Skip to comments.

U.S. government, on its way to bankruptcy, Part 1

True Slant ^

| Jan. 15 2010

| Michael Pollaro

Posted on 02/08/2010 10:31:34 AM PST by Lorianne

The U.S. government is quite literally out of control.

I’m not talking about a government which shows an almost total disregard for the U.S. Constitution. I’m not talking about elitist politicians in Congress who think they know what’s best for you, who think it’s their job to take care of you from cradle to grave, whether you like it or not. I’m not even talking about an administration whose policies sometimes appear to have more in common with the command and control societies of Benito Mussolini or Karl Marx than they do with the freedom loving societies of Thomas Jefferson and James Madison.

No, what I’m talking about is a government whose fiscal finances are a mess. I’m talking about a government that, because of these policies, thinks nothing of spending what it does not have, of committing to obligations that it can not possibly keep, and then trying to stick someone else with the bill.

One of the basic tenets of Austrian Economics is that actions have consequences. And when the government spends money, someone has to pick up the bill.

The fact is if you believe the U.S. government should be policing the world, that’s going to cost you. If you believe the U.S. government should be providing unemployment insurance to the jobless, social security to the elderly, money for your kid’s education or medical care to everyone, that’s going to cost you too. And if you believe the U.S. government had no other choice then to bail out AIG, Fannie Mae or General Motors, to supposedly save the economy, that’s fine. But someone still has to pay the tab.

Over the next few posts, I will attempt to lay bare the facts of a government that is going to have a lot of trouble meeting its obligations. In fact, these obligations, years in the making, are so big, that unless policies change, and fast, the tab the U.S. government is running will be so big that national bankruptcy is a certainty. Not today. Not tomorrow. But it’s coming, and it’s as sure as death and taxes.

If you are an American taxpayer, a holder of U.S. government debt, or simply a holder of U.S. dollars take heed. This is your bill.

(excerpt)

TOPICS: Business/Economy; Government

KEYWORDS:

1

posted on

02/08/2010 10:31:34 AM PST

by

Lorianne

To: Lorianne

Rule:

1. You can NOT go bankrupt as a country if you have your own fiat money supply and a printing press.

2

posted on

02/08/2010 10:37:52 AM PST

by

2banana

(My common ground with terrorists - they want to die for islam and we want to kill them)

To: 2banana

The money-printing thing only works when you have the world's reserve currency. Take a look at Zimbabwe, if you want to see how bad things can get for other countries that think the printing press is a panacea.

Unlike other nations, the U.S. can borrow abroad, fire up the printing presses, then pay back it's international debts in deflated dollars. If China, and other major creditors have their way, that will come to an end soon.

IMHO, it would be much better for everyone, if the U.S. stopped being so cavilier about debt.

To: USFRIENDINVICTORIA

The money-printing thing only works when you have the world's reserve currency. Take a look at Zimbabwe, if you want to see how bad things can get for other countries that think the printing press is a panacea. Zimbabwe never went bankrupt. Yes - they had insane inflation. But they always paid their bills (in inflated currency). They never failed to pay.

4

posted on

02/08/2010 11:03:52 AM PST

by

2banana

(My common ground with terrorists - they want to die for islam and we want to kill them)

To: 2banana

Technically that’s true. But we’re heading into Weimar territory.

5

posted on

02/08/2010 11:07:18 AM PST

by

Lorianne

To: Lorianne

Technically that’s true. But we’re heading into Weimar territory. Actually - the Weimar starting issuing bonds in foreign denominations in the midst of it's super inflation. They went from bad to worse.

6

posted on

02/08/2010 11:09:36 AM PST

by

2banana

(My common ground with terrorists - they want to die for islam and we want to kill them)

To: 2banana

Notice that I never suggested that Zimbabwe went bankrupt — just that it's circling the drain. Bankruptcy is a legal concept that doesn't apply to sovereign nations. However, the more debt that a nation carries, the more it's sovereignty is constrained. Consider (for a chilling moment) the ways that U.S. debt is affecting foreign policies toward China, Saudi Arabia, etc.

To: 2banana

Correct. But in addition, the US is not in any danger of "going bankrupt" from the sort of policies the article decries. Some of those policies do involve loss to the treasury, others he mentions do not. For example, he pretends the financial bailouts are ruinously expensive, but they haven't lost value and are not likely to do so.

The more basic problem is the one entry accounting involved. He effectively pretends that this money is all spent without being received. Entitlements are transfers; you can't go bankrupt by moving money from your left pocket to your right.

The underlying Austrian notion is that borrowing increases total demand without increasing supply and therefore must be inflationary. And the main error in that thought is the typical one in all naive economics - a single partial "all else being equal" is substituted for the full effect.

Money is a good, and demand for it changes. Increasing the supply of it can add net value, when that increased supply fufills an increased demand. The classic Austrian statement on the matter is that any quantity of money could fufill all of its exchange duties, at any level for overall prices, so more of it cannot add value. But this is an error. It pretends that consumers of goods including money are not the judge of its value to themselves, and it pretends that large changes in the price level are without net value for everyone, effects.

Similarly, in a disequilibrium state with resources seriously underutilized, added demand increases resource utilization and therefore supply. This is not always the case - if resources are not underutilized or can't be profitibly employed it can certainly be overdone, and pouring extra deficit spending or monetary ease demand onto an economy already at or near full employment and high levels of use of plant and natural resources, does indeed merely goose prices and is destructive. But we are not in that situation at the moment.

The prudential rule that results from that observation is that fiscal deficits and monetary ease are not damaging during a recession period. This doesn't mean we should tolerate deficits of 10% of GDP with the economy already growing again; they do need to come down. But they aren't going to bankrupt us.

A people with $14 trillion in annual income and $55 trillion in net worth are not bankrupt and are in no danger of going bankrupt merely by transfers or promises or financing arrangements among themselves.

The next item Austrians believe damaging in debt financed spending is they believe it allows disaccumulation of capital, or capital being run off by not being replaced. But rates of investment in the US were not low in the recent boom - on the contrary, the US regularly invested $2 trillion a year or 15% of GDP. That was in fact too high, not too low, and led to overinvestment in long dated real assets. In the recession it has corrected to more like 10% of GDP.

There is an important theoretical error in the Austrian position on this subject that ought to be more widely understood than it is. The idea that investment funded by issue of fiduciary media of any kind (new money creation) must necessarily fail is incorrect. And the idea that investment funded out of savings must always be safe is likewise incorrect. All of the effects the Austrians trace to misallocations of capital arise from any dumb investment, whether financed out of savings from income or not. And smart investments pay for themselves by covering their financing costs, again regardless of how they were funded.

Smart allocation of capital is what is required. Since trend following works in the short run and men are fallible, there will always be bad investment sometimes, too. It is a necessary consequence of other men's freedom. If others screw up enough it can inconvenience everyone, yes. But it cannot be helped.

I don't disagree with the article in calling for lower deficits and spending control, especially on middle class entitlements that, frankly, the American people are rich enough not to need. This is not a nation of paupers, and the political system trying to buy everyone's votes as if it were is dumb. By all means, let's reform entitlements and reduce the scale of government spending. Also, since the economy is already growing again, we do not need further "stimulus" (including stuff voted earlier but not yet spent).

But we do not need a crusade against finance, or money, or the automatic tendency for budgets to move out of balance in recessions, through lower tax receipts and higher transfer payments. That is stabilizing over the cycle. The time to balance budgets is during a boom. Gingrich did it right. Bush did not - with some excuse from wartime but not enough, since the economy was fine and he had plenty of time to use that strength. He should not have given us new drug entitlements and the like, and the blown opportunity was expensive. So was letting Lehman fail messy, which doubled the size of the financial smash and the interventions needed after it.

The left's proposals of giant tax hikes and trillion dollar new entitlements are laughably wrong from the current economic situation. And I don't expect them to fly; the American people can easily see this, and have no interest in more promised handouts. We are in sounder shape politically as well as economically than the article pretends...

8

posted on

02/08/2010 11:14:58 AM PST

by

JasonC

To: 2banana

“Actually - the Weimar starting issuing bonds in foreign denominations in the midst of it's super inflation. They went from bad to worse.”

You're helping make my point about the greenback's reserve currency status. Having the reserve currency allows the U.S. to take on debt, denominated in its own currency. When you monetize that debt, you can pay it back in greatly deflated currency. If that ever changes, things will go from bad to worse.

To: 2banana

Um, no, Weimar hyperinflated because French and Belgian troops were physically occupying the Ruhr, attempting to extract war reparations payments in kind by seizing trainloads of coal at the pit heads. The government called on the workers to resist this by a general strike, and financed that general strike with printed money. The country simply stopped working until the French gave up and left; the currency was destroyed in the meantime. As soon as the French were out, the government moved to a sounder new currency, with help from foreign loans, which did not make the matter worse but instead allowed an easy transition to a sound currency again.

There is practically no episode in history more distorted by people who know none of the actual history, but imagine that they understand it completely from nothing but their active imaginations and ideological principles. Real history is messier than that.

10

posted on

02/08/2010 11:19:01 AM PST

by

JasonC

To: JasonC

I think we are both right:

http://en.wikipedia.org/wiki/Inflation_in_the_Weimar_Republic --------------------------

It is sometimes argued that Germany had to inflate its currency to pay the war reparations required under the Treaty of Versailles, but this is misleading, because the treaty did not allow payment in German currency. The German currency was relatively stable at about 60 Marks per US Dollar during the first half of 1921.[1] But the "London ultimatum" in May 1921 demanded reparations in gold or foreign currency to be paid in annual installments of 2,000,000,000 (2 billion) goldmarks plus 26 percent of the value of Germany's exports. The first payment was paid when due in August 1921.[2] That was the beginning of an increasingly rapid devaluation of the Mark which fell to less than one third of a cent by November 1921 (approx. 330 Marks per US Dollar). The total reparations demanded was 132,000,000,000 (132 billion) goldmarks which was far more than the total German gold or foreign exchange. An attempt was made by Germany to buy foreign exchange with Marks backed by treasury bills and commercial debts, but that only increased the speed of devaluation.

During the first half of 1922 the Mark stabilized at about 320 Marks per Dollar accompanied by international reparations conferences including one in June 1922 organized by U.S. investment banker J. P. Morgan, Jr.[3] When these meetings produced no workable solution, the inflation changed to hyperinflation and the Mark fell to 8000 Marks per Dollar by December 1922. The cost of living index was 41 in June 1922 and 685 in December, an increase of more than 16 times. In January 1923 French and Belgian troops occupied the industrial region of Germany in the Ruhr valley to ensure that the reparations were paid in goods, such as coal from the Ruhr and other industrial zones of Germany, because the Mark was practically worthless. Although reparations accounted for about one third of the German deficit from 1920 to 1923,[4] the government found reparations a convenient scapegoat. Other scapegoats included bankers and speculators (particularly foreign). The inflation reached its peak by November 1923, but ended when a new currency (the Rentenmark) was introduced.

11

posted on

02/08/2010 11:25:46 AM PST

by

2banana

(My common ground with terrorists - they want to die for islam and we want to kill them)

To: Lorianne

This administration’s theme is “How To Serve Man” in the sense that it was on that science fiction show. The men they were serving never came back. They were serving them at the dining table.

12

posted on

02/08/2010 12:50:04 PM PST

by

RoadTest

(The entrance of thy words giveth light; it giveth understanding unto the simple. Ps. 119:130)

To: USFRIENDINVICTORIA

Easy solution ... sell Alaska to China.

In fact, my prediction is that the day will come when China insists on that very thing. They may insist on Hawaii as well.

Maybe we can offer them those trinkets if they'll agree to take California as well?

13

posted on

02/08/2010 1:11:18 PM PST

by

The Duke

To: The Duke

“Easy solution ... sell Alaska to China.”

The Russian's tried that solution.

(I doubt that anyone, who's ever been to Alaska, would want to part with such a jewel. Perhaps there's a market for greater San Fransisco?)

To: USFRIENDINVICTORIA

I doubt that anyone, who's ever been to Alaska, would want to part with such a jewel. The point I'm making is that China is probably sitting on enough dollars to buy Alaska, and that through our own mishandling of our economy we might find ourselves forced to do the unthinkable.

15

posted on

02/08/2010 6:59:37 PM PST

by

The Duke

To: The Duke

I got your point & agree with it — I probably shouldn't have left the impression that I thought you were actually proposing to sell Alaska. It's just that I really do think it's a jewel (just as Canada's north country is).

To: JasonC

A people with $14 trillion in annual income and $55 trillion in net worth are not bankrupt and are in no danger of going bankrupt merely by transfers or promises or financing arrangements among themselves.You're calling GDP "income". If I sell a loaf of bread for $1.00 and make 20% profit then my gross product was $1.00 but my income was only 20 cents.

To: Partisan Gunslinger

Actually my profit was only 17 cents at 20% profit on a $1.00 sale.

To: Partisan Gunslinger

You don't understand value added, I see.

GDP is a measure of value added. Every dollar of final sales benefits someone higher up in the chain of production. In your example, the retailer may make 20 cents or 17 cents, but the wholesale made something, and the packagers something, and the baker something, and the truckers something, and the farmer something - at each tier, including their workers as well as the business owner.

Every cent of the final sale is spoken for, and spoken for exactly once. The sum of the factor earnings at all stages combined, equals the final sale price. A value added measure is precisely one that avoids double-counting transactions for the component that is a mere change of hands without value added.

The total transactions size of the US economy is not GDP, which is $14.463 billion (a current figure) and is indeed an income. Total transactions or gross output including all intermediate products runs more like $25.8 trillion a year (that is a 2007 figure). (The ratio between them isn't any higher because a high portion of final sales are for services).

Yes, our income is $14.46 trillion a year.

19

posted on

02/09/2010 10:17:41 AM PST

by

JasonC

To: Lorianne

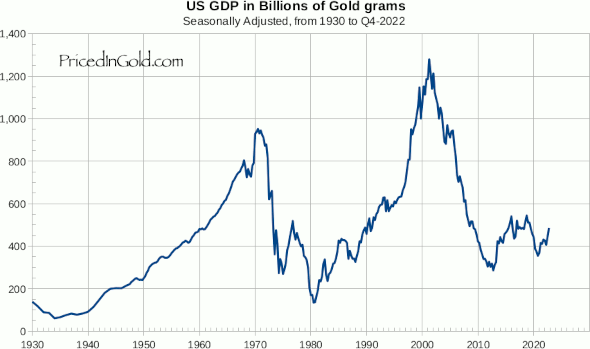

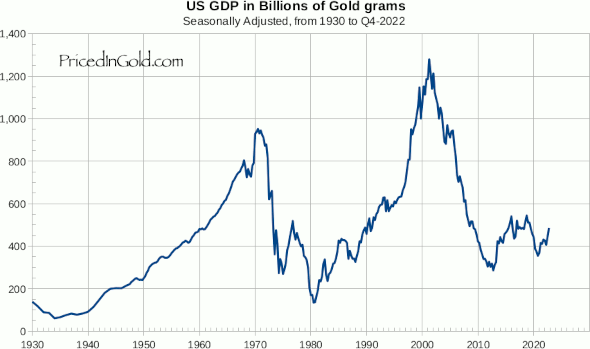

Measure of real (gold-standard) GDP. That is - if you somehow buy the concept of things like service and gov't sectors being counted as product rather than pure overhead.

Notice the smooth growth pattern while Bretton Woods was still in effect? If you want a better idea of just what's happened to this country since 1971 when we went full Keynesian retard? Divide these numbers by US population.

BACK TO THE FUTURE

(Rough numbers. Pop per US Census)

1950: Pop 150.7 MM = ~1325 grms gold per capita GDP

1970: Pop 203.3 MM = ~4200 " "

2000: Pop 281.4 MM = ~4350 " "

2010: Pop 310.0 MM (est) = ~1500 " "

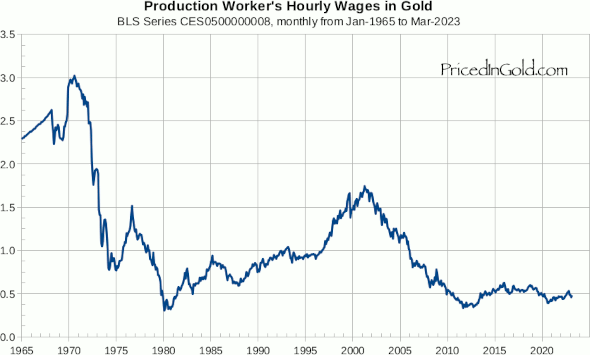

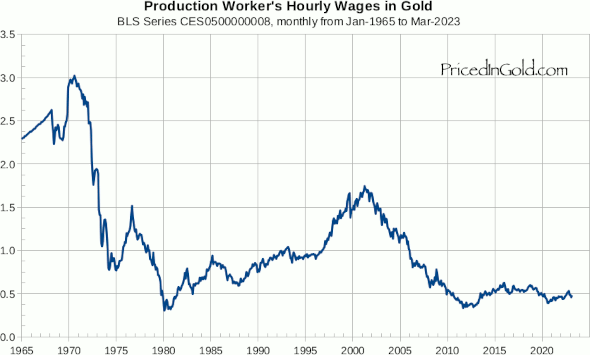

More food for thought:

Thank maybe NAFTA and normalized trade with China had something to do with the failure of wages to recover at the same rate as GDP from 1985-2002?

Perot's giant sucking sound: "Can you hear me now?"

20

posted on

02/10/2010 1:05:02 AM PST

by

CowboyJay

(T(s)EA - Honest money, or bust!)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson