Skip to comments.

PN Bakken: Helms: well costs up, industry uses $86 oil, at $55 lose rigs

Petroleum News ^

| Week of April 15, 2012

| Kay Cashman

Posted on 04/14/2012 4:21:54 AM PDT by thackney

The North Dakota Industrial Commission, Department of Mineral Resources, has released a new and higher average cost for drilling and completing Bakken wells in North Dakota.

Lynn Helms, director of the department that includes the state’s oil and gas division and geological survey, is now quoting $8.5 million for drilling and completing a Bakken well, versus the $7.3 million estimate he used in a December presentation, and the $6.6 million figure he used in August. (See related story on well costs on page 1 of this issue.)

The latest estimate is in a slide he used in a March 20 presentation to the North Dakota Legislature’s Energy Development and Transmission Committee, titled “What Does Every New Bakken Well Mean to North Dakota.”

Helms told legislators that oil companies are using a “flat $86 per barrel” for their “forward economics.”

If the oil price “drops to $55 per barrel we’ll lose rigs and that will put us on the black curve,” he says.

A typical 2012 North Dakota Bakken well will produce for 29 years, producing an average of 580,000 barrels of oil.

The life of the well can be extended, Helms notes, with enhanced oil recovery efforts.

TOPICS: News/Current Events; US: North Dakota

KEYWORDS: bakken; energy; oil

Navigation: use the links below to view more comments.

first previous 1-20, 21-34 last

To: thackney

Just saw this ad and I though of you! ;)

Invest in Alabama Oil Now!

•Estimated Return on Investment 3.5:1 (After-Tax Benefits)

Sounds too good to pass up!

In all seriousness though, as unthinkable as it seems, could we be seeing an actual "oil bubble" developing?

21

posted on

04/14/2012 7:43:54 AM PDT

by

Errant

To: Errant

You can pretend those cost don't exist if you want. I know how to read a 10-K or Annual Report.

When oil prices are down, little is invested for new production, maintenance is cut to the bone. Sometimes they sell off stock to stay alive. When the price goes up, so does the spending. The oil industry has always been cyclical. Those who don't prepare for the coming bust usually have their assets bought up by the ones that did.

If you really believe they are magic money machines, you ought to buy their stock and retire early.

22

posted on

04/14/2012 7:48:56 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

The numbers are not absolute but expressed as a percent of sales.

In an inflationary economy where the sales price of oil and energy is rising, the absolute earnings are increased thus making the stock a good deal in an inflationary economy.

23

posted on

04/14/2012 7:58:29 AM PDT

by

bert

(K.E. N.P. +12 ..... Crucifixion is coming)

To: bert

In an inflationary economy where the sales price of oil and energy is rising, the absolute earnings are increased thus making the stock a good deal in an inflationary economy. Was there any other industry on that list to which that would not apply?

The numbers are not absolute but expressed as a percent of sales.

That also shows the expenses climbed in absolute dollars well. Very typical in the oil market. Price goes up; desire for the producers to produce more goes up; demand for rigs, steel, copper, labor goes up; cost for those goes up; expenses for the producers goes up.

I've been riding this roller coaster for a couple decades. It will cycle again, and again.

24

posted on

04/14/2012 8:05:20 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

expenses for the producers goes up. If y'all are losing money at $55 oil, that means that your costs have almost tripled in the last 10 years. Because the decade before that, y'all were selling oil at less than $30 a barrel and making a nice profit.

I'd almost bet those Saudi Sheiks are having to fly coach to Houston...

25

posted on

04/14/2012 8:21:45 AM PDT

by

Errant

To: Errant

hat means that your costs have almost tripled in the last 10 years Look at the drilling cost as an example. I believe the cost per well has more than tripled in 10 years.

Because the decade before that, y'all were selling oil at less than $30 a barrel and making a nice profit.

While less was invested, production declined until demand pushed it up. There is no question that we had access to cheaper, shallower, easier to produce fields back then. Horizontal drilling was uncommon, it didn't require more than a dozen stages of hydraulic fracturing to make an economical well.

So is it your claim the expenses in the 10-K and Annual reports are faked? Do you think their is a hidden pile of money growing under the mattresses?

26

posted on

04/14/2012 8:29:48 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: Errant

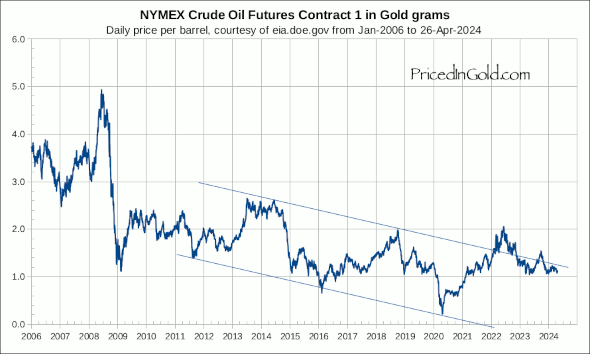

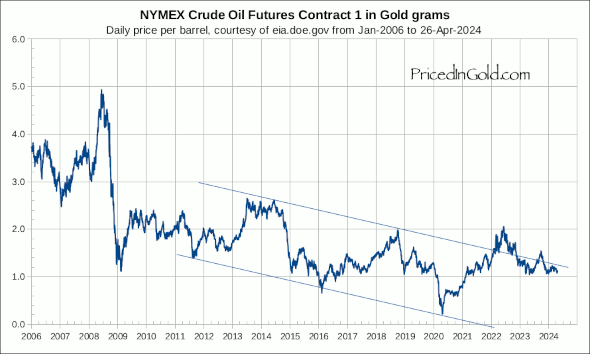

Please consider the following charts:

Price of Oil plotted against Price of Gold

Does that help? In that twenty year time how much has the dollar fallen? How much has commodity prices climbed?

27

posted on

04/14/2012 8:36:54 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

So is it your claim the expenses in the 10-K and Annual reports are faked? Maybe they need to better breakout the salaries/bonuses/ROI of your presidents/vice-presidents/investors and other.

I know the workers haven't seen a tripling of their salaries in the last 10 years, knowing many personally. And as a land owner, on average, the leases haven't increased that much, and I did retire early! :)

28

posted on

04/14/2012 8:43:56 AM PDT

by

Errant

To: Errant

I am sure those capital investment lines are used to hide salaries.

You should call the SEC, maybe you can get a finders fee.

29

posted on

04/14/2012 8:54:52 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

Price of Oil plotted against Price of Gold Yeah, I can start to a agree with you on that, if you include a market that isn't artificial/controlled by a few majors and OPEC.

I'm not sure if we'll ever see an actual free market with true competition and less regulation in our life times, but if we do, while there is going to be turmoil in the oil industry, it will be good for the economy.

In the mean time, those expensive technologies you complain about, are turning our dependence on foreign oil around and a single well can tap six square miles of oil bearing formation. Seems pretty cost affective to me!

30

posted on

04/14/2012 8:57:21 AM PDT

by

Errant

To: thackney

You should call the SEC Yeah, just like MF Global, GS, JP Morgan, ...

31

posted on

04/14/2012 9:01:28 AM PDT

by

Errant

To: Errant

My work is electrical power in the oil/gas/petrochem world. When you talk of expenses not drastically climbing, it is hard not to claim disbelief.

In '05~'06 time frame, when we bought large order of big cable (miles at a time) we could only get price guarantee if we would pay for matching copper futures at the same time.

32

posted on

04/14/2012 9:08:54 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: thackney

What do you do with that copper when you’re done with it?

33

posted on

04/14/2012 9:13:13 AM PDT

by

Errant

To: Errant

We won’t be done with it until the fields shut down.

I know when we have to demolish existing equipment it is salvaged, not thrown in the dump.

But the scrap price of wiring covered with insulation, armor and jackets doesn’t come anywhere near the price of new cable. At least these days it is sent for recycle instead of trash where it can.

34

posted on

04/14/2012 9:17:55 AM PDT

by

thackney

(life is fragile, handle with prayer)

Navigation: use the links below to view more comments.

first previous 1-20, 21-34 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson