Skip to comments.

Plan To Return America To the Gold Standard Set To Be Offered at Washington (5-year transition)

New York Sun ^

| 09/27/2011

| Seth Lipsky

Posted on 09/27/2011 6:25:19 AM PDT by SeekAndFind

NEW YORK — The next big step in the gold standard debate is going to be taken next month at Washington, when one of the original members of the Reagan-era United States Gold Commission offers a five-step plan to return America to sound money.

The architect of the plan, Lewis Lehrman, a businessman and scholar, will present his program in an address October 5 at a conference in Washington on the how to return to a stable dollar. He will outline a five-step program to return America to a gold-backed currency within five years.

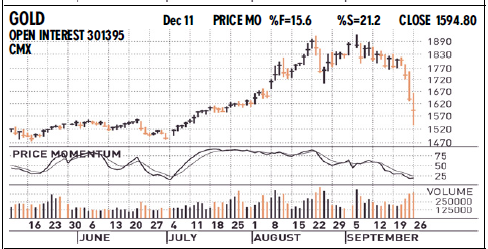

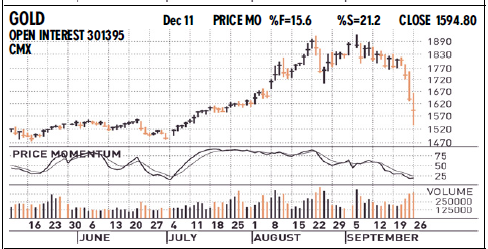

What is significant about the event is its aim of shifting the discussion to practical steps that could be taken to rescue the American monetary system. It comes as the value of the United States dollar has collapsed to record lows, sinking at one point this month to less than an 1,800th of an ounce of gold. The value of the dollar has recovered marginally in recent days, but still lurks below a 1,600th of an ounce of gold, a level that would have been nearly unimaginable — at least in policy terms — as recently as the start of President George W. Bush’s first term, when the dollar had a value of a 265th of an ounce of gold.

“The stand-pat defenders of today’s paper-dollar system turn back every argument in favor of the gold standard by claiming that there’s no practical way to re-establish it,” says the editor of Grant’s Interest Rate Observer, James Grant. “What Lehrman has done is to devise a practical and persuasive plan to do just that.” He predicts “the ball is now — or soon will be — in the paper-money court as it has not been for a long time.”

(Excerpt) Read more at nysun.com ...

TOPICS: Business/Economy; Culture/Society; Government; News/Current Events

KEYWORDS: gold; goldstandard; monetarypolicy

Navigation: use the links below to view more comments.

first 1-20, 21-33 next last

To: SeekAndFind

What will this do to the price of gold or will the government recall all gold? If they recall it, at what price?

2

posted on

09/27/2011 6:31:12 AM PDT

by

RC2

To: RC2

Good luck with getting the Bling out of the brother’s mouths.

To: RC2

What will this do to the price of gold...More importantly what would this do to the price of something important like say, food. Last week an ounce of gold could trade for a truck load of bread, but this week--

--the bread's worth an ounce and a quarter. If gold were money we'd have 250,000% inflation.

To: SeekAndFind

I’ll wait and see how this plays out before I start cheering; wouldn’t be the first time the government’s taken a great idea and used it to gain more power (ie, Civil Rights Act of 1964).

5

posted on

09/27/2011 6:38:47 AM PDT

by

RWB Patriot

("My ability is a value that must be purchased and I don't recognize anyone's need as a claim on me.")

To: SeekAndFind

lemme see... there are roughly a half trillion in gold in fort knox. we owe 14 trillion...

ayep. that makes sense...

6

posted on

09/27/2011 6:39:34 AM PDT

by

camle

(keep an open mind and someone will fill it full of something for you)

To: Gadsden1st

To: SeekAndFind

I hope this process will involve an accurate inventory of gold in Ft Knox or wherever our Federal gold is stored.

8

posted on

09/27/2011 6:44:17 AM PDT

by

aviator

(Armored Pest Control)

To: RWB Patriot

9

posted on

09/27/2011 6:50:23 AM PDT

by

silverleaf

(Common sense is not so common - Voltaire)

To: SeekAndFind

Talkin about returning to the stone age...

There's a man in the funny papers we all know....

To: silverleaf

Hence why I’m suspicious. States generally have a better grasp on such things, and when the fed gets involved, it’s usually to screw things up.

11

posted on

09/27/2011 7:07:53 AM PDT

by

RWB Patriot

("My ability is a value that must be purchased and I don't recognize anyone's need as a claim on me.")

To: SeekAndFind

How about just ending the Federal Reserve’s “dual mandate” which Bernanke cites to justify his actions contrary to his confirmation hearings.

Republicans are way too dense and quiet about this.

During his confirmation hearings, Republican senators were trying to discern whether or nor Bernanke was a Keynesian or a hard money inflation hawk, in disbelieing the “Phillips Curve” claim that inflation and unempployment move in opposite directions-—a theory which was disproved in the 1970s, 1980s, and 1990s when inflation and unemployment moved in the same direction—up and down.

Bernanke said that he didn’t think low inflation is bad for jobs and said he would target inflation at 2% using the CPI and NOT “core inflation” which has a Keynesian bias and ignores food and energy prices and commodities.

Now, the producer price index reads 6% and the CPI is 3.6%-—which is almost TWICE as high as Bernanke agreed to allow.

Why aren’t Bush, Cheney and the Republicans yelling this from the rooftops and accusing Obama of ignoring inflation to get re-elected , same as Carter?

This is the perfect way to contrast what Republicans believe versus what Democrats believe when they urge the Fed to hold interest rates way below the inflation rate during bad times and print lots of money so they can throw 10% money supply growth into the economy to spend as vote-getting stimulus—even though Democrats always claim that deficits CAUSE inflation! THIS IS WHAT VOLCKER DID TO REAGAN-—are Republicans that ignorant not to call out Bernanke on the naked Keynesian bias at the Fed meant to protect Obama????

In 1980—which was an election year.....

Democrat Paul Volcker held the Fed Funds rate at 7.5% for Jimmy Carter as the inflation rate hit 13.5% because Democrats insisted that inflation was good for jobs and didn’t want Volcker to have high rates to ruin Carter’s re-election chances. The unemployment rate stayed around 7.5%, too—but had been starting to drift upward.

But by the time Reagan was inaugurated—Volcker hit him with 20$ interest rates and we had a major recession where the unemployment rate hit 10% and Reagan got killed in the mid-term elections because of the recession and the deficits that were blamed on tax cuts that didn’t even fully phase in by 1982!!!!

Bernanke need to get the Fed Funds rate up at LEAST to the 3.6% CPI inflation rate-—but the Fed is full of Keynesian Democrats and Keynesian bias which thinks there’s no inflation unless and until housing prices rise......

The Keynesian bias towards the housing sector got us into this mess and is keeping us in this mess and Republicans need to expose this and explain it.

In the 1970s—when inflation and unemployment disproved their theory—Democrats amended it by claiming that the Phillips Curve has “shifted upward” because the economy was completely developed, therefore fast growth and low unemployment was a thing of the past and 8% was the new “full employment”.

That’s why Arthur Laffer brought out his Laffer Curve and Reagan cut tax rates at the top to shift the Phillips Curve down again.......and now “full employment” is now 2% or 3% meaning that when the Fed tightens at 5%-—it is premature and inhibits supply-side budget surpluses at lower tax rates because it doesn’t let the unemployment rate fall far enough for long enough....

12

posted on

09/27/2011 7:09:54 AM PDT

by

Beowulf9

To: SeekAndFind

How about just ending the Federal Reserve’s “dual mandate” which Bernanke cites to justify his actions contrary to his confirmation hearings.

Republicans are way too dense and quiet about this.

During his confirmation hearings, Republican senators were trying to discern whether or nor Bernanke was a Keynesian or a hard money inflation hawk, in disbelieing the “Phillips Curve” claim that inflation and unempployment move in opposite directions-—a theory which was disproved in the 1970s, 1980s, and 1990s when inflation and unemployment moved in the same direction—up and down.

Bernanke said that he didn’t think low inflation is bad for jobs and said he would target inflation at 2% using the CPI and NOT “core inflation” which has a Keynesian bias and ignores food and energy prices and commodities.

Now, the producer price index reads 6% and the CPI is 3.6%-—which is almost TWICE as high as Bernanke agreed to allow.

Why aren’t Bush, Cheney and the Republicans yelling this from the rooftops and accusing Obama of ignoring inflation to get re-elected , same as Carter?

This is the perfect way to contrast what Republicans believe versus what Democrats believe when they urge the Fed to hold interest rates way below the inflation rate during bad times and print lots of money so they can throw 10% money supply growth into the economy to spend as vote-getting stimulus—even though Democrats always claim that deficits CAUSE inflation! THIS IS WHAT VOLCKER DID TO REAGAN-—are Republicans that ignorant not to call out Bernanke on the naked Keynesian bias at the Fed meant to protect Obama????

In 1980—which was an election year.....

Democrat Paul Volcker held the Fed Funds rate at 7.5% for Jimmy Carter as the inflation rate hit 13.5% because Democrats insisted that inflation was good for jobs and didn’t want Volcker to have high rates to ruin Carter’s re-election chances. The unemployment rate stayed around 7.5%, too—but had been starting to drift upward.

But by the time Reagan was inaugurated—Volcker hit him with 20$ interest rates and we had a major recession where the unemployment rate hit 10% and Reagan got killed in the mid-term elections because of the recession and the deficits that were blamed on tax cuts that didn’t even fully phase in by 1982!!!!

Bernanke need to get the Fed Funds rate up at LEAST to the 3.6% CPI inflation rate-—but the Fed is full of Keynesian Democrats and Keynesian bias which thinks there’s no inflation unless and until housing prices rise......

The Keynesian bias towards the housing sector got us into this mess and is keeping us in this mess and Republicans need to expose this and explain it.

In the 1970s—when inflation and unemployment disproved their theory—Democrats amended it by claiming that the Phillips Curve has “shifted upward” because the economy was completely developed, therefore fast growth and low unemployment was a thing of the past and 8% was the new “full employment”.

That’s why Arthur Laffer brought out his Laffer Curve and Reagan cut tax rates at the top to shift the Phillips Curve down again.......and now “full employment” is now 2% or 3% meaning that when the Fed tightens at 5%-—it is premature and inhibits supply-side budget surpluses at lower tax rates because it doesn’t let the unemployment rate fall far enough for long enough....

13

posted on

09/27/2011 7:09:54 AM PDT

by

Beowulf9

To: RWB Patriot

except in the issuing of coins and currency as legal USA tender, which is specified to the federal government

Utah and other states may agree to accept gold and silver as legal tender, but only the federal govt can mint it or issue certificates backed by it

State-by-state bartering would be a nightmare

14

posted on

09/27/2011 7:12:02 AM PDT

by

silverleaf

(Common sense is not so common - Voltaire)

To: expat_panama

I predict your post will be completely ignored.

15

posted on

09/27/2011 7:28:57 AM PDT

by

Domalais

To: SeekAndFind

16

posted on

09/27/2011 7:46:33 AM PDT

by

Sergio

(An object at rest cannot be stopped! - The Evil Midnight Bomber What Bombs at Midnight)

To: expat_panama

That kind of inflation for a week, which reverses itself the next week is not a big concern.

Also, if gold were the standard, price volatility would be much less, because current volatility reflects the uncertainty about fiat currencies like the dollar.

Not that I’m pushing for a gold standard. But some kind of standard (taking the power to manipulate from the hands of politicians) would be nice.

17

posted on

09/27/2011 7:57:59 AM PDT

by

Atlas Sneezed

(Author of BullionBible.com - Makes You a Precious Metal Expert, Guaranteed.)

To: silverleaf

[ except in the issuing of coins and currency as legal USA tender, which is specified to the federal government

Utah and other states may agree to accept gold and silver as legal tender, but only the federal govt can mint it or issue certificates backed by it

State-by-state bartering would be a nightmare ]

The federal government should set the standards but they shouldn’t actually control the money.

Much like the “DOE” department of Energy should not be funding energy, but should set standards like the electrical standard like 120V @ 60Hz. But shouldn’t be trying to kill coal plants.

Having a federal government agency around to keep thing standardized between the states is a good thing and is “responsible government”. But that sorta agencey would only take a hundred or so people to run it, compared to the monstrosties we currently have. Like the Department of Education should only consist of about 100 people who work to set education standards and setup and track state metrics, but they shouldn’t act like a clearing house for federal funds being sent to the states.

We need somethign sinular for the money supply, a system of 50 state banks with the federal power only controlling the standards on which money is created.

Somethign like that.

18

posted on

09/27/2011 7:59:18 AM PDT

by

GraceG

To: silverleaf

Is there any law to prevent people trading gold coins for cars or motorcycles or bushels of corn??

To: Beelzebubba

That kind of inflation for a week, which reverses itself the next week is not a big concern.We're looking at gold dropping from over $1,900 to below $1,600 in three weeks while the price of bread hasn't changed. A hundred years ago when gold was money people would work for a month and then try and buy bread with prices up by 25%. They'd borrow to buy food and a month later have to pay back the loan with a paycheck that dropped by 25%.

25% inflation in a month is impossible to work with. 25% inflation after ten years is nothing. Using gold for money was stupid.

Navigation: use the links below to view more comments.

first 1-20, 21-33 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson