Posted on 12/14/2011 11:04:29 AM PST by Kaslin

What effect do you think those much higher tax rates will have upon stock prices beginning in 2013? Especially since the long-term capital gains tax rate will be so much less? Here's what history says, but remember, it ends badly, except perhaps for the insiders....

A quick story in two snapshots. First, the expected future trailing year dividends for the S&P 500 through the fourth quarter of 2012:

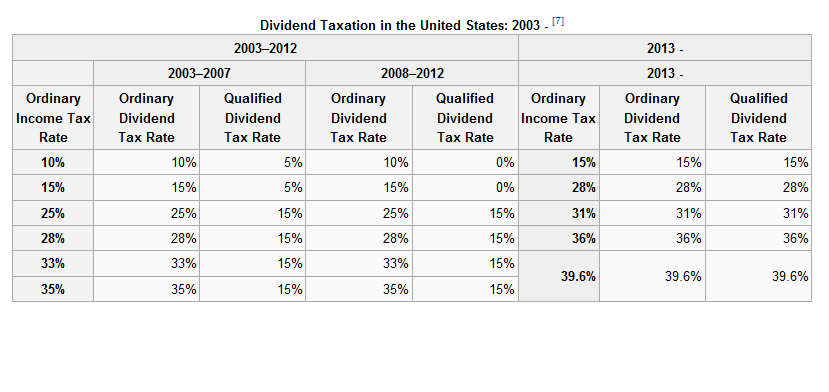

Second, the tax rates that apply to dividend income from 2003 through 2012, and the expected tax rates that will apply for 2013 onward, given current law in the U.S.:

Speaking of which, here's what insiders are up to today!

bfl

What is omitted from this discussion is the capital losses one is likely have to endure to be a collector of those dividends, if one holds stocks from now to then.

And that could be ghastly.

There is a deleveraging that is going on now for which I myself see no imminent bottom. That could be a horrible defect in my particular vision, YMMV.

MFGlobal has demonstrated something that I find terrifying, and that is that the worlds’ assets are quite possibly pledged (hypothecated) multiple times over.

You’re seeing it with gold. We’ve already seen it with real estate. What other assets might be subject to the same treatment?

Public sector pension fund.

*** “There is a deleveraging that is going on now for which I myself see no imminent bottom. “ ****

That’s exactly the attempt of the natural market forces here, beneath all the paper scam. ....

..... Despite, the “Elmer Gantry Market Analysts” trotted out to hype the propped government pension market, the general public is halting purchases.

As I’ve already stated before, the real market is tracking commodities, particularly oil. The paper floating out there HAS NO-OR FALSE- OR LITTLE COLLATERAL.

With the U.S. and state, county, government pensions all mixed in, watch for the next false-market propping attempt (or they lose their pensions). “U.S. Italy” Market Gate, backed by the whips and chains of PhonyCare for govt. pensions/retirements. Spokespersons, Elmer Gantry.

Just like, the price on the last barrel of oil transacted impacts the price of every other barrel of oil "out there".

Just like, the price on the last ounce of gold transacted impacts the price of every other ounce of gold "out there".

In a debt based financial system, all the debt (other than sovereign debt) is in theory collateralized.

This is what I am saying. This is what MFGlobal has revealed. If the assets underlying the debt that bought whatever cockamamie crap Corzine bought are triple pledged, then when they are seized in the margin call from hell, then theoretically ALL assets fall by 2/3rds in value. Instantly.

My comment concerning 'Public sector pension funds' was made under the assumption they are also being used as collateral by municipalities, state governments and fed gov. to issue bonds etc. In effect doing exactly what AIG or LBIE or MF Global was doing through their London office. But here I'm getting over my head..

I view most of big finance to be a game of covering up the cost of Utopianism. I'm learning to find it very interesting and simply want to clarify and test my assumptions. Your question about what other asset classes will sh*t the bed is excellent.

See post 7

By ‘geared up’ I assume you mean leveraged. One thing for sure being undervalued is American’s entrepreneurial spirit.

"Public sector pension fund."

After listening to a James J Puplava interview with John Loeffler, I (or Loeffler) has a better answer to your question.

"Government bonds are the very epicenter of the next crisis"

http://www.financialsense.com/financial-sense-newshour/big-picture/2011/12/17/02/jim-puplava/the-gathering-storm-the-sovereign-debt-crisis-den-of-thieves

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.