Saaaaaaaaaaaay ... guess who controls the spending? I'd say these states are in for a rude awakening.

Posted on 11/05/2010 8:33:12 AM PDT by crosshairs

The big news this week in terms of ginormous government transfer payments is, as usual, out of the Fed, as it embarks on an equally ambitious and ill-fated mission to buy $600 billion of US Treasury debt. Unsurprisingly, it’s not the only immense transfer of wealth taking place between governmental bodies. As spotlighted by Meredith Whitney, CEO of the Meredith Whitney Advisory Group, the feds are continuing to subtly bailout state governments at record levels and in an ongoing and unsustainable fashion which she describes in a recent WSJ opinion piece.

From The Wall Street Journal:

“What [...] investors fail to appreciate is that state bailouts have already begun. Over 20% of California’s debt issuance during 2009 and over 30% of its debt issuance in 2010 to date has been subsidized by the federal government in a program known as Build America Bonds. Under the program, the U.S. Treasury covers 35% of the interest paid by the bonds. Arguably, without this program the interest cost of bonds for some states would have reached prohibitive levels. California is not alone: Over 30% of Illinois’s debt and over 40% of Nevada’s debt issued since 2009 has also been subsidized with these bonds. These states might have already reached some type of tipping point had the federal program not been in place.

“Beyond debt subsidies, general federal government transfers to states now stand at the highest levels on record. Traditionally, state revenues were primarily comprised of sales, personal and corporate income taxes. Over the years, however, federal government transfers have subsidized business-as-usual state spending not covered by state tax collections. Today, more than 28% of state funding comes from federal government transfers, the highest contribution on record.

“These transfers have made states dependent on federal assistance. New York, for example, spent in excess of 250% of its tax receipts over the last decade. The largest 15 states by GDP spent on average over 220% of their tax receipts. Clearly, states have been spending at unsustainable levels without facing immediate consequences due to federal transfer payments and other temporary factors.”

You can read more details in Whitney’s WSJ opinion piece on how state bailouts have already begun.

Saaaaaaaaaaaay ... guess who controls the spending? I'd say these states are in for a rude awakening.

“These transfers have made states dependent on federal assistance. New York, for example, spent in excess of 250% of its tax receipts over the last decade. The largest 15 states by GDP spent on average over 220% of their tax receipts. Clearly, states have been spending at unsustainable levels without facing immediate consequences due to federal transfer payments and other temporary factors.”

WOW. No bailouts for NY and CA!

We still don't have one, and whatever we do have won't be 'balanced' by any stretch of the imagination.

Which 15 states are they talking about besides NY and CA?

The bottom line is that in many States, the #1 budget item is education, which is still very popular with voters, though nonsensically bloated, with out of control spending.

When the rug is pulled out from these bonds, there will have to be massive cutbacks especially in higher education. Unless the institutions are destroyed outright, the sane way to do this is to:

1) Eliminate competitive athletics that require major financial support.

2) Exclude most out of state students.

3) Eliminate college majors that do not have significant job placement after one year.

4) Eliminate most frivolous mandatory classes for undergraduates.

5) Eliminate reeducation of students unable to meet basic standards for English and mathematics.

6) Reject the federal student lunch program unless it is decoupled from the vast majority of federal mandates placed on it.

Here are a few:

The full rankings:

Worst states

1. California

2. New Jersey, Illinois, Ohio (tie)

3. Michigan

4. Georgia

5. New York

6. Florida

Best states

1. Texas

2. Virginia

3. Washington

4. North Carolina

Neutral states: Pennsylvania, Maryland, Massachusetts

See: “Meredith Whitney’s new target: The states”

Posted by Shawn Tully, senior editor-at-large

http://finance.fortune.cnn.com/2010/09/28/meredith-whitneys-new-target-the-states/

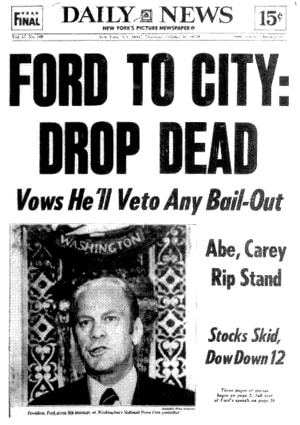

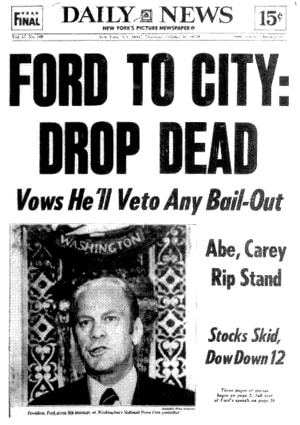

-Re your picture —

When was the last time you saw a 12-point move in the DJIA get a front-page headline??

We’re all boiled frogs, now.... ;)

The list, ping

Let me know if you would like to be on or off the ping list

I wouldn’t bail them out either. They have to stand on their own. If the Feds bail them out, the states will have to play by their rules. That gives the Federal Government more control over the states. States need to cut back on spending, insititute a balanced budget and cut services and government employees. The people in states have to get ticked off and control their state governments. Let the states fail and the people will revolt and force change on the states.

Florida is by law supposed to have a balanced budget. In fact, if revenues do not meet projections, the legislature is called back into session to cut until the numbers balance. The stimulus that Charlie Loafers hugged Obamao for receiving helped them bridge that gap partially but it runs out soon and I am sure there will be much weeping and gnashing of teeth in Taxahappee...

2. New Jersey, Illinois, Ohio (tie)

No shock to see NJ here; this state is filled (very densely) with the most entitled population in the union. While we have some of the most productive people in the nation, we also have a huge welfare/illegal population that receives free healthcare (which has already closed several hospitals), free breakfast AND lunch in public school, and a nobility of public servants (usually going back generations) that have never been net “contributors” in terms of taxes.

Our teachers want class sizes of 4 or smaller, while our police unions want a cop on every corner (not outside, but in a warm cruiser with the heat on for the full shift)...

Many schools have not only lunch, but breakfast and some areas have dinner as well.

I can believe GA is on the list. It seems like everybody in this state (except me) is getting a crazy check. It scares me to death.

This is true for all states, its just that NY is larger than most - the FEDS are, and have been for a long time, giving grant $$ for Education, Housing, Welfare, Medicaid, etc....

I suspect much of this will continue, even with the new Congress.

Get out of Ohio and Georgia as fast as possible!

Medicaid is one of the largest programs. The Federal government pays about half of the costs.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.