MyGovCost.org ^ | 1/24/12 | Craig Eyermann

FR Posted January 31, 2012 by GSWarrior

Stunning.

That’s really the only word we can use to describe the release of a “sensitive and confidential” 57 page memo, written by then soon-to-be U.S. Treasury Secretary Larry Summers in December 2008, about what became President Obama’s signature economic program in the first year of his presidency: the “stimulus package”.

James Pethokoukis has summarized some of the most significant aspects of the memo, which we’ve excerpted below, and which reveals the Obama administration’s thinking behind what became an over 821 billion dollar boondoggle. The bold text represents Pethokoukis’ summary of that thinking, which is directly followed by a supporting quotation from Larry Summers’ memo:

1. The stimulus was about implementing the Obama agenda. The short-run economic imperative was to identify as many campaign promises or high priority items that would spend out quickly and be inherently temporary.... The stimulus package is a key tool for advancing clean energy goals and fulfilling a number of campaign commitments.

2. Team Obama knows these deficits are dangerous (although it has offered no long-term plan to deal with them). Closing the gap between what the campaign proposed and the estimates of the campaign offsets would require scaling back proposals by about $100 billion annually or adding new offsets totaling the same. Even this, however, would leave an average deficit over the next decade that would be worse than any post-World War II decade. This would be entirely unsustainable and could cause serious economic problems in the both the short run and the long run.

3. Obamanomics was pricier than advertised. Your campaign proposals add about $100 billion per year to the deficit largely because rescoring indicates that some of your revenue raisers do not raise as much as the campaign assumed and some of your proposals cost more than the campaign assumed.... Treasury estimates that repealing the tax cuts above $250,000 would raise about $40 billion less than the campaign assumed....The health plan is about $10 billion more costly than the campaign estimated and the health savings are about $25 billion lower than the campaign estimated.

4. Even Washington can only spend so much money so fast. Constructing a package of this size, or even in the $500 billion range, is a major challenge. While the most effective stimulus is government investment, it is difficult to identify feasible spending projects on the scale that is needed to stabilize the macroeconomy. Moreover, there is a tension between the need to spend the money quickly and the desire to spend the money wisely. To get the package to the requisite size, and also to address other problems, we recommend combining it with substantial state fiscal relief and tax cuts for individuals and businesses.

5. Liberals can complain about the stimulus having too many tax cuts, but even Team Obama thought more spending was unrealistic.

As noted above, it is not possible to spend out much more than $225 billion in the next two years with high-priority investments and protections for the most vulnerable. This total, however, falls well short of what economists believe is needed for the economy, both in total and especially in 2009. As a result, to achieve our macroeconomic objectives—minimally the 2.5 million job goal—will require other sources of stimulus including state fiscal relief, tax cuts for individuals, or tax cuts for businesses.

6. Team Obama thought a stimulus plan of more than $1 trillion would spook financial markets and send interest rates climbing. To accomplish a more significant reduction in the output gap would require stimulus of well over $1 trillion based on purely mechanical assumptions—which would likely not accomplish the goal because of the impact it would have on markets.

=====================================

2008 Candidate Barack Obama told us on the campaign trail: " The problem is, that the way Bush has done it over the last eight years is to take out a credit card from the Bank of China in the name of our children, driving up our national debt from $5 trillion for the first 42 presidents, # 43 added $4 trillion by his lonesome so that now we have over $9 trillion of debt that we are going to have to pay back, $30,000 for every man woman and child. That’s irresponsible. It’s unpatriotic."

REALITY CHECK Obama presided over the biggest political heist in US history.

The Obamanations (insiders and politicians) sucked up trillions under the guise of inheriting the "Bush financial crisis."

THIS MADE ME LAUGH OUT LOUD Obama COS Rahm Emanuel "suddenly" discovered he wanted to be Chicago's mayor---the little turn went before the mics and announced his campaign "raised $10 million in just a few weeks." Rahm also controlled the US Treasury as COS.

======================================

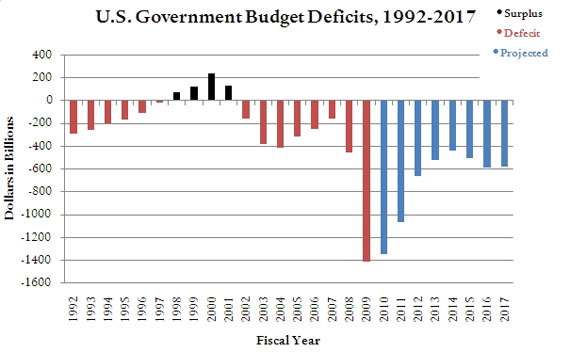

In a fair accounting, President Obama is responsible (along with the then-Democratic Congress) for the $1.3 trillion in deficit spending in 2010 and the estimated $1.6 trillion in deficit spending in 2011. He [Obama] should not get credit, moreover, for the $149 billion in TARP (Troubled Asset Relief Program) repayments made in 2010 and 2011 to cover most of the $154 billion in bank loans that remained unpaid at the end of the 2009 fiscal year—loans that count against President Bush’s 2009 deficit tally.

The Treasury Department says that all but $5 billion of the TARP bank loans has now been repaid. The portion of repayments that was for loans issued in 2009 should be deducted from Bush’s deficit tally, not credited to Obama as deficit savings. There is some astounding number crunching in this article, and a chart of modern day president’s “average annual deficit spending” ........a frightening conclusion of what happens if Obama has an 8 year term.

graph