http://www.freerepublic.com/focus/news/2488552/posts?page=32#32

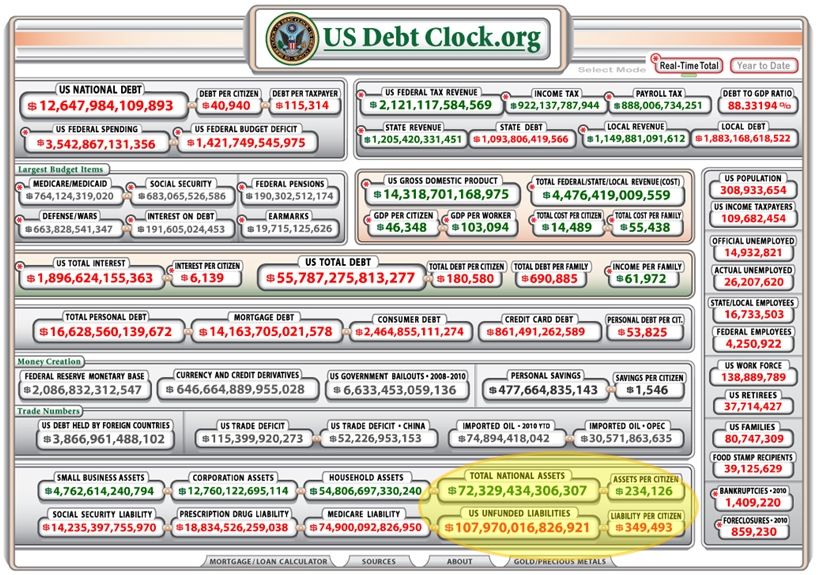

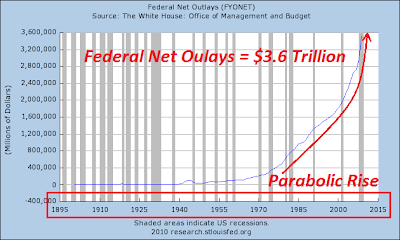

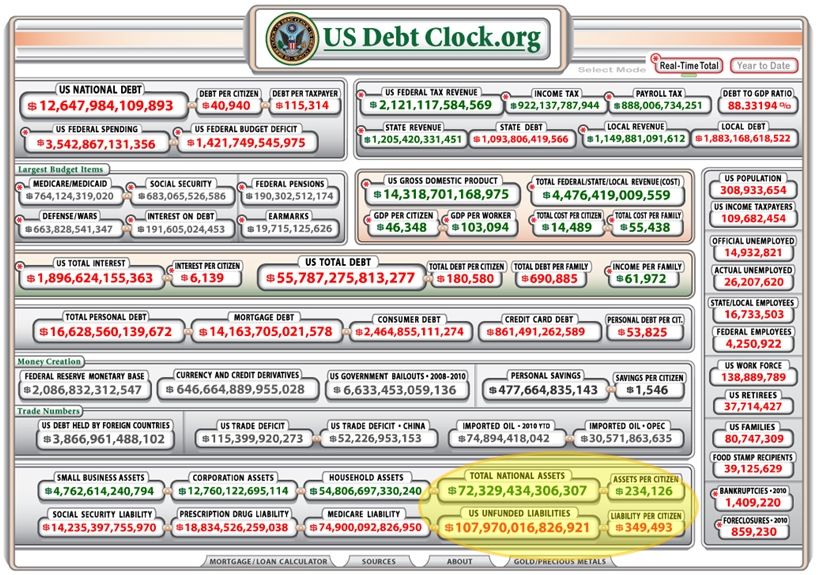

…the real amount of money spent on interest last year alone nearly equals the total amount of money our government takes in!

…the real amount of money spent on interest last year alone nearly equals the total amount of money our government takes in!

|

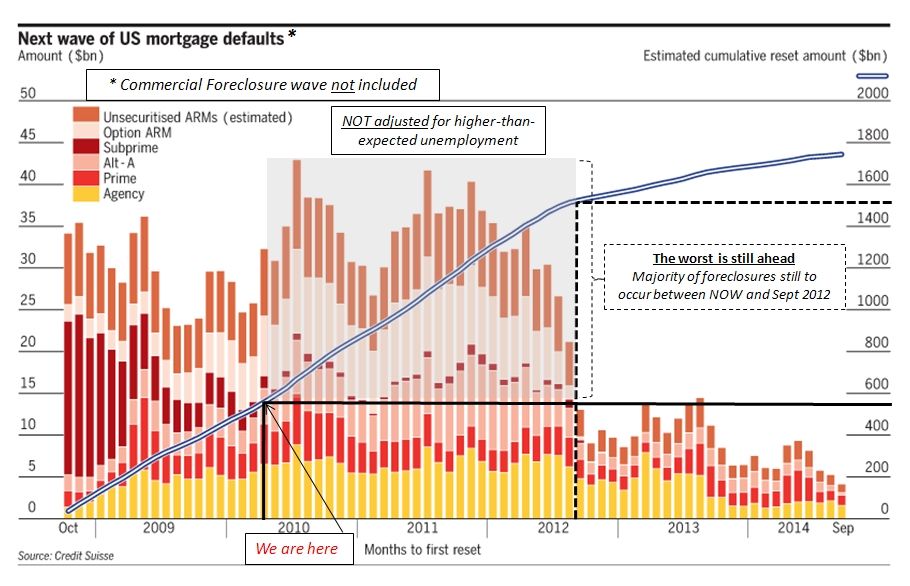

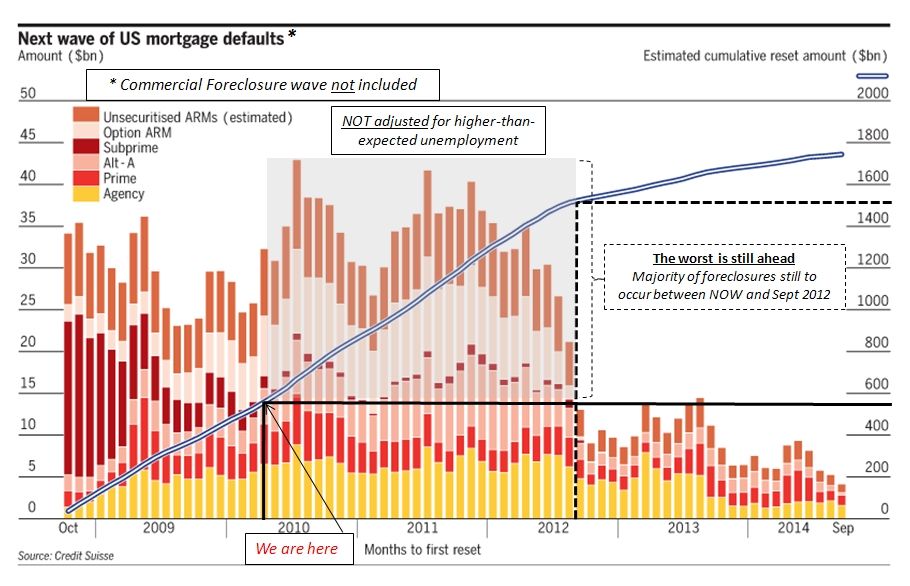

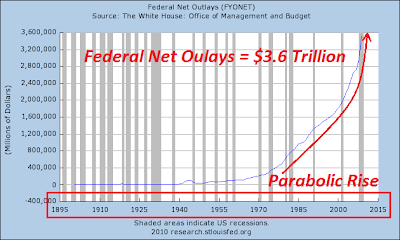

Thanks for the compliment. On Friday, Greece's credit rating got dropped from A+ to BBB-. That can translate to about a 15% interest rate when they borrow. Two days earlier, on March 30, the Federal Reserve terminated its historical $1.25 trillion dollar mortgage-backed securities purchase (MBS) program. The buying spree, which helped to boost the Fed's balance sheet from around $750 billion dollars in the summer of 2007 to north of $2 trillion dollars now, is likely to result in higher mortgage rates as the Fed begins to sell these securities. As the M1 money supply enters the consumer money supply from the sell-off of these mortgage-backed securities, that will translate into an overabundance of dollars, a/k/a INFLATION. Remember those days of interest rates in the 20s? They'll be back before too long. And when Adjustable Rate Mortgages (ARMS) that are TIED to 1-year constant-maturity Treasury (CMT) securities, the Cost of Funds Index (COFI), and the London Interbank Offered Rate (LIBOR) go up at a VERY high rate of increase ... well, many analysts think the UPDATED chart (AT THE BOTTOM OF THIS POST), based upon the ORIGINAL chart (IMMEDIATELY BELOW) produced in a report by Credit Suisse in March 2007 (pg. 47) is a LOWBALL estimate for the "second wave" of mortgage defaults.

|