusion says:

In an asset economy, the short-run expected return to an asset may depend

on high-frequency news events. The dividend return of capital, for example,

may occur quarterly; while news concerning this expected return may arrive

daily. When asset markets are informationally efficient, this high-frequency news

is embedded immediately into the market price of the security. This poses a

potential problem for the use of securities as a means of financing high-frequency

payments. On any given day, a consumer holding equity as a means of payment

may find the value of his current holdings insufficient to finance a planned

expenditure.

For an asset economy then, the prescription of “full transparency” is not

generally warranted.

Which is to say “If it’s all the same in the end, why should we give out information when it will only increase the volatility?”

Note that their analysis explicitly assumes “it’s all the same in the end”, i.e. the day-to-day news does not affect the long term price.

There have been a few people who have looked at it the other way and concluded that the current lack of news, i.e. the fact that the future has become more uncertain, prevents proper valuation. That is, “it’s all the same in the end” can’t be true because there is no end.

Cogitate that.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.