Posted on 09/22/2012 4:14:35 PM PDT by blam

Why QE3 Won’t Jumpstart The Economy And What Would

Economics / Quantitative Easing

Sep 22, 2012 - 12:56 PM

By: Ellen Brown

The economy could use a good dose of “aggregate demand”—new spending money in the pockets of consumers—but QE3 won’t do it. Neither will it trigger the dreaded hyperinflation. In fact, it won’t do much at all. There are better alternatives.

The Fed’s announcement on September 13, 2012, that it was embarking on a third round of quantitative easing has brought the “sound money” crew out in force, pumping out articles with frighting titles such as “QE3 Will Unleash’ Economic Horror’ On The Human Race.” The Fed calls QE an asset swap, swapping Fed-created dollars for other assets on the banks’ balance sheets. But critics call it “reckless money printing” and say it will inevitably produce hyperinflation. Too much money will be chasing too few goods, forcing prices up and the value of the dollar down.

All this hyperventilating could have been avoided by taking a closer look at how QE works. The money created by the Fed will go straight into bank reserve accounts, and banks can’t lend their reserves. The money just sits there, drawing a bit of interest. The Fed’s plan is to buy mortgage-backed securities (MBS) from the banks, but according to the Washington Post, this is not expected to be of much help to homeowners either.

Why QE3 Won’t Expand the Circulating Money Supply

In its third round of QE, the Fed says it will buy $40 billion in MBS every month for an indefinite period. To do this, it will essentially create money from nothing, paying for its purchases by crediting the reserve accounts of the banks from which it buys them. The banks will get the dollars and the Fed will get the MBS. But the banks’ balance sheets will remain the same, and the circulating money supply will remain the same.

When the Fed engages in QE, it takes away something on the asset side of the bank’s balance sheet (government securities or mortgage-backed securities) and replaces it with electronically-generated dollars. These dollars are held in the banks’ reserve accounts at the Fed. They are “excess reserves,” which cannot be spent or lent into the economy by the banks. They can only be lent to other banks that need reserves, or used to obtain other assets (new loans, bonds, etc.). As Australian economist Steve Keen explains:

[R]eserves are there for settlement of accounts between banks, and for the government’s interface with the private banking sector, but not for lending from. Banks themselves may . . . swap those assets for other forms of assets that are income-yielding, but they are not able to lend from them.

This was also explained by Prof. Scott Fullwiler, when he argued a year ago for another form of QE—the minting of some trillion dollar coins by the Treasury (he called it “QE3 Treasury Style”). He explained why the increase in reserve balances in QE is not inflationary:

Banks can’t “do” anything with all the extra reserve balances. Loans create deposits—reserve balances don’t finance lending or add any “fuel” to the economy. Banks don’t lend reserve balances except in the federal funds market, and in that case the Fed always provides sufficient quantities to keep the federal funds rate at its . . . interest rate target. Widespread belief that reserve balances add “fuel” to bank lending is flawed, as I explained here over two years ago.

Since November 2008, when QE1 was first implemented, the monetary base (money created by the Fed and the government) has indeed gone up. But the circulating money supply, M2, has not increased any faster than in the previous decade, and loans have actually gone down.

Quantitative easing has had beneficial effects on the stock market, but these have been temporary and are evidently psychological: people THINK the money supply will inflate, providing more money to invest, inflating stock prices, so investors jump in and buy. The psychological effect eventually wears off, requiring a new round of QE to keep the game going.

That is what happened with QE1 and QE2. They did not reduce unemployment, the alleged target; but they also did not drive up the overall price level. The rate of price inflation has actually been lower after QE than before the program began.

Why, Then, Is the Fed Bothering to Engage in QE3?

If the Fed is doing no more than swapping bank assets, what is the point of this whole exercise? The Fed’s professed justification is that by buying mortgage-backed securities, it will lower interest rates for homeowners and other long-term buyers. As explained in Reuters:

Massive buying of any asset tends to push up the prices, and because of the way the bond market works, rising prices force yields [or interest rates] down. Because the Fed is buying mortgage-backed bonds, the purchases act to directly lower the cost of borrowing to buy a home. In addition, some investors, put off by the rising price of the bonds that the Fed is buying, turn to other assets, like corporate bonds – which, in turn, pushes up corporate bond prices and lowers those yields, making it cheaper for companies to borrow – and spend.

Those are the professed objectives, but politics may also play a role. QE drives up the stock market in anticipation of an increase in the amount of money available to invest, a good political move before an election.

Commodities (oil, food and precious metals) also go up, since “hot money” floods into them. Again, this is evidently because investors EXPECT inflation to drive commodities up, and because lowered interest rates on other investments prompt investors to look elsewhere. There is also evidence that commodities are going up because some major market players are colluding to manipulate the price, a criminal enterprise.

The Fed does bear some responsibility for the rise in commodity prices, since it has created an expectation of inflation with QE, and it has kept interest rates low. But the price rise has not been from flooding the economy with money. If dollars were flooding economy, housing and wages (the largest components of the price level) would have shot up as well. But they have remained low, and overall price increases have remained within the Fed’s 2% target range. (See chart above.)

Some Possibilities That Might Be More Effective at Stimulating the Economy

An injection of money into the pockets of consumers would actually be good for the economy, but QE3 won’t do it. The Fed could give production and employment a bigger boost by using its lender-of-last-resort status in more direct ways than the current version of QE.

It could make the very-low-interest loans given to banks available to state and municipal governments, or to students, or to homeowners. It could rip up the $1.7 trillion in government securities that it already holds, lowering the national debt by that amount (as suggested a year ago by Ron Paul). Or it could buy up a trillion dollars’ worth of securitized student debt and rip those securities up. These moves might require some tweaking of the Federal Reserve Act, but Congress has done it before to serve the banks.

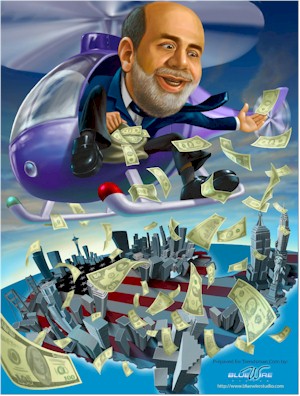

Another possibility would be the sort of “quantitative easing” first proposed by Ben Bernanke in 2002, before he was chairman of the Fed—just drop hundred dollar bills from helicopters. (This is roughly similar to the Social Credit solution proposed by C. H. Douglas in the 1920s.) As Martin Hutchinson observed in Money Morning:

With a U.S. population of 310 million, $31 billion per month, dropped from helicopters, would have given every American man, woman and child an extra crisp new $100 bill per month.

Yes, it would produce an extra $31 billion per month on the nominal Federal budget deficit, but the Fed would have printed the new bills, so there would have been no additional strain on the nation’s finances.

It would be much better than a new social program, because there would have been no bureaucracy involved, just bill printing and helicopter fuel.

The money would nearly all have been spent, increasing consumption by perhaps $300 billion annually, creating perhaps 3 million jobs, and reducing unemployment by almost 2%.

None of these moves would drive the economy into hyperinflation. According to the Fed’s figures, as of July 2010, the money supply was actually $4 trillion LESS than it was in 2008. That means that as of that date, $4 trillion more needed to be pumped into the money supply just to get the economy back to where it was before the banking crisis hit.

As the psychological boost from QE3 wears off and the “fiscal cliff” looms, perhaps Congress and the Fed will consider some of these more direct approaches to relieving the economy’s intractable doldrums.

(Give me my Obama money!)

Everything (on this subject) that I thought that I knew, I don't, apparently.

Yeah, 'Aggregate Demand', that's the ticket.

Ben Bernanke - The Early Years

There is no going back because those who fueled the consumer economy the most are those who are still buried with debt. The US consumer is tapped out. Those who would spend can't and those prudent individuals who can spend, won't. Throwing more trillions at the banks will only lead to more distortion in commodities. I believe it will be food this time around. Governments fall when food gets out of reach.

It's a dangerous game. The crash will play out, sooner or later, no matter how cleverly the consequences are disguised.

The economy will take care of itself, if we’d get out of the way. People are eventually going to need consumer goods.

Shrink the government, free up individual income, and people will need those things faster.

How about jobs? Real Jobs for people? Sell off oil leases, permit the pipeline from Canada to be built? Drop the environmental nut laws and keep the coal business alive. More offshore drilling—Open up ANWAR in Alaska and expand it. Let GM go off on her own. Some ideas?

I don't care what they'll make .. building them would put hundreds of thousands of union welders, iron workers and a ton of et cetera's to good paying work.

Hire non-union laborers for the factory.

WE can make plastic shoes and boots as good as China.

Make steel !

We still have time to glean the knowledge and expertise from men before they die and it's gone forever.

America was built by BUILDERS ... not finance managers or IT guys.

We can still build stuff.

So naturally like everyone else I speculate in stocks, I turn paper cash into PM money), and buy whatever tangible goods I can today knowing that prices will rise. I would not put the cash in a CD paying .75% (why bother) or loan it to our bankrupt federal government for the politicians to spend. Speaking of the latter, the only real reason that BB lowers rates is so the pols can have more fun money for a last binge or two or three.

Here’s a start.

National Voter ID.

National E-Verify in addition to the failed I-9.

National E-Verify for public assistance.

Cease collecting public union dues (let the unions collect this direct, if they can).

Convert public pension to 401K’s.

Kill Davis-Bacon.

Kill NLRB.

Kill all rules (high dollar impacts) written by regulatory agencies that weren’t voted on by congress.

Not all regulatory schemes are bad. Some, such as Glass-Steagall, were born of hard financial lessons learned during the last depression.

We need to return to it, once again erect firewalls between certain speculative ventures and the cash accounts of individuals and businesses.

Using the lifeblood of the national economy for pc social engineering on the one hand and high velocity, high tech rigged gambling on the other led to ruin.

An injection of money into the pockets of consumers would actually be good for the economy, but QE3 won’t do it.

Giving people some money -- in their pockets -- doesn't and never has spurred economic growth. It causes a momentary blip in consumer spending; nothing else.

Economic growth only occurs when entrepreneurs see fit to save their profits and reinvest them in the business. That's what's not happening now.

The belief that increasing consumer spending will grow the economy is a sad, sad fallacy.

What would work would be to first get the Marxist out of the White House. Then get the Marxists out of the Senate and the House, Then get the message out that America is again open for business.

I truly believe things could turn around fairly quickly, and that among the first people to really be helped would be those in poor neighborhoods and the inner city. I want everyone to do well, but the way to make that happen is not to vilify those who work hard and who have been successful and take from them to ‘redistribute’ - especially when the government is the middle man.

Is the Fed going to buy high quality, performing MBS’s off the banks’ balance sheets, or are they absorbing toxic MBS assets that the banks can’t sell at a real market price, because the market price isn’t anything near what the banks count them for on their balance sheets?

I can’t figure out any rationale for the former.

If the latter, the concept might actually improve banks’ balance sheets, by removing the troubled assets. Presumably the Fed can hold the MBS’s however long it takes them to unwind. Owners and operators of the big banks would benefit big time at public expense. Presumably this would cleanse the financial system, creating room for expanded lending, to fuel a recovery. And of course, the next cycle of theft, malfeasance, and bailouts.

Wonder if the Fed will restrict their buying to US banks?

Recession - neighbor loses job

Depression - you lose your job

Recovery - when Obama loses his job

Thanx, Sam ... that’s on my truck window tomorrow.

Exactly.

And the fastest way to recovery is to flush the crap out of the system and punish the bankers who propped up, hid or fraudulently peddled this crap in the first place. A real “free marketeer” would say to the banks “Well, you peddled this crap, you’re responsible for the outcome, we’re not going to prop up up with ANY program, and we won’t allow the Fed to collapse the US dollar to prop you up with swap lines, either. You’re going to implode, there will be criminal prosecutions and we might even ask for the death penalty... if we don’t declare you to be a clear and present danger to the national security first...”

Sadly, most “conservatives” keep carrying water for the bankers who are taking us and our economy down for the count.

ROFL!

Love the image of Bernanke’s early years in post 2!

Stop thinking of the Fed as an "investor" in this case. The Fed is simply buying back bonds that were created from mortgages that had already been extended (and therefore money already created). If the Fed is buying mortgage-backed securities, then it's basically buying money that has already been printed when the mortgages that were bundled to create those securities were underwritten in the first place. That's how money is created, and "buying" these securities actually just insures that these mortgages -- no matter how sound they are -- will retain a certain face value over time.

I'll re-post something here from a different thread earlier this week ...

Something to keep in mind here is that with a "paper currency" like the U.S. dollar, money is created as a debt instrument. If you buy a home for $300,000 and apply for a $250,000 mortgage, that $250,000 is basically created "out of thin air" when your bank borrows the money from the U.S. Treasury so they can lend it to you. You get a mortgage, the seller gets $300,000 in cash, and there is now an additional $250,000 in circulation that never existed before.

Now let's suppose you lost your job and never made even a single mortgage payment. The bank forecloses and gets the house back, which under most circumstances wouldn't be a huge problem because they can turn around and sell it for $300,000 to someone else and pay you the difference after they recover their legal costs for the foreclosure. But let's suppose that you lost your job at the same time a lot of other folks lost their jobs, and the bank can't sell the house for more than $200,000. The $300,000 that you paid to the previous owner is still out there, but $100,000 worth of assets have vanished overnight. This would include your $50,000 down payment and $50,000 worth of the bank's assets (the difference between their $250,000 loan and the $200,000 value of the home).

Multiply this story several million times, and you find yourself asking if that $100,000 in "lost" assets (or at least the $50,000 difference between the current value of the home and the mortgage balance) ever really existed in the first place. That is really what this deflationary spiral is all about. There is basic deflation in this case because money has been lost and economic activity has declined, but the Fed is buying mortgage bonds and the U.S. Treasury is printing money like crazy in an attempt to drive the "dollar value" of that home back up to $300,000.

We don’t need fedeeral donations to targeted cronies (QE3). Only the people who are causing the problem will benefit. We need a genuine stimulus like tax reduction and the repeal ob Obamacare (Obamanightmare). This would be fealt by everyone, everyone would benefit and the economy would start to grow.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.