That's crazy.

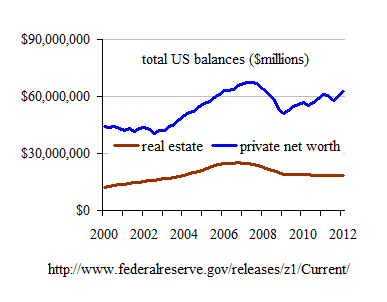

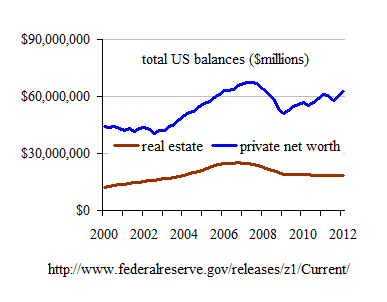

OK, blame goes anywhere the blamers can toss it but reality stays at what it is. Private real estate is only a fourth of private assets and values have fallen with Obama after having risen with Bush.

Posted on 06/12/2012 5:30:11 AM PDT by lbryce

The recent recession wiped out nearly two decades of Americans’ wealth, according to government data released Monday, with middle-class families bearing the brunt of the decline.

The Federal Reserve said the median net worth of families plunged by 39 percent in just three years, from $126,400 in 2007 to $77,300 in 2010. That puts Americans roughly on par with where they were in 1992.

The data represent one of the most detailed looks at how the economic downturn altered the landscape of family finance. Over a span of three years, Americans watched progress that took almost a generation to accumulate evaporate. The promise of retirement built on the inevitable rise of the stock market proved illusory for most. Homeownership, once heralded as a pathway to wealth, became an albatross.

The findings underscore the depth of the wounds of the financial crisis and how far many families remain from healing. If the recession set Americans back 20 years, economists say, the road forward is sure to be a long one. And so far, the country has seen only a halting recovery.

“It’s hard to overstate how serious the collapse in the economy was,” said Mark Zandi, chief economist for Moody’s Analytics. “We were in free fall.”

The recession caused the greatest upheaval among the middle class. Only roughly half of middle-class Americans remained on the same economic rung during the downturn, the Fed found. Their median net worth — the value of assets such as homes, automobiles and stocks minus any debt — suffered the biggest drops. By contrast, the wealthiest families’ median net worth rose slightly.

Americans have tried to rebalance the family budget but have found it difficult to reverse the damage.

(Excerpt) Read more at washingtonpost.com ...

Here’s Bush in his speech, pushing home loans for totally unqualified minorities.

http://www.youtube.com/watch?v=MqR15H0gNBU

“...America is saying NO to him by refusing to cooperate...”

We’ll see come November, Unk...I hope you are right.

Hopefully, it won’t be just no, but also a major “GFYourself Obama” moment.

This has not stopped since 2010 either. People are still getting screwed. I would say 40% might be a little high but I have lost no less than 30% of my wealth. But never having that much I won’t lose any sleep over it since I think it is a cheap enough price to get rid of The Disaster.

Bush could announce nothing which did not follow the laws governing those loans.

What was an unintended consequence of the low interest rates incident to the 911 attacks became a problem with a certain disaster by the Democrat policies governing housing. Bush and even McCain repeatedly warned Barney and the boys but they refused to listen.

Wealth is dependent on Value. Value is what people think it is, even the value of gold. So all wealth is phantom. Because how people value things constantly changes. Any value exists only at an instant, what it will be one minute later or was one minute earlier is different.

Obama had PLENTY to do with the policies leading to disaster BTW since as a “community organizer” (shake-down artist) he was instrumental in extorting loans from banks which were the root of the eventual collapse.

There was no law to require the TARP bailout. None whatsoever. The fact that Hank Paulson had to go on his knees before Nancy Pelosi to get it passed is testament to that fact.

All GWB had to do was to say clearly in 2005-6 that there would be no injection of Federal money to rescue balance sheets from exposure to shaky mortgages, and that banks who bought those mortgages (there is and was no law requiring them to do so) from the originating lenders did so entirely at their own risk.

It really didn’t though. It started in the real estate market, with Bush and Co deciding everyone should own a house.

Democrats made it worse with regulations placed on the banking industry, but it was the real estate bust set in motion from 2003-2006 that started the ball rolling, to be fair about it.

Both sides are of equal blame for this. Now how to get out of it is a different issue with the Democrats making it far worse than need be.

The problem is the feds forced banks to make those loans. And there were laws passed by the Democrats for the last 30 yrs essentially forcing them.

It is true that there were regulations which greatly loosened up the requirements for lending, and that those regulations were largely driven by Democrats (although with GOP acquiescence).

But that only applied to the mortgage companies who originated the loans. The banks who were bailed out by TARP by and large did not originate the loans. What they did was to buy up those loans from the originators without using appropriate due diligence as to their soundness. There is no excuse for that, no reason for the taxpayers to bail them out.

That's crazy.

OK, blame goes anywhere the blamers can toss it but reality stays at what it is. Private real estate is only a fourth of private assets and values have fallen with Obama after having risen with Bush.

Don’t get me wrong, I am not defending or justifying bailing out the banks. BUT what they did was rely upon the government guarantees wrt those mortgages. It is common practice to bundle loans and sell them in the derivative markets and that is what the banks bought.

This had worked for a couple of decades so it was not as though there was a lot of perceived risk in doing so. Plus, it should be recognized that there is no a lot of freedom of movement as regards the banking industry. It was so regulated in virtually every aspect that it was already almost another arm of government.

But for the Democrats this would have never happened because those toxic loans would have never been made in the first place.

“All he had to do was to make it clear that there would be no bailouts of any institution which made bad bets on mortgages, and much of the 2008 chaos could have been prevented.”

Perhaps. But the fact is that thousands of young people in their 20’s and 30’s on Wall Street individually were making millions of dollars by means of those deadly bundled sub-prime loans. If their companies went bankrupt, well, too bad and all, but they still would have their millions. And that’s the way it went down. All the incentives were on the side of short term self interest, and so far as I can tell, things haven’t changed.

“Government induced real estate bubbles can do that.”

What about Wall Street’s role? Without them to buy up the loans the banks were making, and bundle them and sell them as Triple A rated bonds, banks might have given some thought to how risky their loans were. As it was, they felt like they had no liability for making bad loans. They were sold the next day to Wall Street, packaged with hundreds of others, rated AAA, and sold the world over. The world bought them because they thought anything that Moody’s and Standard and Poor rated AAA was safe. They didn’t realize that the bond rating agencies effectively were in on the game. All the short term incentives were in place. The traders made their millions and when it all went bad and their companies were bankrupt, well, they still had their millions.

It's my understanding that investment banks not only purchased mortgages but actively encouraged their issuance, including opening lines of credit for mortgage brokers.

The banks used to require a decent credit history and a down payment before government told them to cut it out or we’ll break your knees. Banks were threatened for being responsible.

Without the government pressuring banks to make risky loans, there would not be a glut of investments to “creatively” bundle and sell.

“It’s my understanding that investment banks not only purchased mortgages but actively encouraged their issuance, including opening lines of credit for mortgage brokers.”

You have it exactly right.

Investment banks provided ‘warehouse lines of credit’ to mortgage brokers. The brokers would write enough loans to use up their credit line.

The investment bank would take those loans and securitize them, tranch them, build derivatives on them. And they would recharge the warehouse credit line and the process would start over.

The investment banks and hedge funds doing this were not compelled by any government regulation. The CRA didn’t cover them at all, it applied only to deposit-takers.

And the IBs and hedgies wanted subprime paper. The riskier, the higher yield, the better. They were chasing yield. They came up with and encouraged the exotic loans that flourished in the bubble, the Alt-As, No Down, No Doc, NINJA. All non-conforming paper that was issued to anyone who had a pulse.

“The banks used to require a decent credit history and a down payment before government told them to cut it out or we’ll break your knees. Banks were threatened for being responsible.”

The government didn’t tell banks to do any such thing. I assume you think that the CRA did this, since that idea gets endlessly parroted. However misguided and intrusive the CRA may be it didn’t require substandard loan quality nor did it require CRA lending to be mortgage loans. What the CRA required is that banks make a portion of their loans to the neighborhoods that their depositors lived in.

What few seem to understand around here is that the extreme mortgage loans created during the bubble were a private sector invention created by financial firms whose lending was not covered by the CRA, or any other regulation for that matter. They were the invention of investment banks and hedge funds who wanted high-yield paper that they could securitize and use as the basis for building derivatives. The riskier the mortgage the higher the yield. This was all non-conforming paper that took market share away from the stodgy GSEs.

” Banks were threatened for being responsible.”

Please clarify this for me.

“Without the government pressuring banks to make risky loans, there would not be a glut of investments to “creatively” bundle and sell.”

I disagree. Banks are in the business of making money. They were presented with a situation where they could sell any loan they made to Wall Street, whether it was a good loan, a medium risk loan, or a high risk “subprime” loan. Having sold the loan, they had no more risk. Since they had no responsibility in the event of default, they had every incentive to make any kind of loan they could make, pocket the profits, and to heck with whether it would ever be paid back. We will be dealing with the results for years to come.

“What few seem to understand around here is that the extreme mortgage loans created during the bubble were a private sector invention created by financial firms whose lending was not covered by the CRA, or any other regulation for that matter.”

But wait a second. It can’t be the private sector’s fault. Everyone knows that the country’s financial problems are always caused by the government.

A friend just sold their house last year. Why did the buyers only need 5% down to make the purchase? Fannie Mae is still calling the shots and subsidizing mortgages to encourage home ownership.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.