Posted on 03/19/2010 7:52:19 AM PDT by rabscuttle385

It’s been a long time since economic policy was forged in the states.

Last May the Obama administration forced South Carolina not just to take its share of federal stimulus funds, but to spend the money on new programs rather than paying down the state’s debt. I was horrified. Obama, I felt, had killed fiscal federalism. Then I realized that fiscal federalism has been dead for a long time.

Fiscal federalism is the idea that states should set their own economic policies rather than following directives from Washington. Libertarians have a particular attachment to the concept. If states can differentiate themselves on the basis of taxes, spending, and regulation, that gives Americans more leeway in deciding the rules under which we live. If we’re dissatisfied with the policies of the state we live in, we can register our discontent by voting with our feet and moving to another jurisdiction. This competition for residents helps keep lawmakers in check, giving them an incentive to keep taxes and other intrusions modest.

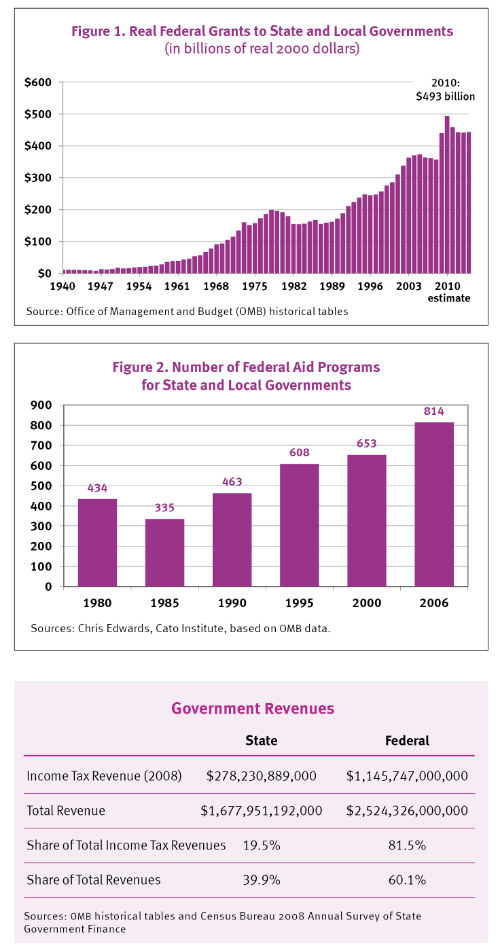

For decades, alas, fiscal power has become increasingly centralized, making a joke of federalism. Washington has taken over more and more state functions, largely through grants to state and local governments, also called grants-in-aid. Figure 1 shows federal grant spending in constant dollars from 1960 to 2013. As you can see, total grant outlays increased from $285 billion in fiscal year 2000 to a whopping $493 billion in fiscal year 2010—a 73 percent increase. Grants also account for a bigger share of federal spending: 18 percent in 2009, compared to 7.6 percent in 1960.

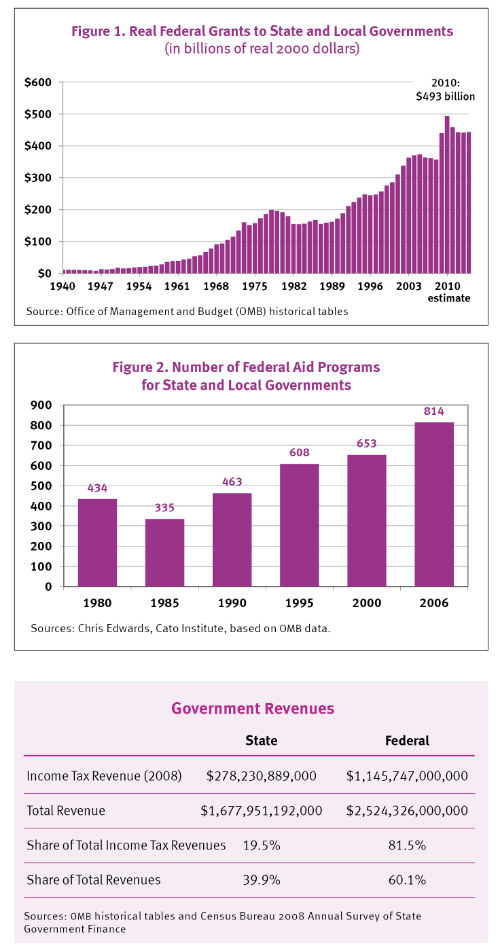

The same pattern is evident when you look at the total number of federal grant programs (Figure 2). According to data computed by the Cato Institute’s Chris Edwards, in 1980 there were 434 federal grant programs for state and local governments. In 2006 there were 814.

Meanwhile, Washington’s tax bite has grown so big that differences in state tax rates don’t mean as much as they used to. As the table shows, 60 percent of all government revenues in 2008 came from the federal income tax, making it the dominant tax burden in Americans’ lives. In 1930 the figure was 30 percent.

Obviously, other things being equal, it’s less costly to run a business in a state with a low tax rate than in a state with a high tax rate. But that difference becomes less important as the percentage of the total tax bill imposed by the central government grows, especially since you can deduct your state tax bill from your taxable income on your federal return.

What’s more, the overwhelming tax presence of the federal government means state authorities must follow orders from Washington if they want to retrieve some of their constituents’ federal tax dollars. Instead of competing with each other to keep their taxpayers, states compete with each other to get money from the federal government.

This lack of meaningful interstate competition is terrible for taxpayers. The states and the federal government now act as a tax cartel. They are in a position to charge more for their services even when the quality is getting worse.

Choosing where to live was never solely about a state’s fiscal policies, of course. But today state policies are practically irrelevant to the decision. According to a regional household survey conducted by the Metropolitan Philadelphia Indicators Project at Temple University in 2004, just 27 percent of respondents in Philadelphia cited tax concerns as a reason they moved to their current location. Compare this to the 59 percent of survey respondents who said their residential choice was motivated by housing costs, the 47 percent who were motivated by good schools, and the 44 percent who wanted to be closer to family and friends. On the list of reasons for moving, tax concerns ranked ninth.

When respondents were asked whether they had ever considered moving in order to pay lower taxes, 73 percent of Philadelphia residents said no. Within the subsection of respondents living in affluent suburbs, the number climbed to 83 percent. (Interestingly, those who had considered moving because of tax concerns were more likely to move within the next two years than others in the group surveyed.) Similarly, a 2003 study in the Journal of Gerontology found that while tax burdens are the most important fiscal characteristic affecting the location choice of retirement-age individuals, climate, general economic conditions, and housing costs are still much more important.

In theory, fiscal federalism is a great weapon to hold our state and local governments in line. But today it’s only that, a theory. In practice, it hardly exists. To bring it back, we would need to radically decentralize the government’s power to tax and to spend, abolishing the national income tax altogether and ending federal grants to state and local governments. Under those circumstances, with the feds expelled from our state and local lives, lawmakers would have to cajole us and treat us like high-maintenance mistresses for fear of losing us to the state next door.

Contributing Editor Veronique de Rugy (vderugy@gmu.edu) is a senior research fellow at the Mercatus Center at George Mason University.

This lack of meaningful interstate competition is terrible for taxpayers. The states and the federal government now act as a tax cartel. They are in a position to charge more for their services even when the quality is getting worse.

Federalism has been dying since FDR. Congress seems to meet year round on its assault on Federalism/10th Amendment.

Democrats are Nationalist Socialists

It is time for a rediscovery of the Founders' ideas which made America a place of refuge from government oppression for over 150 years, and which, thanks to the "Progressives" (regressives), is being destroyed.

Liberty, under the Founders' Constitution, as others have stated, depends upon a virtuous and knowledgeable citizenry.

John Adams stated:"The foundation of every government is some principle or passion in the minds of the People."

The Founders' principle was LIBERTY. The virtue among the people often referenced by the Founders was linked to this love of liberty referenced by John Jay, the first Chief Justice of the Supreme Court:

"Let virtue, honor, the love of liberty . . . be the soul of this constitution, and it will become he source of great and extensive happiness to this and future generations. Vice, ignorance and want of vigilance, will be the only enemies able to destroy it."(Quoted in "Our Ageless Constitution" Essay entitled, "Virtue Among the People" available here

Rediscovering and understanding the principles which made the American Constitution a protection for liberty may be the most important task of our day, and time is running out. The "enemies" already have censored these principles from the nation's textbooks and much of our public discourse.

If every person on this thread and every person involved in the TEA Party movement would commit himself/herself to understanding and then sharing the ideas of liberty with at least 3 people, what a difference that might make! Levin's "Liberty and Tyranny," Schweikart's "A Patriot's History of the U. S.," and Stedman and Lewis's "Our Ageless Constitution" lay out these principles in easy-to-understand language and are an excellent means by which our own "dumbed-down" generations can be exposed to the truly revolutionary principles by which our liberty was obtained.

Perhaps the idea of Federalism, if understood, by enough citizens, can be restored, along with all the other built-in constitutional protections and provisions for liberty our genius Founders' envisioned for a free society.

You have three replies and 70 views. Mainstream American Conservatives don’t care about this issue. They in fact just want to use the Federal Treasury for their own ends. Sorry, it won’t play well on Free Republic.

I want to radically reset the Federal State relationship, and radically re structure the relationship between the Federal Government and the States. I promise you that most modern conservatives will look at you like you have grown an extra head out of your shoulder.

At some point, the American people will wake up and realize what has happened. Luckily for the current group of politicians, it doesn't look like that will happen any time soon. So, they can cash out their cushy pensions and live the high life, calling themselves ublic servants for being on the payroll. It seems to me that the servants are stealing the silverware and we will be using plastic sporks and paper plates.

And the states, being tapped out in their own borrowing capacity and realizing that raising taxes drives industry away, prefer to pass the buck to the feds, who print as much money as needed for their spending excesses.

Taxing the present generation isn't popular, so we'll indirectly tax future generations who don't yet have a vote.

You might be interested in today's article from FEE concerning The Evil of Government Debt.

If mainstream economists could think as clearly today, we'd be in much better fiscal shape as a nation.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.