Skip to comments.

Easy Money Is Punishing the Middle Class

Wall Street Journal ^

| Sep 27 2012

| Sean Fieler

Posted on 09/27/2012 1:11:49 PM PDT by WilliamIII

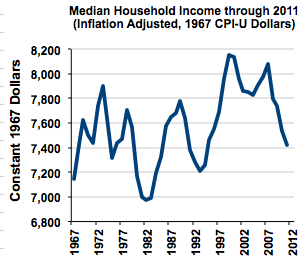

With the Republican Party committed to a gold commission and the Federal Reserve committed to easy money, a substantive debate about the principles underpinning our monetary system is finally in the offing. For sound money to carry the day, Republicans will need to do more than point out the still-hypothetical risks of easy money. The GOP will have to detail the harm that the middle class has already suffered as a result of a policy of low but persistent levels of inflation.

A little inflation appears to be a free lunch, lubricating the economy and gradually erasing past financial mistakes. But the nature of the free lunch is that its costs aren't absent—they're just distributed broadly. And in the case of low but steady inflation, the broadly distributed costs are borne by the middle class. Over time, rising prices have eroded American workers' standard of living. And, over time, the Federal Reserve's persistent easy money hurts the very person it is presumably intended to help, the American worker.

(Excerpt) Read more at online.wsj.com ...

TOPICS: Business/Economy; Editorial

KEYWORDS:

To: WilliamIII

Easy money isn’t intended to help the “American Worker”.

It’s so that the palms that matter can be greased.

IMHO

2

posted on

09/27/2012 1:15:47 PM PDT

by

ripley

To: WilliamIII

...over time, the Federal Reserve's persistent easy money hurts the very person it is presumably intended to help, the American worker. It was never intended to help the American worker. It was intended to help the American politicians from being caught overspending the American worker's money.

To: WilliamIII

Easy money, or inflation, is a method of taxing that is hidden. Tax hikes with out voting for tax hikes, cool!

Another advantage is that inflation is regressive so pols can claim to be lowering taxes on the poor while, in reality, raising them.

4

posted on

09/27/2012 1:25:21 PM PDT

by

Aevery_Freeman

(All Y'all White Peoples is racist!)

To: WilliamIII

the still-hypothetical risks of easy money. Thanks to the Fed creating money out of thin air, lack of a gold standard, and fractional reserve banking system,our current monetary system, with its easy credit, low interest rates, and increases in the money supply lead to booms which lead to bubbles. Sooner or later, a contraction phase starts when credit is tightened, interest rates go up, and the increase in the money supply is slowed down.Then,the bubbles burst, and and the booms go bust, and a new recession occurs.These risks are not hypothetical. They happen over and over again.

5

posted on

09/27/2012 1:29:00 PM PDT

by

mjp

((pro-{God, reality, reason, egoism, individualism, natural rights, limited government, capitalism}))

To: WilliamIII

6

posted on

09/27/2012 1:37:55 PM PDT

by

khelus

To: WilliamIII

Death to savers! The lack of higher interest rates channels more fools into the market.

7

posted on

09/27/2012 1:42:35 PM PDT

by

Theoria

(Romney is a Pyrrhic victory.)

To: khelus

OOPS

Unemployment counting all in the civilian labor force who are unemployed and employed part time but need full time

=

Unemployment counting all in the civilian labor force who are unemployed and employed part time but need full time plus those who have been removed from the civilian labor force and need a job

8

posted on

09/27/2012 1:55:20 PM PDT

by

khelus

To: Alex Murphy

It was never intended to help the American worker. It was intended to help the American politicians from being caught overspending the American worker's money.And it was intended to help the banks. The Fed (and its enablers in D.C.) have been very effective in spreading the lie that a central bank exists to help the people.

9

posted on

09/27/2012 3:34:24 PM PDT

by

BfloGuy

(Without economic freedom, no other form of freedom can have material meaning.)

To: Theoria

Re: “Low interest rates channel more fools into the stock market.”

Exactly.

Unemployment ABOVE 8% for almost 4 years.

Median income DOWN more than 8% in the last 4 years.

Yet, the Dow and SP 500 are near their all time 2000 bubble highs.

The ever optimistic financial press is an accessory to this criminal deception.

If a Republican was president and running for reelection, EVERY business news story would carry a dark hint of pending catastrophe.

And the bond market itself is a ticking time bomb.

Bond king Bill Gross of Pimco openly admits his strategy is to “front run” the Federal Reserve.

When the Fed recently announced it would begin buying mortgage backed securities, Pimco started scooping up billions of dollars of them.

Pimco’s strategy?

When the Fed steps in, Pimco will slowly sell back all their holdings for a couple percentage points of gain.

Bond investors who are not nimble enough to sell out at the first sign of inflation, or currency risk, or default risk, are going to get crushed when thousands of panicked investors rush to the Exit door at the same time.

To: zeestephen

Yet, the Dow and SP 500 are near their all time 2000 bubble highs. Adjusted for inflation the SP500 is about 1085 in year 2000 dollars..

11

posted on

09/28/2012 4:56:30 AM PDT

by

EVO X

To: mjp

But they told us the Federal reserve would put and end to the boom and bust cycle! Do you mean to tell me they lied to our great grandfathers?

12

posted on

09/28/2012 5:00:55 AM PDT

by

listenhillary

(Courts, law enforcement, roads and national defense should be the extent of government)

To: EVO X

Re: “Inflation Adjusted S&P”

Yes, you make a good point.

However, the P/E 10 (inflation adjusted 10 year P/E moving average) is cause for worry.

Off the top of my head...

P/E 10 historical average - about 16.5

Current P/E 10 - about 21.5

Personally, I’m obsessed with the macro factors.

Record global money printing.

Record global debt.

Record global unfunded pension and health care liabilities.

This cannot end well.

To: zeestephen

I was just playing the devil’s advocate. I am in your camp...

14

posted on

09/28/2012 6:45:05 PM PDT

by

EVO X

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson