New York Attorney General Andrew Cuomo said Thursday it was bringing civil charges against senior Bank of America executives, including former company CEO Ken Lewis, for their role in the company's controversial purchase of Merrill Lynch.

Separately, the Securities and Exchange Commission said it had struck a $150 million settlement agreement with BofA over its decision to pay billions of dollars in bonuses to former Merrill employees.

The lawsuit contends that the bank's management team understated the losses at Merrill in order to get shareholders to approve the deal, then subsequently overstated the firm's willingness to terminate the merger to regulators weeks later in order to get $20 billion of additional aid from the federal government.

"Bank of America and its officials defrauded the government and the taxpayers at a very difficult and sensitive time," Cuomo said at a press conference Thursday, joined by federal bailout cop Neil Barofsky, whose office aided in the investigation. "I believe that Bank of America officials exploited this fear."

Bank of America's last-minute decision to purchase the ailing Merrill in September 2008 has remained a central issue in the wake of the financial crisis, prompting both federal and state probes into the matter.

Cuomo's office, which has been aggressively pursuing an investigation into the merger and subsequent bonuses paid to former Merrill employees, said it was charging Lewis and Bank of America's former chief financial officer Joe Price with fraud.

It is interesting he is filing civil charges. It is indicative there is no viable criminal case.

(no link)

The American dream house - Fannie Mae gives minorities a chance

The Washington Times - Friday, December 10, 1999

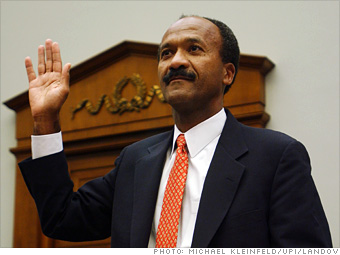

Author: Franklin D. Raines

A decade after the Berlin Wall collapsed, a wall of injustice still divides minority families from the American dream of owning a home. We must tear down this wall, and the free market is the greatest bulldozer.

For instance, Fannie Mae brings private capital, management and efficiency to the task of expanding affordable homeownership in America. At the center of the housing finance system, Fannie Mae is a major force in the expansion of minority homeownership.

Since Fannie Mae doesn’t make home loans ourselves, we back mortgage lenders by buying or securing loans they make in the primary market; the company does not serve minority borrowers directly. Nevertheless, Fannie Mae outperforms the overall market when it comes to financing minority lending, according to data provided to the U.S. Department of Housing and Urban Development (HUD), and Federal Reserve data gathered under the Home Mortgage Disclosure Act. Last year, Fannie Mae financed $46 billion in home loans for more than 450,000 minority families, 77 percent more than the previous year.

By far, Fannie Mae is the largest single source of funds for minority homebuyers in the nation. Notably, Fannie Mae finances more minority homeowners than the federal government does through the FHA.

In his column, “Minority housing gap: Fannie Mae, Freddie Mac fall short,” which ran Nov. 17, Martin Luther King III called for more progress in mortgage lending to minorities. We couldn’t agree more. Yet Mr. King suggests that Fannie Mae does less than the primary market when it comes to lending to minorities. Not so. Evidence to support this assertion, sourced to an Urban Institute study, was based on interviews with a handful of lenders, not solid loan data analysis. Another source, a U.S. General Accounting Office study, relied on outdated HUD data.

In fact, when HUD Secretary Andrew Cuomo recently proposed to increase the percentage of the business Fannie Mae and Freddie Mac does with underserved families, as tough as the new targets are, Fannie Mae immediately signed up. This means we will devote 50 percent of our business to low- and moderate-income homebuyers.

However, Fannie Mae’s commitment to underserved families goes well beyond the HUD mandate. Five years ago, Fannie Mae launched our Trillion Dollar Commitment, a pledge to invest $1 trillion to help 10 million underserved families become homeowners or obtain decent rental housing by 2001. We targeted lower-income families, residents of central cities and rural areas and others for whom mortgage finance has always been difficult to obtain. No company in the world has ever made such a commitment, but next year we will meet our goal ahead of schedule. Furthermore, over the 1990s Fannie Mae has carefully studied, surveyed and identified the specific barriers to minority homeownership, including income, credit, misinformation and even discrimination. Then we’ve systematically developed breakthrough strategies to dismantle the barriers. They include 3 percent down payment mortgages, technology that reduces closing costs and nearly $10 billion in experimental mortgages to challenge outdated assumptions about credit. Thirty-three percent of borrowers using our special community lending products were minority families.

To reach families where they live, Fannie Mae has opened 44 local Partnership Offices across the nation and launched over $300 billion in local investment plans with lenders, city housing agencies, non-profit organizations and others. Fannie Mae also helps banks meet their Community Reinvestment Act requirements. Over past two years, we purchased over $3 billion in CRA loans; by 2002, we’ll buy $10 billion more. The Wall Street Journal “Business and Race” column described our impact on the housing finance industry this way: “Fannie Mae’s moves have rewritten the business plans of major lenders. To fight the information barrier, the Fannie Mae Foundation has pioneered consumer outreach to help families understand what it takes to buy a home and feel comfortable and confident with the process. An astounding 7.3 million consumers have responded, and 40 percent are minorities. Indeed, the Foundation’s new homebuyer education campaign, `Your Credit Matters,’ brought 24,000 responses fromminority families in the first 60 days.”

These strategies have helped minority homeownership grow at a faster rate than that of white families, and minority homebuyers report they feel less discrimination. The racial divide still exists. Bridging it must be the first priority of the housing finance system. On this 50th anniversary of the National Housing Act, Fannie Mae is proud to lead the market to make the American dream of homeownership as diverse as the nation itself. Yet we will not be satisfied until the wall is down and the minority housing gap is closed.

Franklin D. Raines is chairman and CEO of Fannie Mae.

//

No direct link - related link:

http://findarticles.com/p/articles/mi_pwwi/is_200001/ai_mark07000832

70.5 million families, or 67%, now own homes

Tulsa World - November 13, 1999

Author: DANA SIMON, World Staff Writer

In July, Cuomo announced a policy to require the nation’s two largest housing finance companies to buy $2.4 trillion in mortgages over the next 10 years to provide affordable housing for about 28.1 million low- and moderate-income families. The historic action by HUD raised the required percentage of mortgage loans for low- and moderate-income families that finance companies Fannie Mae and Freddie Mac must buy from the current 42 percent of their total purchases to a new high of 50 percent in 2001. The percentage will first increase to 48 percent in 2000.

In addition, the Federal Housing Administration (FHA), which is part of HUD, insured nearly 1.3 million home mortgages in the 1999 fiscal year — many of them going to minorities and central city residents. FHA has insured more than 6.8 million home mortgages since 1993. Without FHA insurance, many families would be unable to get mortgages to become homeowners. On Jan. 1, FHA began insuring home mortgages loans of up to $115,200 in communities where housing costs are relatively low and up to $208,800 in communities where housing costs are high. This was the second increase in the loan limits since October 1998 — and will open up homeownership to more families in the years ahead.

The National Partners in Homeownership — a coalition of 66 national groups representing the housing industry, lenders, nonprofit groups and all levels of government — has also helped boost homeowner- ship. The Partners group was created in 1995. It has implemented initia- tives to make buying a home more affordable, faster and easier. Activi- ties to increase homeownership also are being carried out by 157 local homeownership partnerships established to support the national strategy. Amongthe activities developed by the Partners are homeownership counseling sessions, homebuying fairs, and help with locating homes.

On top of these initiatives, the Community Reinvestment Act — a federal law that requires lenders to make loans to all segments of the communities they serve — has resulted in more loans to people in low- and moderate-income neighborhoods since it was enacted in 1977. A significant portion of these funds has been used for mortgage lending that has boosted homeownership. Community groups estimate that lenders have pledged more than $1 trillion in CRA loans since 1977.

//

(no link)

GAPS SEEN IN LOANS TO BLACKS AND HISPANICS

Boston Globe - September 16, 1999

Author: Bruce Butterfield, Globe Staff

EXCERPT

But ACORN officials said their study should raise concerns about the long-term commitment of big banks everywhere. Other housing advocates in Boston agree, though they note that minority lending by major banks has shown signs of improving recently.

The ACORN study agreed. Minority home lending in Greater Boston improved between l997 and l998, particularily for Hispanic borrowers, it found.

The number of Hispanic loans rose dramatically, by 37 percent in Greater Boston, outdistancing for the first time the increase in loans to whites, which was 12 percent.

Loans to African-Americans reversed their downward trend in the final year of the four-year study, posting gains as well. But the gain was just 5 percent.

In Washington, Housing Secretary Andrew Cuomo , citing the ACORN study and another by the Urban Institute that disclosed wide discrimination in minority lending, said he would use the findings to help fight Congress over proposed cuts in spending for housing discrimination laws.

The ACORN study was based on a survey of mortgage data from major lenders in 41 cities.

//

(no link)

MORTGAGE-LOAN DISCRIMINATION IS STILL COMMON, STUDIES FIND

Miami Herald, The (FL) - September 16, 1999

Author: TONY PUGH, Herald Washington Bureau

At a time of record home ownership, two new reports suggest mortgage lenders still routinely discriminate against minorities.

Last year, blacks were twice as likely to be rejected for conventional loans as whites in each of 41 cities examined by the grassroots housing activist organization ACORN , the Association of Community Organizations for Reform Now. The same study found Hispanics were at least 11/2 times more likely than whites to be denied a mortgage loan.

A study commissioned by the Department of Housing and Urban Development found that the discrimination typically begins early in the process of buying a house, sometimes in pre-application inquiries in which minority buyers receive less time and information from loan officers and are quoted higher interest rates.

In Miami, ACORN said, blacks make up 20.6 percent of the population but got only 6 percent of conventional mortgage loans in 1998. But Hispanics, who make up about 49 percent of the population, got 57.1 percent of the loans in 1998.

The studies, released Wednesday, contain information obtained through the Home Mortgage Disclosure Act and also relied on white and minority ``testers,’’ who posed as home buyers with similar credit and income but received vastly different treatment.

``Nothing else can explain it,’’ HUD Secretary Andrew Cuomo said. ``All the numbers are same. All the facts are the same. The only difference is the color of the skin.’’

(snip)

//

(no link)

$7.5 MILLION STUDY WILL TARGET HOUSING BIAS

Contra Costa Times (Walnut Creek, CA) - November 17, 1998

Author: Tony Pugh

Warning the housing industry to “think twice before you discriminate,” HUD Secretary Andrew Cuomo announced Monday a $7.5 million study to document the extent of housing bias against blacks, Hispanics, Asians and American Indians.

The yearlong study by the Department of Housing and Urban Development will include more than 3,000 individual tests of mortgage lenders, rental agents and real estate agents to see if customers are treated differently because of their race or ethnic origin.

Cuomo said the effort would be the most comprehensive and sophisticated analysis of housing discrimination ever conducted.

Testers will look for evidence that lenders and others steered minorities to certain neighborhoods and lending institutions, provided less favorable credit assistance, quoted higher security deposits and fees to minority renters and withheld information about the availability of homes or rental units.

If proven to be racially motivated, such activity would violate federal fair housing laws.

“We will not hesitate to enforce the law,” Cuomo said. “And if you’re a large organization, don’t think you’re immune from the law. We’re serious.”

Local housing advocates with the Oakland-based nonprofit group Acorn have for years called for HUD and other agencies to monitor the rate of lending to minorities in the East Bay.

(snip)