Can you provide a link to any economic study that makes that claim? Even the study cited by this Wall Street Journal editorial says that revenues go UP with tax increases. It just says that spending goes up even more. In any case, this editorial is deeply flawed and I have blogged about this at this link. Following is an excerpt from the post:

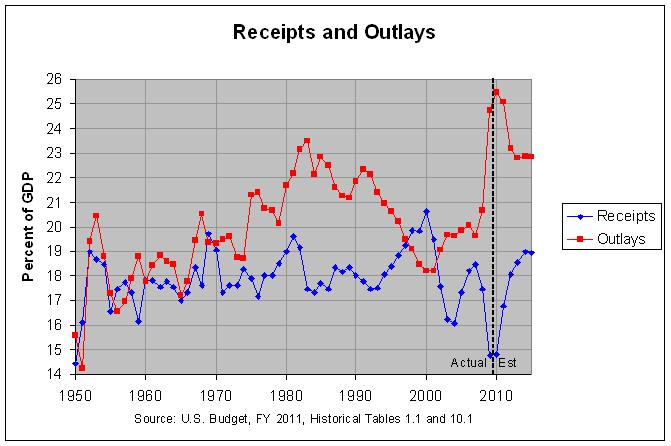

The following graph shows the growth of spending from 1950 to 1990.

The actual numbers and sources for this graph can be found at this link. The graph and actual numbers show that, as a percentage of GDP, spending was generally increasing for 1947 through 1983, nearly all of the period in question. However, spending as a percentage of GDP dropped steadily from 1991 through 2000. I was unable to find one of the cited revisions to this study which might address this period. However, the editorial itself states the following:

Our research indicates this is a sucker play. After the 1990 and 1993 tax increases, federal spending continued to rise. The 1990 tax increase deal was enacted specifically to avoid automatic spending sequestrations that would have been required under the then-prevailing Gramm-Rudman budget rules.

The statement that "federal spending continued to rise" is highly misleading. As shown in the graph above, federal spending as a percent of GDP (the red line) sank sharply from 1991 through 2000. The first table at the following link shows that spending did rise measured in current dollars. However, any good economist would at least correct those numbers for inflation and likely population growth, if not GDP. The following table shows federal outlays in current and inflation-adjusted (FY 2005) dollars from 1990 through 2009.

FEDERAL OUTLAYS (dollar amounts in billions)

Actual Amount Percent Change

------------------------- -------------------------

Current FY 2005 Percent Current FY 2005 Percent

Year Dollars Dollars of GDP Dollars Dollars of GDP

---- ------- ------- ------- ------- ------- -------

1990 1,253 1,832 21.9 9.6 6.3 3.3

1991 1,324 1,849 22.3 5.7 0.9 1.8

1992 1,382 1,858 22.1 4.3 0.5 -0.9

1993 1,409 1,846 21.4 2.0 -0.7 -3.2

1994 1,462 1,879 21.0 3.7 1.8 -1.9

1995 1,516 1,897 20.6 3.7 0.9 -1.9

1996 1,561 1,907 20.2 2.9 0.5 -1.9

1997 1,601 1,916 19.5 2.6 0.5 -3.5

1998 1,653 1,959 19.1 3.2 2.2 -2.1

1999 1,702 1,990 18.5 3.0 1.6 -3.1

2000 1,789 2,041 18.2 5.1 2.6 -1.6

2001 1,863 2,073 18.2 4.1 1.6 0.0

2002 2,011 2,201 19.1 7.9 6.2 4.9

2003 2,160 2,304 19.7 7.4 4.7 3.1

2004 2,293 2,378 19.6 6.2 3.2 -0.5

2005 2,472 2,472 19.9 7.8 4.0 1.5

2006 2,655 2,564 20.1 7.4 3.7 1.0

2007 2,729 2,565 19.6 2.8 0.1 -2.5

2008 2,983 2,704 20.7 9.3 5.4 5.6

2009 3,518 3,186 24.7 17.9 17.8 19.3

Source: Budget of the United States Government, FY 2011: Historical Table 1.3

As can be seen, outlays in FY 2005 dollars went up very slowly during this period. In fact, they went down from 1992 to 1993, reaching a level below their 1991 level. If they had also been corrected for population growth, they would have likely gone down over a much longer period. In any case, the editorial continues: The only era in modern times that the budget has been in balance was in the late 1990s, when Republicans were in control of Congress. Taxes were not raised, and the capital gains tax rate was cut in 1997. The growth rate of federal spending was dramatically reduced from 1995-99, and the economy roared.

Of course, a dramatic reduction beginning in 1995 could not be due to a capital gains tax cut in 1997. The most recent tax change before 1995 was the 1993 tax hike. In addition, the above table shows the growth rate of federal spending over this period. As can be seen, the growth rate reached its minimum in 1993 and stayed low until 2000. Spending then began to rise sharply, even as a percentage of GDP, through 2009. Most of this was following the Bush tax cuts of 2001 through 2003. Hence, tax cuts don't appear to restrain growth in spending. This would suggest that growth in spending is largely independent of tax hikes and tax cuts.

For the above reasons, I find the Wall Street Journal editorial to be less than credible. At best, it suggests that we need to make a conscious effort to restrain spending, just as we did during the nineties.