Posted on 04/29/2011 2:34:22 AM PDT by Scanian

Politicizing the Fed — Congress seeks more control over the 12 regional banks (GRAPHIC WARNING!)

The Wall Street Journal ^ | 06-14-10 | The Wall Street Journal Editorial Staff

http://online.wsj.com/article/SB10001424052748704575304575297130299281828.html

Posted on Sunday, June 13, 2010 8:57:59 PM by GOP_Lady

http://www.freerepublic.com/focus/f-news/2533919/posts

For 97 years the 12 regional banks of the Federal Reserve system have operated relatively free of political interference from Washington. The looming financial reform bill threatens that independence, not least through an effort to impose new presidential appointees at the regional banks.

[snip] .... the Fed regional banks, which have long operated independently of political intrusion. Federal Reserve bank presidents aren’t appointed by the President precisely to avoid Treasury and White House control. They are appointed by their regional bank boards.

However, in another threat to Fed independence, the Senate bill departs from that tradition by making the president of the New York Fed a Presidential appointee. Blame for this Congressional intrusion goes to Treasury Secretary Tim Geithner and former Goldman Sachs executive Stephen Friedman for orchestrating the selection of former Goldman economist William Dudley as Mr. Geithner’s replacement at the New York Fed.

Mr. Friedman chaired the search committee to replace Mr. Geithner even as he increased his ownership of Goldman shares. Though this violated Fed rules, Fed Vice Chairman Donald Kohn and the Board of Governors gave Mr. Friedman a conflict-of-interest waiver. Congress has now seized on this to justify putting the New York Fed chief on a Washington political leash.

The Waters provision will also give Congress and the White House a new and powerful lever to influence the operation of the 12 regional Fed banks. Accusations of racial or gender indifference, much less outright bias, are politically deadly. With the threat of such an accusation in their holster, the Waters czars will have enormous clout to influence Fed governance and regulatory decisions, perhaps including monetary policy.

Fed regional presidents are often the main proponents of tight monetary policy. The presence of a diversity czar is one way Congress and the White House can intimidate these regional presidents to go along with the policies they favor. No Fed bank president will want to take the risk of being hauled before Congress to answer a report that the banks under his jurisdiction aren’t racially or gender sensitive enough in their lending.

This political sway is already clear from how meekly the Fed as an institution is bowing to the Waters provision. The Senate bill doesn’t have the same provision, so it could be removed in the House-Senate conference that begins this week. But we’re told that Fed officials in Washington have told the regional banks to keep quiet because it can’t be stopped and Ms. Waters and the House might punish them if they try. In other words, the political intimidation is already obvious even before the provision becomes law.

The public debate over Fed independence has focused on Congressional demands for an audit, but that’s benign compared to the threat of political appointees sitting on the senior staff of the regional banks and Board of Governors. While masquerading as reform, the Waters and New York Fed provisions are the most brazen attempt to hijack central bank policy since its founding nearly a century ago.

The law will make it harder for regulators to do what ought to be their main job, which is making sure that they don’t again let a credit mania run out of control. It’s one more way in which this much vaunted reform will make the financial system even more politicized, and thus more vulnerable to another panic.

I’d pass on the dollar to doughnut offer. a good doughnut costs a 1.40 around here ;)

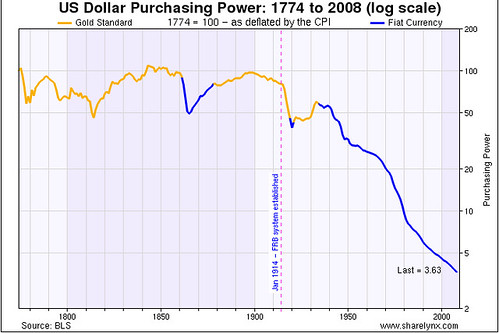

And now it's worth $1000. The notion that the Fed has helped the dollar in any way is an outright lie. The value of the dollar has basically gone in 1 direction since the inception of the Fed - DOWN.

You're simply FOS:

Conspiracy hacks and people like Ron Paul claim the FED is unaudited. But the truth is that the audits are available on the web for all to see. Every dollar is accounted for by independent auditors.

Again, you're FOS. The audits you link to are not the type of audits being proposed under the transparency bill. THAT audit would be under the purview of Congress (i.e. The People) and would turn over rocks that aren't being turned over now by the hand-tied bean counters you refer to.

You know this hasn't been done, yet you and others like you continually post this ridiculous tripe. You even have the nerve to call those proposing the legislation "conspiracy hacks."

Is Jim Demint a conspiracy hack?

The problem is our basic system of money being based on federal debt (basing it on gold would be worse); money should be based on some typical bucket of the goods and services a nation actually produces. There’s also a question of the basic usurpation involved in a central bank coining money and/or fractional reserve banking. Governments should coin money.

Maintaining the purchasing value of the dollar over a 100 year period is not an important economic goal. The only one who cares about that is someone who intends to stick cash in a mattress and keep it there for decades instead of investing it.

Your charts don't show the "year to year" change in the CPI. They show the cumulative change. It makes a scary chart, but it's really not important.

Under the gold standard, we had wild swings, of inflation and deflation which were as much as 20 and 25% on the gold standard. You also had deflationary depressions every 20 years.

Under the FED, we've had consistent small amounts of inflation. But because it's constant inflation, and not alternating with deflation the purchasing value of the dollar does fall over a long period of time.

Again, it's the year to year fluctuation that is important, because that's what drives business decisions, or brings them to a screeching halt in the case of deflation. Deflation is very damaging to the economy because why should anyone invest if you can just hold cash and increase your purchasing power.

"Again, you're FOS. The audits you link to are not the type of audits being proposed under the transparency bill."

The only "rocks" that aren't turned over now are the policy making processes, and the only reason to audit those is to bring political influence into the processes.

The interest rate decisions are announced as soon as the Federal Reserve Board of Governor's meets. So there is sufficient transparency with regard to interest rate decisions.

The Open Market committee makes decisions on stabilizing markets. You don't want to make those transactions transparent at the time you do them, because traders like George Soros will work against you. But the dollars are accounted for and reported in the audits.

I don't think it's right to say our system of money is based on "federal debt". The government could pay off it's debt and we would still have a money supply.

It's probably fair to say that it is "debt" based, since the multiplier effect of lending is believed to be greater than one, meaning more money is created through repetitive lending, than originally existed.

For those following this discussion...The multiplier effect is where I deposit $100 in the bank, and the bank loans out $90 to Loan Recipient A. Loan Recipient A deposits $90 in his bank, and his bank loans out $80, etc. In this short example, you can see how money deposits grew from $100 to $100+$90+$80 = $270 through bank lending. In this example, the money supply grew because of lending not because of any Federal Reserve actions.

I agree with you basing it on gold would be much much worse. But I'm not aware of a reasonable alternative to debt based money. You could stop lending altogether, but then, entrepreneurs wouldn't be able to get funding, except by selling their ownership rights. It would make for a far less efficient capital market.

Best take on the subject I've ever come across, but it takes a bit of reading.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.