Posted on 05/17/2012 6:22:51 PM PDT by blam

Get Ready For Another 2008-Style Financial Crisis

Stock-Markets / Credit Crisis 2012

May 17, 2012 - 12:18 PM

By: Dr Martenson

Well, my hat is off to the global central planners for averting the next stage of the unfolding financial crisis for as long as they have. I guess there’s some solace in having had a nice break between the events of 2008/09 and today, which afforded us all the opportunity to attend to our various preparations and enjoy our lives.

Alas, all good things come to an end, and a crisis rooted in ‘too much debt’ with a nice undercurrent of ‘persistently high and rising energy costs’ was never going to be solved by providing cheap liquidity to the largest and most reckless financial institutions. And it has not.

Forestalled is Not Foregone

The same sorts of signals that we had in 2008 are once again traipsing across my market monitors. Not precisely the same, of course, but with enough similarities that they rhyme loudly. Whereas in 2008 we saw breakdowns in the credit spreads of major financial institutions, this time we are seeing the same dynamic in the sovereign debt of the weaker European nation states.

Greece, as expected and predicted here, is a right proper mess and will have to leave the euro monetary system if it is to have any chance at recovery going forward. Yes, all those endless meetings and rumors and final agreements painfully hammered out by eurocrats over the past year are almost certainly going to be tossed, and additional losses are going to be foisted upon the hapless holders of Greek debt. My prediction is that within a year Greece will be back on the drachma, perhaps by the end of this year (2012).

Greek default spectre turns material

The weekend Greek revolt against the austerity measures imposed on its economy in return for eurozone funding has elevated the prospect of a Greek default on its debts or a chaotic exit from the eurozone.

The collapse in support for the mainstream parties that had reluctantly accepted the austerity program and the vehement opposition to the measures by the radical left party that finished the runner up in the weekend’s elections has made it almost impossible for a coalition to be formed that would persevere with the program.

It is likely new elections will have to be held next month but given the degree to which Greeks have protested against the harsh eurozone prescriptions – and the 20 per cent shrinkage in GDP and 20 per cent-plus unemployment that has accompanied them – it is improbable that Greece will continue with the reforms it agreed in return for the next $300 billion tranche of eurozone funding.

If it does walk away from that commitment there will be chaos in Greece and, to a lesser extent, elsewhere. Greece would inevitably default on its debts and could be forced to quit the eurozone.

(Source)

There really is no choice for Greece but to leave the euro, and the sooner, the better. Even then, there is a lot of hardship coming their way. But in my estimation, that’s better than the imposed austerity that is a guaranteed torture chamber. The institutions that avoided taking losses on their Greek debt on the first pass through, due to their preferred status in the process (the ECB among them), are almost certainly going to eat big losses this time, perhaps a full 100% of them.

Leaving the euro is going to be quite a process, and the ripple effects are going to be large and somewhat unpredictable. I found this description of what will happen within Greece and its banking system to be well on the mark:

The instant before Greece exits it (somehow) introduces a new currency (the New Drachma or ND, say). Assume for simplicity that at the moment of its introduction the exchange rate between the ND and the euro is 1 for 1. This currency then immediately depreciates sharply vis-à-vis the euro (by 40 percent seems a reasonable point estimate). All pre-existing financial instruments and contracts under Greek law are redenominated into ND at the 1 for 1 exchange rate.

What this means is that, as soon as the possibility of a Greek exit becomes known, there will be a bank run in Greece and denial of further funding to any and all entities, private or public, through instruments and contracts under Greek law. Holders of existing euro-denominated contracts under Greek law want to avoid their conversion into ND and the subsequent sharp depreciation of the ND. The Greek banking system would be destroyed even before Greece had left the euro area.

There would remain many contracts and financial instruments involving Greek private and public entities denominated in euro (or other currencies, like the US dollar) that are not under Greek law. […] Widespread defaults seem certain.

Euro area membership is a two-sided commitment. If Greece fails to keep that commitment and exits, the remaining members also and equally fail to keep their commitment. This is not just a morality tale. It has highly practical implications. When Greece can exit, any country can exit.

As soon as Greece has exited, we expect the markets will focus on the country or countries most likely to exit next from the euro area. Any non-captive/financially sophisticated owner of a deposit account in that country (or in those countries) will withdraw his deposits from banks in countries deemed at risk - even a small risk - of exit.

Any non-captive depositor who fears a non-zero risk of the future introduction of a New Escudo, a New Punt, a New Peseta or a New Lira (to name but the most obvious candidates) would withdraw his deposits from the countries involved at the drop of a hat and deposit them in the handful of countries likely to remain in the euro area no matter what - Germany, Luxembourg, the Netherlands, Austria and Finland.

The ‘broad periphery’ and ‘soft core’ countries deemed at any risk of exit could of course start issuing deposits under English or New York law in an attempt to stop a deposit run, but even that might not be sufficient. Who wants to have their deposit tied up in litigation for months or years?

(Source)

The Greek banking system will be destroyed immediately upon Greece’s exit from the euro, but the banking system there is already all but dead anyway. Best just to sweep the floor clean and start over. The idea is easy enough to understand; if your bank is about to go under, it is best to get your money out before that happens.

The only mystery to me is why so many people have left their money in the Greek banks this long. I suppose they were waiting for a clearer signal? Well, it would seem that the signal has now been sent and received:

Greek Depositors Withdrew $898 Million From Banks Monday Greek depositors withdrew €700 million ($898 million) from the country's banks on Monday, fueling fears of a bank run amid the growing political disarray.

With deposits falling, Greek banks become even more dependent on the European Central Bank to meet their funding needs, exposing the central bank to potentially huge losses if Greece leaves the euro area.

Monday's deposit withdrawal far outpaced Greek banks' steady decline in deposits since the start of the country's debt crisis in 2009, as depositors withdraw cash and transfer funds overseas. In the past two years, deposit outflows have generally averaged between €2 billion and €3 billion a month, though in January they topped €5 billion.

The latest data from the Greece's central bank show that total deposits held by domestic residents and companies stood at €165.36 billion in March.

(Source)

Again, the real mystery to me is who still has 165 billion euros in Greek banks at this stage of the game? Also a mystery is why Greece has not yet imposed a withdrawal moratorium and capital controls? It is only a matter of time, perhaps days, before they do.

Of course, it is the contagion effect that most worries the market, because the same dynamic of utter insolvency leading to the intractable nature of Greece’s dilemma applies to Spain, Portugal, and Italy.

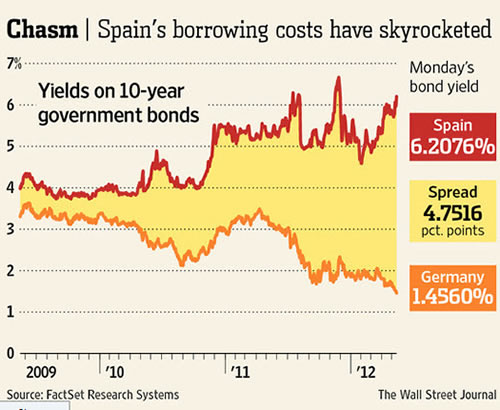

Indeed, the market is already adjusting to this possibility, as evidenced by the spikes in the yields of those country’s bonds:

Contagion Fears Hit Markets

LONDON - Investors battered European stocks, dumped the bonds of Spain and Italy, and bid the euro down against the dollar Monday after the collapse of weekend coalition talks in Greece edged that country closer to an exit from the euro zone.

The sweeping market action dealt a blow to hopes that the damage of a Greek exit, should it occur, could be comfortably contained.

In the market carnage, Greek stocks fell to two-decade lows, and Spanish bond yields leapt to levels not seen since the panic of last November. Shares of a big Spanish lender dropped 8.9% on the Madrid bourse, pulling the benchmark index down 2.7%. The Italian market also fell 2.7%, and the euro slid to $1.2845 late Monday in London, its lowest level in four months.

(Source)

The worry and the carnage are both running deep. And they should. Everything is now interlinked to such a degree that there is no possible way for a run on Greek banks or continued declines in the value of sovereign debt to be anything other than exceptionally destructive.

Everybody owes everybody, and there’s not enough productive economy to mask the insolvency of the system any longer.

We saw this as Spain’s sovereign yields vaulted, Spanish bank shares plunged, a not-so-happy linkage courtesy of the LTRO funding which enabled (and encouraged) Spanish banks to load up on Spanish debt. A virtuous circle morphed into a vicious spiral, each element weakening the other all the way down.

That the US stock market is only down less than 5% from recent highs is a testament to the power of the liquidity that the Fed and US banking system have directed at keeping things elevated. However, this cannot last, at least not without another big quantitative-easing (QE) injection from the Fed. Without such an infusion, I am calling for another 2008-2009-style market rout of at least -30% but possibly as much as -50%.

QE, stat!

The reason we need another QE injection is that the same dynamic of debt destruction is again stalking the markets. As expected, the Fed has been waiting for a clear signal that it is time for more thin-air money, and again they are going to wait too long to prevent more damage from occurring.

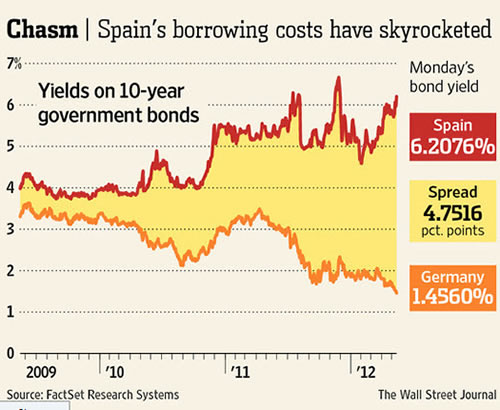

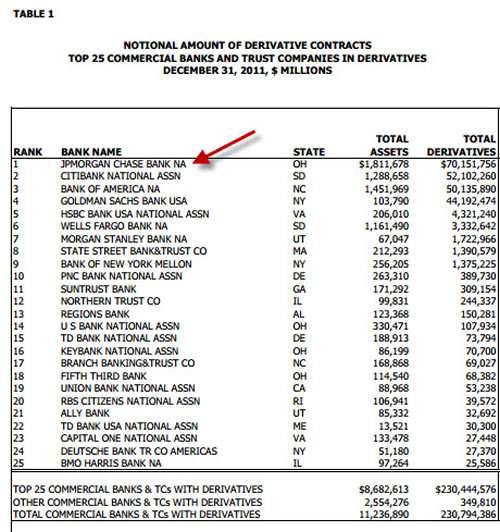

This time I am expecting a coordinated central bank action that will involve most or all of the major central banks of the OECD: Japan, UK, US, and Europe.

One day, we will wake up to find some global message about the need for a coordinated response to a major crisis, and each of the central banks will be issuing some massive new amount of thin-air money. Of course the programs will be called something fancy that will require shortening to an acronym and will involve buying some form of debt (sovereign debt, but maybe also bank debt), and we’ll track this via central-bank balance-sheet expansion.

Perhaps we’ll see this line go up a little steeper, or perhaps the same trajectory will be maintained a little longer:

Regardless, more printing is on the way, because the alternative is the utter collapse of the entire Western banking system. And quite probably a few governments, too.

To me, that is an unthinkable outcome, and one that I have every faith will be avoided at any every cost. It is the main reason that I am quite content to hold onto all of my gold at this juncture. Anybody selling physical gold here is either broke (and needs the money) or is just not paying attention.

To drive the point home, consider this picture posted on Zerohedge taken from a German television production purported taken of the Ministry of Finance in Athens. A picture is worth a thousand words:

(Source)

By the time the Ministry of Finance is storing records in garbage bags and shopping carts, perhaps, just maybe, one might become a little concerned about loaning money to the Greek government. One hopes.

If You Think Greece is Bad

Greece, of course, is tiny compared to Spain or Italy. The situation in Spain -- which is big enough to matter -- is truly dire, very large, and getting worse.

Spain has been playing fast and loose with the numbers, and that fact has now been revealed to the world. It’s not a pretty picture.

Spain Underplaying Bank Losses Faces Ireland Fate May 10, 2012

Spain is underestimating potential losses by its banks, ignoring the cost of souring residential mortgages, as it seeks to avoid an international rescue like the one Ireland needed to shore up its financial system.

The government has asked lenders to increase provisions for bad debt by 54 billion euros ($70 billion) to 166 billion euros. That’s enough to cover losses of about 50 percent on loans to property developers and construction firms, according to the Bank of Spain. There wouldn’t be anything left for defaults on more than 1.4 trillion euros of home loans and corporate debt.

Taking those into account, banks would need to increase provisions by as much as five times what the government says, or 270 billion euros, according to estimates by the Centre for European Policy Studies, a Brussels-based research group. Plugging that hole would increase Spain’s public debt by almost 50 percent or force it to seek a bailout, following in the footsteps of Ireland, Greece and Portugal.

“How can you only talk about one type of real estate lending when more and more loans are going bad everywhere in the economy?” said Patrick Lee, a London-based analyst covering Spanish banks for Royal Bank of Canada. “Ireland managed to turn its situation around after recognizing losses much more aggressively and thus needed a bailout. I don’t see how Spain can do it without outside support.”

(Source)

And this is just the losses that Spanish banks face on their real-estate portfolios. They are also now facing losses on all the Spanish sovereign debt that they bought with their LTRO funding as well. Very simply, Spain now needs a massive rescue, and soon.

Meanwhile German citizens are all done with helping their southern neighbors. Merkel has used up all of her political capital on the rescues performed to date, and it is far from clear that any more help is politically doable here. The only way that I can see such help coming is under some terms other than drawing upon the savings of Germany’s citizens. Printing, perhaps, but even that is a dicey political proposition here.

If Spain drops here, then you can just set an egg timer for when Italy will go. And then France. The dominoes will rapidly fall from there.

Why I Am Nervous These Days

In describing JPMorgan’s recent $2 billion (or is it $20 billion…or more?) trading losses and Jamie Dimon’s (the CEO of JPM) awkward explanation of how certain hedging operations went wrong, the author of this next piece asks the obvious question:

Does Jamie Dimon Even Know What Hedging Risk Is?

But wait a minute? If you’re hedging risk then the bets you make will be cancelled against your existing balance sheet. In other words, if your hedges turn out to be worthless then your initial portfolio should have gained, and if your initial portfolio falls, then your hedges will activate, limiting your losses. That is how hedging risk works. If the loss on your hedges is not being cancelled-out by gains in your initial portfolio then by definition you are not hedging risk. You are speculating.

(Source)

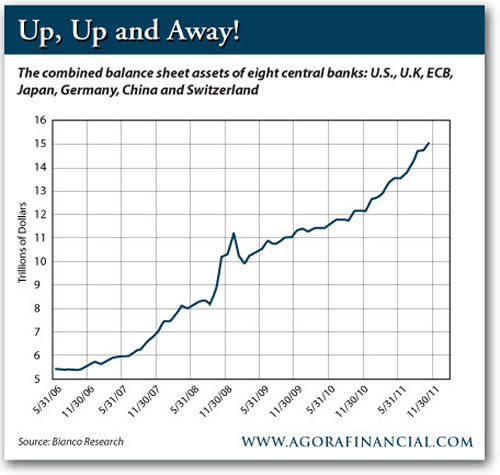

We still don’t know the exact dimensions of JPM’s losses here (my expectation is that more bad news will follow soon enough), but we can be sure that the big banks have not learned from the mistakes of the past and are still engaged in risky practices involving derivatives.

Whatever JPM was up to (and I am still not entirely clear on what that was), it was not classic hedging, which serves to minimize losses, but something far more speculative.

The reason this gives me such cause for concern is that it once again exposes a small portion of the derivative monster that will certainly be awakened when the European situation goes into full meltdown over the Greek, then Spanish, the Portuguese, then Italian situations.

While derivatives are, in theory, a zero-sum game, and therefore could, in theory, be forgiven and forgotten in a pinch, the reality is that they’ve been used to pretend that risk did not exist and therefore losses don’t exist.

The ugly truth here is that we are at the tail end of a most unfortunate credit bubble -- four decades of global excess by the OECD countries -- and there are massive losses to account for. Just as the offsetting counterparties involved in the subprime CDO and CDS mortgage crisis did not zero out because the losses they were allegedly papering over were all too real, the same will prove true of the derivative paper allegedly covering sovereign and corporate debts.

Remember, the biggest holder of derivatives is the company that just demonstrated that it doesn’t really understand the concept of hedging.

(Source)

Overall derivatives, especially interest-rate-linked derivatives, have increased by over $100 trillion since the crisis began. As JPM just evidenced, and as hinted at by the interminable hand-wringing over allowing Greece’s paltry $78 billion in credit-default swaps to be triggered, real dangers lurk here.

I wish I could analyze the situation better than the rest of the crowd that either screams catastrophe looms or coos that everything is safe, but I cannot. The situation is too opaque, too convoluted, and too complex to tease apart. I simply don’t know what the true nature of the risk really is -- and the truth is, nobody really does. You might as well ask these analysts to tell you the exact size and shape of the first ten waves that will hit Laguna Beach exactly one year from now beginning at 12:05 p.m.

Instead, what I can offer to you is the idea that instead of reducing (let alone eliminating) risk, all that derivatives have done is mask risk. This means that whatever losses are resident in a system with four decades of debt-fueled malinvestment and overconsumption are still there just waiting to be realized.

It is this certainty that the losses remain, the risk is masked, and the bets have only grown larger that makes me very nervous these days as I contemplate the possible implications and repercussions of a Greek exit from the euro.

To Sum Up Part I

Given this environment of massive, rapidly-accelerating, and obfuscated risks, the prudent among us are undoubtedly wondering, How the heck is this going to play out? And how do I prepare for it?

In Part II: What To Do When the Central Banks Blink, I lay out my forecast for how low asset prices will sink before the central banks once again attempt to ride to the rescue with gargantuan liquidity measures.

But this next time won't work as it did in 2008, in my estimation. I see central banks being near the end of their ability to influence developments at this point. More liquidity will affect different asset classes differently, and for the first time raise real (and valid) concerns about the widescale debasement we are witnessing across the world's major fiat currencies.

Putting your capital into those resources best positioned to appreciate most as the result of money printing and hold or increase their purchasing power in such an environment should be a top priority for every concerned investor.

Click here to access Part II (free executive summary; paid enrollment required for full access).

Regardless, more printing is on the way, because the alternative is the utter collapse of the entire Western banking system. And quite probably a few governments, too."

"To me, that is an unthinkable outcome, and one that I have every faith will be avoided at any every cost. It is the main reason that I am quite content to hold onto all of my gold at this juncture. Anybody selling physical gold here is either broke (and needs the money) or is just not paying attention."

Don’t sell gold, but don’t buy it either just yet either. It is likely to get cheaper as things start crashing. Then the printing will start, and gold will rise.

We all know that Obama’s backers are going to create another devastating September Surprise in their efforts to keep him in power.

That will be just in time for Romney to suspend his softball campaign because of the national fiscal crisis.

people better wake before it happens to believe it happens

because no one alive has seen what is about to happen

So, is gold the only resource that fits this bill?

I agree with you on gold.

And below is an April 5th message I sent to some of my readers who are long the ETF GLD. http://www.TableOfWisdom.com

It is an example of TRUE hedging, in this case on the ETF GLD (gold ETF).

These call options went up 50% this week despite having a stike price of $135. I recommended 1 contract for every 100 share lot owned by the investor to hedge the position. The possible loss is absolutely defined (100% of the premium) and was simply an insurance policy against predictable idiocy, which paid off. This way the investor didn’t have to take the bigger risk of selling their gold positions.

Subject: Strategy to quell the effects of Bernanke’sWar on Gold

Date: Thu, 5 Apr 2012 17:58:21 +0000

“Below are some notes I made at Marketwatch in regard to GLD followed by my suggested strategy for GLD, which I strongly suggest you employ. If you are not confident in putting in the order yourself, ask your discount broker to help you.

One must be extremely naive to believe anything the Fed says. Their tactics have been transparent. Every quarter or so they pull out Soros and Buffet to inveigh upon the value of gold (despite there being no call for their opinion in that regard except by Obama/Bernanke) - followed by the Fed flat out lying about QE.

The choices are clear:

1. Outright Treasury default

2. QE 3, 4, 5, 6

I believe the latter despite an intentional war on gold. It is a war to stave off the public outrage before the November elections as gold, oil & food are the “smoking gun” evidence of their treachery. It’s unfortunate the Obama & Bernanke would rather fight the war on gold prices than a war on oil prices, which would actually help the people and economy.

Gold is easier for them to manipulate but the news for Ben & Barry is that gold isn’t causing inflation - they are.

Here’s the Strategy:

Part 1: HOLD your GLD. It will likely double again over the next year.

Part 2: Following is the symbol for a PUT option that gives the owner the right to sell 100 shares of GLD through the third week of December 2012 at the STRIKE price of $135. per 100 shares.

Option Symbol: GLD122X135-E (PUT OPTION)

Each contract protects 100 of your shares for approximately $2.50 per share. So, if you own 200 shares of GLD, buy 2 contracts for approximately $500.00

This will protect your positions for over a month beyond the November election and I believe will actually make you money as a result of the -volatility along the way. You can make money on these because of the sensitivity options have to price changes in the underlying stock. The option doesn’t need to be “in the money” (below the strike price) for the option price to go much higher.

The prices tend to move up on days like 4/4/2012 when gold was down by 3%.

The REASON for employing the strategy is that you cannot afford NOT to own gold given the fiscal condition of the US Government. The risk of not owning gold can well be unprecedented devastation, which is what most people will suffer.

The worst thing an investor can do right now is to fall for what Bernanke is selling and get scared out of real assets and into bonds or other so-called safe investments. Those in cash and fixed income will be ravaged. The option strategy is an insurance policy that will let you sleep at night knowing that you are protected from the economic savagery of the Obama Administration and his lap dog Ben Bernanke who is lying about QE. Your upside is unlimited, while your downside -IS- limited to the price you paid for the option.

Sincerely,

Scott”

I feel good old cash is better, in almost any currency except Euros. Just a bit after the SHTF in Europe, and there is rubble all around, I am going to look for some good European focused mutual funds. I will not try to be brilliant and pick individual companies, but a lot of European companies will survive, and they will be at bargain prices then.

The Big 5 are so expose to European crisis.

So just a couple of weeks ago I was doubting my decision to get out of the market in 2010. Thinking maybe it was time to get back in. Not a chance now...

This scares me to death! What should we do with my 401k investments? I have to leave the funds there but can move out of stocks and into bonds or just cash accout. But I have no idea what to do. When I research, all I find are sites selling either gold or annuities.

Any sinsere help would truly be appreciated!!

This scares me to death! What should we do with my 401k investments? I have to leave the funds there but can move out of stocks and into bonds or just cash accout. But I have no idea what to do. When I research, all I find are sites selling either gold or annuities.

Any sinsere help would truly be appreciated!!

I believe there are index funds that track the entire European stock market. Vanguard may have such a fund.

Great post, as usual. Thanks.

Clueless females "feeling all tingly" for The One.

Probably not.

I've invested (looking forward) in a number of things I know that I'm likely to need in the future, anticipating it will be unaffordable or maybe even unavailable when I need it.

I've made 'life-time' buys of a number of items, incandescent light bulbs is just one example.

I don't think you can go too wrong by being in cash or cash equivalents right now. I don't see a lot of upside to anything right now, and there is a lot of downside risk, so for me preserving and accumulating cash is what I plan to do, until late fall maybe even.

My forecast:

Europe will crash pretty hard soon.

The US will crash too, but not before Europe. It may be possible to invest in Europe first when they hit bottom, then take the profits and invest in the US at the bottom too.

China and Asia are no longer safe havens either.

Oil and basic energy will always be good, but there will be good and bad times to buy. If you like investing in things like natural gas, there may be some great bargains coming along, because in the next six months to a year, the current low price for gas will be taking its toll on gas producers. Wait until gas starts going up again, and find out who the survivors are.

Oil tankers. Oil tankers are currently one of the crappiest market segments out there. Shippers way over ordered new ships during the boom years, and are now facing a glut of ships in a recession. This will correct itself over the next few years, but in the meantime, shippers are struggling to stay alive. You can research this market, find some eventual winners, and invest sometime this year, but be careful that the companies will survive, many have a lot of debt. But right now is about the bottom of the market, you only need to avoid companies that will fail. There may be a shipping ETF or mutual fund that can help reduce the risk of bankruptcies.

It is hard to get interest income right now, such as CDs or money markets, because the Fed has interest rates so low. But if you want interest income, investing in junk bond mutual funds are a good way to get it. By investing in the mutual funds rather than buying junk bonds you eliminate a lot of the risk for an unsophisticated investor like me, but still make a good interest return, around 7%.

And finally, healthcare. You can never go wrong by paying attention to demographics and buying what the baby boomers need. Right now they are retiring, and they need increasing health care. Specializing in elderly focused investments will do well over the next decade. But these companies will be crashing along with everything else soon, so wait till they are on sale.

Duh!!!..and it will be..

(drum roll please...You heard it here 1st!)

A Global currency followed by a One World Government!!!

yeah!..that's the ticket!..../s

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.