Skip to comments.

PRECIOUS METALS: Gold Hits 6-Week Low As Refuge Demand Slips

Wall Street Journal ^

| 07/01/2011

| Matt Day

Posted on 07/01/2011 6:26:43 PM PDT by SeekAndFind

Edited on 07/01/2011 6:41:24 PM PDT by Admin Moderator.

[history]

Gold futures slid to six-week lows below $1,500 an ounce Friday, pressured as optimism over Greece's debt situation and strength in global stock markets hit demand for the metal as a refuge.

The most actively traded contract, for August delivery, settled down $20.20, or 1.3%, at $1,482.60 a troy ounce on the Comex division of the New York Mercantile Exchange, the lowest ending price for a most-active contract since May 17. The contract fell 1.2% on the week.

(Excerpt) Read more at online.wsj.com ...

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: gold; preciousmetals; silver

Navigation: use the links below to view more comments.

first 1-20, 21-29 next last

To: SeekAndFind

Related News:

http://www.forextv.com/forex-news-story/forex-forex-us-dollar-advance-to-resume-even-as-clouds-clear-over-greece

US Dollar Advance to Resume Even as Clouds Clear Over Greece

With a second Greek vote – this one on the implementation of newly adopted austerity measures approved on Wednesday – sailing through with little fanfare, it appears investors have already moved on from the debt crisis in the Mediterranean country that had consumed the markets’ attention over recent weeks. Indeed, with Greece now cleared to receive a 12 billion euro tranche of aid to cover its immediate obligations and likely to be approved for a further 110 billion aid package to tide things over until 2014 at an EU sit-down on July 3rd, the threat of immediate default has seemingly passed.

The spotlight now shifts to economic growth considerations. Chinese Manufacturing PMI figures showed factory sector growth slowed to the weakest in 28 months in June, marking a post-Great Recession low. Meanwhile, the final revision of the analogous gauge for the Euro Zone is expected to confirm the weakest reading in 18 months and the US ISM manufacturing report is due to reveal the worst outcome since August 2009. Japanese data released overnight was likewise ominous.

The sharp deterioration in growth prospects for all of the world’s leading economic engines telegraphed in such outcomes – particularly against the backdrop of unwinding fiscal and monetary stimulus – ought to weigh heavily on investor confidence and boost the safe-haven US Dollar anew.

CLICK ABOVE LINK FOR THE REST

To: SeekAndFind

*Rolleyes*

Well, let’s see...I’ve been at this 13 years now. Gold (and other metals) always back off during the summer months.

So, you DOPES - buy, buy, BUY!

See you in September, LOL! :)

3

posted on

07/01/2011 6:33:23 PM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: SeekAndFind

I beg your pardon.

As if any sane person ever believed that the printers of paper would submit to the reality of gold and silver without bringing on the total destruction of the world economic system?

To: Diana in Wisconsin

curious about your opinion on silver. Physical silver.

5

posted on

07/01/2011 6:45:22 PM PDT

by

warsaw44

To: SeekAndFind

Who in their right mind would buy gold at historical highs

PST - come close - secret

THE TIME TO BUY WAS WHEN GOLD WAS $300-400-500 dollars an ounce.

NOT when it is at record levels. WHY do you think there are all these tv commercials advertising NOW IS THE TIME TO BUY -

Hint - because they want to unload all the gold they bought years ago on the cheap

When people tell the general public it is time to buy - then they have missed the boat.

NOW is the time to SELL gold - not buy

When gold gets back down to around 400-700 an ounce. THEN BUY

Until then - we can only cry that we missed the boat!

To: silentknight

Hint. Paper dollars were worth more back then and we weren’t printing them 24/7. Our credit rating wasn’t in jeopardy of being degraded.

Gold will never see $400-$700 again...never. It has found a home at $1500+/-. China, Russia & India are buying with both hands.

Just something to think about.

7

posted on

07/01/2011 7:24:30 PM PDT

by

panaxanax

(0bama >>WORST PRESIDENT EVER.)

To: Diana in Wisconsin

I don’t know, I think I should invest in pretty pieces of paper with presidents and numbers on them. They ain’t making any more of them.

Wait! they are making more of them all the time....

Never mind.

8

posted on

07/01/2011 7:32:44 PM PDT

by

farmguy

To: panaxanax

Yes I have heard this all before

Gold bugs will never believe that their metal is going to go back down - WAY down

Only a fool would buy when the bubble is about to pop

You will never see your money again - sure you migth see some small advances but $3000 gold - not going to happen.

NO way - no way

Gold will easily return back down into the 800-1000 range and likely back to 500-700 range. I have watched these fear fed cycles forever. Always end the same. Stupid investors are sucked in and lost their money.

Really saw buy you prey on the older people. They will never see that money again - never.

To: silentknight

Also- in the end days - who the heck wants a piece of gold or silver. I would shoot you less - salt and sugar - grain - other commodities. But gold and silver? You would be laughed right off the neighborhood island if you show up with that crap.

People will need what it takes to survive and you can’t fill your stomach with gold bars. You can try - but it won’t end well.

It is a piece of metal - a piece of metal that people have given some false price to.

Quite insane really

Paper money isn’t much better

Some of you are REALLY sweating now - you have all this gold because you were told to buy it. NOW what? What are you going to do with it? If war breaks out and the country falls apart - not many people will care for your gold. They want food - salt - drink - water - trades. Not gold tooth fillings

I have a feeling many mom and pop’s are being ripped off by these gold looters. Paying them so called “TOP” dollar for their gold and silver. This is a laugh - they are paid pennies on the dollar. Go look it up.

The time to buy gold was in 1998-2001 give or take - you picked. They were giving gold and silver away. Pennies basically.

Now we have a HUGE bubble that will soon break.

Sure - get in now - and watch your money disappear.

But don’t say you were not warned

To: silentknight

Gold bugs will never believe that their metal is going to go back down - WAY downHere's what's going down -- stocks! Who's buying that garbage? Only thing holding them up is all that quantitative easing. That same factor will keep gold going up.

I have a proposition: we are equidistant now between $1000 and $2000 gold. Which do you think we will see first? $1K or $2K gold? I've got a box of Omaha Steaks (i.e. I will buy you a box of them) that says $2K gold comes before $1K gold. What say you?

11

posted on

07/01/2011 7:58:53 PM PDT

by

Migraine

(Diversity is great... ...until it happens to YOU.)

To: silentknight

Hmm.. when Gold reached $300 back then, I was told the same thing, that it was a worthless investment etc...

12

posted on

07/01/2011 8:12:23 PM PDT

by

JudgemAll

(Democrats Fed. job-security Whorocracy & hate:hypocrites must be gay like us or be tested/crucified)

To: silentknight

Paper money isn’t much better The implication of what you wrote is that paper money is at least somewhat better than gold. This one sentence proves you are an idiot.

13

posted on

07/01/2011 9:00:03 PM PDT

by

ProudGOP

To: warsaw44

I've nearly doubled in value of physical silver over the past two years. Should have sold on the big jump to $48/oz, then reinvested, but I consider the holdings as insurance against $ denominated disaster, which could happen in a heartbeat, I believe, impossible to time. I don't know silver's (and gold's) ultimate price, but it seems clear that the $ will be going down in value, sometimes dramatically, sometimes slowly, with bounces of course, for the foreseeable future. Our central bank is very crooked, and intend to rob you of your savings.

Over the millennium, precious metals have more or less maintained their trade value - coin of these are real money.

14

posted on

07/01/2011 9:02:49 PM PDT

by

GregoryFul

(Obama - Jim Jones redux)

To: Diana in Wisconsin; silentknight; panaxanax; Migraine; JudgemAll; SeekAndFind

After reading all the comments, I have come to the conclusion that there is a vast amount of differing opinions on gold here. I really would not expect anything less from a forum that has some of the greatest conservative minds in America. As for me, I just signed up last week, but I have been lurking for a few years, about 3. Just before the election in "08" is when I found FR, and so I lurked until last week when i finally decided to jump in.

That being said, please check out this graph and answer my question below.

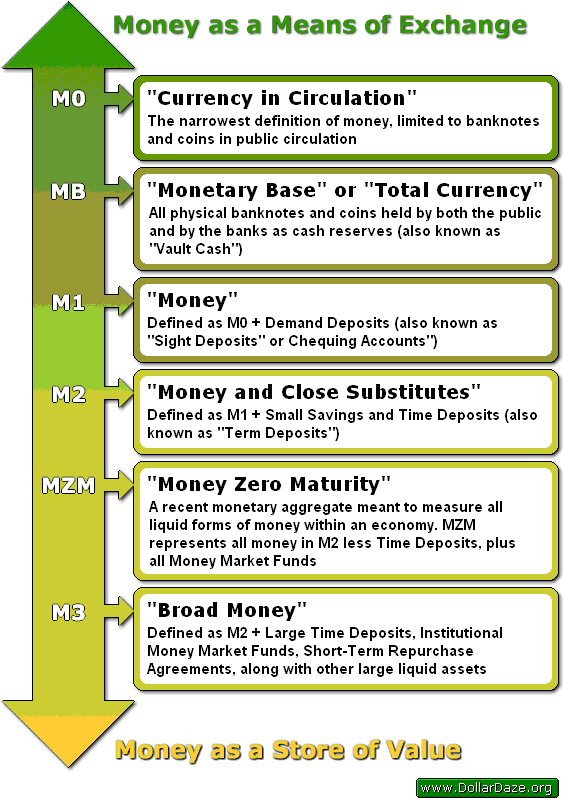

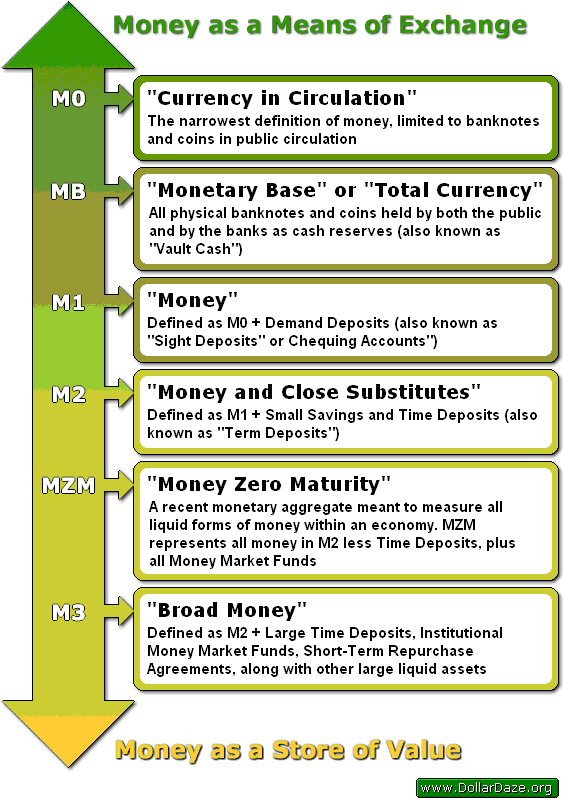

(Oh yea, I found the graph at a site called Fishers Precious Metals. They have an article that was written in November of last year, 2010, about the worth of gold compared to the amount of money in circulation using the M3 factor. At the end of my comment is a graph that shows how wealth is measured in a scale from M0 to M3, which was posted back in January 2009 I found at Goldnews)

Now for my question to you all.

Now for my question to you all.

Considering the graph above, what is your opinion about the idea that in order for gold to match what it is truly worth that, at least in 2010, gold should have been at almost $3700.00 an ounce?

Also, considering how much money the Obama administration has printed since last year, some would say that the true value of gold right now should be well over $6,000.00 an ounce and climbing, not the $1487.38 and dropping it closed at today. Would you agree?

Any comments about this would be much appreciated.

As I said, I am new I am still on probation, so it may take awhile for my response to your answer to be posted. As for the timeline of being on probation, I am clueless, because there is nothing in writing to let newbies as we are called to know when we will be off probation.

Anyway, I thank you all ahead of time for your attention to this matter. It matters much to me because I am invested in gold stocks and would like to know if I should invest in more, or sell what I have while I am ahead.

Just so you know, I purchased my gold stocks when gold was about $850.00 an ounce and my gold stocks are worth approximately 1/10th that of gold bullion.

(

There are several different monetary aggregates used to measure a nation's money supply. These monetary aggregates can be thought of as forming a continuum from most liquid (money as a means of exchange) to least liquid (money as a store of value). The measures, while not completely consistent across different countries, may be generalized as follows:

I hope this works, but I may not know until tomorrow, depending on when those in charge post my comment. I will check back periodically. Thanks again.

15

posted on

07/02/2011 1:53:55 AM PDT

by

John 8_58

( "Most assuredly, I say to you, before Abraham was, I AM.")

To: silentknight; OneLoyalAmerican; Migraine; ProudGOP; farmguy

>”It is a piece of metal - a piece of metal that people have given some false price to.”<<

You are wrong on so many levels. Do you really think that paper money that is backed by nothing more than a false promise from a failing, lying and bankrupt government is a better storage of wealth?

>>”THE TIME TO BUY WAS WHEN GOLD WAS $300-400-500 dollars an ounce.”<<

Actually, the time to buy was when gold was $35.00, or better yet, back when you could get a Double Eagle for $20.00. Back then, three of those Eagles would buy a good horse & saddle. The same holds true today.

Example: Last week I traded (bought) a pre-64 Winchester Model 94 .30/.30 for 6 old common date Morgan dollars. Pretty much the same price they were 100 years ago.

The price of gold may very well go down to $1000. If that happens, all that means is that the value of the dollar went up and it takes less of them to buy an ounce of gold. It ain’t rocket science, my friend.

>>”...[1998-2001] They were giving gold and silver away. Pennies basically.”<<

Who is “they” and why were ‘they’ giving away gold & silver for pennies on the dollar?

Being a “gold looter” myself, I can attest to the fact that we gross about 10-15% profit on re-selling scrap. By the time we deduct high advertising costs, gas to and from the sellers house, gas to and from the refiner, shipping etc. we actually make about 8% profit, sometimes less & sometimes more.

Plus, you have to have large sums of cash on hand and meet with someone you’ve never met before. Talk about a risky and dangerous situation, huh? Try getting a call from someone that says they have “lots” of old gold/silver jewelry and then drive 50 miles to find out it is all junk costume jewelry. Or that the sterling silver flatware is silver-plated. Total loss of your time and gas money.

It is clear by your posts that you have no clue as to what you are talking about. You don’t make sense.

BTW, what was your advice to people when gold hit $1000.00? I’m betting you told them to sell, sell, sell!

Gotta go for now.

16

posted on

07/02/2011 3:50:32 AM PDT

by

panaxanax

(0bama >>WORST PRESIDENT EVER.)

To: farmguy

17

posted on

07/02/2011 5:29:33 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: warsaw44

18

posted on

07/02/2011 5:33:59 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: John 8_58

There is some gold price manipulations going on which are dependent and independent.

Yes, there is speculation and some bubble.

But, yes, there too is a force of artificial depreciation of it.

Then you have panic hoarders, reasonable savers and what not shortage nonsense and industry factors.

PANIC hoarders, as in Obama panicking everyone, is a sure guarrantor of gold surges in the future.

Industry factor is that the industry works like a church. The preacher digs the raw materials, but it is not to spoon feed people about it, it is for them to refine it further.

Also there is the military shortage factor. Whenever war/government goes up, yes, private industry goes down, but war effort goes up, and government hoarding is a must. (aside, interestingly, the only industry that the state is capable of bringing revenue with through taxes is the tourism industry. the State of Washington, for budget cuts, ironicaly, did away with this cash cow in favor of “services for the poor”, and go figure because bums need tourists).

And then there is the real value of Gold.

1. The speculation is from account holders who are permanent players and compound on the tick marks up and down. This has a life of its own.

2. The depreciation comes from opportunist big manipulators like Soros, saying one thing and doing another one (opposite). But it also comes from the feds. rate. Then you have the issue of boycotts, state laws and strange popularities or liquidities. Everyone is playing the paper these days, that is the liquidity/popularity. So, as a result, gold owners feel gauged because they know their metal is valuable but they cannot find ready users and buyers of their gold on a convenience basis. As a result we see sprouting up left and right pawn shop like outfits who are out sharking for gold rings etc...

Watch the dang signs in the sky!!! Why do you think these shops are popping up? WHo runs them? PErhaps Soros is selling gold here but then raises those shops up left and right on the back door. PEOPLE ARE GETTING MANIPULATED! Something is up.

The feds rate works like this, as a cut off point of standards. It’s like for promotion within the army or government schools in Europe: we want so many people to be leaders in this or that sector, so we will adjust the score. The dow is adjusted in score by the cut off point of floating admissability into the dow accounting.

Also, floating stocks has always been a rip off because companies always float it out when they expect losses in the future. They buy back when they expect a gain and want to retake control of their own companies. The high dow is thus a function of stupid exuberance, but also of scarcity of a stock as the companies buy them back. Jitteriness is also a factor in making a lot of money on derivatives since derivatives are a ratio of the rate of change (derivative) of the stock to the actual price of the stock (original equation or integral of the path of the stock price curve).

Compared to the year 2000 Dow Jones which was near these levels of today, Gold is still 5 times more expensive today, so really in stock value vs. Gold, the stock market decreased up to 80%!!!!

Question is, can it go lower and compound further down 80%?

The stock market is going to crash, gold will go up, but once the market will go back up, gold will NOT go back down.

So, in the dollar to foreign currency and stock market play, it’s a cut off point that is decided. We decide what the standard is. In absolute term, our standard will decrease, but in relative terms, we are still on top with the dollar and the stock market, so to speak.

IF the rest of the world crashes, the dollar will go up, however, and then our exports and economy will really tank for good.

19

posted on

07/02/2011 7:20:02 AM PDT

by

JudgemAll

(Democrats Fed. job-security Whorocracy & hate:hypocrites must be gay like us or be tested/crucified)

To: silentknight

RE: Gold will easily return back down into the 800-1000 range and likely back to 500-700 range. I have watched these fear fed cycles forever.

___________________________________________________________________________

Your reasoning for the above is to appeal to history ( e.g. the 1980’s when Reagan took over as presidency ). But that does not adequately respond to Post #6 above which gives the actual reason for Gold being in around the $1500 mark... OUR UNSUSTAINABLE DEBT, OUR UNFUNDED LIABILITIES, and OUR WELFARE MENTALITY where close to 50% of our population does not pay taxes while the other half works to sustain a bloated government.

Let’s address those issues first and then maybe we can listen to your explanation as to why Gold will drop to 3 digits.

Navigation: use the links below to view more comments.

first 1-20, 21-29 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson