We shouldn’t mix cause & effect though. Those graphs are predicated on the idea that “gold holds its value not matter what”.

That is true, *except* when a huge country like the US makes a decision about currency backing. As I discussed above, backing artificially raises the price of gold, and likewise, removing the backing drops the price of gold back down.

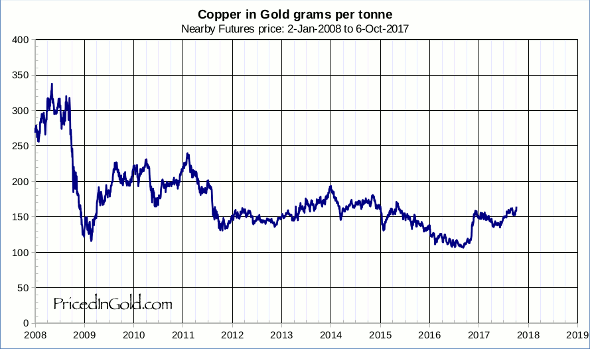

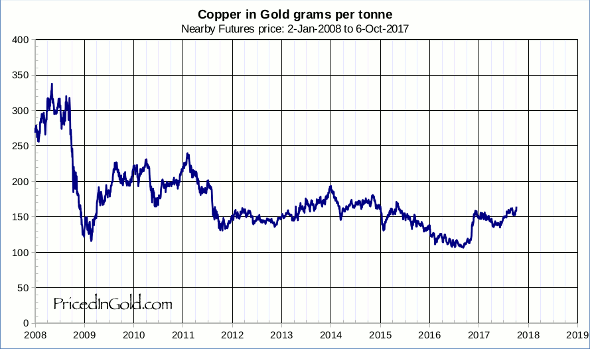

So those graphs can be interpreted as the drop in gold price, in real terms - how much other of all other commodies an ounce could buy - immediately after 1971, then things getting substantially better.

Then the third part of those graphs is the drop after 2000, which clearly represents the rise in gold price.

In some ways we’re definitely not better off than we were 80 years ago. Now it seems that for many families, both man and wife have to work just to stand still, where previously just the man working was enough. But is that just because of their unneccessary trappings?

I don’t mean to be the anti-goldbug. If I had money to invest a sizeable portion of it would be in metals. But I would like people who have their whole nest egg in gold to step back from gold madness that makes them cheer when the dollar falls and think that $100k gold would be perfectly reasonable.

We shouldn’t mix cause & effect though. Those graphs are predicated on the idea that “gold holds its value not matter what”.

It does. Unlike FRN, PG has a relatively stable (thousands of years) historic exchange value in terms of capital (land, other PM's, copper, steel, et c.,.). Its supply has increased at roughly the same rate as the human population which makes it uniquely suitable for indexing other commodities and currencies. Hence the vernacular term "Gold Standard".

"Then the third part of those graphs is the drop after 2000, which clearly represents the rise in gold price."

A wholly incorrect assertion. That part of the graph represents the massive dollar devaluation that has occurred over the past 10+ years. IOW - a big haircut in terms of absolute affluence for those who take their earnings, or hold assets denominated in USD. PG has risen only moderately vs. basic input commodities, which means it's not a bubble that we're seeing so much as a simultaneous collapse in purchasing power of the USD and Euro.

Beginning to wonder if THIS GUY is setting monetary policy at the Fed.