To: RC2

For those earning >= $250,000 Essentially your taxes REVERT back to the Clinton era tax rates ( from 36% to 39.5% ).

3 posted on

07/10/2012 7:16:46 AM PDT by

SeekAndFind

(bOTRT)

To: SeekAndFind

Of course that is just federal income tax. If you add state income taxes, local property taxes, etc., someone taxed at a rate of 39.5% is paying over 50% of his income in taxes.

On F&F they said Schumer had suggested limiting the tax increase to those making over $1 million, but they indicated he might switch to Obama's position. For a family living in New York City, $250,000 doesn't put you in the ranks of the super-rich or afford the lifestyle it might in the South or Midwest.

To: SeekAndFind

For those earning >= $250,000 Essentially your taxes REVERT back to the Clinton era tax rates ( from 36% to 39.5% ). Only the top marginal rate. However, there will also be increases in dividend and capital gains taxes.

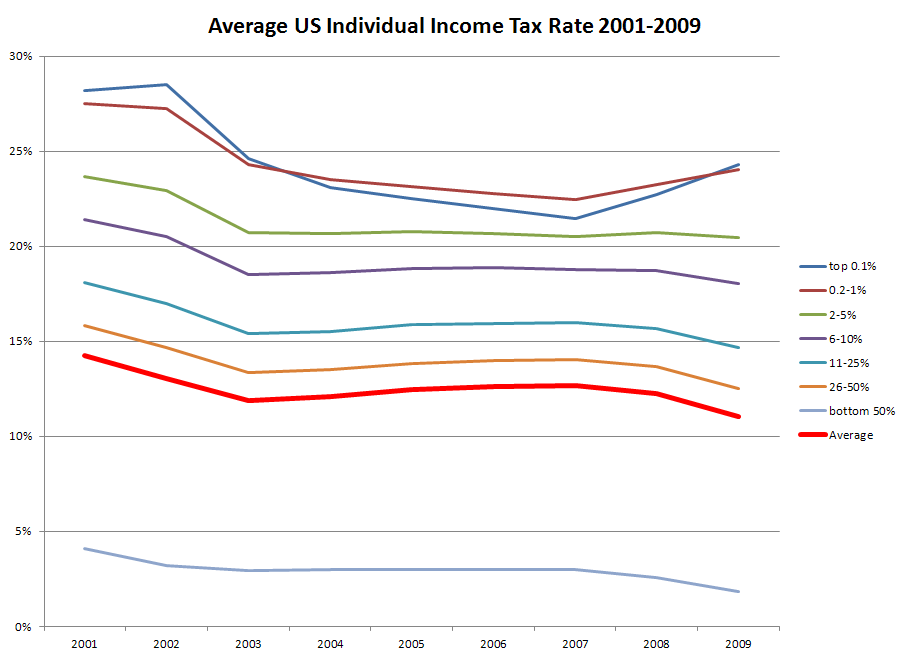

Looking back at 2003, you can see how the tax cuts affected the average tax rate for everyone:

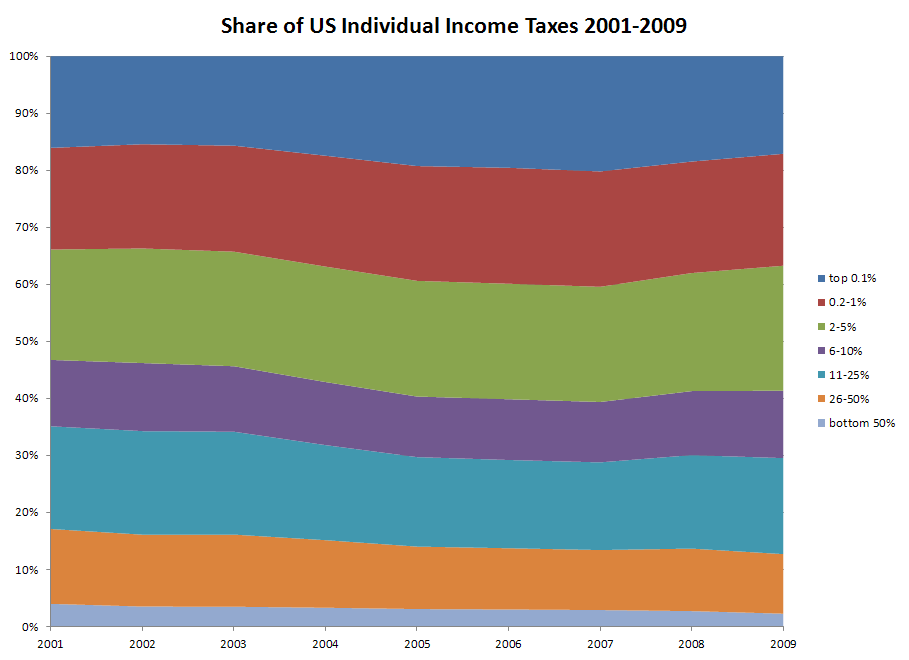

But, it didn't really affect the share of income taxes paid by the various income groups. In fact, the higher income taxpayer ultimately paid a higher share of income taxes, at least until 2008:

24 posted on

07/10/2012 10:16:55 AM PDT by

justlurking

(The only remedy for a bad guy with a gun is a good WOMAN (Sgt. Kimberly Munley) with a gun)

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson