To: Oldpuppymax

Income to the federal government INCREASES every time taxes are cut. It’s just a FACT. Actually, I thought the most interesting fact in the article, and one I wasn't previously aware of, is that revenue has remained very, very close to 18% of GDP, consistently for the last fifty years!

That's despite of low tax rates, high tax rates and other variations in domestic economic policy.

IOW, the only effect of high tax rates is reducing economic growth, and the only effect of lowering taxes is increasing economic growth. The increase in government revenues from lower taxes is, apparently, entirely incidental to this sole effect. Incidental, of course, to an effect that benefits all citizens and is good in itself! This should be the primary take-home message.

10 posted on

07/25/2010 8:52:29 AM PDT by

Stultis

(Democrats. Still devoted to the three S's: Slavery, Segregation and Socialism.)

To: Stultis

Historically, the increase in revenue does NOT benefit all citizens. Both Republicans and Democrats used it in the 1960s, 1980s, and 2000s to increase spending and the deficit. The one exception I am aware of is the 1920s when the federal government actually used most of the revenue from tax cuts to reduce the national debt.

To: Stultis

Historically, the increase in revenue does NOT benefit all citizens. Both Republicans and Democrats used it in the 1960s, 1980s, and 2000s to increase spending and the deficit. The one exception I am aware of is the 1920s when the federal government actually used most of the revenue from tax cuts to reduce the national debt.

To: Stultis

Historically, the increase in revenue does NOT benefit all citizens. Both Republicans and Democrats used it in the 1960s, 1980s, and 2000s to increase spending and the deficit. The one exception I am aware of is the 1920s when the federal government actually used most of the revenue from tax cuts to reduce the national debt.

To: Stultis

Actually, I thought the most interesting fact in the article, and one I wasn't previously aware of, is that revenue has remained very, very close to 18% of GDP, consistently for the last fifty years! Following is what the article said:

Over the past 50 years, tax revenues have deviated little from their 18% of gross domestic product (GDP) average.

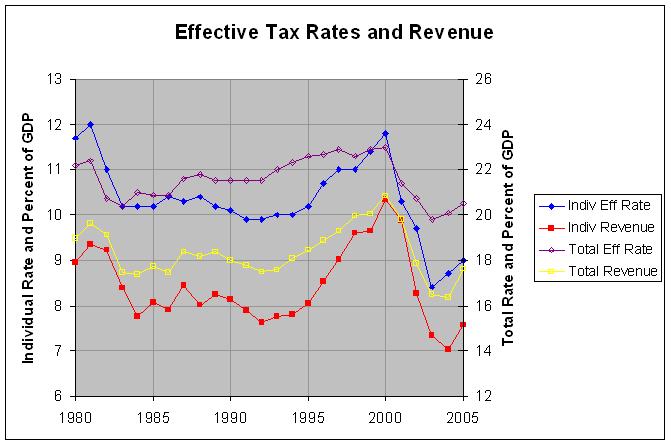

This is why I always attempt to check sources and not accept anyone's interpretation of them. The article said "deviated little" and you interpreted this to be the same as "very, very close". More important, however, is the fact that "deviated little" is a highly questionable interpretation of the data. The following graph shows total tax revenues and total individual income tax revenue from 1980 to 2005.

The actual numbers and sources for this graph can be found at this link. As can be seen, total revenue varied from 16.35% of GDP to 20.86% of GDP and revenue from individual income taxes varied from 7.03% of GDP to 10.34% of GDP during that period. I don't know how one can call these deviations "little". In any case, the graph shows that there was a relatively close correlation between these two revenue levels and the corresponding effective tax rates that generate them. I explain all of this in much more detail at this link.

I try to fact-check all claims that I hear in the political arena but I pay especially close attention to these "amazing facts" that both sides occasionally come up with. A careful analysis of the data almost always show these to be a simple sleights of hand, so to speak. The actual facts usually turn out to be much closer to what one would expect them to be.

15 posted on

07/26/2010 11:57:01 PM PDT by

remember

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson