Skip to comments.

ANS production down <Alaska North Slope Oil}

Petroleum News ^

| Week of December 18, 2011

| Kristen Nelson

Posted on 12/17/2011 2:22:10 PM PST by thackney

The Alaska Department of Revenue’s fall forecast, released Dec. 15 as Petroleum News was going to press with this issue, shows a sharp decrease in forecast production compared to the spring forecast, with Alaska North Slope crude oil volumes dropping below 600,000 barrels per day beginning in the current fiscal year, 2012. In the spring forecast, Revenue was projecting production of more than 600,000 bpd through fiscal year 2017.

Production is projected to average 574,000 bpd for FY 2012, dropping below the 500,000 bpd mark in FY 2020.

In his cover letter to the governor, Revenue Commissioner Bryan Butcher said North Slope production declined 6.3 percent in fiscal year 2011 and a decline of another 4.7 percent is expected in FY 2012, “assuming that the oil production included in the ‘under development’ and ‘under evaluation’ layers of our production forecast come to fruition.”

Without those layers, the FY 2012 decline could be as high as 9.1 percent, he said. For FY 2012, Revenue shows 26,000 bpd under development and 1,000 bpd under evaluation.

In a press release on the forecast Butcher said, “Alaska’s revenue outlook is strong and relatively stable this year due mostly to continued high oil prices,” but warned of the impacts of steadily declining oil production.

New oil is a crucial part of the department’s ANS forecast, accounting for 4.6 percent in FY 2012 and rising steeply to 47.2 percent of ANS production in FY 2021.

Butcher contrasted production forecasts by Revenue in fall 2007, shortly after the passages of ACES, or Alaska’s Clear and Equitable Share, when Revenue was projecting “that ANS production in 2012 would be 675,000 barrels per day. Four years later our production forecast has changed, with 100,000 fewer barrels per day anticipated in FY 2012,” he said.

Spring vs. fall

There is also a difference between what Revenue projected last spring and its fall forecast. The final year of the spring forecast, FY 2020, shows production of 530,000 bpd; the fall forecast shows projected production dropping to 486,000 — the first projection below 500,000 bpd — in FY 2020.

One change between spring and fall is when production is expected from BP Exploration (Alaska)’s Liberty prospect east of Endicott and from ConocoPhillips Alaska’s west side CD-5 project in the National Petroleum Reserve Alaska.

In the spring, Liberty production was shown as beginning in FY 2013. The fall forecast wraps Liberty into an offshore category which includes Northstar, Liberty, Nikaitchuq and Oooguruk, and while Liberty isn’t noted separately, the first uptick in production from the offshore category comes in FY 2016, peaking in 2017. The spring forecast showed a similar pattern, with Liberty production beginning in one year and peaking in the next and the uptick volumes are similar to standalone Liberty forecast from the spring forecast, which showed a peak of 39,000 bpd.

NPR-A production, shown in the spring forecast as beginning in FY 2015, is shown in the fall forecast as beginning in 2017 and peaking in FY 2019.

Kuparuk production the same

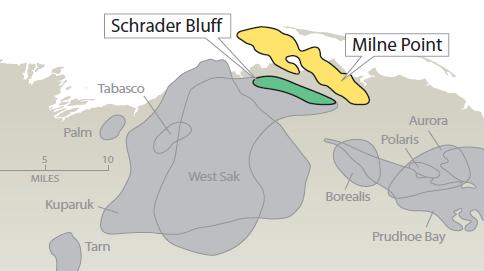

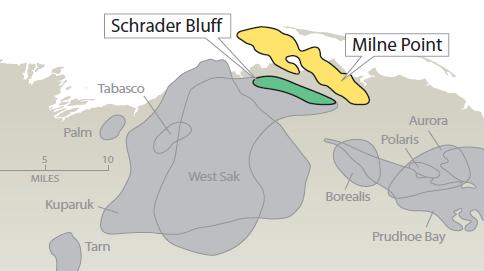

For producing fields, only the Kuparuk forecast remains the same, 87,000 bpd in FY 2012, dropping down through 83,000 and 81,000 bpd in FY 2014, with some differences in the out years, but nothing substantial. Prudhoe Bay stood by itself in the spring forecast; in the fall forecast it includes production from Milne Point, so while Prudhoe numbers would appear to be up, they are actually down compared to the combined Prudhoe-Milne spring forecasts.

Prudhoe is forecast to produce 276,000 bpd in FY 2012, down from 297,000 in the spring forecast. The FY 2013 fall forecast shows 269,000 bpd, down from 284,000 in the spring forecast; the downward trend (both overall and compared to the spring forecast) continues through 2020, the last comparison year.

Prudhoe Bay satellites are also forecast to produce less in the fall forecast, from 37,000 bpd in 2012 to 16,000 bpd in 2020 in the spring forecast down to 36,000 bpd for 2012 in the fall forecast and dropping off to 18,000 bpd in 2020 in the fall forecast compared to 27,000 bpd in the spring forecast.

ANS price up

While Revenue’s production forecast is down from last spring, the price forecast is up. In the spring, Revenue projected Alaska North Slope on the West Coast at $94.70 a barrel for fiscal year 2012; the fall forecast estimates $109.33.

Revenue’s ANS West Coast price forecast is $109.47 a barrel for FY 2013 (compared to $95.79 in the spring); this fall’s forecast continues above the level forecast in the spring through FY 2016, when the trend reverses and the fall forecast drops below the spring forecast through FY 2021, the end of the forecast period shown in the fall forecast.

The fall West Texas Intermediate price forecast is below the spring forecast with the exception of FY 2014.

TOPICS: News/Current Events; US: Alaska

KEYWORDS: alaska; alaskaoilproduction; canada; economy; energy; iran; northslope; oil; preppers

Navigation: use the links below to view more comments.

first previous 1-20, 21-28 last

To: thackney

No... Make up the lost flow with oil in the lower 48 so we have backup. Take the Alaskan pipeline down, upgrade then bring it back online. Also stop exporting gasoline which will help.

21

posted on

12/17/2011 3:25:09 PM PST

by

TrumpisRight

(President Palin sounds so good....)

To: dirtboy; All

I looked into it once and was told the pipeline gets closed down in the vicinity of 300,000 barrels or less.

This is so sad when there is so much oil up there and we are not allowed to drill for it!! Let's hope we knock the regime out next year.There's lots riding on it.

Those who think Keystone will actually get started in the US as zero has promised are being duped once again.Zero will never actually allow it to happen,IMHO. He will come up with excuse after excuse why he can't get it started,that's a promise. We have been rolled again.

22

posted on

12/17/2011 3:30:15 PM PST

by

rodguy911

(FreeRepublic:Land of the Free because of the Brave--Sarah Palin 2012)

To: thackney

That was the best quick map I could find. By survey drilling there is a MUCH larger field in ANWR than Prudoe. The Naval Oil Researve covers most of the area surrounding and south of Barrow and it has several Prudoe size fields. Preliminary exploration in the Artic Ocean has found fields out more that 50 miles almost everywhere they looked.

None of it is in production.

23

posted on

12/17/2011 3:53:15 PM PST

by

El Laton Caliente

(NRA Life Member & www.Gunsnet.net Moderator)

To: El Laton Caliente

The Naval Oil Researve covers most of the area surrounding and south of Barrow and it has several Prudoe size fields. The Naval Oil Reserve became the National Petroleum Reserve, Alaska. I was on the early design team for what was to be the first production site drill site, CD5 for ConocoPhillips, an expansion of the Alpine Central Production facility back in 2005.

Because of that experience, I've followed it rather closely, even getting to review some logs from a few exploratory drilling. I've never seen any claim of a Prudhoe size field. Sorry but I have to doubt that claim.

What has been found has been extremely light and high in value, but nothing massive in size. The CD5 drill site has been held up with various permitting issues, mostly around the bridge over the Nigliq Channel of the Colville River Delta. We had a FR thread about that last week:

http://www.freerepublic.com/focus/f-news/2818595/posts

24

posted on

12/17/2011 6:02:24 PM PST

by

thackney

(life is fragile, handle with prayer)

To: Calif4Palin

Make up the lost flow with oil in the lower 48 The problem discussed here is not the amount of oil in the lower 48. It is the amount of oil flowing through the Alaskan pipeline.

Take the Alaskan pipeline down, upgrade then bring it back online.

Are you suggesting we take down the Alaskan pipeline then replace it with a smaller pipeline? What do you mean by upgrade?

Why not open up more areas to production and get the taxes at a more competitive level instead of just giving up and accepting a declining position?

25

posted on

12/17/2011 6:06:16 PM PST

by

thackney

(life is fragile, handle with prayer)

To: El Laton Caliente

Preliminary exploration in the Artic Ocean has found fields out more that 50 miles almost everywhere they looked.

None of it is in production. Some of it is in production. North Star is a man-island producing offshore.

The Milni Point field extending offshore is in production from extend horizontal reach drilling.

The Oooguruk field extends out offshore but is produced from onshore drill pad with the horizontal drilling exetending out miles offshore.

BP has delayed the liberty field but has built the rig and has begun development of this similar design by planning to set the world records in extended horzontal drilling reach around 8 miles.

There certainly is great potential for far more. Shell has had some delays has received some approval for their drilling Offshore North Slope with their large arctic rig, the Frontier Discoverer.

http://thehill.com/blogs/e2-wire/e2-wire/200025-interior-approves-shells-arctic-drilling-plan

26

posted on

12/17/2011 6:34:09 PM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

North Star is also offshore, but they are drilling what in the gulf would amount to bay or near shore rigs. The deeper areas are not in production.

ANWR was set up as an oil drilling area, but they have never allowed production.

27

posted on

12/17/2011 7:20:19 PM PST

by

El Laton Caliente

(NRA Life Member & www.Gunsnet.net Moderator)

To: El Laton Caliente

The deeper areas are not in production. The deeper areas are a long, long way out. That flat north slope continues where the ocean starts.

ANWR was set up as an oil drilling area

The coastal plain was. There has been only one well ever drilled there but the results are a tightly held secret.

I certainly agree the Alaskan North Slope, on and offshore, holds great potential that we have only started accessing.

28

posted on

12/18/2011 4:55:17 AM PST

by

thackney

(life is fragile, handle with prayer)

Navigation: use the links below to view more comments.

first previous 1-20, 21-28 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson