Skip to comments.

Raise Taxes And Cut Government Spending To Reduce Debt? No

Forbes ^

| 10/22/2012

| Nathan Lewis

Posted on 10/22/2012 6:46:37 AM PDT by SeekAndFind

At some point, the U.S. government will have to deal with its exploding debt load. Typically, we hear that the solution involves “some combination of reduced spending and higher taxes.” Proponents often claim that this solution is “mathematically inevitable.”

Oh really? There are two great examples in history of governments that got out of huge debt commitments without either defaulting or devaluing the currency, which is essentially another form of default. One was Britain after the Napoleonic Wars, ending in 1815; the other was the United States, after World War II. This was quite unusual. Most governments, when faced with excessive debts, have defaulted either legally or via currency devaluation.

After World War II, the U.S. government had a debt/GDP ratio of about 125%. In 1970, this had fallen to 25%. During this entire period, the dollar was pegged to gold at $35/oz. under the Bretton Woods system.

Did spending go down during this period? It did immediately after the war, dropping from $93 billion in 1945 to $30 billion in 1948. Then, it went up, reaching $195 billion in 1970.

Did taxes go up? No, they did not. Immediately after the war’s end, wartime tax rates were reduced slightly. The Revenue Act of 1945 repealed an excess profits tax, and reduced income and corporate tax rates. Tax rates were reduced further in the Revenue Act of 1948, although they went up slightly in the early 1950s. A fairly large tax rate reduction took place in 1964. The overall trend was a modest decrease in tax rates.

Was the debt paid off? Nope. In 1948, federal Government had gross debt outstanding of $252 billion. In 1970, it was $381 billion.

Apparently, when “mathematically inevitable” meets reality, reality wins.

So, what happened? Mostly, GDP increased, so that the debt/GDP ratio declined

(Excerpt) Read more at forbes.com ...

TOPICS: Business/Economy; Culture/Society; Government; News/Current Events

KEYWORDS: spending; tax; taxes

To: SeekAndFind

Interesting article; thanks. Unfortunately, there’s no political will and less poltitical talent necessary to do the right thing........so, its off the fiscal cliff the U.S. goes.

2

posted on

10/22/2012 6:57:31 AM PDT

by

Rich21IE

To: SeekAndFind

Devalue=hyper inflation.

LLS

3

posted on

10/22/2012 7:09:10 AM PDT

by

LibLieSlayer

(OUR GOVERNMENT AND PRESS ARE NO LONGER TRUSTWORTHY OR DESERVING OF RESPECT!)

To: SeekAndFind

The ‘Progressives’ are betting that this is the way to destroy the Republican party once and for all. The resulting recession will be blamed on the Republicans. This is war and until the loyal opposition treats it as such, they’ll lose each and every battle.

4

posted on

10/22/2012 7:55:19 AM PDT

by

griswold3

(Big Government does not tolerate rivals.)

To: SeekAndFind; Rich21IE; griswold3

After World War II, the U.S. government had a debt/GDP ratio of about 125%. In 1970, this had fallen to 25%. During this entire period, the dollar was pegged to gold at $35/oz. under the Bretton Woods system. Did spending go down during this period? It did immediately after the war, dropping from $93 billion in 1945 to $30 billion in 1948. Then, it went up, reaching $195 billion in 1970.

Give me a break! Surely the author knows that you need to correct these figures for inflation. Better yet, you should take them as a percentage of GDP. The author had enough sense to do this for debt in the first paragraph but, for some reason, he switched to current dollars for spending. In any case, the second table at this link shows that spending reached a peak of 43.6% of GDP in 1943 and 1944 and dropped to low of 11.6% of GDP in 1948. The 11.6% of GDP is a bit of an anomaly since the second lowest level of spending since World War II was 14.2% of GPD in 1951. In any case, spending reached 19.4% of GDP in 1952 and was about the same level (19.3% of GDP) 18 years later in 1970.

Did taxes go up? No, they did not. Immediately after the war’s end, wartime tax rates were reduced slightly. The Revenue Act of 1945 repealed an excess profits tax, and reduced income and corporate tax rates. Tax rates were reduced further in the Revenue Act of 1948, although they went up slightly in the early 1950s. A fairly large tax rate reduction took place in 1964. The overall trend was a modest decrease in tax rates.

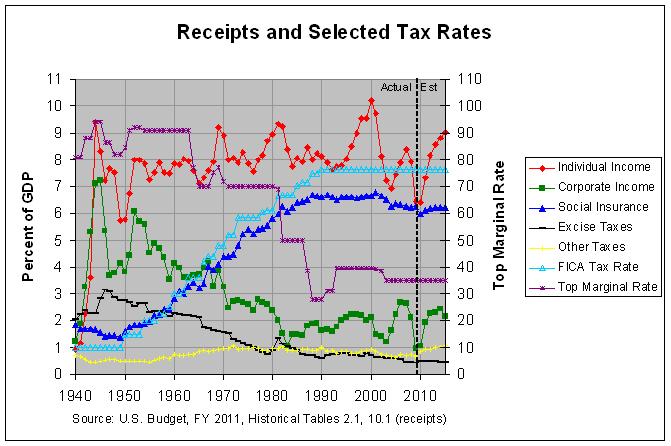

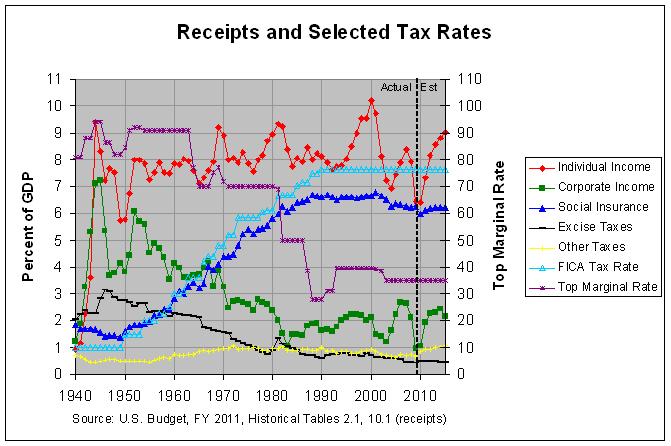

The following graph from this link shows that the top marginal rate did start a gradual decline starting in 1963:

As an be seen, revenue from individual income taxes remained at around the same level from 1952 on. However, revenue from social insurance (chiefly Social Security) increased a great deal until about 1990. This is because the FICA tax rate increased a goodly amount over this time period.

Was the debt paid off? Nope. In 1948, federal Government had gross debt outstanding of $252 billion. In 1970, it was $381 billion.

Now the author is back to non-inflation-adjusted numbers despite giving debt as percent of GDP in the first paragraph above. He truly has no shame! In fact, the gross debt went from 122% of GDP in 1946 to 37.6% of GDP in 1970 (see this link).

Apparently, when “mathematically inevitable” meets reality, reality wins.

So, what happened? Mostly, GDP increased, so that the debt/GDP ratio declined

No, the first graph at this link shows that the growth of GDP was fairly stable from 1948 on. What really happened was that a hugely-expensive war ended! As can be seen in the second table at this link, the gross deficit reached a high of 35.2% of GDP in 1943. Since the end of the war, the highest gross deficit was 13.6% of GDP in 2009. In addition, the gross deficit was on 6% of GDP in 1941, before the U.S. entered the war.

The trouble is, we have no major world war that can end, delivering us from huge deficits. Our deficits are basically peacetime deficits since Afghanistan is plays a relatively small role in it. On the contrary, we are now facing the retirement of the Baby Boomers which has only just begun. Hence, we are in a very different position than we were at the end of World War II. The author should therefore change his conclusion to "when “mathematically inevitable” IS reality, BOTH win.

5

posted on

11/04/2012 1:32:21 AM PST

by

remember

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson